THY: Superconnecting

and geopolitical risk

May 2016

The centre of European aviation gravity has been moving eastwards to Istanbul where THY Turkish Airlines has a clear mission — to establish itself as a leading global superconnector, deploying a unique narrowbody-focused connecting strategy, bypassing Europe’s major flag carriers in the process (see Aviation Strategy, March 2014). Although economic conditions remain resilient, with 4.5% real GDP growth expected for this year, the country and the airline are being directly impacted by what THY describes as “geopolitical risks and security concerns”.

THYs first quarter results were poor, the worst quarterly performance since the airline embarked on its dynamic expansion ten years ago. Foreign arrivals in Turkey have been in decline since the middle of 2015, with THY noting extensive group cancellations from Europe, Russia, Japan and China. Nevertheless, continuing capacity expansion and strong growth in connecting passengers pushed traffic numbers up by 10% and ASKs by 19% between the first quarter of 2016 and the same period in 2015. Load factor fell to 74.0% from 76.9%. RASK slumped by 16.6% (11.7% if the effect of the depreciating Lira is excluded). CASK disturbingly went in the opposite direction — the reported unit cost did fall by 8.1% but, if currency effects and fuel decrease impact are, factored in, CASK would have risen by 8.3%.

In summary, total revenue fell by 1% to $2.19bn and the net operating result was a loss of $280m compared to a loss of just $35m in Q1 2015. Net income was a loss of $421m against a profit of $153m in 2015. THY appears to regard this quarter as an outlier rather than reflecting a fundamental change in its fortunes, pointing out that, as well as the tourism disruption impact, maintenance costs were exceptionally high in the early part of 2016.

This year THY might benefit from a side-effect of the Middle East wars. An agreement between the EU and Turkey, which hadn’t been finalised by late May, would extend visa-free travel, for up to one year, for all Turkish citizens to, from and within the Schengen area, in return for Turkey stemming the flow of refugees across its borders. The EU is also asking for a series of reforms to civil rights in Turkey to reverse what it sees as a move towards authoritarianism under President Erdogan, and it this issue which is holding up the conclusion of the travel agreement.

There is no chance in the foreseeable future that Turkey, although it is an official candidate for membership, will become an EU state, but the EU proposed last December that, as part of an overall convergence programme, Turkey and the EU should move rapidly to a “wide ranging aviation agreement”, ie open skies. Turkey is, after the US, the most important aviation market for the EU, with about 40m passengers a year.

The proposed agreement would replace the current system of horizontal EU bilaterals, which permit EU carriers to fly to/from any EU state to Turkey, but which excludes EU carriers from the substantial Turkish domestic market (54m passengers). The combination of the new visa regime and open skies would boost THY’s core business, but the potential expansion of European LCCs into the Turkish market also poses a threat to THY. Perhaps the greater threat would be Pegasus Airlines (see Aviation Strategy, November 2015) — the LCC explains its recent high but unprofitable expansion partly as a strategy to establish greater market presence before the likes of Ryanair and easyJet arrive on a large scale.

2016 will see THY increase its seat capacity by a net 16%, with the delivery of 11 widebodies , A330-300s and 777-300ERs, and 30 narowbodies, 737-800s and A321s. The airline projects an increase of 18% in passengers to 72.4m this year.

Revenues for the year are predicted by THY to grow by 16% to $12.2bn. which seems a little optimistic given the recent downward trend in unit revenues. Concerned also by unit cost trends, the Istanbul-based airline analyst at HSBC is forecasting an 8% rise in 2016 revenues to $11.36bn, a fall in operating profit of 8% to $95m and a 30% reduction in net profit to $745m.

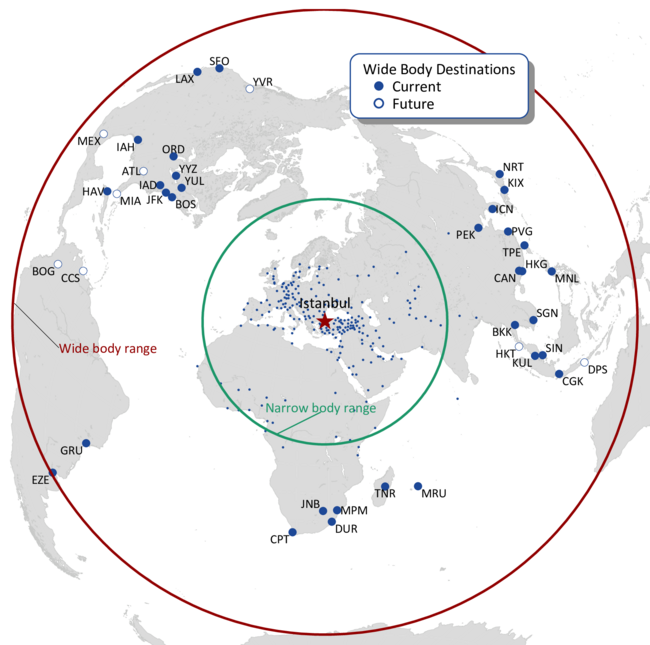

THY is continuing to expand beyond its unique narrowbody connecting market (see map) into its widebody market which from its Istanbul hub covers most of the planet. The Americas is the main focus, with new routes starting or planned to Vancouver, Atlanta, Mexico City, Havana, Bogota and Caracas. The risk is more direct competition with the three Middle East superconnectors.

On the other hand, THY is a growing threat to the European network carriers, especially Lufthansa, siphoning off intercontinental connecting traffic to its lower cost hub operation and also attacking local feed traffic to the Euro-hubs by its innovative 737 connecting strategy, bringing intercontinental service to myriad secondary city pairs.

Even with a planned sharp reduction in growth post-2016 THY is on target to meet two psychologically significant targets — surpassing Lufthansa Passenger Airline in terms of traffic in 2019 and reaching 100m passengers by around 2021.

This, however, depends on the new Istanbul airport opening in early 2018, as currently scheduled. Initially the airport, yet to be named, will have three runways and a terminal capacity of 90m passengers. By 2028 capacity will have been extended to 150m passengers. The government has announced that commercial operations will be run down and closed at Atatürk airport, although the timing is unclear.

THY’s fleet plan (see table) reveals a marked change in growth strategy. For the five years from 2016 THY’s seat capacity growth will be around 5% pa in contrast to 15% pa for the ten years to 2016. The airline officially is not planning for any increase in its widebody fleet. This makes THY an enticing target for both Boeing and Airbus but, based on past ordering policy, THY, if or rather when it decides on long-haul expansion, is likely to select both 787s and A350s. There is regular speculation about THY opting for new or second-hand A380s, but it is very difficult to see how this type could fit into its network.

The narrowbody fleet is planned to grow by a net 20-30 units a year after 2017, with 737MAXs and A321neos systematically replacing the conventional types in THY’s fleet. Again this is fairly modest growth by historic standards.

THY, although growing at roughly twice the rate of the Euro-majors, is entering a period of relative consolidation. It is focusing on a number of KPIs with the aim of at least maintaining its current cost advantage — with a slightly lower average stage length, THY estimates its unit costs to be about 30% below those of the Euro-majors and 10% below the average of the superconnectors but at a much shorter stage length.

- With fixed costs representing 29% of total costs, increasing aircraft utilisation by 10%, roughly the efficiency gain it achieved during 2010-15, will reduce CASK by 3%.

- There is significant potential for pushing up load factors. On short haul, THY's load factor in 2015 was 83.5%, up from 76.7% in 2010, but still some points below the LCC standard. On long haul the load factor was 77.1%, again below the levels being attained by European and US network carriers.

- RASK is about 8.1 US¢ at present compared to 11¢ for the Euro-majors; THY sees the potential of increasing its unit revenue to 9¢. Winning more business class passengers — currently only about 4% of the total — is the challenge.

Finally, there is the perennial question of a deep alliance with Lufthansa, the last attempt at which ended a bit acrimoniously in 2013. THY may feel that it doesn’t need Lufthansa on purely commercial rationale but there is now a wider geopolitical consideration.

| TOTAL | 299 | 339 | 324 | 342 | 368 | 402 | 433 | 430 | |

| year end | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | |

| Widebodies | A330-200 | 20 | 20 | 18 | 18 | 16 | 13 | 13 | 8 |

| A330-300 | 26 | 31 | 31 | 31 | 31 | 31 | 31 | 31 | |

| A340 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | |

| 777-300ER | 23 | 32 | 35 | 35 | 34 | 32 | 32 | 32 | |

| Total | 73 | 87 | 88 | 88 | 85 | 80 | 80 | 75 | |

| Narrowbodies | 737-900ER | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 |

| 737-9MAX | 5 | 10 | 10 | 10 | |||||

| 737-800 | 92 | 112 | 110 | 99 | 96 | 88 | 86 | 82 | |

| 737-700 | 4 | 1 | 1 | 1 | 1 | ||||

| 737-8MAX | 20 | 30 | 55 | 65 | 65 | ||||

| A321 neo | 14 | 39 | 61 | 86 | 92 | ||||

| A319 | 14 | 14 | 11 | 9 | 8 | 6 | 6 | 6 | |

| A320 | 29 | 29 | 22 | 19 | 12 | 12 | 12 | 12 | |

| A321 | 56 | 66 | 68 | 68 | 68 | 66 | 64 | 64 | |

| E195 | 6 | 3 | |||||||

| Total | 216 | 240 | 227 | 245 | 274 | 313 | 344 | 346 | |

| Cargo | A330F | 6 | 8 | 9 | 9 | 9 | 9 | 9 | 9 |

| Wet Lease | 4 | 4 | |||||||

| Total | 10 | 12 | 9 | 9 | 9 | 9 | 9 | 9 |