Geneva Forum poll results

May 2012

The renowned February Geneva Forum, the 26th in the series, took place this year in Barcelona in March. Unusually this year there was no clear consensus on the direction of the industry.

The outlook for the economy — headlined by a presentation from Norbert Walter (former chief economist at Deutsche Bank) — was unsurprisingly shown as being in severe doubt, depending on the outcome of the Euro debt crisis. The dynamic growth in the BRICs and static performance in the developed world was seen as continuing, with some risks of a reduction in world economic growth from a lack of consumption in the developed world.

As usual the delegates were polled on various questions (see table, page 2). On the economy the audience seemed relatively positive — with most believing that the world economy would show growth of over 2.5% in 2012 (although less than 3%). Given the news flow it is hardly surprising that the biggest risk to economic growth was seen as a renewed crisis in the Eurozone. A notable 26% considered fuel prices as the major risk. On oil prices themselves, most of the delegates understandably plumped for little change to the current position, just 5% expected a dip below $90/bbl over the next 3-5 years, and 14% looked at prices over $150/bbl.

On the outlook for aircraft finance, the delegates expected most new aircraft finance to come roughly equally from leasing companies and the capital markets although a notable minority thought that the ECAs would be relevant despite the changes in export credit rules. When asked about the impact on the ability to raise capital of the introduction of new generation aircraft, more than a third of respondents thought there would be no impact, while a notable 30% thought it would make it easier. However, on the question of the impact of increased narrow-body production by the manufacturers, the majority expressed concern that it would lead to reduced residual values of older aircraft; and the question of the manufacturers' production rates has been a concern of the conference delegates for the past few years for this very reason. Finally, when asked for the most influential factor on the leasing industry in years to come, a third of the respondents selected lack of availability of bank finance.

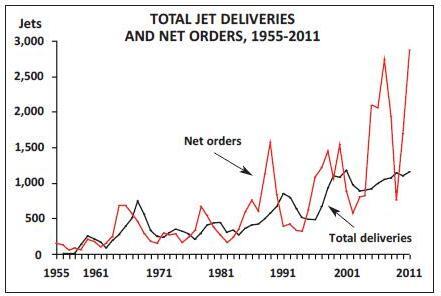

There were observations — mostly from US based presenters — concerning a “bubble” in aircraft orders. Adam Pilarski of Avitas, in particular remarked on the fact that the backlog is approaching 50% of the active world fleet and represents more than seven years of current production rates (or twelve years' production of the widebody backlog). Richard Aboulafia of The Teal Group expressed further concerns about the actual money value of the order backlog. He did not go so far as saying it was a bubble, but cast doubts on the validity of some of the orders in the backlog, noting in particular that the Gulf super-connectors' widebody orders, $82bn at list prices, accounted for 26% of the total value on order (and 62% of that with Airbus).

Can this really represent a bubble? A pre-condition for market bubbles is that there is an excess of finance available for particular asset types, and that financiers throw cash irrationally at an investment whose price is expected to continue to rise for ever. In this, the post-Lehman world, this should be unlikely; the capital requirements imposed on the banking industry under Basel III are reining in the ability to lend, as well as the appetite. Some notable banking names have withdrawn from funding the aviation industry. The new rules on ECA funding coming in next year will further remove capacity for cheap debt capital. There may be the concern that some will have difficulty finding the funding to acquire the aircraft more than there is a liquidity inspired bubble.

The current commercial order backlog stands at around 9,400 aircraft representing over eight years of current production (the highest ratio it has ever been) and 45% of the fleet at the end of 2011. We have analysed the current order backlog — and present the analysis in the following tables. There are a large number of aircraft on order, but little sign of a bubble. Even the lessors only account for 15% of the backlog (even though there may be some duplication), slightly less than the 1991 GPA peak. The industry has been delivering around 1,000 aircraft in the past three years but this is set to increase in the short run. The current dated orders call for annual deliveries of between 1,300 and 1,400 a year to 2015 — seemingly a significant jump. But this level of deliveries would still only represent 5-6% of the active fleet each year and is consistent with a 20 year useful life; existing aircraft almost certainly have a shorter economic life than hitherto because of the need to go for fuel efficiency.