AMR: Loner likely to post more losses

May 2011

American is the only one of the US legacy carriers likely to post a loss for 2011 (and for 2012), amid signs that it is losing corporate market share to Delta and United, which are benefiting from broader networks following their recent mergers. Analysts and investors are becoming a little impatient and asking: will AMR be able to reverse that trend and when?

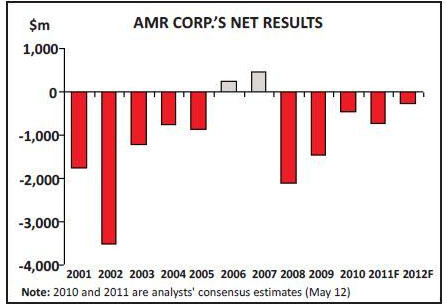

AMR has had only two profitable years in the last decade (2006 and 2007). It incurred net losses totalling $12.2bn in 2001–2010 and is expected to lose another $1bn in the next two years (according to Thomson/First Call consensus estimates).

The airline may not even break even on an operating basis this year. In an April 29 research note, JP Morgan projected that it would have a negative 0.1% operating margin in 2011, followed by a slightly positive 2% margin in 2012. By comparison, in the next two years Delta and United are forecast to achieve operating margins in the 7–9% range.

The reasons for AMR’s financial under–performance are well known. It never had the benefit of Chapter 11. It did well to secure $1.8bn of voluntary annual labour concessions in 2003, but four of its key competitors (UAL, US Airways, Delta and Northwest) achieved much greater savings in bankruptcy in 2002–2007, and AMR ended up with a significant labour cost disadvantage. Then all of the concessionary labour contracts became amendable in May 2008 and the workers began to demand substantial pay increases.

The talks have gone nowhere. The unions have now worked under the old contracts for three years and their patience is running thin.

To add to the woes, American had long delays in its global alliances efforts; notably, it waited a decade to secure transatlantic ATI with BA. And, in recent years, its key competitors have gained scale and strength through mergers, while AMR has been left out in the cold.

While the overall cost gap has narrowed significantly (largely because of success in reducing non–labour costs), recent trends on the revenue side have not been so encouraging. According to BofA Merrill Lynch, AMR has under–performed the industry in PRASM by five points in the last two years. Its 5.5% PRASM gain in the first quarter was two points below industry gains, and American under–performed in all regions.

There were some special factors in the latest period. AMR estimated that it took a $100m revenue hit from weather cancellations, the Japan crisis, a Miami airport fuel fire and its distribution battle with Orbitz et al. American’s own moves to shift capacity to its largest markets may also have temporarily diluted its domestic unit revenues. But there are also signs of competitive factors being at play. As BofA Merrill Lynch analysts put it, “increased scale by merged competitors may be shifting corporate share away from AMR”.

AMR’s intended remedies are also well known. On the cost side, while continuing to negotiate with its unions for contracts that must be both fair and cost–effective, AMR is counting on there being a convergence of labour costs over time, as competitors will not be able to sustain the labour rates and benefits secured in bankruptcy. CEO Gerard Arpey noted that by year–end 19 of the 30 major labour contracts in the US industry will be amendable. Of the 11 remaining contracts that extend into 2012 and beyond, nine are at carriers currently involved in mergers. So those airlines will also be looking to sign new integrated agreements in the near term. “So, simply put, almost the entire industry is either in negotiations or will be very soon.”

On the revenue side, over the past year or so AMR has been engaged in an all–out effort to compensate for its network disadvantage and bolster its global and domestic presence particularly in business markets through alliances/JVs and by switching capacity to five “cornerstone” markets in the US.

To summarise, AMR has, first of all, implemented a joint business (JB) with BA and Iberia. The venture was officially launched in October 2010, and the airlines made an immediate grab for business traffic share by putting in place a very attractive New York–London “express” service that now includes 15 flights a day. They have just implemented their first fully coordinated Atlantic summer schedule, making it easy for passengers to make connections in London to 50 cities in Europe.

This spring AMR has also been boosting its US East Coast–Europe service with the help of oneworld partners. It has added the JFKBudapest route (to connect with Malev), expanded its JFK–Barcelona and Miami- Madrid operations, and is adding Chicago- Helsinki this month (to connect with Finnair).

The transpacific JV with JAL was launched on April 1, with AMR and JAL code–sharing in 120 markets and revenue sharing following later. The Japan crisis has meant very tough market conditions, but AMR’s leadership believes that overall the partnership puts it in a much better position to manage through the near–term and achieve long–term success as Japan rebuilds.

The strategy of focusing on five “cornerstone” markets (New York, Chicago, LosAngeles, Dallas–Ft. Worth and Miami) was launched a year ago. It has meant AMR redeploying aircraft from Boston, the Caribbean and elsewhere to the five cornerstones. This spring’s focus has been on strengthening Los Angeles, where American and Eagle have added 10 new destinations, including Shanghai. Total daily departures at LAX have increased by 28% to over 150. American believes that it has an unmatched set of partners there to attract premium traffic (Cathay, Qantas, JAL, BA, Iberia and Alaska).

American and Qantas have just announced that they are seeking regulatory approval for a JBA for the Australia/New Zealand–US market and beyond to third countries. This is timed to maximise the benefits of Qantas’ new Sydney–Dallas service that begins in mid–May. The airlines will code–share on that route and on beyond–sectors in the US and Australia.

AMR is also building on its industry–leading franchise in Miami and Latin America. The best opportunity currently is in Brazil, thanks to a new US–Brazil open skies ASA that is being introduced in stages. American has asked for 10 additional US–Brazil frequencies from Miami.

In the past year AMR has also been active in forging code–share alliances with smaller carriers (including JetBlue and WestJet). And, as might be expected, it is “aggressively pursuing” corporate contracts, both individually and with new partners.

There is not a lot that can be done about the pace or outcome of labour negotiations, but investors certainly want to know when the revenue initiatives start producing some tangible benefits. With all that progress and exciting new activity, why financial losses for another two years?

Last year American said that it anticipated over $500m in annual revenue benefits from the transatlantic and transpacific JVs and the cornerstone initiatives. A large portion of the benefits were expected to be realised in 2011, with the full value to be achieved by the end of 2012.

But now the management is effectively saying that it will take more time for the revenue benefits to ramp up. For example, in the transatlantic JV, the airlines initiated joint sales efforts and began signing combined agreements with corporate accounts only in early April. Because of the cycle of contract renewals, it will be some time before the full benefits are seen. But AMR still expects the full run rate of the $500m benefits to be in place by year–end 2012.

Arpey predicts that as industry labour costs begin to converge and the benefits from the revenue initiatives ramp up, AMR’s RASM performance and margins will begin to improve relative to the industry. The other point emphasised by the management is that the strategic initiatives are really for the long term.

After long leading the industry in taking a disciplined approach to capacity, American is now under some pressure to grow to maintain a competitive network. In April its international ASMs grew at a brisk 11.6% rate. However, in response to fuel, like its peers American has now sharply curtailed growth in the autumn months. It now intends to retire at least 25 MD–80s and grow its mainline capacity by only 2.2% in 2011, consisting of a 0.5% domestic decline and 6.2% international growth.

American recently converted two 777- 300ER options and now has five of those aircraft scheduled for delivery in 2012- 2013. It has taken some stick from analysts for ordering aircraft while continuing to report losses, but with an average fleet age of 15 years, it cannot defer fleet modernisation.

It continues to take 737–800s to replace MD–80s.

AMR has a relatively weak balance sheet, with a high level of lease–adjusted debt ($17.4bn). It has a significant $2.5bn of scheduled debt and capital lease payments and capex of around $1.7bn in 2011, though some of the maturities are likely to be refinanced. On the positive side, over $1bn of Section 1110 aircraft are becoming unencumbered this year. Also, after raising $1bn in a private note offering in March (which was secured by various international route rights and airport slots), AMR now has strong liquidity: total cash of $6.5bn at the end of March, or over 25% of annual revenues — something that gives it much financial flexibility.