ANA: From JAL's shadow to Asia's number one by 2012?

May 2010

While Japan’s All Nippon Airways (ANA), the world’s tenth largest airline in terms of passengers, is battling recession and faces much uncertainty due to JAL’s bankruptcy restructuring, it can also look forward to new business opportunities starting in late 2010. The Haneda “big bang” in October, start of 787 deliveries at year–end, a new open skies regime with the US, antitrust immunity (ATI) on the Pacific and JAL’s expected sharp contraction make up a unique set of developments that could help make ANA one of Asia’s leading carriers by 2012.

$1bn of cuts

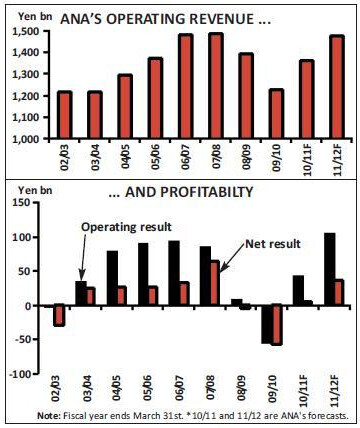

As a sobering reminder of the financial challenges still faced by global airlines, ANA reported a steep ¥57.3bn (US$609m) net loss for its fiscal year ended March 31st. This contrasted with a small ¥4.3bn ($45m) net loss in FY 2008, which had been the airline’s first annual loss in six years. On an operating basis, ANA lost ¥54.2bn ($576m) on revenues of ¥1,228bn ($13bn) in FY 2009. The losses came despite over ¥100bn ($1bn) of cost cuts and earnings–boosting measures. ANA eliminated many unprofitable domestic routes, reduced frequencies or switched to smaller aircraft both domestically and internationally, cut labour expenses through increased unpaid leave, and slashed sales and contract costs. ANA was also very aggressive in trying to stimulate demand with new types of discount fares, and it tried to boost revenues with “pay for value” services, such as offering business class meals in economy class for a fee.

While ANA succeeded in creating some demand in the leisure segment, business travel and unit revenues remained extremely depressed throughout the year. Operating revenues fell by 11.8% last year or by 17.4% from the 2007 level.

The main culprit was international passenger service, which saw revenues plummet by 26.4% last year. ANA kept its planes full (passenger numbers were up by 5.3% and load factor rose by 6.3 points to 75.7%), but its average fare in international service fell by 30%.

The more stable domestic passenger segment saw continued weak demand (ANA’s passenger numbers were down by 6.7%) and sluggish unit revenues (down 3.3%). The domestic revenue decline was 9.8%. ANA is still primarily a domestic operator. Domestic passenger service accounted for 58% of its total air transportation revenues, while international passengers’ share was only 19.7% (down four points); the rest came from cargo (8.7%) and “other” revenues, including charters (13.6%).

Of course, JAL’s FY 2009 results will be much worse, given its higher cost structure and greater international exposure, as well as the passenger book–away in the months leading up to the January 19th bankruptcy filing. In late April JAL was expected to report an operating loss of around ¥170bn ($1.8bn) for the fiscal year ended March 31st.

ANA’s balance sheet is in relatively good financial shape, with total assets of ¥1,859bn ($19.8bn), shareholders’ equity of ¥473.5bn ($5bn), interest–bearing debt of ¥941.6bn ($10bn) and a lease adjusted debt/equity ratio of 2.4 at the end of March.

Return to profitability in 2010?

Notably, ANA has been able to tap the capital markets for funds despite the tough industry environment. Last summer, when JAL had no choice but to seek an emergency loan from the government, ANA sold stock for the first time in three years, raising almost ¥150bn ($1.6bn) to fund new aircraft. And last month (April) ANA sold bonds for the first time since 2008; the offering was doubled in size to ¥20bn ($213m) due to strong investor demand. ANA is already forecasting a return to modest profitability this year. Its latest two–year (2010–2011) business plan, released on March 19th and affirmed on April 30th, projects 11.5% revenue growth, a 3% operating margin and a small ¥5bn ($53m) net profit in FY 2010. If there is a profit, ANA will recommence dividend payments.

In FY 2011 the business plan anticipates a return to essentially pre–2008 type results. Revenues would have virtually recovered to the 2006–2007 peak level. The 7% operating margin would be slightly better than the 6–6.5% margins ANA was earning in 2004–2007. There would be a ¥37bn ($393m) net profit (2.5% of revenues).

This would be a swifter financial recovery. ANA hopes to achieve it by significantly growing its international passenger revenues, cutting costs further and streamlining the group structure.

In the current year ANA is relying primarily on a new ¥86bn ($915m) package of cost cuts and productivity improvements, though it is also targeting ¥32bn ($340m) of revenue improvements through “greater competitive ability” (including initial positive impact from stronger code–share alliances).

The new cost–cutting programme aims to shave ¥19bn from sales and distribution expenses and ¥20bn from labour costs and achieve ¥47bn savings from restructuring and other measures. On the labour front, ANA is looking to reduce back–office staff numbers by 1,000, offer an early retirement programme, extend working hours and cut management salaries.

ANA has launched a two–year corporate streamlining effort aimed at improving efficiency and flexibility. This year will see the number of companies in the airline group reduced from seven to four. First, the cargo operation, ANA & JP Express, will be merged into another subsidiary, Air Japan, by July. Both units are Tokyo–based and operate 767–300s. Air Japan will be the surviving entity.

Second, by October ANA will combine its three smallest passenger airline units — Air Nippon Network (A–Net), Air Central and Air Next. A–Net is a Dash 8 operator feeding to ANA at Tokyo and Sapporo. Air Central is a Nagoya–based turboprop operator. Air Next is a lower–cost airline launched by ANA in 2005 to operate 737–500s on domestic routes.

Subsequently, in FY 2011, the intention is to consolidate the four airlines into three. This will probably mean formally merging Air Nippon into ANA. Air Nippon is an old–established Tokyobased unit that operates 30 of ANA’s 737–500/700/800s mainly in domestic short–haul markets.

But the main thrust of ANA’s new business plan is to grow international passenger revenues. In fact, achieving the FY 2011 goal of operating income in excess of ¥100bn ($1.1bn) relies heavily on international routes.

The business plan projects that international passenger revenues will surge from last year’s ¥214bn ($2.3bn) to ¥357bn ($3.8bn) in FY 2011 – a 67% increase. In the same two–year period, domestic passenger revenues are forecast to rise by only 7%, from ¥631bn ($6.7bn) to ¥676bn ($7.2bn).

ANA believes that the international passenger revenue targets are achievable, first, because of demand growth on China and other Asian routes (even as Japan’s domestic market stagnates). The Asia–Pacific region is leading the global economic recovery, which will help Japan–based carriers even though Japan’s economic recovery remains fragile.

Second, ANA is uniquely well positioned to tap recovering Asian demand because of the significant increase in airport capacity in the Tokyo metropolitan area this year. In particular, the opening of Haneda Airport to more international flights in October 2010 will be a major business opportunity for the carrier.

Third, closer cooperation with Star partners United and Continental, assuming that ATI is granted later this year, can be expected to boost ANA’s international passenger revenues from FY 2011.

ANA has seen accelerating demand trends in recent months, particularly internationally. As of late April, there had been no sign of recovery in unit revenues, but the airline expects half of the ¥60bn increase in international passenger revenues this year to come from RASK improvement (though almost half of that relates to fuel surcharges).

The business plan forecasts do not assume any growth opportunities resulting from JAL’s restructuring or quantitative effects of ATI. The forecasts are based on an exchange rate of ¥95 to the US dollar, a market price of Dubai crude oil of US$75 per barrel in FY 2010 and US$80 in FY 2011, and a price for Singapore kerosene of US$85 in FY 2010 and US$90 in FY 2011.

On the balance sheet front, ANA is looking to modestly improve its shareholders’ equity ratio (to 28% of assets), maintain interest–bearing debt at current levels and improve its debt/equity ratio from the current 2 to 1.8 times by FY 2011.

In summary, the 2010–2011 business plan aims to achieve a quick recovery in earnings this year and stable profits thereafter. The next two years will be an “evolve and survive” period, to be followed by a growth phase from FY 2012, when the next phase of Haneda international route allocations and other airport issues will hopefully have been settled.

Implications of JAL’s restructuring

For some years now, ANA has had the goal of becoming “the number one airline group in Asia” in terms of quality, customer satisfaction and value creation. The next few years could also make it the leading airline in Asia in terms of size. But ANA’s fortunes are intrinsically linked to what happens at JAL, the other half of Japan’s airline duopoly that filed for bankruptcy protection on January 19th and is currently being restructured with the help of ¥900bn ($9.6bn) in cash injections and loans from the state–backed ETIC (Enterprise Turnaround Initiative Corporation of Japan), the state–owned Development Bank of Japan and other major creditor banks.

JAL’s restructuring poses both risks and opportunities for ANA. But JAL’s plans are still far from clear; if anything, things have become increasingly complicated. JAL’s trustee warned recently that the company could miss the end–of–June deadline for submitting its rehabilitation plan by as much as two months.

From ANA’s point of view, the main risk is that the state support for JAL will distort competition. ANA’s leadership has voiced its concerns in testimony to the government, arguing that JAL must not use public funds to undercut fares or fund new investment. Concern about the JAL impact prompted Moody’s to downgrade ANA’s credit ratings in November, and in part due to such concerns analysts’ consensus recommendation on ANA’s stock has remained at “hold”.

Then there is the long–term negative impact. The restructuring will significantly reduce JAL’s total ¥2,300bn ($24.5bn) liabilities. A revitalised, leaner JAL could eventually become a formidable threat to ANA.

The Japanese government has a difficult balancing act on its hands. However, based on comments by various ministers, the government seems to have taken on board ANA’s concerns and is also determined to try to even out things. ANA has secured a bigger proportion of international landing slots in Tokyo than it would normally be entitled to, and it may also get preferential treatment in future slot allocations.

Of course, ANA has already seen market share gains resulting from passengers booking away from JAL. Even United noted in its fourth–quarter call that JAL book–away may have contributed to its significant recent RASM gains on the Pacific.

JAL’s contraction is obviously good news for ANA. In particular, it should provide opportunities for ANA to grow its international operations by adding frequencies or new routes. Most or all of the domestic routes that JAL is abandoning are between regional cities and of no value to ANA.

JAL’s preliminary revitalisation plan in January called for the axing of 14 international and 17 domestic routes by March 2012. As a result of worsening losses and pressure from creditor banks, in late April JAL unveiled accelerated, deeper cuts for the current year: 15 international routes (86 weekly flights) and 30 domestic routes (58 daily flights) will now go by March 2011, starting on September 30th. This will bring the total number of route eliminations since March 2009 to 28 international and 50 domestic, representing 40% and 30% reductions in capacity over the 2008 level.

Disagreement on cuts

The international cuts include elimination of service to Rome, Milan, Amsterdam, Sao Paulo (which contains the largest ethnic Japanese population outside Japan) and Bali. ANA has not yet commented on whether it might be interested in moving into any of those markets. These cuts will be part of the rehabilitation plan that JAL will be submitting to the bankruptcy court. The problem is that JAL, ETIC and the creditor banks cannot agree on the measures. The banks are demanding deeper cuts in international operations, which have been generating huge losses, while local governments are vigorously protesting the domestic cuts that could lead to local airport closures.

So the final contents of the rehabilitation plan are far from clear. It is not yet even possible to totally rule out the extreme scenario of JAL pulling out of all international service or limiting such service to the growing Asian market, which some of the banks have been calling for because they fear that the current cuts will not ensure JAL’s survival. Such scenarios would obviously have fundamental impact on ANA, potentially making it Japan’s sole flag carrier.

However, those scenarios are unlikely. JAL’s management has stood firm on keeping international routes. JAL and ANA are part of separate transpacific ATI applications and can look forward to profitable cooperation with their global partners.

ANA’s growth plans

Over the past month, ANA’s share price has been inching up as several analysts have upgraded their recommendations on the stock, noting that ANA is well–positioned to grow as JAL contracts (the upgrades also reflect perceptions that demand recovery is gathering pace). ANA’s international growth strategy focuses on three things: expanding its network and service from Tokyo taking advantage of this year’s major capacity increases at Haneda and Narita airports; improving connections especially between North America and China/Asia using a Haneda/Narita “dual hub” strategy; and taking advantage of alliances and ATI to extend its global reach and grow revenues.

The increase in Narita slots took effect at the end of March when the airport’s extended 2,500–metre runway B became operational. ANA is using the slots to boost frequencies on many of its Asia routes this year and to launch a new Narita–Munich route in July (Lufthansa’s second hub will allow it to tap demand in southern and eastern Europe). ANA is also striving to improve China–North America and China–other Asia flight connections (also with other Star members) and will be utilising a new yield management system to help capture connecting traffic.

Tokyo’s Haneda Airport will be opened up to more international flights when a fourth runway opens there in October. The runway will boost maximum annual aircraft movements by 43%, but the total slots will be increased in stages. Initially, there will be 60,000 slots available annually for international flights (half of those during the day, half late night or early morning) or 80 departure slots per day, which will be evenly divided between Japanese and non- Japanese airlines. An advisory panel has recommended that another 30,000 be added to the daytime slots by 2013, to boost international departures to 120 per day – about 30% of those at Narita Airport.

ANA’s initial Haneda plans feature a new route to Taipei (its fifth international destination from that airport) and frequency increases in the four existing markets (Seoul, Beijing, Shanghai and Hong Kong) in October. The airline is also restarting a domestic route to Tokushima and boosting frequencies to Okinawa.

In addition, ANA is exploring the possibility of offering long–haul flights to the US West Coast and Southeast Asia from Haneda in the late night and early morning periods when Narita is closed. Star members United and Continental are among five US carriers competing for four daily slot pairs at Haneda from October; United wants to serve it from San Francisco and Continental from Newark and Guam.

The new Narita and Haneda opportunities mean that ANA’s international passenger flights out of Tokyo are set to increase by 54% in the next two years, from 236 per week in FY 2009 to 364 in FY 2011. In contrast, ANA will be contracting at Osaka’s Kansai Airport, suspending several Asian routes to reduce costs and regain profitability.

In the domestic passenger market and in cargo operations ANA is in the consolidation or damage–limitation mode. Domestically, ANA has a strong brand and competitive position, but the market is maturing and the goal is to establish a demand–supply balance and to try to improve profitability through network restructuring and efficiency measures. ANA will shift more capacity to Haneda and strengthen ties with feeder partners.

With cargo, the plan is to try to “stabilise” the operation of the Okinawa cargo hub and network, which ANA has been developing since 2006 but which was hit hard by recession. ANA has postponed the utilisation of widebody freighters (instead deploying nine medium- size freighters) and will be introducing a new cargo revenue management system and new freight charges in an effort to grow revenues.

US and Japan open skies

After the Haneda “big bang” in October, ANA can hopefully turn its attention to an assortment of exciting developments affecting its long–haul operations: ATI on the Pacific, closer cooperation with United and Continental, Japan–US open skies and Boeing delivering its first 787s by year–end. The US and Japan reached a tentative open skies agreement in December 2009, which will for the first time allow immunised alliances; however, the US must grant ATI to alliances involving both JAL and ANA before the open skies pact can take effect. It was specifically ANA’s interest in ATI that led to the Japanese government being willing to consider open skies with the US, despite its concerns about US dominance in the transpacific market.

ANA, United and Continental immediately applied to the DOT for ATI and a JV on the transpacific. JAL and American followed suit with their own ATI application in February. The DOT is expected to look at the two applications in concert. Approval seems highly likely, given that the proposals would ensure roughly equal US–Japan market shares for the three global alliances. ANA expects the authorisations by around October and is targeting the summer 2011 flight schedule for implementation.

While waiting for ATI, ANA has begun code–sharing with Continental, which joined Star last year. Continental’s network has offered new options for ANA customers especially in Micronesia, southern US and Latin America.

ANA is poised to benefit if UAL and Continental complete their planned merger, because it would result in a more powerful US partner and probably streamline the transpacific JV–building process. The downside would be potential integration problems and a volatile transition period, during which the US managements might have less time to focus on the JV.

The start of the 787 deliveries (still officially by year–end) will open up new long–haul expansion possibilities for ANA. The airline is believed to be considering at least two new US cities; the possibilities include Houston (Continental’s hub), Boston and Miami.

ANA has 55 787s on firm order, following a top–up order for five last summer, and expects to receive eight of those in the current fiscal year. Like JAL, ANA has converted its 28 orders for the 787–3 short–range version to the longer–range 787–8. Nine 767–300ERs are acting as interim aircraft because of the 787 delays.

This year’s total of 25 new deliveries will also include four 777–300ERs — the type that together with the 787 will form the backbone of the future longhaul fleet. ANA will complete its 747- 400 and A320–200 retirements in FY 2010.

In December 2008 ANA shelved its long–awaited large aircraft decision; the choice had been between the A380, the 747–8 or not acquiring a new fleet at all. But, interestingly, press reports in late April quoted a senior ANA executive saying that the airline was now “more interested” in the A380 because of its positive passenger reception and because of the possibility of a Japan- Singapore open skies pact, which would allow SIA to pick up passengers from Japan to the US.

One of the challenges that ANA faces as it strives to become “Asia’s number one” and strengthen Tokyo as a hub linking North America/Europe and Asia is the high level of airport charges in Japan. ANA’s president Shinichiro Ito has also frequently noted that for that same reason it would be hard to launch a low–cost subsidiary in Japan.

| Yen bn | REVENUE FORECASTS 07/08 08/09 09/10F 10/11F |

||||||||||||

| Other | 129 | 148 | 174 | 172 | |||||||||

| Cargo & mail | 110 | 94 | 117 | 131 | |||||||||

| International pax. | 291 | 214 | 273 | 357 | |||||||||

| Domestic pax. | 699 | 631 | 655 | 676 | |||||||||

| Total revenue | 1,230 | 1,088 | 1,219 | 1,336 | |||||||||