AirAsia leads the Asian LCC charge

May 2010

Asian LCCs are taking an ever–increasing share of traffic to/from and within the Asia/Pacific region, and so far this year AirAsia and Jetstar have signed a strategic alliance while Tiger Airways has undergone an IPO. In the first of a series on Asian LCCs, Aviation Strategy looks at the prospects for the largest LCC in the region — AirAsia.

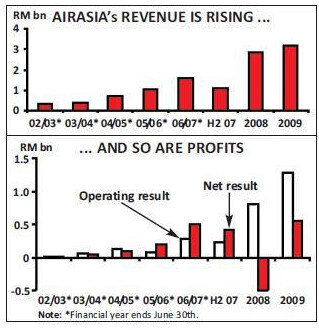

The AirAsia family (including AirAsia X) currently operates 136 routes to 18 countries in the Asia/Pacific region and Europe, and employs almost 7,000. The AirAsia group (which excludes AirAsia X) posted its best–ever set of financial results in 2009 (see charts, below). Last year the core AirAsia operation (based in Malaysia) posted an 11.5% rise in revenue, to RM3.2bn (US$905m), based on a 21% rise in passengers carried to 14.2m in 2009. Operating profit rose to RM1.3bn (US$366m) in 2009 (compared with RM807m in 2008), and a RM497m net loss in 2008 turned into a RM549m (US$156m) net profit last year – giving the airline impressive operating and net margins of 40.4% and 17.3% respectively in 2009.

However, it is not all good news for AirAsia. At the Malaysian operation unit revenue fell 14% in the fourth quarter of 2009 compared with Q408 — faster than a 10% fall in unit costs over the same period. The key problem is fares; on average they fell 23% from 4Q08 to 4Q09, although ancillary revenue per passenger rose by 11% over the period, thus reducing the fall in unit passenger revenue a little (it dropped 20% year–on–year, to RM200.8, or US$57.2). The push for ancillary revenue is also continuing, and in March AirAsia launched a ticketing service for music concerts and various other entertainment events.

Yield the 2010 priority

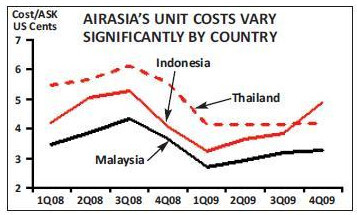

This is all relative of course, since AirAsia’s unit costs are among the lowest in the global aviation industry – if not the lowest (which is AirAsia’s claim). There is an ever–continuing effort to cut costs (for example, AirAsia aims to eliminate airport check–in by the end of this year, with all passengers then having to check–in online) and as can be seen in the graph, right, although unit costs rose through 2009 (thanks largely to fuel prices), they are still extremely low. Given the fall in average fares through the end of last year, the focus for 2010 is on improving yields rather than maximising growth, with Tony Fernandes, AirAsia group CEO, saying this year is about “fine tuning the current route network to extract higher yields”. Fernandes (with Conor McCarthy) has a major stake in the airline through controlling Tune Air, the holding company that owns 30.9% of AirAsia.

In 2009 the Kuala Lumpur–based Malaysian operation accounted for more than 50% of the domestic market and 21% of international traffic to/from Malaysia, but the new focus on yield means that some under–performing routes are likely to be closed this year. Of course there will still be growth in some areas, first via increasing services between AirAsia’s main bases in Malaysia, Thailand and Indonesia, and second though new routes to India.

After concentrating on building routes into China for the last few years AirAsia is now turning to India, where Indians have been flying to Indonesia and Thailand in order to connect to the AirAsia network. AirAsia is targeting to carry 2m passengers a year to India by 2011 (it carried 0.6m in 2009), building upon the success of existing routes to Tiruchirapplalli, Kolkata, Kochi and Thiruvananthapuram that average more than 80% load factors.

Routes being launched this year include five from Kuala Lumpur (to Mumbai, New Delhi, Chennai, Bangalore and Hyderabad) as well as Penang–Chennai. The first three routes are to be served by AirAsia with A320s, but the latter two are operated by AirAsia X, using A330s, and once all these are launched AirAsia will offer 150 flights a week between Malaysia and India.

Altogether the AirAsia group added 12 routes in 2009 and four new bases (Penang, Bandung, Phuket and Surabaya), and there was a 24% rise in passengers carried across the group, to 22.7m. In 2010 overall group capacity will grow by up to 14%, with increases in frequency on the existing network and through the launch of up to 12 new routes.

Subsidiary cheer

AirAsia is also targeting a 40% rise in cargo revenue in 2010, which it is encouraging through signing more deals with cargo agents and direct with large import/export companies within Asia (and in particular southern Asia), as well as via Special Prorate Agreements (SPAs) with other airlines into destinations where AirAsia does not currently operate. For the first time AirAsia has released detailed figures for its subsidiaries — probably because at long last there seems to be signs of a turnaround at the airlines in Indonesia and Thailand (each of which AirAsia owns 49% of).

AirAsia Thailand had seen the domestic and tourist market in Thailand recover, leading to higher yields in 2009. Thai revenue rose 5% to THB 9.3bn (US$273m) in 2009, with a core operating profit of THB 148.4m (US$4.4m), compared with a THB 735.4m loss in 2008. At the net level however the Thai operation made a THB 809m (US$23.8m) loss in 2008, thanks partly to foreign exchange translations.

The immediate focus in Thailand was to be expansion of international routes – currently its routes are split 50:50 between domestic and international, and the plan is to change this to 30:70 by 2014 since the domestic market is believed to be “saturated”, according to the airline. But how the airline’s plans will be affected by the current political turmoil in Thailand is unknown — though the tourism market will inevitably collapse.

AirAsia Thailand was due to launch its first four routes into India this year, from Bangkok to Mumbai, New Delhi, Kolkata and Hyderabad, and these were to be followed by further destinations. The airline was also increasing routes to/from Phuket, its second Thai hub that was launched last year.

The airline has 19 aircraft, and this year eight new A320s are arriving, seven of which will replace the remaining 737s in the Thai fleet, thus completing the overhaul of the fleet in the country. Prior to the domestic unrest, AirAsia Thailand expected capacity to increase by 25% this year (largely thanks to the A320s, which have 20% more capacity than the 737s they are replacing) with a 16% rise in passengers carried to 5.8m.

AirAsia Indonesia had revenue of IDR 2,017bn (US$202m) in 2009, some 32% up on 2008. However it still could not make a core operating profit, reporting a loss of IDR 79.3bn (US$7.9m), although lower than the IDR 140.9m operating loss for 2008.

Efficiency boost

The Indonesian operation made a net loss of IDR 189.3bn (US$18.90m) in 2009, as opposed to an IDR 140.9m net loss the year before. Its routes to Australia and Singapore out of Indonesia are believed to have high load factors and be high yielding, but many other routes are still not breaking even yet. Fernandes says that as A320s come into the Indonesian fleet and replace the remaining 737–300s this “will replicate the cost advantages in Malaysia and [Indonesia] is on course to deliver sustainable profits for the full year 2010”. That boost from more efficient aircraft is needed; the chart on page seven shows that AirAsia Indonesia now has the highest unit costs of the three AirAsia group airlines.

The turnaround of these subsidiaries is critical not just for the sake of those airlines, but because the aircraft operated by these subsidiaries are carried on the main AirAsia balance sheet. Once the performance of the subsidiaries improves enough then ownership of the aircraft can formally be transferred to them, which will result in a much improved balance sheet for the AirAsia group. If all aircraft operated by the subsidiaries are transferred, the group’s net gearing would fall from 2.6 times (as at the end of 2009) to under 2 times, according to the estimates of one analyst.

The subsidiaries also owed the AirAsia group RM852.8m (US$242.9m) at the end of 2009, although the group says that “the platform has been established for associates to repay to the parent company beginning 2010 and expected to be fully paid by 2013”.

Vietnam and beyond

As well as Thailand and Indonesia, AirAsia wants to be in every major ASEAN market, and there is now a race between AirAsia, Jetstar and Tiger Airways to set up directly–owned or franchise airlines in as many key Asian markets as possible. AirAsia has wanted to enter the Vietnamese market for several years, and in 2007 partnered with the state’s Vietnam Shipbuilding Industry Corp in order to start an LCC there. But these plans had to be abandoned due to problems getting approval from the Vietnamese government, reportedly due to pressure to protect Vietnam Airlines.

However, this February AirAsia paid a reported RM33.3m (US$9.5m) for 30% of VietJet, a Hanoi–based start–up and the country’s first private airline, which will be renamed VietJet AirAsia.

VietJet was formed back in 2007, with Sovico Holdings, a conglomerate, now owning 51% and its chairman Nguyen Thanh Hung owning 19%. But VietJet has not been able to commence operations so far, and so presumably AirAsia will transfer over some of its aircraft to enable its Vietnamese operation to launch domestic and international flights later this year (May is the target date for services).

Vietnam has a population of approximately 80m and AirAsia already operates to Hanoi and Ho Chi Minh City. The country is considered a key location to base an AirAsia airline in as it links ASEAN countries with China and the south, north and east of Asia.

Jetstar potential

Beyond Vietnam, east Asia is the next priority for AirAsia, as it has few routes there and has huge potential for low cost routes. But AirAsia’s expansion options throughout Asia now appear greater than ever, thanks to the new partnership with rival Jetstar. In January AirAsia agreed an unexpected partnership with Australian–based LCC Jetstar Airways, which is owned by Qantas and as the second largest LCC in Asia is (or was) AirAsia’s biggest rival. AirAsia and Jetstar say they have identified “many hundreds of millions of dollars of cost–saving opportunities”, thought to be in the region of A$200m to A$300m (US$184m–US$276m) annually (to be split between the two airlines) – although these are not expected to fully flow through until 2011, with around US$57m of savings expected to be shared between the two airlines this year.

The two airlines operate to more than 20 common destinations, but although they may co–operate in everything from ground handling and future fleet specification and purchasing, it is believed the vast majority of savings in the short–term will come from the joint buying of aircraft maintenance services and supplies.

The potential co–operation in fleet specification may be the most interesting part of this deal, as with a joint fleet (including affiliates) of 152 and with 205 aircraft on order, a combined voice on these airlines’ requirements would have to be taken into account by Boeing and Airbus as they plan replacements/ renewed versions for the 737s and A320 series. AirAsia and Jetstar are particularly keen to persuade manufacturers to build aircraft with two models — one for full–service airlines and one designed specifically for the needs of LCCs.

The partnership between AirAsia and Jetstar was certainly a surprise to Tony Davis — CEO of rival Singaporean LCC Tiger Airways – who called the alliance “hilarious” and a “publicity stunt” designed to take attention away from Tiger’s IPO. Davis says that the two airlines appear to be at “complete loggerheads” and he cites the example of Jetstar in January ordering IAE V2500 engines for the 55 Airbus A320s it will receive — whereas AirAsia uses CFM engines. Furthermore the VietJet move (see page eight) is a direct challenge to Jetstar’s own affiliate LCC in Vietnam – Jetstar Pacific.

Certainly the two airlines had been fierce competitors previously, and there will be many areas where co–operation will be difficult, if not impossible, in the short–term. But Davis’s comments may reveal concern from Tiger about the longer–term potential for collaboration between the two.

AirAsia X

Already AirAsia and Jetstar are talking about extending co–operation into a joint leasing company for the older A320s they own, and if they eventually expand beyond cost–cutting and into revenue sharing this may open up the tantalising possibility of an equity tie–up or even merger in the long–term. AirAsia X is not part of the AirAsia group, although AirAsia owns a 16% stake in the long–haul LCC, with 48% controlled by Aero Ventures (owned by AirAsia CEO Tony Fernandes and others). The other shareholders include the Virgin Group (16%), Bahrain–based Manara Consortium (10%) and Japanese lessor Orix (10%).

Kuala Lumpur–based AirAsia X “produced profits” in 2009, the group claims, with revenue for 2009 of RM757.4bn (US$215.7m) and 1m passengers carried. Load factor rose steadily through 2009, reaching 83% in the October–December period.

However, the general aviation recession has also affected AirAsia X’s plans, with Azran Osman–Rani, CEO of AirAsia X, saying: “We started the year with many plans, but what 2009 taught us was we really needed to be nimble and flexible — which is why we now have not only plan A, but also B and C.

”That means that the airline will instead focus its immediate future on consolidating its existing network to India (two routes are being added this year), China (where one more route will start in 2009), Seoul (where it has just obtained rights) and Australia (where it is fighting to operate to Sydney), while halting expansion to Europe.

In February AirAsia X unexpectedly suspended its Kuala Lumpur–Abu Dhabi route after just three months of operation due to poor demand, and forcing the airline into what it calls a “rethink” of its Middle East route strategy, which until then had envisaged Abu Dhabi as a “virtual hub”, with aircraft from Asia flying on to Europe, Africa and other destinations in the Middle East.

Part of the failure is believed to be due to the fact that this was the airline’s only route into the Middle East (and served with just one A340), and management believes that a country/region needs to be served with a variety of routes in order to be sustainable.

Treading water in Europe

But a key factor surely must have been the competition on the route from Emirates, which offered six flights a day on Dubai–Kuala Lumpur compared with AirAsia X’s five flights per week). If/when AirAsia does return to the Middle East AirAsia is likely to look at other less competitive destinations (i.e. anywhere but Dubai), and Jeddah is believed to be under consideration. The withdrawal from the Middle East also has implications for AirAsia’s X’s ambitions for Europe, where currently the airline operates only direct to London Stansted. The airline had been looking at new destinations, ideally one in central Europe and one in the east, served via a stopover in the Middle East. Nice was under consideration, but unsurprisingly Paris Orly was seen as a better option, and AirAsia X secured the rights to serve Orly in late 2009.

However, given the Middle East retreat this is now not going to happen this year, and further direct services to London Stansted are the only possibility for European expansion in the short–term.

AirAsia X had also been analysing North America destinations, with one on the east coast (flown onwards from London Stansted) and one on the west coast (direct from Asia) being the preference. New York and Californian airports are being looked at, and in the latter category Oakland may be one unusual destination under consideration as AirAsia X now sponsors the Oakland Raiders American football team and – importantly – the airport is a base for Southwest, which would ensure considerable feed traffic. AirAsia X points out that AirAsia sponsored the Manchester United football team in the UK from 2005–2008, which was a great help in raising the airline’s profile prior to the launch of its first UK route in 2009.

AirAsia X currently operates six A330s and two A340s, but four A330s are being delivered this year (starting in June). Last summer AirAsia X ordered 10 A350–900s, with options for another five aircraft. The aircraft will have 400 seats in a two–class configuration, and the first will be delivered in 2016. The airline had been evaluating the A350 against the 787, but eventually went with Airbus. The A350s will replace A340s on longer routes to Europe and the US.

AirAsia X has just started a refurbishment of all economy and business class seats on its aircraft, which is targeted to be completed by June. It is adding lie–flat beds to all aircraft, which necessitates the elimination of premium economy seats, as well as refurbishing all economy seats and increasing their pitch. By the summer all A340s will have 18 lie–flat business seats (a reduction from the 30 regular business seats previously offered) and A330s will have 12 lie–flat seats (down from 28).

This will also allow an increase in economy of capacity from 256 to 309 on A340s, although just one extra economy seat on A330s (up to 365). AirAsia X is also taking out the existing in–flight entertainment system (which will save 1.5t of weight per aircraft) and instead will offer passengers portable (and paid–for) entertainment sets.

Fleet plan

Other than ground handling, AirAsia and AirAsia X are operated independently of each other, although intriguingly last year Tony Fernandes hinted at a merger between the two airlines, saying that it would be a “logical” thing for them to do. That seems highly unlikely, and more probable is that AirAsia X may raise funds this year or in 2011 in order to help finance aircraft orders. For the AirAsia group (excluding AirAsia X), the fleet will grow from 84 at present to 173 by 2014, after which it’s due to grow by just two aircraft in 2015. The group has deferred the delivery of eight A320s due this year and eight due in 2011, which it says is due to constraints in the infrastructure at its main base, the low cost carrier terminal (LCCT) at Kuala Lumpur airport.

The government says a new LCCT will be built by March 2012, but there is considerable doubt locally as to whether this timeline is feasible.

The average fleet age is now just over two years and the group will now receive 16 A320s this year (six in 2Q, six in 3Q — when it will then become an all–Airbus operator — and four in 4Q), four of which will go to Malaysia, eight to Thailand and four to Indonesia.

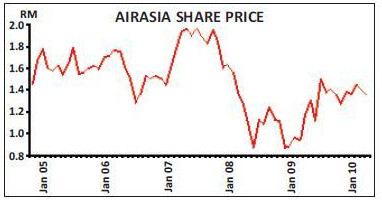

Altogether the AirAsia group will receive more than 100 aircraft worth US$6bn over the next four years, and some analysts are worried about how these will be paid for given the debt situation. In September last year AirAsia raised RM505m (US$144m) through a share issue, with the proceeds going to reduce the airline’s debt, but long–term debt stood at RM7.1bn (US$2bn) as at the end of 2009, a 17% rise compared with December 31st 2008 — and one analyst forecasts that this may rise to more than RM11bn (US$3.1bn) by the end of 2012. Cash and cash equivalents were RM747.6m (US$213m) at the end of the year (RM153.8m a year earlier), helped by the share issue.

However, in March OSK Research issued a note saying that “the huge amounts owed by its Thailand and Indonesian operations, together with significant unrecognised shares of operating losses also worry us”.

There is also concern about the introduction of the accounting standard FRS 139 at the start of this year, which requires AirAsia (and all companies) to report more financial assets/liabilities within its balance sheets rather than off balance sheet.

So despite the good results in 2009, there are still challenges ahead for the AirAsia group. There are tentative plans to list the Thai and Indonesian airlines, with Thai AirAsia expected to be tried first, either later this year or, more likely, in 2011 – providing that the “consolidation” strategy of this year goes to plan.

| Cost/ASK - US Cents | Q1 | Q2 | Q3 | Q4 | 2009 |

| Employees | 0.34 | 0.38 | 0.36 | 0.38 | 0.35 |

| Fuel | 1.04 | 1.30 | 1.37 | 1.39 | 1.21 |

| User charges/ | 0.26 | 0.25 | 0.29 | 0.33 | 0.26 |

| Station expenses | |||||

| Maintenance | 0.17 | 0.11 | 0.15 | 0.13 | 0.16 |

| Aircraft-related costs | 0.15 | 0.13 | 0.15 | 0.09 | 0.14 |

| Depreciation/Amort. | 0.41 | 0.41 | 0.43 | 0.44 | 0.42 |

| Other | 0.24 | 0.25 | 0.30 | 0.37 | 0.29 |

| Sales & marketing | 0.11 | 0.11 | 0.17 | 0.14 | 0.14 |

| Total cost/ASK | 2.71 | 2.93 | 3.21 | 3.27 | 2.95 |

| Finance costs | 0.51 | 0.51 | 0.46 | 0.46 | 0.47 |

| Cost/ASK incl. finance | 3.22 | 3.44 | 3.67 | 3.73 | 3.42 |

| Fleet | Orders | Options | ||

| AirAsia (Malaysia) | ||||

| A320-200 | 48 | 105 | 50 | |

| Thai AirAsia | 12 | |||

| A320-200 | ||||

| 737-300 | 7 | |||

| Indonesia AirAsia | 10 | |||

| A320-200 | ||||

| 737-300 | 7 | 105 | 50 | |

| AirAsia group | 84 | |||

| AirAsiaX | 6 | 20 | ||

| A330-300 | ||||

| A340-300 | 2 | 10 | 5 | |

| A350-900 | 92 | |||

| Total AirAsia family | 135 | 55 | ||