Tough times ahead for SIA

May 2009

Although the SIA group is the world’s largest airline company by market cap, this hasn’t stopped Singapore Airlines from feeling the full force of the global recession. After a 43% fall in net profits during the October–December 2008 quarter, the group avoided reporting only its second–ever quarterly net loss in January–March 2009 thanks to a reduction in the Singaporean corporate tax rate (which enabled SIA to book a 12 month tax “write–back” in the final quarter of its financial year).

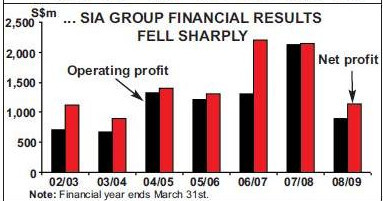

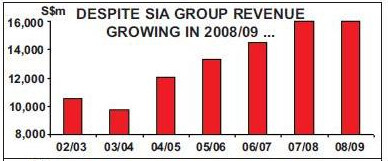

The change in the tax rate can’t hide the fact that the challenges facing the Singaporean flag carrier — which currently operates to more than 70 destinations across the world — are considerable. In the 2008/09 financial year (ending March 31st 2009), the SIA group saw net profit fall 47% to S$1,147m (US$799m), even despite the tax write–back of S$138m (US$96m) and a 1% rise in revenue to S$16bn. Operating profit fell even further — by 57% — to S$904m (US$630m).

Management blamed the profit plunge on a number of factors, including the performance of its cargo operation, which made an operating loss of S$245m (US$171m) in the 12 month period, compared with a S$132m (US$92m) profit in the previous financial year. But while the group also has major engineering and airport services divisions, group profitability depends largely on the airline division, which made a S$823m (US$573m) operating profit in 2008/09 — some 50% (or (S$821m) lower than in the 2007/08 financial year.

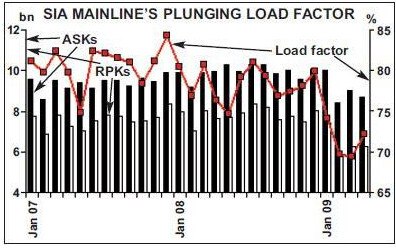

A closer look at the results reveals two worrying trends. Firstly, in the 12 month period passengers carried fell 4.4% to 18.3m. With ASKs up by 1% and RPKs down by 1.5% in the financial year, load factor fell 3.8 percentage points to 76.5%. But crucially, proportionately SIA is losing more lucrative premium passengers than economy travellers.

Traditionally the group has had robust results because of its focus on first and business class passengers, but these revenues are falling fast, not helped by the fact that in the last quarter of 2008 real GDP in Singapore fell by 17% on an annualised rate.

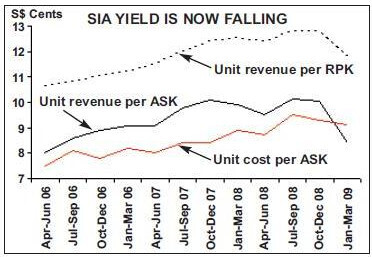

Yield worries

This has led to SIA cutting some of its all–business class services to New York Newark and Los Angeles that were launched only last year (using A340- 500s). This trend is exacerbated by the fact that SIA has no domestic routes, revenue from which could have expected to remain more robust than international services in the current downturn. Mainline yield remained flat in October-December 2008 compared with the previous quarter (see graph), but then fell by a substantial 9% in the January-March 2009 period. In a report released in mid–April, Merrill Lynch said that SIA was being affected significantly by trying to stick with its premium price/product strategy in today’s environment, and that: “Simply put, the market is highly price–sensitive and unwilling to pay for SIA’s frills. Yields will still be sharply down due to the collapse of lucrative business class traffic (40% of passenger revenue).”

In today’s world corporate budgets for premium travel are severely restricted, and no amount of additional economy traffic at the SIA group will fully compensate it for the loss of high margin premium passengers. Merrill Lynch says that “although airlines have historically rebounded early in cyclical recoveries, we think it will be different this time … premium traffic needs a turnaround in the financial services sector.”

The second problem that SIA faces is cost control. While staff costs fell 12.4% in the 2008/09 financial year, fuel costs rose by 27.5% to S$6.4bn (US$4.5bn) — even though fuel prices in the world market gradually fell over the three month period — thanks to fuel hedging losses of S$543m (US$378m).

In fact SIA’s hedging strategy has been nothing short of disastrous, and the huge loss for the financial year was signalled back in February when the group revealed that 44% of its fuel needs for the January- March quarter had been hedged at an average price of US$131 per barrel, considerably above the spot price at that time.

Earlier this year one analyst estimated that SIA’s unrealised fuel hedging losses could be as high as S$1.8bn (US$1.2bn). Unlike most other airlines, the SIA group does not make provisions for anticipated hedging loses, but reports them only in the profit and loss account for the quarter they expire in – so looking forward there could be a considerable amount of bad news yet to be reported by SIA. All the group says is that lower fuel prices in the global market “will be offset by progressive settlement of fuel hedges contracted at higher prices ... but the consequential effect of these hedges will tail off over the next twelve months”.

Capacity cuts

The SIA group also lost S$144m (US$97m) in October–December 2008 due to the strength of the Singaporean dollar against other currencies, and the full year’s results were accompanied by a warning that “in the near term, promotional pricing and reduced business travel will keep revenue under pressure”. The group added that: “Action taken to trim excess capacity, together with a strong balance sheet, will help to sustain the company through the downturn.” Indeed in February, as a response to “the drop in demand owing to the global economic slowdown”, SIA announced it would retire 17 older aircraft in the 2009/2010 financial year (ending March 31st) as part of cuts in capacity across its network. SIA had previously planned to decommission four aircraft (three returning to lessors at the end of their contracts and the conversion of a passenger aircraft to a freighter), but this has now been raised to 17, representing an 11% reduction in overall capacity compared with the previous year. As recently as November last year SIA was saying it wanted to increase capacity by 1% in 2009/2010, so the reversal in its fortunes has been recent and pronounced. With 17 aircraft now being taken out of service, it’s likely that some – or many – of these will end up parked in the desert.

SIA had already begun to cut capacity from the second half of 2008 in response to the global recession, but the “upgraded” capacity reduction is being taken from all parts of its network in all sorts of ways, including route cutting (such as from Singapore to Amritsar, Vancouver, Osaka via Bangkok and Los Angeles via Taipei), reduction of frequency (to India, Japan, China, South Korea and the US in particular, as well as selected other routes elsewhere) and via capacity reductions (for example, in March the daily 747–400 service on Singapore–London was replaced by a 777–300ER service, cutting capacity by 7.5% a day on the route).

Although the 17 aircraft that are being decommissioned are not yet known, they are likely to be the larger 747–400s and older 777s. SIA traditionally has a young fleet (its average age is currently less than seven years), and is among the pioneer carriers in introducing new types.

| Fleet | Orders | Options | |

| SIA | |||

|---|---|---|---|

| A330 | 4 | 15 | |

| A340 | 5 | ||

| A350 | 20 | 20 | |

| A380 | 6 | 13 | 21 |

| 747-400 | 12 | ||

| 777-200ER | 46 | 28 | |

| 777-300 | 12 | ||

| 777-300ER | 19 | 13 | |

| 787 | 20 | ||

| Total | 104 | 82 | 68 |

| SIACargo | |||

| 747-400F | 12 | ||

| SilkAir | A319 | 6 | 4 |

| A320 | 10 | 6 | 12 |

| Total | 16 | 10 | 12 |

| Group total | 132 | 78 | 94 |

The mainline has a fleet of 104 (see table, right) and 68 aircraft are on order. The first of 19 A330s on order was delivered earlier this year and they have been rolled out onto services to Australia and Japan from April, replacing 777s.

However, these aircraft are arriving on leases from AWAS as a short–term replacement on regional and mediumhaul routes only, and are filling in until 20 A350s are delivered to SIA from 2013 onwards.

In October 2007 SIA became the first operator of the A380. Six have been delivered so far and four more are due this year, out of a total order book of 19. The A380s are used on routes from Singapore to Sydney, Tokyo, London Heathrow and — from June, once the seventh and eighth aircraft are delivered — to Paris CDG.

With such a large order book and given SIA’s current difficulties, there must be considerable doubt as to whether all those aircraft will be delivered. SIA insists that it has no plans to defer deliveries at the moment, although it says this cannot be ruled out in the future. If adjustments are made, then the A380 orders will surely be the first to be deferred. The 20 787s on order also look vulnerable, particularly since new delivery dates are yet to be confirmed by Boeing.

The SIA group also includes regional subsidiary SilkAir, which operates to more than 25 destinations with a fleet of 16 A319s and A320s (and with 10 aircraft on order). In the 2008/09 financial year, SilkAir’s profits fell 16% to S$34m (US$24m).

But more problematical is SIA’s cargo operation, given its contribution to revenue and its hefty loss in 2008/09. According to Chew Choon Seng, group CEO, the “air freight business is even in deeper straits than the passenger business”, and the group is likely to park temporarily some of its freighter fleet, which currently stands at 12 747–400s.

The solutions?

Worryingly, in April SIA’s cargo traffic fell by a substantial 22%, ahead of a 17% reduction in capacity, and with cargo load factor falling 3.7 percentage points to 58.0%. Given the challenges of falling premium revenue and a rising cost base, what can SIA do? In the short–term the only answer to the premium problem may be to slash first and business class fares, something that the group appears very reluctant to do. But if that’s difficult, then cutting the cost base at SIA is even more of a problem. The capacity reduction is a help, but without large amendments to the order book the main area of variable cost that management can alter is staffing.

At the beginning of the year SIA announced a voluntary unpaid leave scheme (for periods of between a week and two years) and management met with unions in February to discuss other “measures”, such as a shorter working week and voluntary retirements. At that point a cut in salaries was not on the agenda; a three–year collective agreement with SIA’s pilots was reached only in November 2008 (after 12 months of negotiations), although this included only some elements of pay (specifically a variable component of basic wages) and excluded all other (i.e. more contentious) issues, such as management’s wish to have pilots work across different types of aircraft (e.g. A330s and A340s).

But take–up of the voluntary scheme was not sufficient and in April SIA introduced compulsory leave of one day a month (either without pay or to be taken as part of annual leave entitlement) for all managers — and said it would introduce the measure to its entire workforce from the beginning of May.

However, pilots and cabin crew would have to take this as unpaid leave since the airline now has too many staff, given its plan to reduce capacity by 11% in the current financial year. Management announced that two of the three main unions (including the one representing ground staff and cabin crew) had agreed the measure “in principle”, although the pilots union (Air Line Pilots Association- Singapore) didn’t initially agree, with the union saying the proposal from management was unfair as the airline wanted pilots to take three days unpaid leave a month and first officers four days a month, compared with the one day a month every other employee was being asked to accept.

If a deal hadn’t been agreed with pilots then the tentative agreements with the two other unions would have become nonbinding. Relations between pilots and the management at SIA are strained anyway, stemming from 2003 when the airline cut pay and conditions, leading to pilots voting out the then union leadership for accepting such a deal.

This time around a deal was agreed at the last moment, with management backing down and pilots accepting one unpaid day of compulsory leave a month. Yet these agreements are unlikely to put off the need for cuts in the workforce. SIA says that: “We will only contemplate retrenchment as a last resort but we do not have the luxury of time and we need to agree and act on some measures quickly so that we can push back the point of retrenchment and improve our chances of avoiding it altogether".

Other problems ...

The airline currently employs 14,200, of which 7,100 are cabin crew and 2,300 pilots. While SIA is shutting its pilot bases in Brisbane and Perth, these employ a small number of foreign pilots. If SIA is to make a serious dent into its cost base, then a percentage reduction matching the cutback in capacity this year would result in 1,500 redundancies. And a larger figure of 2,000 would be feasible given deeper cuts in overhead staff (i.e. not pilots, cabin crew or ground staff) that must surely be achievable without affecting customer service too much. Maybe a benchmark is close rival Qantas, which announced 1,750 job losses in April. Whatever the level, it’s almost inevitable that SIA will have to make significant redundancies, and sooner rather than later. There are other major challenges ahead for SIA, most particularly from its traditional rival Qantas (see the article in this issue). A restructuring of the shareholding in Jetstar Asia and Valuair has seen Qantas increase its stake in these carriers from 45% to 49%, while at the same time Temasek has sold its 33% holding in these airlines to other investors.

This now sets Singapore–based JetstarAsia and Valuair free to compete vigorously against SIA’s own LCC, Tiger Airways, as Asian open skies become more widespread. An added danger for SIA would be any partnership between Qantas’s JetStar and AirAsia, which some analysts speculate could happen now that AirAsia has had to cancel its attempt to de–list (see Aviation Strategy, Jan/Feb 2009).

The SIA group holds a 49% stake in Tiger Airways, a Melbourne–based LCC that was launched in 2004 [other shareholders include Indigo Partners (24%), RyanAsia (16%) and Dahlia Investments (11%) — a subsidiary of Temasek]. It operates a fleet of 10 A319s and A320s and has 56 aircraft on order, and operates only on regional routes in order to avoid any dilution of the SIA brand. It currently has a route network of 25 destinations in nine Asia/Pacific countries.

In March Tiger opened its third base (after Singapore and Melbourne) in Adelaide, with two A320s based there initially to serve six domestic routes. In July Tiger is launching services on Melbourne- Sydney, which is the largest domestic route in Australia. Tiger will offer 24 flights a week, where it will compete against Qantas, JetStar and Virgin Blue. This is a major strategic change for Tiger, which until now has kept away from the busier routes and instead concentrated on niche sectors.

Elsewhere, in March a Singapore- Jakarta route was launched following an adjustment to the air services agreement between Singapore and Indonesia, and where Tiger is competing against AirAsia. There had been plans to set up a Tiger subsidiary in South Korea, to operate flights to China, Japan and other countries, in partnership with the Incheon city government, but those plans have now been abandoned due to “the global economic situation and continued regulatory uncertainty in Korea”.

It’s believed that Korean carriers lobbied the government against what they claimed would be “unfair competition” from Tiger, and the Incheon city government has now agreed a deal with Korean Air for it to relocate Jin Air, its LCC, to Incheon from Seoul.

Into the future?

In the financial year ending March 31st 2008, Tiger Aviation — which owns Tiger Airways and Tiger Airways Australia — reported a net profit of US$6.6m. This was its first–ever profit (and, unsurprisingly, the first time it has released financial results) and compares with a US$9.9m net loss in 2007/08. The role of Temasek Holdings, the Singapore state–owned investment fund, in guiding SIA’s future is critical. Temasek owns 55% of the SIA group and its stake had been a positive for SIA, in that it had been a stable and relatively passive majority shareholder.

But according to one analyst Temasek’s investment portfolio has lost around US$50bn in value over the last three years, and inevitably in the current recession its investments are coming under increasing scrutiny, particularly as Ho Ching, the current head of the fund (who is the Singaporean prime minister’s wife) is being replaced by Chip Goodyear, the former CEO of a major diversified Australian mining company and who is believed to be more aggressive in his approach than his predecessor.

Most immediately Temasek’s views will be relevant to the future of SIA’s 49% stake in Virgin Atlantic Airways, which was bought back in March 2000 for US$975m. Last year the SIA group said that it was unhappy with the performance of Virgin and that it would be willing to sell its shareholding if it received the right offer. This would suit Virgin as well, since SIA’s stake in Virgin Atlantic is holding up plans to rebrand Virgin Blue’s long–haul operation as Virgin Australia (rather than the current V Australia). SIA’s stake in Virgin Atlantic gives it a veto right over the use of the Virgin name on any route that SIA operates, or is permitted to operate.

The sticking point for SIA is not so much finding a buyer, but the price that SIA and Temasek will be willing to accept without appearing to lose too much face in terms of selling the Virgin Atlantic stake for what may be perceived by others as a “fire sale” price.

Certainly the focus of strategic attention for SIA now appears to be selling rather than acquiring. In 2007 SIA and Temasek attempted to acquire 24% between them of China Eastern, but this was rejected by minority shareholders in early 2008 in anticipation of a better offer from Air China, and according to SIA there is no plan to resuscitate the deal in the short- or medium–term. Negotiations had been expected to be restarted after the Olympic Games in Beijing were completed, but (even if the SIA group could afford another bid) China Eastern’s parent company now appears to be more interested in a merger with the parent company of Shanghai Airlines.

A tough 2009

In May SIA also said it was separating out its ground handling subsidiary SATS, in order to better “focus on what it knows”. There’s no doubt that SIA’s prospects for 2009 are grim. The Singapore state’s GDP is forecast to contract by a huge 7.9% this year and some analysts expect the April–June quarter to be in the red, given that, as Chew Choon Seng says: “The drop in air transportation has been sharp and swift ... we have to face the reality that 2009 is going to be a very difficult year."

Indeed load factor has fallen away dramatically in the last few months (see chart) – and the traffic figures for March reveal a substantial drop in demand, with RPKs down by a massive 21.8%, way ahead of the reduction in ASKs of 9%. Passenger load factor in the month fell by 11.4 percentage points, to 69.4%. This trend continued into April, when RPKs fell 17.7%, ahead of a 12.9% cut in capacity, and with load factor dropping by 9.8 percentage points on routes to Europe.

Along with the April figures the airline commented that “the ongoing global economic slowdown continues to impact travel demand. As a result, all route regions except East Asia registered lower PLFs compared to last year. SIA will continue to monitor traffic movement and make appropriate adjustments where necessary to match capacity to forward demand”.

While Chew Choon Seng adds that the company "will contemplate retrenchment only as a last resort", that last resort is drawing ever closer, unless SIA dares to make significant aircraft order postponements and cancellations. Yet if SIA goes down that route, this would severely hit its cherished brand image, one that is underpinned by a young fleet and a reputation for being the first to introduce new models (and a legacy from its origins in 1972 when, with no domestic routes, it had to immediately compete against foreign airlines on international routes, and thus had to concentrate significant resources on marketing and brand management.)

Whatever it does, SIA appears to have little room for manoeuvre, and as a result shareholders are sure to be in for a rough ride in 2009.