Qantas - jumping through hoops

May 2009

Apart from having its safety record praised by Dustin Hoffman in “Rain Man”, Qantas can be described as being unique in many ways.

Profitable history

Founded in 1921 as Queensland and Northern Territories Aerial Services, the Australian flag carrier is the second oldest surviving airline in the world. It is based in a sparsely populated and physically isolated country with no realistic alternative to air transportation; Australia is the world’s sixth largest nation by land mass but has a population of only 21.5m. The resulting population density of 2.8 people per square kilometre (the world average is 13.1/km2) is deceptive; 60% of the population live in the five major conurbations of Sydney, Melbourne, Brisbane, Perth and Adelaide, while the next 14 largest cities (with populations of between 100,000 and 1m people) account for a further 15% of the total. By far the majority live on the western and southwestern coasts. Given Australia’s geography there is no natural single hub, almost enforcing an air route network of point–to–point services domestically and international operations to each of the top five cities. Uniquely, Qantas has also been consistently profitable – at least since privatisation in 1995 (and helped considerably by the failure of Ansett just before the industry downturn in 2001–02).

Deregulation of the Australian industry in 1990 paved the way for the merger with former domestic government–owned Australian Airways, while a core 20% shareholding by British Airways in 1993 (subsequently disposed of in 2004) provided the impetus for full privatisation, the backbone for a solid joint venture on the UK–Australia “kangaroo route” and the basis of the establishment of the oneworld alliance with BA and American.

Recently Qantas has created for itself another unique accolade: it is arguably the only legacy carrier to have successfully introduced a profitable LCC operation — Jetstar — alongside its own premium brand to allow it to compete with the new generation of low frills operators.

The core company strategy relies on the premise that it needs to maintain a domestic market share of around 65% to optimise profitability. In the face of increasing threat from low cost operators in the domestic market and the encroaching lower cost mediumhaul international operators from Asia undermining its inbound and outbound leisure markets, it started to develop a two brand airline policy.

The group initially re–launched Australian Airlines as a full–service leisure–based international carrier in 2002 — but closed it down again in 2006. In 2004, the group set up Jetstar, initially with a fleet of 14 717s, as a true low cost operator – primarily to counter the threats from Virgin Blue. With significantly lower wage costs than the mainline operation, a true low cost model and benefiting from certain group synergies, it was designed to have operating costs some 15% below those of Virgin.

The management worked hard to avoid cannibalisation of its mainline operation; with continuous detailed route–by–route margin analysis providing the basis for allocation of the greatest loss making routes to the new sister company. Five years later and Jetstar has some 15% of the domestic market, with Qantas/QantasLite mainline brands retaining a 50% share (against a 25%-30% share for Virgin Blue and 5% for SQ–owned Tiger).

The group has started expanding the brand within southeast Asia with the aim of creating a pan–Asian brand (hitting back at SIA’s incursion with Tiger): it has a 49% stake in Singapore–based Jetstar Asia, and an initial 10% stake (to grow to 30% in 2010) in Vietnam–based Jetstar Pacific (the second largest carrier in a country of 84m people).

The Jetstar network now encompasses nine international routes to and from south and southeast Asia on the main outbound leisure routes and it has started a base in Darwin to facilitate greater coordination.

When Qantas launched Jetstar there was some opposition from the unions on the basis that the group would use this as the proverbial “Trojan Horse” and increasingly move services from the higher cost main Qantas brand to the start–up. Somehow Qantas management appears to have dispelled these fears — but that is exactly what the group appears to be doing.

Currently Jetstar is in the process of taking over the loss–making domestic New Zealand routes operated by Qantas, and even expanding services further into Japan (it already replaced the QF Narita to Cairns and Gold Coast services last December), which Qantas itself has been unable to do profitably. Qantas’s management proudly emphasises that Jetstar has been profitable since start up in 2004; but more importantly has improved the group’s domestic profitability by over A$250m annually – half from the profits generated at Jetstar and half from losses avoided at Qantas mainline.

FFP business

In hand with the two brand approach, the group started looking (as many have done before it) at ways to “unlock the potential of its portfolio of businesses”. The cargo operation has been set up as a separate business unit; the air freight operation is primarily selling belly–hold capacity on Qantas and Jetstar, while also using three wet–leased Atlas freighters, although the division also has a series of parcel and express operations and a significant ground transport operation. Taking a leaf out of Air Canada’s book, the group has also set up its frequent flyer plan as a separate business centre. With five million members (the largest FFP in Australasia), revenues of A$850m in the year to June 2008 and profits (under one measure) of A$234m it is seen as an attractive separate business.

In July last year the company announced significant changes to the redemption policies – including the opportunity to redeem points for any seat on QF or JQ (including taxes and surcharges) as well as the more classic restricted seat allocations.

At the same time it signalled plans to float 40% of the business through an IPO. Suggestions at the time pointed to a total value of the business of over A$2bn (compared with Qantas' current market capitalisation of A$4.5bn). These were done in comparison with the then value of Aeroplan (the Air Canada offshoot). Given the financial markets' turmoil, Aeroplan’s market value has halved over the past year to C$1.4bn (which incidentally compares with Air Canada’s market value of C$128m) and Qantas has sensibly shelved the flotation plans until the financial environment improves.

The holiday businesses meanwhile have been merged into separately quoted Jetset Travelworld, in which Qantas retains a 58% stake. At the same time the group has started separately identifying its flight training, maintenance, catering and airports businesses – either moving towards the Lufthansa–style holding company structure or more likely aiming to release greater value by onward sale.

This very strategy seemed attractive to others too: the group received an unsolicited approach from a TPG–led consortium in December 2006 – at a price some 33% above the then share price (typical top–of the- market stuff?). The board recommended acceptance, but the dragon of national pride raised its head and core institutional shareholders in the end forced the bidders' retreat (since which time the shares have fallen 70% from their peak).

It may have been that the consortium saw more returns from the long anticipated global consolidation of the industry (see Aviation Strategy, March 2007); and indeed Qantas itself, under newly appointed CEO Alan Joyce, tried to kick–start an acceleration of the process last year by approaching British Airways with the idea of a merger (embarrassingly while BA was itself in negotiations with Iberia). Not unsurprisingly, (QF prides itself on its investment grade rating, which may well have suffered from the inclusion of BA’s pension problems) this approach petered out.

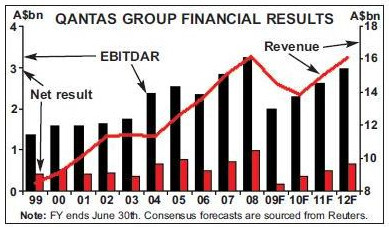

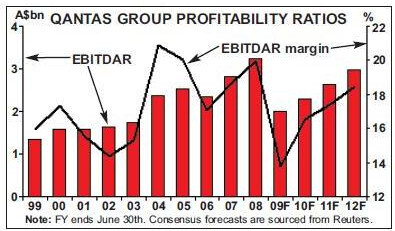

The group achieved a record level of profitability in the year ended June 2008. Revenues were up by 7% to A$16bn, EBITDAR grew by 14% despite the strength of the fuel price and net profits as published jumped by 35% to A$970m.

Even if this reflects the peak of the cycle, the EBITDAR margin of 20% was marginally below the peak of 21% achieved in 2004 – and this is after a significant level of outsourcing (particularly of IT services) in the past few years. This performance was significantly aided by the continuing cost cutting and results improvement “Sustainable Future Programme” introduced in 2003 to generate A$3bn in profit enhancement.

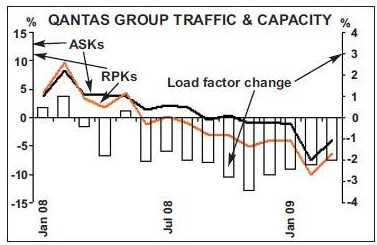

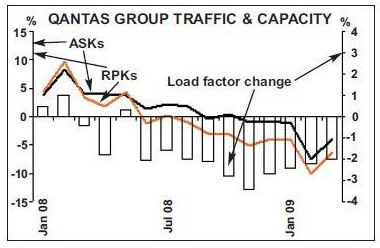

Since then the full force of the economic downturn has hit – as for everyone else – and the operating environment has gone pear–shaped. The group’s traffic started showing serious weakness in June 2008, led primarily by the international business. This deterioration accelerated in October 2008, and for a couple of months even the fast growing Jetstar’s international operations saw declines in traffic. The company has been trying to reduce capacity in line with the deterioration in demand, but load factors are still running some two points below prior year levels.

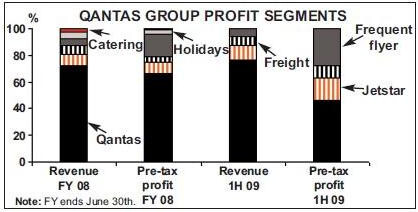

The first half results – for the six months to December 2008 – showed a severe deterioration in profitability. Total group revenues grew by 2% to A$7.9bn in the period but pretax profits slumped by two–thirds to A$288m – despite the benefit of an A$86m pre–tax gain on the sale of the holidays division. This was on the back of a 0.4% increase in capacity, a 2.4% fall in traffic and a 1.2% improvement in yields.

Qantas’s main brand operations saw pretax profits down to a mere A$200m from A$836m in the prior year period, with traffic down by 5.2%, revenues down by 3.4% with capacity down by 2% year–on–year.

The company states that unit costs (presumably excluding fuel) fell by 3.5%. Jetstar profits merely halved from the comparable period to A$72m on a 15% increase in passenger revenues and a 13% growth in capacity (equally split between international and domestic growth) although load factors dipped by half a point to 78%. It may be interesting to note that domestic system yields at both Qantas and Jetstar fell by 2%, while international yields (where the fuel surcharges will have stuck more easily) grew by 3.4% on a constant currency basis.

The freight operation saw only a 10% decline in profitability to A$41m – air freight performed well, up by 13% to A$37m but was brought down by weakness in associate domestic freight express joint ventures. QF Frequent Flyer meanwhile experienced a 20% jump in revenues to A$482m but, because of the costs of the launch of the new redemption plans, reported a profit of $119m (similar to the previous year).

Of course a large part of the deterioration in profitability was due to the cost of fuel, exacerbated by US Dollar strength in the period. The in–plane cost of fuel rose by some 40% in the six months but hedging brought benefits of some A$179m and the total fuel bill rose by 28% to A$2.2bn, equivalent to 29% of total operating costs. In addition staff costs were up by some 13% in the period – partly reflecting redundancy provisions, retraining costs relating to new aircraft types (the good old A380 again) and a new wage agreement. Other variable aircraft costs also rose by some 13%, reflecting higher maintenance material costs from the strength of the US Dollar as well as increased levels of heavy maintenance to improve on–time performance. Total costs in the six months jumped by 11% to A$7.6bn.

Importantly, despite the deterioration in results the group’s cash balances (after all this reflects the start of the peak Australian travel season) were little changed from the year end at A$2.8bn (17% of annual revenues), while net debt stood at A$3.3bn or 60% gearing of net debt to equity. At the time of the interim release in February, the management confirmed a full year prognosis of pre–tax profits of A$500m.

March woes

Since then the environment has deteriorated significantly further. Last month the group issued a severe profits warning, revising its guidance down to a pre–tax profit of between A$100 and A$200m – suggesting an almost unprecedented second–half loss of A$150m, although this does include additional write–downs and provisions of A$150m. The deterioration in the market conditions apparently started to be seen at the end of March – and was particularly experienced in the long–haul Qantas premium passenger routes and in cargo operations. The management emphasised however that the other segments – principally Jetstar and the regional QantasLite – continue to perform well, while the QF Frequent Flyer business was benefiting from high levels of redemptions (apparently running some 24% above last year).

As the group entered its winter season, it looks as if the management may have been a bit surprised by an acceleration in the competitive environment, citing a very high level of discounting – particularly on the Pacific (one of the strongly profitable route areas in recent years) and on the kangaroo route – and severe competitive pressure on full–freight and belly–hold cargo yields out of China and out of the US.

Management also reconfirmed that it has seen severe declines in premium traffic volumes — in the order of 20% — while economy yields were also showing year–on–year falls of around 10–15%. Capacity on the Pacific into Australasia appears to be growing well above the levels of current demand, with what looks to be a 25–30% increase in capacity for the second half of the year: Virgin Blue started operations into LAX from Sydney in February (and recently Brisbane) as part of its new Virgin Australia long–haul offshoot. Qantas itself has been adding capacity with its A380 operations on the LAX route (management dryly noted in a conference call that the A380 is an aircraft “for the best of times”); Delta will be starting a new non–stop operation from July. This translates into a growth of some 33% in capacity into California alone.

Capacity cuts

The kangaroo route meanwhile, always (and naturally) highly dependent on the strength of the UK economy, has not only been experiencing weakness in underlying demand but is also seeing exacerbated levels of competition from carriers in the Middle East. Given that it has to be operated as a multi–stop route, and that it is one of the longest leisure routes in the world, there is not a huge amount of competitive disadvantage in offering a service that changes equipment half way, even if the total journey time is 20% greater; but you still have to use price to stimulate demand even in the good times. Capacity into and out of Australasia from the Middle East (Emirates and Etihad have to put their new aircraft somewhere) appears to be doubling in the second half of the year. The company announced immediate remedial action to attempt to stem the bleeding. It is parking 10 additional aircraft (five 747–400s and five 767s) — with the aim of trying to sell them (adding to the five existing parked 747–300s and five 737–300s up for sale) — and cutting Qantas international and domestic capacity by a further 5%.

It is also deferring some of its aircraft orders. Of the 17 A380s on order it stated that it would take delivery of the next three due in 2009, but that the following four have been deferred for 10–12 months. It has negotiated deferrals to the deliveries of the 737–800s from Seattle – of which it has 31 on order and 49 options: it will take the next three due this year and has deferred the following 12 for up to 14 months.

It also has one of the largest orders in place for the 787 (65 on order and 50 options) and is (ironically) in negotiation with Boeing to delay deliveries — the first 14 of these were due to be operated by Jetstar as part of its international expansion plans; the remainder for replacement of the 767s. (Interestingly enough Virgin Australia has also deferred its 2010 planned 777 deliveries). At the same time the company announced plans to cut 500 management jobs and total staff reductions of 1,750, or 5% of the total 34,000 (with luck without union opposition or compulsory redundancies) and was pursuing further aggressive cost reductions – at the same time noting that the extended SFP benefits this year should be running at around A$550m (with the aim of garnering an additional running A$1bn annual benefits by 2010).

Undoubtedly Qantas is one of the best quality airlines in the world, is well managed, has strong control over its domestic market and is one of the few carriers worldwide to have worked out how to counter the threat from the new airline business models. In the short run it is not only suffering from the general economic malaise and lack of demand, but is being battered by an extraordinary increase in competitive capacity on its main profitable routes. The company has significant flexibility in being able increasingly to transfer routes to the low cost Jetstar subsidiary in this period of weak demand – but even this is unlikely to offset the declines in fortunes on the Pacific and European routes.

The markets appear to believe the company guidance – but there must be a real risk that Qantas could fall into its first annual loss since privatisation.

| Qantas/QantasLite | Jetstar | Total | Orders | Options | |

| A380 | 3 | 3 | 17 | ||

| 747 | 30 | 6 | 30 | 2 | |

| A330 | 16 | 22 | |||

| 767 | 29 | 29 | 65 | 50 | |

| 787 | 38 | 0 | |||

| 737-800 | 38 | 31 | 49 | ||

| 737 Classic | 26 | 32 | 26 | 67 | 40 |

| A320/21 | 11 | 32 | |||

| 717 | 11 | ||||

| Dash 8 | 21 | 21 | 9 | ||

| Q400 | 12 | 38 | 12 | 139 | |

| Total | 186 | 224 | 191 |