Vueling: a Catalan phoenix?

May 2009

In 2004 Vueling, a new low cost carrier, set up in Barcelona with strong expansion plans.

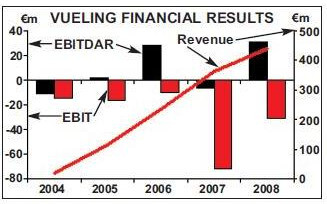

Vueling floated on the Madrid stock exchange in 2006 with promises of profitability and great growth prospects. Throughout 2007, however, it found that its very existence had spurred an intense price war within the domestic Spanish market as SAS–owned Spanair tried desperately to ensure its survival and as Iberia redesigned its domestic route network in the face of the expansion of capacity at Madrid, which in itself led to the incursion of easyJet and Ryanair into the Iberian markets.

As a result this destroyed many of Vueling’s promises. Meanwhile, the incumbent legacy carrier Iberia had quietly established a stake in its own LCC (Clickair) to which it passed many of the routes that avoided Madrid as it built up the Barajas hub, and which it aimed to use in direct opposition to the incursion of the low cost menace.

A lengthy merger

It could have been that Vueling might have passed the way of the usual start up carrier and failed ignominiously. However, its main shareholder — Hemisferos — took direct action at the end of 2007 in aggressive revolt against the then management. It brought in a new CEO from Spanair, ousting founder Carlos Manos (and the newly appointed chairman Barbara Cassini of BA’s go fame), and in the background negotiated a merger with arch rival Clickair. This merger has had to go through the regulatory hoops – not only with Brussels and the Spanish authorities, but also involving a tedious negotiation to absolve Iberia (who will end up with a major stake) from the need to bid for the resulting outstanding publicly owned shares in Vueling. It is finally to be consummated in July after eighteen months of preparation, creating a truly Spanish opposition to the foreign LCC inrush.

In hand with the merger plans, Vueling itself had constructed its own attempts to restructure the business towards a viable model and instituted its “profit improvement” plan in July 2008.

During 2008 it reduced its growth plans significantly with the aim of creating some semblance of profitability, concentrated on generating improvements in unit revenues at the expense of growth (the old econometric relationship between capacity and demand really does have an impact) and started aggressively promoting non–internet based distribution channels to access the higher yielding SME businesses; many seem to forget that outside the Anglo- Saxon world there is still a conservative reticence to embrace the new world anarchy of the internet. (And even within it – as evidenced by easyJet’s embrace of GDS distribution).

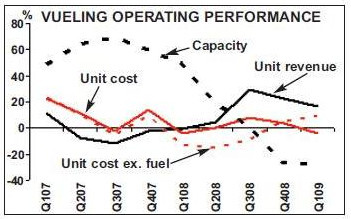

These plans only really seem to have started to come to fruition from the start of the winter 2008/09 season. In the fourth quarter of 2008 the company cut its fleet by six aircraft from the 23 A320s it had been operating. Although for the full year 2008 the company showed a growth in capacity of 5% and traffic of 7%, the final three months of the year saw a reduction in capacity and traffic of 28% year–on–year but a decline in revenue of only 10%.

Surprisingly perhaps, Vueling posted an EBITDAR profit for the full year of €1.6m after a loss at the same level in 2007 of €14.4m. More importantly it ended the year with some €43m in cash – down €44m from the prior year period but still reflecting a massive 50% of annual revenues.

It is very difficult for any airline to manage a reduction in activity but at last the results of the restructuring are starting to be seen in the first quarter results published last month. In the three months to the end of March 2009 the company operated 40 routes from its three remaining bases in Barcelona, Madrid and Seville, some 15 lower than the same period the previous year, using 16 aircraft compared with 23 in the prior year period.

Despite this, the company managed to improve aircraft utilisation by 3% to 10.8 hours a day. Total capacity fell by 2 8% but traffic declined by only 27% and the load factor improved by 1.3 points to 67%. Unit revenues (per ASK) in the period climbed by 18%: average fares per passenger grew by 10% to a still paltry €46.50 while ancillary revenues jumped by 2 3% to €10.20 per passenger and average revenues per flight increased by 14% year on year.

Underlying unit costs excluding fuel meanwhile grew by 10% (which you would expect as you reduce capacity) — although this was heavily influenced by an increase in distribution costs related to the expansion of GDS access from September last year (distribution through travel agents virtually doubled over the prior year level in the quarter although still only representing around 16% of sales – albeit reaching 19% of total sales in April this year).

Virtually unhedged however, with the fall in the fuel price total unit costs per ASK fell by 3% with the total fuel bill falling by 55% to €15m. Total revenues for the quarter fell by 16% to €74m but total costs slumped by 30% and Vueling achieved a first quarter EBITDAR of €3.1m compared with a loss in the prior year period of €13.3m.

Operating profits were still negative to the tune of €10m (down from losses of €32m in the three months to March 2008) and the net loss improved 72 % to €6m from €23m a year a go. In the company presentations on the quarterly results the management carefully emphasise that the airline displays operating profitability for the period from July 2008 to March (neatly forgetting the period from April to June last year).

Rationality in Spain?

It also emphasises its belief that it will see a very strong improvement in returns for the quarter ended June this year (helped by the disparity of the timing of Easter festivities between this year and last) and will at last be able to report a profit for the full year in 2009. The merger with Clickair mean while is slowly evolving. The two companies have already started operating as a single organisation and in June will present a “single face” to the customer. By July it is anticipated that the two will finally become a single entity. This may at last allow for some level of rationality to enter the domestic Spanish market, given that Spanair is under new ownership and with a need there to recover some idea of profits, and with the current dire economic environment in Spain and the poor demand environment.

With the Clickair/Vueling merger bringing a major competitor under the Iberia umbrella, there may be the opportunity to create a more stable operating environment in one of the most competitive low cost markets in Europe.