Private equity looks to pick up ILFC on the cheap

May 2009

International Lease Finance Corporation (ILFC) — the world’s largest aircraft lessor by fleet value — is facing an uncertain future thanks to its reliance on the formerly ultra–cheap debt rating of its parent AIG, which was effectively taken over by the US government last year after running into financial trouble.

Thanks to disastrous forays into hedging and risky derivatives, US insurance giant AIG had substantial liquidity problems last year, with credit and debt rating being downgraded substantially. This cut off access to public debt markets, and the situation for AIG became so dire that in September 2008 the US Department of the Treasury had to step in, leading to the Federal Reserve Bank of New York providing AIG with a two–year $85bn revolving credit facility (subsequently raised to $150bn).

In return, the US government took a 79.9% stake in AIG, and the credit facility was accompanied by a number of financial and operating restrictions, including the requirement that AIG’s businesses were restructured, most importantly to include the offloading of a number of investments in order to pay off debts. AIG sold its 50% stake in London City Airport in September last year, and ILFC was also put up for sale.

Parent trouble

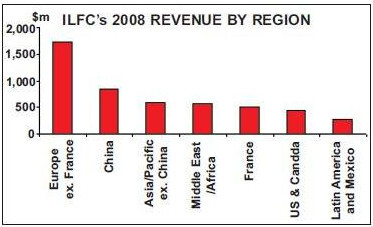

For California–based ILFC, a change of ownership should have been a relatively straightforward exercise, as the lessor made a net profit of $1.1bn last year, 19.7% up on 2007, based on revenue of $5.1bn — 7.6% higher than in 2007. This was despite 12 of ILFC’s clients going into bankruptcy protection in 2008, accounting for 38 leased aircraft. ILFC’s portfolio is reasonably well spread around the globe — the chart shows where ILFC’s revenues come from, with the two largest single country markets being China and France. But the situation is made far more complicated by the fact that ILFC’s credit rating is dependent upon AIG’s credit rating. In the past this has been hugely to ILFC’s benefit, with an AAA rating at its parent giving ILFC access to debt at interest rates lower than many of its leasing rivals.

Usually ILFC finances its purchases through a combination of cash and debt but, ominously, in the 10K for 2008 filed with the US SEC in March, ILFC said that: “A combination of the challenges facing our parent, American International Group, the downgrades in our credit ratings or outlooks by the rating agencies, and the turmoil in the credit markets have eliminated our ability to issue commercial paper and public unsecured debt.”

Funding problems continue

In effect AIG’s troubles mean that ILFC cannot raise funds externally, and hence it has also been forced to take credit from the New York Fed. ILFC went on to say that “to fulfil our short–term liquidity needs in the third quarter of 2008 we borrowed approximately $1.7bn from AIG Funding, a subsidiary of our parent American International Group, to repay our maturing commercial paper obligations and other general obligations as they became due. Subsequently, we drew down the maximum available on our revolving credit facilities of $6.5bn”. But the funding crunch has not eased since then. Though ILFC repaid that loan from AIG Funding via a “Commercial Paper Funding Facility” provided by the New York Fed, in January Standard & Poor’s (S&P) downgraded ILFC’s long–term debt from A- 2 to BBB+, and ILFC then no longer had access to the CPFF, which it had to repay by the end of January. But just a short time later, on March 12th, ILFC borrowed another $800m from AIG Funding to “fund our contractual obligations through the end of March”, and another $900m loan was provided by AIG on March 30th to pay obligations through to the end of April.

ILFC’s funding crisis will not go away, and to make matters worse ILFC admits that: “Without additional support from AIG or obtaining secured financing from a third party lender, in the future there could exist doubt concerning our ability to continue as a going concern.”

Therefore it was hardly surprising that Moody’s downgraded its credit rating on ILFC’s unsecured long–term debt from Baa1 to Baa2 in mid–March. Moody’s also assigned ILFC a “negative outlook” and said that: “Though AIG reported strong preliminary 2008 operating results for ILFC, pressure on airlines' earnings and the potential for higher lease defaults and lower aircraft lease rates could weaken ILFC’s profitability … the current cycle presents greater challenges than previously encountered by the company, given its larger scale and higher volume of maturing leases.”

The worst case scenario is a collapse of ILFC, which would be disastrous for the manufacturers. As at December 31st 2008 ILFC owned 955 aircraft, with nine others on finance leases and 99 others being managed for clients At that same date ILFC had commitments to buy 168 aircraft from Boeing and Airbus, at an estimated purchase price of $16.7bn.

Unfortunately for ILFC, although it has passed the peak of its delivery cycle (it received an average of 90+ aircraft each year during 2002 to 2006, with another 66 arriving last year, when 11 aircraft were sold from the fleet), it has a further 48 aircraft being delivered in 2009. Deliveries then fall to just five in 2010, six in 2011 and nine in 2012 before picking up again with 74 787s orders, the first of which is due to be delivered in July 2012 – although further delays in delivery dates from Boeing are possible. Ten A380s are also being delivered, from 2013 onwards.

A critical 2009

As of March this year ILFC had customers for all the aircraft being delivered in 2009 and 2010, though the percentage drops to zero per cent for deliveries in 2011, 44% in 2012, 69% in 2013 and 24% after that – a total of 79 future deliveries that do not yet have customers. Unsurprisingly almost all of these are for 787s (43 aircraft not yet contracted) and for A380s. The 787s are the greatest concern for ILFC, as there is a straightforward cancellation option on the A380s, which can be exercised until June 2010 without any great financial downside. However, it’s the 48 aircraft scheduled for delivery this year that is the immediate problem for ILFC, as the lessor has to find $3bn to pay the outstanding amounts on these units. If a buyer is not found soon then ILFC will be in big trouble because without access to cheap finance its costs increase dramatically, which would force it to cancel orders.

Of course if ILFC did go under, the biggest impact would be on the manufacturers. The approximate $0.5bn of nonrefundable deposits prepaid by ILFC to Airbus and Boeing would be scant compensation, as the manufacturers would not be able to find replacement customers for the majority (or at least a sizeable minority) of the ILFC aircraft. Incidentally Steven Udvar–Hazy, the chairman of ILFC, recently appealed to the manufacturers to cut production by up to 35% by mid–2010, or else they (the manufacturers) would have to finance sales of aircraft themselves.

The suitors

Clearly though, the US government has decided that AIG is too important to be allowed to fail, and it directly follows that ILFC will not be allowed to fail either — and therefore it’s in everyone’s interest to provide enough short–term funding until a buyer is found. But the problem that the US government faces is that while the underlying business fundamentals of ILFC are fine, this is in effect a fire sale — and buyers brave enough to step forward in the global recession will be keen to pick up the lessor at a bargain price. In the current environment, prospective buyers come from only two sectors — sovereign wealth funds or private equity funds. In the first category, among those believed to be interested in ILFC last year was CICC, China’s sovereign wealth fund, which was reportedly looking for support from the Bank of China (which bought SALE in 2006 for $1bn, before renaming it BOC Aviation). Middle Eastern sovereign wealth funds were also rumoured to be interested, as was Temasek Holdings of Singapore. Among private equity firms, interest reportedly came from Kohlberg Kravis Roberts and TRG Capital.

However, there was briefly another intriguing possibility — Udvar–Hazy (who sold the company he founded to AIG in 1990 for $1.3bn) said last year that he wanted to complete a deal for ILFC by March this year. But that didn’t happen — presumably because his efforts to persuade other investors to back him did not go as smoothly as expected. Instead it’s believed that Udvar–Hazy is willing to work with whichever consortium is successful in acquiring ILFC.

Altogether, six bidders disclosed interest by an initial deadline in mid–December, after which the list was reduced down to three, who had to submit second round bids by April 8th, with two of those scheduled to be shortlisted for a final round after that.

The three front–runners as of April 8th were reported to be a consortium between the Carlyle Group and Thomas H Lee Partners; one between private equity companies Onex Corp and Greenbriar Equity Group; and one led by Terra Firma Capital Partners.

A bargain price?

These are all heavyweight bidders; Carlyle is of one of the largest private equity funds around, with at least $85bn of funds under management, while Terra Firma — led by notorious UK financier Guy Hands — has previously bought and merged AWAS and Pegasus, which currently has a portfolio of more than 300 aircraft (see Aviation Strategy, September 2008). All three are believed to be indicating bids in the region of less than $5bn, substantially less than the company’s book value of $7.6bn as of the end of 2008. As of end 2008 ILFC’s debt stood at $32.5bn (6.6% up on 2007), giving a debt/equity ratio of 4.3 (the same as in 2007). But as recently as late last year some analysts had estimated ILFC’s worth as being around $8–10bn — so the bids of around half the upper estimate must be disappointing for AIG and the US government (but hardly surprising given the fact that everyone knows that ILFC has to be sold).

The fact is that improvements in ILFC’s credit rating – and access to cheaper borrowing – will not occur until a new owner is chosen although, interestingly, along with its credit re–rating in March, Moody’s added that if ILFC was sold to a financial investor–led consortium this would be unlikely to improve the company’s ratings – while a sale to a “highly–rated strategic investor” could strengthen the rating.

Moody’s also warned that an acquirer that required ILFC to pay dividends to service debt used to fund the purchase would “reduce the firm’s financial flexibility”. However, a deal is unlikely to be financed by putting substantial extra debt onto ILFC’s balance sheets as AIG cannot sell the lessor without the consent of the existing ILFC debt holders. If they did not approve a sale, then the debt would automatically default and be immediately payable; this would undoubtedly sink ILFC.

The three shortlisted bidders could hardly be described as “highly–rated strategic investors”, although at least Terra Firma does have another leasing company in its portfolio, which raises the prospect of a merger between AWAS and ILFC if Guy Hands is successful with his bid.

Given the terrible timing (from AIG’s point of view) for a sale, the key negotiations will be over price, with the private equity companies likely to play hardball. Unfortunately for ILFC, given the large number of aircraft arriving this year and a portion of debt that is due to be repaid from October onwards, between $4bn and $6bn of cash has to be found somehow.

While AIG previously said it would give short–term funding support to ILFC until it is sold, or to March 2010 (in effect giving a deadline for its sale), in April it was reported that ILFC was negotiating a $5bn credit line “backstop” with the Federal Reserve to help facilitate its sale. Potentially this will provide potential buyers with an assurance that some kind of federal support will continue in the short–term, which will reduce the immediate financing need for any acquirer of ILFC.

Though the negotiations with the New York Fed, the US government, AIG and ILFC will inevitably be complicated, if ILFC comes pre–packaged with a credit line in the short–term then someone will pick up one of the world’s major lessors with guaranteed financing and for substantially less than its book value. After that, the future for ILFC will depend on how urgently the new owner wants (or is forced) to cut back debt – potentially to include the sale of aircraft or the cancellation of orders in any case.

| 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total | |

| 737-700/800 | 12 | 5 | 5 | 22 | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 777-300ER | 4 | 4 | ||||||||||

| 787 | 4 | 11 | 8 | 1 | 5 | 12 | 17 | 16 | 74 | |||

| A319 | 7 | 1 | 1 | 9 | ||||||||

| A320 | 11 | 3 | 14 | |||||||||

| A321 | 9 | 1 | 10 | |||||||||

| A330 | 5 | 5 | ||||||||||

| A350 | 2 | 4 | 8 | 6 | 20 | |||||||

| A380 | 5 | 3 | 2 | 10 | ||||||||

| Total | 48 | 5 | 6 | 9 | 16 | 13 | 7 | 13 | 18 | 17 | 16 | 168 |