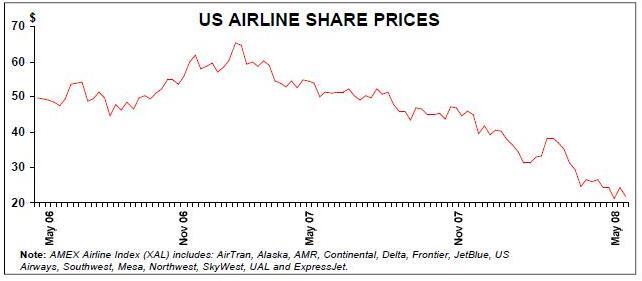

A dramatically smaller US airline industry by 2010?

May 2008

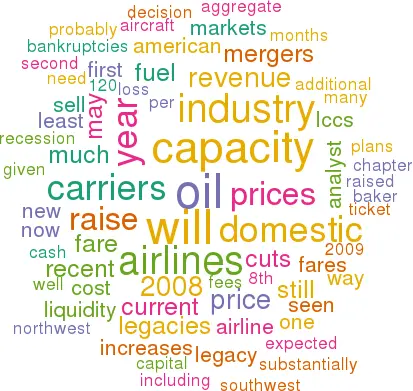

The run–up in the price of oil from the $100 level to over $120 per barrel in April, coupled with the realisation that the price could go much higher, has cast a dark cloud over the US airline industry, with one Wall Street analyst suggesting that the profit impact would be "every bit as great as the events of 9/11". The airlines have two imperatives. First, they need to raise as much liquidity as they can while that is still possible, to prepare for a potentially prolonged downturn. Second, they need to repair the broken revenue and cost equation, to reduce cash burn and facilitate an eventual return to profitability.

The first part is fairly straightforward: giving the brilliant treasury teams and their bankers a chance to really prove themselves with imaginative fund–raising — asset sales, additional borrowings, debt refinancings, etc.

Fixing the revenue and cost equation is more complicated. Because the US legacies have already reduced their non–fuel costs substantially in recent years (in and out of Chapter 11), there is limited scope for further cost cutting. Most of the improvement will have to be on the revenue side, and the only way to effectively increase revenues is to raise domestic fares substantially.

But it is extremely difficult to get fare increases to stick in the fiercely competitive US domestic market. There is excess capacity, and LCCs now have pricing power in all the key markets. Nevertheless, last year US carriers were able to raise fares to partially offset higher fuel prices.

The problem this year is that recession is expected to begin to bite at some point. While demand has held up well despite the weakening economy and bookings for the summer are strong, most airlines expect this trend to stall in the autumn. That could make it impossible to implement fare increases. Consequently, a major capacity pull–back is on the cards. It is likely to be the result of voluntary cuts by airlines (this year), mergers (from 2009) and the disappearance of some carriers through the bankruptcy and liquidation process. The extent of the industry shrinkage will depend primarily on the level of fuel prices (and how quickly they rise), as well as the depth and length of the recession.

On the positive side, US legacies have entered this downturn better prepared than ever before. They have chosen to carry significant amounts of cash, given the volatility seen in the business. Aircraft capex plans are extremely modest, as the carriers basically stopped ordering after September 11 and (continued on page 2)then held back in order to repair balance sheets.

But the earnings outlook is dismal. According to Merrill Lynch analyst Michael Linenberg’s latest forecast (May 8th), which assumes WTI oil price averaging $111 per barrel this year, the eight largest US airlines (including Southwest) will have an aggregate net loss of $4.2bn in 2008. For 2009, ML is currently projecting a $1.5bn loss, based on a $100 average WTI oil price.

With the price of oil hitting $126 in the early part of May, even steeper losses could materialise. ML’s oil price sensitivity analysis showed that, at $120 oil, the aggregate 2008 loss for the eight largest carriers would be $6.2bn; at $130 oil it would be $8.1bn, and at $150 oil $12bn. These calculations assume unit revenue growth of 7%. Interestingly, Southwest would still be profitable at $150 oil.

Clearly, the industry’s financial situation and prospects have deteriorated to the extent that the full range of potential remedies is needed. US legacy carriers will get back on their feet through a combination of the following:

- Liquidity raising The good news is that all of the legacy carriers probably have enough cash to weather the storm at least through 2008. But as oil prices have surged above $120, pressure has really built up to raise additional liquidity. After all, aircraft values are still holding up, financing is still available, etc. — but there is no guarantee that would be the case in six months' time.

At the end of April, AirTran raised a very useful $140m through stock and convertible debt offerings, proving that the capital markets are still open to airlines, but at a cost.

Several of the legacies have non–core assets that they can sell. AMR has already arranged to sell its asset management unit American Beacon Advisors for $480m and plans to divest of American Eagle this year (see pages 10–16). Continental has announced its intent to sell its remaining 10% stake in Copa, which could raise $160m.

In a May 8th research note, JP Morgan analyst Jamie Baker suggested that Continental needs to "pull as many liquidity strings as possible" and criticised Delta/Northwest for their "decision to forgo cashing the Air France check". Baker argued that all airlines "need to raise capital now or down the road to survive outside of Chapter 11", given the current fuel prices and without even factoring in a recession.

- Fare increases In the first quarter, most of the domestic fare increases initiated by the legacies only stuck in non–LCC markets, so they were not very useful. But fare–raising efforts have intensified and appear to have become more successful in recent weeks, as oil hit the$120 mark. Most recently, on May 8th American, United and Delta again raised ticket prices by $20 per round trip on most domestic routes, and Northwest immediately matched them.

Fares in the US domestic market will have to increase substantially if fuel prices remain at current levels. The big question is: how much capacity will have to come out of the system to facilitate multiple fare hikes, especially if demand weakens?

- New revenue streams Given the difficulty in raising fares, US airlines are under enormous pressure to find new revenue sources. Recent months have seen a proliferation of new fees for items that were previously included in ticket prices.

For example, charging $25 for a second checked bag has spread like wildfire. At least one airline has introduced fees for selecting aisle or window seats, while others have raised fees for travelling with pets or booking over the phone.

- Capacity cuts The US airline industry is showing remarkable capacity discipline: in 2008, for the first time ever, aggregate domestic capacity will actually decline. In ML’s estimate, current plans add up to a modest 1.3% reduction in domestic ASMs (including LCCs). The cuts accelerate sharply towards the end of the year, with the fourth quarter seeing a 4% capacity reduction.

But that is probably nowhere near enough, and the general expectation is that there will be significant additional capacity cuts in the second half of the year. Jamie Baker has suggested that the industry needs to shrink by as much as 20% in order to re–calibrate for current fuel trends.

Most carriers have at least some fleet flexibility. The best positioned are probably Northwest and American, with their DC–9 and MD–80 fleets, while LCCs should continue to be able to sell some of their new aircraft.

The legacies are finding it easier to cut domestic capacity now that LCCs too have joined in — at least temporarily. Most significantly, Southwest has reduced its 2008 ASM growth to only 4–5%.

- Mergers Legacy mergers are now seen as inevitable in the US — one way to rationalise the industry and make it more stable. This is how Calyon Securities analyst Ray Neidl explained it in his recent testimony to a Senate committee: "The industry will have to restructure one way or the other, either through the relatively organised regulatory oversight of mergers or in the more risky and disorganised guise of bankruptcy, which may lead to certain airlines having to liquidate." While mergers would obviously do nothing to help the industry this year and are laden with risks and pitfalls, they would provide a way to raise needed capital.

Since Continental’s recent bold decision to spurn UAL and not participate in any merger in the current environment, there appear to be two deals in the making:

Delta/Northwest, which was announced in mid–April and has not been at all well received by investors because of its apparent lack of synergies and capacity cuts; and UAL/US Airways, on which a decision was expected in mid–May.

- Bankruptcies As is typical in recessions, the past couple of months have seen a spate of small carrier bankruptcies in the US, including Aloha, Champion Air, ATA, Skybus, Eos and Frontier. Many of those led to immediate shutdowns (Frontier continues to operate), and more casualties are expected. These liquidations will help ticket pricing in certain leisure markets.

Northwest and UAL have had covenant issues recently, which caused much investor panic, but both airlines easily negotiated waivers with their lenders. The consensus is that the legacy carriers will avoid Chapter 11 in 2008 but that speculation is justified for 2009, particularly in a recession scenario. The industry is fortunate to have the breathing space, because many of those bankruptcies would be for real.