America West-US Airways: scepticism over "Project Barbell"

May 2005

US Airways and America West (AWA), the seventh and eighth largest US carriers, confirmed recently, in response to press speculation, that they are in discussions regarding a potential merger.

No details have been disclosed, but press reports citing "people familiar with the talks" have suggested that the idea is to create a new national, AWA–managed LCC that would rival Southwest in size. Such a deal would effectively rescue US Airways, which needs additional equity funding for Chapter 11 exit but is struggling to come up with an acceptable business plan in the current high fuel cost environment.

It is hard to respond to something like this with anything other than extreme scepticism. Over the decades, most airlines — and especially US Airways — have been involved in merger talks, but such talks hardly ever come to anything. On the rare occasion that they lead to a definitive agreement, the result (in the US at least) is invariably labour turmoil, soaring costs and shareholder value destruction.

In the case of AWA/US Airways, there would be extra potential obstacles.

Any merger deal would have to be approved not just by the airlines' boards, unions and federal regulators but also by US Airways' creditors, US Airways' bankruptcy court and the ATSB. It would also be an extremely tough undertaking to raise the estimated $350- 500m in new equity funding that the combination reportedly requires.

However, these are very unusual times. As the US legacy airline sector approaches another potential liquidity crisis in late 2005, labour unions have lost virtually all of their bargaining power while bankruptcy courts and middlemen like General Electric (GE) have assumed much control.

No matter how unlikely a merger between AWA and US Airways may seem, could GE push such a deal through, with help from existing and potential big–name equity investors such as Texas Pacific and Wexford Capital?

The AWA–US Airways proposal raises many intriguing questions. First, given the dismal history of large airline mergers in the US, why would AWA even want to consider it?

Second, AWA–US Airways would be unlike anything ever seen before — a combination of two mid–size airlines that have weak cash positions and balance sheets but have transitioned to LCC–type labour costs. Could that make a viable new LCC type in the US?

Third, would an AWA–US Airways transaction lead to a material capacity reduction, helping to raise industry unit revenues? Would it mark the start of the long–overdue industry consolidation process?

Why would AWA consider it?

Most airline mergers have been difficult and expensive, with complicated fleet and labour issues. Integrating labour has usually been the hardest part, due to differences in wage levels, benefits or seniority profiles, and solving those issues has tended to increase costs. Past experience has also shown that mergers between weak entities are a bad idea.

While US Airways is in Chapter 11 for the second time in two years, AWA narrowly avoided Chapter 11 in January 2002, when it was rescued by the ATSB.

US Airways' motives are entirely clear. It needs to boost its revenue forecasts and show better prospects in its business plan in order to attract additional investment. Also, a deal with AWA would facilitate a graceful exit for David Bronner, chairman of 36%-equity holder Retirement Systems of Alabama (RSA) and his temporary management team at US Airways.

By contrast, AWA is actually experiencing a promising financial recovery, thanks to industry–leading unit revenue trends — partly because of a healthier operating environment in the West and partly because of transcontinental capacity cuts. The airline incurred a relatively small loss in the first quarter, accounting for only 1.5% of revenues, and is clearly headed for profitability.

Analysts say that its stock would be on their "buy" lists without the black cloud of a merger hanging over it. Why would AWA want to risk all that?

AWA’s CEO Doug Parker, when commenting on mergers in general terms in the company’s first–quarter earnings call, suggested that several things have changed that may make airline mergers more successful than in the past. First, the labour cost differentials between AWA and some of the high–cost legacy carriers have narrowed dramatically, suggesting that some of the integration hassle may be avoided.

Second, with more legacy carriers in Chapter 11, the prospects for right–sizing fleets in mergers are enhanced. Third, the regulatory environment is now more open towards airlines helping themselves, as opposed to being helped by the government.

It is logical to assume that Washington would now look at airline mergers more leniently, though other airline CEOs have said that they are getting mixed messages. In any case, AWA–US Airways would probably easily pass muster with the regulators because of the scant route overlap and the LCC status.

However, regarding labour integration, analysts have pointed out that, while AWA and US Airways now have similar wage rates for most groups, they have significantly different seniority profiles. US Airways has a much older work force, as AWA was only founded in 1983.

This could pose thorny labour issues at AWA, creating an odd situation where the acquirer’s workers could lose out to their counterparts at the target airline.

Of course, AWA and US Airways have materially different overall cost structures.

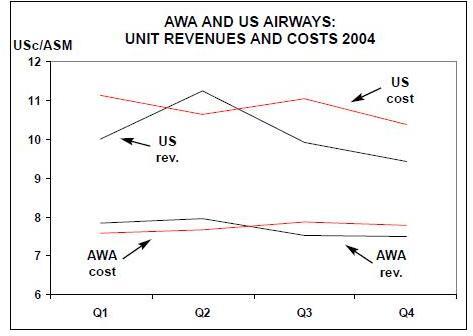

AWA is an LCC, with CASM of 8.29 cents in the first quarter with an average stage length of 1,022 miles. US Airways had CASM of 10.89 cents (average stage length 768 miles) in the first quarter. However, US Airways' CASM declined by an impressive 6.8% year–over–year despite higher fuel prices, and it is no longer totally out of line with other legacy carriers' unit costs.

Although AWA’s leadership insists that the airline could survive in the long term as a stand–alone entity, the merger talks are probably driven by concerns about strategic weaknesses. There would appear to be three key issues. First, as other legacy carriers' costs come down, AWA’s cost advantage diminishes. Second, AWA has a geographically limited network.

Third, the legacy carriers' fare reform, such as Delta’s recent SimpliFares, may have the worst impact on carriers such as AWA and ATA, which depend heavily on connecting traffic that has been attracted by undercutting legacy carriers' nonstop fares. (AWA has so far reported minimal impact from SimpliFares, but it is early days yet.)

In recent months Doug Parker has spoken frequently about the industry’s need to consolidate and AWA’s desire to play a part in it. In late 2004 AWA considered bidding for ATA but backed away mainly because the associated aircraft leases were too expensive (Southwest ended up with a smaller deal with ATA). Subsequently, Parker predicted that there would be many more merger opportunities, suggesting that the number of LCCs in the US would whittle down from the current 7–8 to 2–3 in the next few years.

That said, Parker made it clear in the first–quarter call that AWA would be extra careful to preserve its hard–worked–for LCC status, saying that the "guiding principle in any transaction is that it may not put that work at risk".

New merger structures?

Several analysts have suggested that the only way AWA and US Airways could avoid serious integration issues is to structure the transaction as a "partnership" or "holding company", rather than as a conventional merger. Ray Neidl of Calyon Securities suggested that such structures could produce up to 80% of the benefits of a merger without many of the risks and costs.

There are now examples of the holding company structure among large airlines in Europe, most notably Air France–KLM and Lufthansa–Swiss, where the airlines have kept their own identities but cooperate in planning, marketing and yield management, as well as the usual code–sharing.

In these cases the short, or even medium, term scope for cost–cutting rationalisation is still greatly limited by national and union considerations. Northwest’s CEO Doug Steenland, when asked about mergers in the company’s first–quarter call, called the European models an "interesting development". He pointed out that the US mainline–regional relationships are already based on a similar model, that it works well and that he would not be surprised to see the approach tried among the larger carriers.

Potential synergies

In many ways, an AWA/US Airways combination would make a lot of sense. AWA operates mainly on the West Coast and US Airways on the East Coast — hence the name "Project Barbell" for the talks. In addition to expanding the networks of both airlines and helping their transcontinental services, it would be an opportunity to diversify. AWA, which relies heavily on leisure traffic, would get more business–type (still higher–yield) traffic, while US Airways could benefit from access to the more stable West Coast environment.The key aspects of the existing business models are in sync. In addition to LCC–style wages and work rules, both airlines operate hubs (AWA at Las Vegas and Phoenix, US Airways at Philadelphia and Charlotte), provide assigned seating, offer two classes of service and have extensive RJ operations.

The fleets are similar, both operating A320s, 737 classics and 757s, while US Airways also utilises 767s and A330s on long–haul routes.

S&P analyst Philip Baggaley made the point that, despite the obvious revenue benefits, AWA–US Airways would still not provide what he would call "truly natural coverage", meaning that the combination is weak in the mid–continent area where some of the most successful hubs are.

The latest reports in the Wall Street Journal suggest that the AWA/US Airways planners are focusing attention on Midwestern markets and are considering flights to Hawaii, which neither currently serves. That would be in line with AWA’s recent strategy of shifting capacity from transcon to international leisure routes (mainly Mexico so far).

It would also copy the Southwest/ATA strategy of code–sharing to Hawaii from points in the West, which is believed to be a huge success (operated from Phoenix, with Las Vegas in the planning stage). In addition to long–haul aircraft, US Airways would bring to the combine its valuable Star Alliance membership, and including AWA’s routes in Star would obviously be an early priority. There have also been reports that Air Canada, another Star member, might already be involved in the AWA/US Airways negotiations.

Approvals and funding

The ATSB and GE have an incentive to see both airlines survive and are therefore likely to endorse any transaction.

The ATSB, which rescued both airlines in 2002–2003 with government guarantees on loans that currently have an aggregate outstanding balance of about $1bn, would need to waive conditions on the loans to facilitate a merger transaction.

GE, a major lessor for both airlines, is believed to have encouraged and been involved in the merger talks right from the start. As JP Morgan analyst Jamie Baker put it, GE’s motive is to "lengthen the orderly process of US Airways' liquidation, already well–underway". GE is reportedly looking to take back about 60 leased aircraft from the combined fleet, as part of a strategy to reduce exposure to US airlines. This could make fleet rationalisation easy for AWA–US Airways, facilitating cost savings without the hassle having to negotiate with lessors or justify fleet cuts to employees.

While US Airways Creditors' Committee is likely to support a merger deal that would keep the airline flying, there is always uncertainty associated with Chapter 11 proceedings. It is always possible that the bankruptcy judge could require a bidding process to determine if better offers could be had, as happened with the AirTran–ATA proposal late last year.

USB analyst Robert Ashcroft has cautioned that Southwest could try to derail a transaction, as it did with ATA. "That precedent showed it is unwise to count on Southwest to sit on the sidelines", he observed, though he noted there was no obvious way to do it other than perhaps bid for the US Airways assets.

An AWA–US Airways transaction would probably be on the shakiest ground in respect of funding. The deal would be unusual in that the acquirer (AWA) would not be in a position to contribute any funds. Although AWA had an adequate $254m in unrestricted cash at the end of March, upcoming debt maturities and the continued high fuel prices mean that it may need to raise around $100m or refinance debt later this year just to maintain adequate liquidity next winter. CEO Parker said that although the company was confident of being able to raise the funds, it was not comfortable enough to commit cash for any kind of transaction.

US Airways itself is estimated to need about $300m in added liquidity, on top of $125m it has already received from Air Wisconsin. Neither US Airways nor AWA has much in terms of unencumbered assets.

Soa significant amount of external funding would be required, consisting essentially of full risk bearing equity funding.

In recent weeks the airlines have reportedly approached and met with numerous potential equity investors — private equity firms, existing creditors and regional carriers — many of which US Airways had already approached about providing Chapter 11 exit funding. The list includes some very big names, notably Texas Pacific Group (which has a 55% voting stake in AWA) and Wexford Capital, which earlier made a provisional commitment to invest $125m in US Airways when it emerges from Chapter 11.

Of course, further funding from RSA is always possible, even though the pension fund has written off its existing investment.

As always, but especially in this kind of merger scenario, it would all depend on AWA and US Airways coming up with a viable business plan.

Industry implications

Mergers in the past have not tended to remove much capacity, but an AWA–US Airways combination could lead to a modest reduction. Analysts estimate that the 60–aircraft removal by GE would amount to perhaps 1% of industry capacity. On the positive side, those aircraft would probably go overseas.

Many people have noted that US Airways' outright liquidation would be much more helpful for the industry in terms of excess capacity reduction. However, in such a scenario most of the aircraft, gates and routes would probably be taken up by LCCs. So any overall capacity reduction would only be temporary. In the longer term, the benefit would be that the assets are in more efficient hands.

Even in a merger scenario, it is likely that some assets, such as gates and perhaps regional aircraft, could be put up for sale as the two airlines eliminated duplicate service and facilities.

The combination would have respectable market mass — Ashcroft noted that a fleet of 340 (excluding the 60 GE aircraft) would make it about the same size as Continental, though the average aircraft size would be smaller.

The combination would be heavily exposed to Southwest at three key hubs (Philadelphia, Phoenix and Las Vegas), and there is little doubt which side would win the market share battles. As Jamie Baker put it: "While the notion of building a supposed low–cost carrier capable of rivalling Southwest may have a nice ring to it, any resulting balance sheet would most certainly pale in comparison to Southwest's".

No one is expecting any AWA–US Airways merger to lead to a round of industry consolidation. Philip Baggaley made the point that many of the legacy carriers have experience of difficult mergers in the past and they certainly have their hands full dealing with losses. There is a lack of three key things required for a successful merger: management time, money and goodwill on the part of employees.

However, in the first–quarter conference calls most legacy carrier CEOs predicted that the competitive landscape would change significantly in the next 12–18 months. Consolidation is likely to take many different forms — also asset buyouts and liquidations. Many in the industry feel that asset buyouts may dominate, because that seems to be the method preferred by the strongest LCCs.

Southwest’s CEO Kelly told Reuters in a recent interview that there were no plans to invest in another airline, even though the ATA partnership was showing good results. For the moment, Southwest is interested in selected gate acquisitions at airports like Philadelphia, as well as 737s that might be sold by another airline.

JetBlue is mainly interested in gates and slots that may become available, according to its top executives. With such acquisitions partly in mind, the airline recently completed a $250m convertible debt offering. "We have the cash to be able to do some things but not merge with another airline — that is out of the question for us", CEO David Neeleman commented in the company’s first–quarter earnings call.