South America's three key markets: Chile, Argentina and Brazil

May 2004

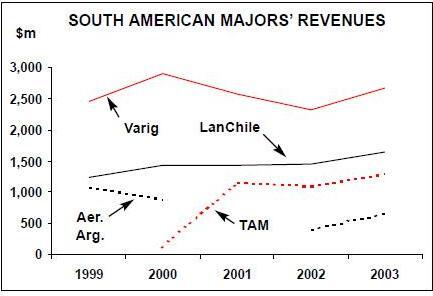

South America has long been a target for US and European airlines keen to exploit the VFR and business travel markets.

But poorly performing economies, small domestic markets and protectionist regulations have hampered the emergence of strong local airlines. Now however, as economies improve and aviation regimes begin to liberalise, South America’s own airlines are gaining strength and looking to expand into neighbouring countries. In this briefing Aviation Strategy takes a look at the three largest markets in South America.

Chile: LAN’s success story continues

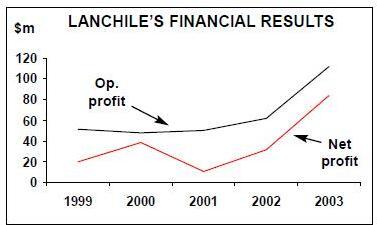

LanChile — or LAN as it has recently been rebranded — was privatised in 1989 and has been consistently profitable ever since the early 1990s.

September 11 and the economic collapse of neighbour Argentina were major challenges — traffic on domestic Chilean routes fell 7.2% in 2002 (as opposed to a 1.8% decrease in international traffic) — but LAN reacted by reducing capacity by 10%, cutting costs by $35m a year and diversifying its network, with new routes to Ecuador and Peru. So even though September 11 and the Argentine crisis cost LAN more than $200m in lost revenue, the airline still managed to post positive results in 2001 and 2002 (see graph, page 8).

LAN followed up these measures with further cost cutting in 2003, including the restructuring of aircraft lease deals, which saved another $15m annually. Luis Ernesto Videla, LAN COO, claims that the airline now has a lower cost per ATK than virtually all the major US airlines. In 2003 LAN posted record financial results, with revenues of $1.6bn and a net profit of $83.6m, and for the first quarter of 2004 the airline reported net profits of $48.1m, compared with $21.6m in 1Q 2003.

LAN is benefiting from a rise in international traffic, with international RPKs rising 21.4% in 2003, helping to overcome a 10.5% fall in domestic RPKs. Chile’s domestic market is small anyway, but domestic traffic has dropped considerably over the last few year — in 2003 LAN’s international RPKs were more than four times as large as domestic RPKs. Overall, RPKs rose 13.7% in 2003, outstripping an ASK increase of 7.4% and resulting in a 3.8 percentage point rise in load factor to 69.1%.

LAN (including its cargo and domestic operations) employs more than 10,000 people and operates to 33 destinations in South America, North America, the Pacific region and Europe. It has a fleet of 33 aircraft and — unusually for a South American airline — just four types: nine A320 family aircraft, eight 737–200s, four A340s and 12 767–300ERs (six of which are on three–year leases from ILFC).

Twelve A319s are on order, nine of them converted from a previous A320 order, the result of a renegotiation with Airbus in 2003 that also included the postponement of two A340–300 deliveries to 2004.

However, LAN may order 767s/A340s this year if international demand picks up even faster, with routes to Europe a priority. For cargo operations, LAN expects to order two 767–300Fs shortly, for delivery in 2005.

LAN’s domestic routes are operated by LanExpress, which has 2,000 employees and operates a fleet of 14 A320 family aircraft and 737s. LanExpress’s operations were previously the passenger division of Chilean carrier Ladeco, which LAN bought in 1995. The Ladeco name disappeared in 2001 after LAN turned its cargo business into LanCargo and its passenger operation into LanExpress. Together, LAN and LanExpress account for more than 80% of the Chilean domestic market.

Cargo contributed 38% of revenue in 2003 — the highest proportion among non–specialist airlines in the world — and the airline is benefiting from an increase in cargo volumes throughout South America. However, in 2003 the Chilean Economic Prosecutor recommended that LAN be investigated for possible cross–subsidisation of domestic passenger business from its cargo operations, an allegation that LAN fiercely denies. Financially, LAN is one of South America’s strongest airlines, and as of June 2003 the airline had a cash pile of $130m, virtually no short–term debt, and with all of its long–term debt relating to aircraft. LAN is also the only South American airline to be listed abroad — on the NYSE — but although LAN carried out an IPO in 1997, three families — the Pinera Group, the Cueto Family and the Hirmas Eblen Group — together own 83% of the airline (American Depository Receipts represent 5.4% and minority shareholders own 11.5%).

With such a small free float, LAN is keen to improve its liquidity, and in early 2004, plans for a secondary offering on the NYSE of up to 10% of the airline’s equity base (which will take advantage of the strength of the Chilean Peso against the US Dollar) were announced.

If the LAN group is to expand into the larger South American markets, then a much larger equity issue will be needed. Until now LAN (which is a member of one world) has followed a gradual expansion policy across South America, establishing small, local airlines in secondary markets with wet–leased aircraft. LAN’s portfolio includes:

- LanDominicana, launched in June 2003 with four 767–200s and operating between Miami and Santo Domingo. LAN owns 100%.

- LanEcuador, launched in April 2003 and operating two 767–300s between Miami and New York, and Quito and Guayaquil, and an A320 on services to Buenos Aires and Santiago de Chile. To comply with local laws, domestic investors — including Xavier Rivera, president of Ecuador — hold a majority of LanEcuador, while LAN owns 45%.

- LanPeru, established in 1999 and which operates domestically and to the US with two A320s. LAN owns 70%.

- LAN also has an interest in Aerolinhas Brasileiras (73%) and the cargo airlines Florida West International Airways (25%) and Mexico’s MAS Air (25%).

This has been a low cost, low risk strategy, though in some countries LAN has encountered opposition from local politicians on the grounds than a "foreign" carrier was entering their country.

Now, however, LAN is becoming more aggressive in its expansion strategy. In March 2004 LAN announced its "LAN alliance", offering common branding and service levels across all the LAN airlines, not only LanChile (which is now to be known as LAN) but also LanEcuador, LanPeru and LanDominicana. There is speculation that this may be the first step towards dropping individual country brandings and renaming all the airlines as LAN. If carried out, the single brand identity would bring marketing benefits and make it easier for the LAN group to expand across South America.

At the same time as the alliance announcement, LAN also declared it was now examining how best to enter larger markets, in particular Argentina, Brazil, Uruguay and Colombia. This may mean acquisitions — though this presents the problem of opposition to "foreign" takeovers — or the launch of new airlines.

In February 2004 LAN dismissed speculation that it was interested in buying Avianca, the Colombian airline currently under Chapter 11 protection.

Talks had been held following an approach by Avianca, but in a statement the Chilean airline said that "as of today there are no active negotiations to acquire a stake" — though this doesn’t rule out a move in the future.

But LAN has declared an interest in acquiring a majority stake in Lafsa, the Argentinean airline launched by the government in 2003 (see Argentina section), though it faces stiff competition from Southern Winds, the private Argentinean carrier that has a management contract to run Lafsa. American Falcon is another Argentinean carrier that LAN is reported to be considering buying a stake in.

As for Uruguay, an open skies agreement was signed between Chile and Uruguay in 2003, and LAN is sure to be looking at opportunities to enter the market there.

Competition to LAN comes from Santiagobased Sky Airlines, which was launched in December 2001 by Chilean entrepreneurs Jürgen Paulmann and Fernando Uauy (who previously founded National Airlines, which collapsed after coming under new ownership). It initially operated charter services before moving into scheduled services in the summer of 2002, and today it operates domestic services with a fleet of eight 737–200s.

While it claims "low costs", Sky is positioned as a full–fare competitor to LAN, and has between 15% and 20% of the domestic market (though it claims a market share of 22%). Sky says it is now consolidating its domestic position, and that may include a rebranding to "SkyChile" to take advantage of LAN’s dropping of "Chile" from its title.

The airline is also considering launching its first international routes, probably to Argentina and Brazil, though before it can do that Sky has to face the challenge of Aerolineas del Sur, an offshoot of Aerolineas Argentinas that aims to launch domestic Chilean services sometime in 2004.

Owned by the Marsans group, which also controls Aerolineas Argentinas, the new airline plans to operate three 737–200s on domestic routes and possibly a 747–200 to Madrid and Miami.

Aerolineas is expected to directly challenge Sky on its most important routes, and Sky may have to change its full–fare policy and undergo a fare battle if it is to survive the challenge. The Aerolineas entry might encourage Sky to prioritise routes to Argentina before other international markets, though it is doubtful Sky will have the resources necessary both to launch internationally and engage in a fare war with an aggressive new entrant.

Sky could be an acquisition candidate for an airline trying to establish a presence in Chile (whether it is the Marsans group, a South American carrier or a European airline), and there has been speculation that Sky’s owners may be prepared to sell up if the right offer came along.

Another potential start–up is Principal Air Chile, which is believed to be planning domestic routes.

Argentina: Aerolineas finally emerges from chaos

In contrast to the fortunes of LanChile, Aerolineas Argentinas has undergone year after year of crisis, a period that culminated with September 11 fall–out, the collapse in the Argentine economy, the devaluation of the peso and a change in the airline’s ownership.

After Iberia acquired an 85% stake in 1990, Argentina’s flag carrier struggled though the 1990s, eventually leading to a merger with Austral Lineas Aereas in 1999.

But although costs were reduced, Argentineas was still in deep financial trouble and in June 2001 the airline filed for bankruptcy after the government refused to sanction plans for radical restructuring proposed by Iberia’s owner SEPI, the Spanish state holding company. Salvation came in the form of a Spanish travel group Marsans, which bought Iberia’s stake in November 2001 and invested more than $50m to restart international routes that had been dropped over the summer.

The turnaround has been remarkable. The airline posted a net profit of $13m in 2002, and came out of court supervision in December 2002, though this was only after tough negotiations with debt holders who eventually accepted a deal for 40% of the debt owed to them (thereby writing off $350m of debt), payable over a number of years.

Formally, Aerolineas remains under the equivalent of Chapter 11 protection until the last tranche of debt is repaid, in the second quarter of 2004. Unions also agreed a three–year deal in exchange for a "no redundancy" promise.

In the first quarter of 2004, Aerolineas saw turnover rise60% to $191m, passengers carried up 31% to 1.5m, and load factor increase five percentage points to 78.7%.

Today Aerolineas serves 64 destinations across the globe and has 7,000 employees.

It has a 39–strong fleet, including 22 737–200s, six 747s and six MD–80s. Aerolineas also operates four A340s, with six more on order. The airline is likely to make an order for further short–haul aircraft this year, and the Fokker 100 is one model under consideration. Acquisitions may also be made for long–haul, most likely to be further 747–400s, to join the single 747–400 in its fleet, an aircraft on lease from Pegasus Aviation.

Analysts expected full–year 2003 net profits would be in the range $20m-$30m, given that in the first half of 2003 Aerolineas posted a net profit of $9m, compared with a $58.5m net loss in January–June 2002. Revenue rose 56% over the half–year, to $289m. But when the results were released, in February, the 2003 net profit was $44m, the improvement due to rising passenger numbers and a tight grip on costs.

The airline carried 5.2m passengers in 2003, 40% up on 2002, and had a load factor of 74.4%, up from 63.4%. In particular, international traffic was boosted by an influx of tourists keen to take advantage of the depreciation of the peso.

This year Aerolineas plans to make investments of almost $200m, including $87m on fleet expansion and $30m on "foreign subsidiaries".

The airline is also hiring at least another 1,200 staff over the year as the recovery in the Argentinean economy continues, and also has ambitious plans to build 12 hotels in Argentina over the next three years. Antonio Mata, Aerolineas chairman, now forecasts a net profit of $56m for 2004.

But despite its recovery, minor financial wobbles still occur — for example in October 2003 Banesto, a Spanish bank, obtained a court order to seize two 747–200s in lieu of unpaid debts (though the matter was resolved within a week and the aircraft returned to Aerolineas service).

Nevertheless, Aerolineas is keen to carry out an IPO, although plans to do this at the end of 2004 have now been postponed until 2005 to ensure that it has a longer track record of profitability.

The tentative plan is for up to 20% of equity to be floated, initially in Buenos Aires but subsequently on the Madrid stock exchange. Marsans may then float up to another 20% of the airline, though it will retain a majority stake given its plan for a network of airlines across South America.

Aerolineas has traditionally been at the forefront of calls for pan–continental unity and alliances between the region’s airlines.

Back in 2002 it called for an Alas Andinas, or Andean Wings alliance, a concept that other airlines were suspicious of, believing it would be an instrument for Aerolineas’ dominance of smaller carriers.

But a pan–continental alliance for common fleet buying or marketing co–operation appears doomed now that South America’s majors gain so much from global alliances and are strong enough to expand into adjacent markets on their own.

Though Aerolineas is not part of a global alliance, Marsans says it wants to launch airlines in Chile, Uruguay, Bolivia and Paraguay, and has up to $30m to invest in new opportunities across the continent. As well as the foray into Chile with Aerolineas del Sur (see above), in March Aerolineas announced it had signed a Letter of Intent to buy Varig’s 49% stake in Uruguayan carrier Pluna. This would be a controversial move given the traditional rivalry not only between the two neighbouring countries but also between the two respective airlines.

The Uruguayan government would prefer a local buyer, and as it owns 49% of Pluna, its wishes will be hard to ignore. Lineas Aereas Federales (Lafsa) was launched by the Argentine government in October 2003 in order to keep a domestic rival to Argentineas going after the collapse of two other domestic airlines, Lapa and Dinar. The Lafsa fleet consists of five 737–200s, with plans to add a sixth. Lafsa is run on a management contract by Southern Winds, an airline launched in 1996 (originally under the name Pampas Air) that operates scheduled and charter services in Argentina and Brazil, and internationally to Miami and Madrid with a fleet of two 737–200s and a 767–300ER. 30% of Southern Winds is owned by Eduardo Eurnekian, the former owner of the failed Lapa and the current owner of Aeropuertos Argentinos. His involvement in running Lafsa angered unions, but in the end the government’s plans went ahead as there was little alternative for the employees of Lapa and Dinar.

The government provides considerable financial support to Lafsa, including paying the wages of Lafsa’s 800 staff as well as a reported $1m per month to help with fuel and other costs. In addition, Lafsa does not pay landing fees. The government says it intends to privatise the airline by the end of 2004, once the airline is established and after the management contract with Southern Winds expires. The original six–month contract expired in April and a six–month optional extension is being exercised. That expires in October 2004, and if the government keeps its promise then Southern Winds is itself the favourite to buy Lafsa, ahead of potential "foreign" acquirers such as LAN. But six months is a long time in the Argentinean airline industry, and privatisation is by no means guaranteed by the end of 2004.

In the meantime other small domestic carriers such as AeroVip and American Falcon have put heavy pressure on the government for similar aid and subsidies as given to Lafsa. The government is responding with a plan to cut VAT on fuel and other charges, but for all the government’s efforts in establishing more domestic competition, Argentineas has more than a 90% domestic market share, and it will be some time before Southern Winds, Lafsa and others will be to dent that to any measurable degree.

Brazil: Varig/TAM soap opera

Brazilian airlines have gone through a torrid time in the last few years, thanks to a combination of a troubled economy, a devaluation of the currency and damaging fare wars, but intervention by the radical Lula government in 2003 appears to be stabilising the industry. The government’s actions include the paying of increased insurance premiums on behalf of the airlines, the granting of tax breaks on aircraft leasing and the cancellation of $150m worth of unpaid social security payments owed by Brazilian carriers.

In return, the government is encouraging airlines to cut back their capacity, and the state aviation authority is now assessing all new route requests in terms of how the extra capacity will affect the overall Brazilian market.

But the biggest state intervention is in trying to engineer a merger between troubled flag carrier Varig and TAM, the number two domestic airline — a deal that was announced in February 2003 but has been on/off ever since.

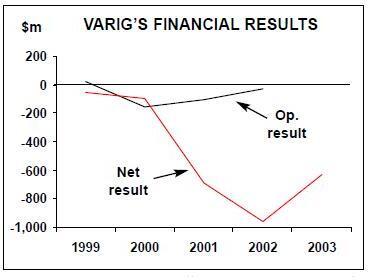

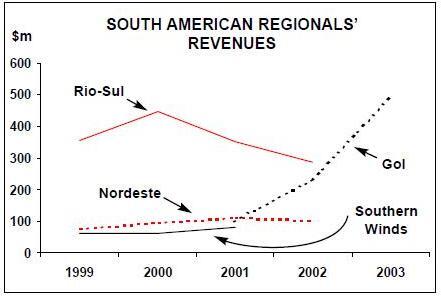

Varig — Brazil’s oldest airline — has more than 10,000 staff and serves 50 destinations in Brazil and around the world with a fleet of 53 Boeing aircraft. Its cargo operation is Varig Log, which has a fleet of 11 727s and DC–10s.Varig also owns 97% of Rio–Sul, which operates domestically using a fleet of 26 737s and ERJ–145s, and 99% of Nordeste, which operates within Brazil with seven 737s. In October 2003 Varig closed its LCC subsidiary Rotatur, which launched in 2000 and used 737s.

Though Varig has more than a 75% market share of international traffic to/from Brazil, on domestic routes it has been losing share for a number of years. The airline is in serious financial trouble — it is saddled with more than $2bn of debt and in 2003 posted a net loss of $625m, its third massive loss in three years (although an improvement on the almost $1bn net loss of 2002).

However, Varig has been carrying out major cost–cutting, including reductions in routes and a halving of the fleet over the last few years (including the return of six leased 767–200s and three MD- 11s to GECAS in 2003) and is benefiting from an upturn in the Brazilian economy. Crucially, Varig has gained from a co–operation deal with TAM, which includes joint operations on certain routes and a unified fares policy — an alliance that has increased Varig’s bottom line (i.e. reduced its losses) by $100m in 2003.

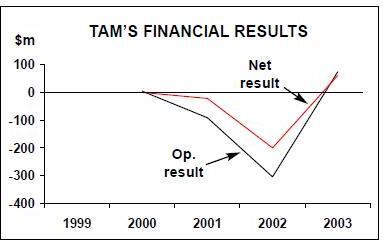

TAM’s origins date back to 1961, but today the airline has more than 6,000 employees and operates a fleet of 44 A320 family aircraft, seven A330s and 30 Fokker 100s to more than 20 destinations in South America and other continents.

The company racked up a substantial net loss of $200m in 2002, but helped by job cuts of 500 jobs in 2003 and its code–sharing alliance with Varig, the company posted a net profit of $60m last year. The success of this alliance is increasing the doubt as whether a full merger between Varig and TAM will go ahead after all, as it appears to many observers that most of the benefits of a merger can be achieved within the scope of the current alliance.

A combined airline would have many difficult decisions to make, including staffing levels and how to rationalise a fleet with no less than 10 different aircraft types, a situation that would be unsustainable. TAM is already running down its Fokker 100 fleet, but a merged company would have to make a decision on TAM’s outstanding orders, for five A319s, five A320s and a single A330.

The deal is problematical anyway as it involves the current shareholders of Varig taking 5% of the merged airline and TAM shareholders accepting 35%. The rest of the equity would go to the current debt holders at Varig — largely the government and various state–owned entities. Varig/TAM would also receive a loan of more than $0.5bn from BNDES, the national development bank.

Varig’s existing non–governmental shareholders — the Ruben Berta Foundation, which owns 56% — are particularly upset at the squeeze on their stake due to the debt–for–equity swap. The Foundation argues that Varig’s international brand and membership of the Star alliance is being undervalued in the proposed deal. With the economy picking up, the currency improving against the dollar, and both domestic and international traffic also strengthening, the feeling is that the arguments for a higher relative stake in a merged company will be much stronger in a few months' time than they are at present.

To make matters worse, there is the point of view that TAM is doing perfectly well on its own and doesn’t need a merger forced upon it by the government. It’s also unlikely that TAM’s existing code–shares with American and Air France would survive the merger with Star alliance member Varig. Varig’s unions are also unhappy about the merger plan, which they fear will lead to redundancies, while the rest of Brazil’s airlines claim the merger will kill domestic competition.

The combined airline would control more than 70% of the domestic market, way ahead of the third place airline, Gol. The continuing rows and negotiations have been called a "soap opera" by the head of Brazil’s competition authority, and in January 2004 Antonio Luiz Teixeira de Barros, TAM’s president, said that a merger is "nearly impossible" thanks to differences between shareholders.

Given the difficulty of agreeing a merger and the success of the existing co–operation, it’s likely that the airlines would quite happily like to carry on with the current arrangement — but this is not an option the government will agree to. The government insists the current co–operation must be a step towards a full merger, and that Varig and Tam’s argument that they can survive on their own is based entirely on the benefits of the current temporary partnership. There is little doubt that the abandonment of code–sharing would have serious repercussions on both airlines.

Many of Varig and TAM’s routes are to small, regional cities, where profitability is hard to achieve; what the alliance has done is to increase load factor on the two–thirds of their routes that they co–operate on by 10% over the last year.

Therefore, in the absence of a merger, some kind of compromise between the government and the two airlines will have to be agreed.

Indeed in February 2004 the two airlines put forward a proposal to form what they call an "association", which basically is an enhancement of the current co–operation set within a new, jointly- owned subsidiary that will operate some regional routes. This association would last for a period of two years, during which the airlines will restructure and — in Varig’s case — reduce its burden of debt. At the end of the period the two airlines would then agree a merger, presumably in which Varig’s shareholders will get a bigger stake than the 5% now proposed.

How the Varig/TAM "soap opera" will turn out is still anyone’s guess, but taking a close interest is Gol Transportes Aereos. Launched in January 2001, the airline is owned 87.5% by Grupo Aurea, a Brazilian conglomerate, and 12.5% by AIG (parent of ILFC). Gol currently has 2,500 employees and operates 18 737–700s and four 737–800s on domestic routes out of Sao Paulo.

The airline claimed a 19% market share of the domestic market in 2003, with revenue of $491m, double that of the year before, operating profit of $101m and net profit of $56m. Launched as an LCC, Gol has grown fast and its aggressive fare discounting has shaken up the Brazilian market and forced other airlines to reduce their prices; this has been a major contributor to the red ink seen at many of Brazil’s airlines.

The Varig/TAM deal is encouraging speculation that Gol may make its own merger/acquisition, with the most obvious candidate being VASP. It’s speculation that Gol denies, though a successful Varig/Tam merger would make life difficult for the other domestic airlines in Brazil.

VASP is Brazil’s fourth airline, with a fleet of 30 727s, 737s and A300s operating to 21 domestic destinations. 40% of the airline is owned by the VOE/Canhedo Group — an alliance between the Canhedo Group and VASP’s employees — and 60% by the state of Sao Paulo. VASP also own 50.1% of Ecuatoriana.

VASP has been eclipsed by the emergence of Gol, but is fighting back through planned renewal of its ageing 737–200s, likely to be replaced in 2004 by leased 737–200Advs, 737–700s or A320s. In the first half of 2003 VASP reported a net loss of $2.9m, compared with a $59m loss in January–June 2002, but it is believed to have significant debts.

As the larger Brazilian airlines pull out of selected domestic routes, this leaves an opportunity for regional start–ups. One of them is Ocean Air, launched in 2002. Ocean Air has 400 employees and a fleet of seven Emb–120s and three Fokker 50s, and in 2003 it made a net loss of $6m on revenue of $10m.

| Lan | LanChile | Lan | Sky | ||

| Chile | Cargo | Express | Airlines | ||

| A319 | 1 (12) | 1 | |||

| A320 | 8 | 4 | |||

| A340 | 4 | (2) | |||

| 737-200 | 8 | 1 | 9 | 8 | |

| 767-300ER | 12 | ||||

| 767-300F | 3 | ||||

| Total | 33 | (14) | 4 | 14 | 8 |

| Aerolineas | Southern | ||

| Argentinas | LAFSA | Winds | |

| A310 | 1 | ||

| A340 | 4 (6) | ||

| 737-200 | 22 | 5 | 2 |

| 747-200B | 5 | ||

| 747-400 | 1 | ||

| 767-300ER | 1 | ||

| MD-80 | 6 | ||

| Total | 39 (6) | 5 | 3 |