Inter-LCC competition

May 2004

Investors in Europe’s leading LCCs have been getting nervous because easyJet’s and Ryanair’s success has generated a complex competitive reaction.

After announcing its six month results to March 2004 — revenues up 18% to £440m, operating loss of £31.7m, a 31% improvement on the previous year’s result (easyJet has always made a loss in the winter season), yields and load factor both up — easyJet’s share price dived 24% in one day.

Following on from Ryanair’s crisis in January when it lost 30% of its stock–market value, the media reported a major loss of investor confidence in LCCs and started questioning the whole LCC concept.

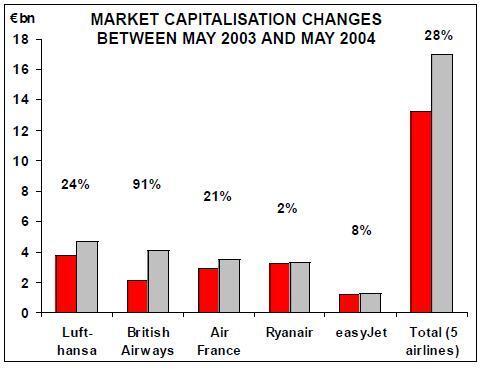

It’s really a matter of perspective. As the graph below indicates, both easyJet and Ryanair have marginally increased their market capitalisation from this time a year ago, but their share of the market value of the mainstream quoted airlines has declined — mainly because British Airways' share price has nearly doubled, and Lufthansa and Air France (now incorporating KLM) have seen their valuations increase by 20–25%.

What has happened is that the network carriers have regained ground while LCC valuations are no longer based on the unlikely combination of year on year exponential growth in traffic volume while maintaining high operating margins. Having said that, Andrew Lobbenberg, the ABN Amro analyst who has read the airline stock–market most accurately, now reckons that easyJet is well undervalued. And the 2004 net profit margins predicted for easyJet and Ryanair — 9% and 24% respectively — compare well with those of Air France and Lufthansa — 1% and 3% respectively.

The catalyst for easyJet’s recent share slip was CEO Ray Webster’s comment that he was "cautious" about the full–year performance because of "unprofitable and unrealistic" pricing by LCCs and full–service competitors.

This is a genuine concern — Aviation Strategy highlighted the plethora of start–ups in the April issue, many of which have fragile business plans.One of the problems for easyJet and Ryanair is that European LCC start–ups tend to include London in their network because it is the densest city–pair from wherever they are based. However, it is usually also the most competitive city–pair with yields that reflect that competition.

While some of the flimsier LCC competition will soon disappear, the German market poses some difficult challenges.

In addition to its recently opened Berlin Schoenefeld base, easyJet plans another base at Dortmund in July. It will also start flights between Cologne–Bonn and the UK in June. In Germany, the second biggest LCC–market, easyJet will be competing not only with Lufthansa but also with Air Berlin, Hapag–Lloyd Express, Germania and Germanwings.

easyJet and Ryanair are confident that their operating models provide them with a substantial cost advantage over the German carriers which are encumbered by local labour costs and conditions.

But all easyJet and Ryanair can see are the fares being sold — the finances of German LCCs remain opaque, as Germanwings is 50% owned by Lufthansa while Hapag–Lloyd Express is part of the TUI conglomerate.

easyJet and Ryanair have largely avoided competing directly against each other (Ryanair quickly abandoned an advertising campaign comparing its fares to easyJet's), but the second tier of UK LCCs have intensified inter–LCC competition.

For example, both easyJet and bmibaby operate out of Nottingham East Midlands airport, overlapping on eight routes. FlyBe promotes itself as a regional LCC and competes with easyJet on city–pairs rather than airport–pairs — for instance, easyJet operates 737–700s on Bristol–Belfast International while FlyBe operates BAe146s and Dash 8s on Bristol–Belfast City.

Precisely how bmibaby and FlyBe are doing financially is not revealed although their parents, bmi and Walker Aviation, have reported substantial losses in recent years (both, however, have valuable slots at Heathrow which underpin their commercial viability).

Although successful LCCs are supposed to grow only organically and avoid acquisitions, LCC takeovers for tactical reasons do happen — most recently of course with easyJet/Go and Ryanair/ buzz. Even Southwest has bought out competitors — Morrisair (partly to obtain its reservation system) and Muse Air (headed by Lamar Muse, Southwest’s founder/CEO, when it was making life difficult for Southwest in the intra–Texas market).

Some intra–UK consolidation now might not be illogical.

The other source of additional competition for the LCCs has come from the flag–carriers. BA’s success with reducing its cost base and selling internet–only LCC–type fares through BA.com was covered in the previous issue of Aviation Strategy, and it is also worth noting that on some European routes BA is aiming to fill the back of 757s or 767s with BA.com passengers.

Air France has now introduced discounts of up to 80% on standard domestic fares in an attempt to stem the expansion of easyJet, now France’s second biggest carrier. Inevitably, legal processes have been opened, with easyJet challenging what it sees as the unfair bias of the French slot coordinator, COHOR.

The Aer Lingus factor

The UK–Ireland market has become a Ryanair/Aer Lingus duopoly, and although Ryanair has enjoyed a higher share of operating profits in the past, Aer Lingus has successfully turned itself into a LCC flag–carrier, offering far more effective competition than in the past.

Ryanair has disclosed that UK–Ireland profits were down approximately 20% in 2003.

Aer Lingus’s 2003 results underline the remarkable turn–around of the still fully state–owned carrier: an operating profit of €83m (a 30% rise on 2002’s €64m) and a net profit of €69m, (96% up). During the year Aer Lingus achieved a further cost reduction of €89.5m, adding to a cumulative reduction since 2001 of €344m.

The change in business model from 2003 versus 2001 includes a decline in overall capacity of 6%, with traffic up 7% and passenger load factor up 11 percentage points to 81%. This comes with a decline in average yield of 23% and a 35% fall in costs per RPK. The airline is successfully turning aerlingus.com into its primary distribution channel: at year–end 2003, 50% of all bookings were online.

Overall, Aer Lingus achieved an operating margin of 9.3% in 2003, excellent relative to its AEA peers, yet CEO Willie Walsh states "we are significantly under–performing our main competitor in Europe [Ryanair] …we have set ourselves a medium term target of a 15% operating margin.

Competition within the European market is intense and we anticipate further low cost competition on key routes in 2004".