Regional spin-offs: a unique investment opportunity

May 2002

Following on from JetBlue’s extremely successful IPO (Aviation Strategy, April 2002), two US Majors are tapping the equity markets for new funds — not directly, but through the spin–offs of their regional carrier subsidiaries.

In a marketing splurge both regional carriers were re–christened, Continental Express became ExpressJet and Pinnacle Airways emerged out of Express 1, a Northwest Airlink commuter. ExpressJet has hubs at Houston, Cleveland and Newark, while Pinnacle feeds its parent at Detroit, Minneapolis and Memphis.

In mid–April the ExpressJet IPO was launched by Salomon Smith Barney, the price having being pushed up from $14 to $16 a share and the number of shares on offer increased. The IPO capitalised ExpressJet at just under $1.1bn, which, remarkably, is above the equity market valuation of UAL and compares to $1.6bn for its parent, Continental Airlines. Continental in effect received all of the funds, about $480m from the flotation, and its stake in ExpressJet was reduced from 100% to 53%.

The schedule and pricing of the Pinnacle IPO, led by Morgan Stanley, has not yet been finalised, but it could capitalise the carrier at $800m compared to a current stock–market valuation of $1.7bn for NWA Corp.

Investor confidence

It is clear that investors are showing much more confidence in the fast–growing regional sector:

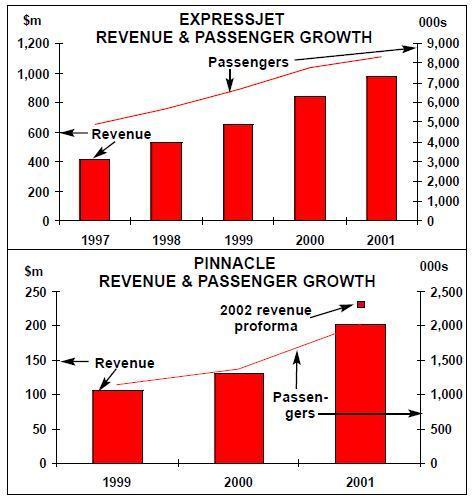

Pinnacle more than doubled its traffic and capacity during 1999–2001 while ExpressJet grew by about 60% over the same period. The impact of September was significant but nowhere near as severe as that on the US Majors: for example, ExpressJet noted that its revenue declined by 6% in the second half of 2001 compared to the first half, the equivalent decline for the Majors was 19%.

Yet the regionals are almost totally dependent on their parent for traffic and cashflow.

Both ExpressJet and Pinnacle operate using capacity purchase agreements (having changed from revenue–sharing agreements which simply prorated revenue for passengers connecting between the regional and mainline carriers).

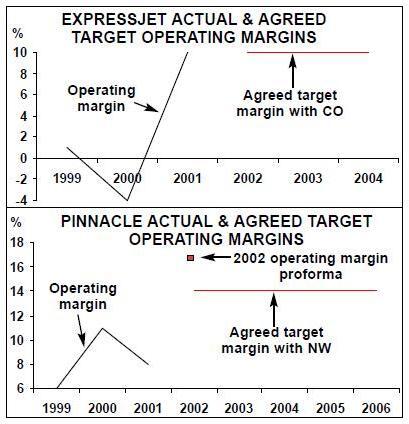

In ExpressJet’s case Continental pays its regional carrier a rate per block hour, which is designed to provide ExpressJet with an average operating margin of 10%. If uncontrollable costs such as fuel, insurance, ground handling fees, etc. vary so that the operating margin drops below 8.5% in any quarter, Continental makes a compensation payment to ExpressJet to bring the margin back up to 8.5%. If the margin rises above 11.5% ExpressJet compensates Continental so that the margin is reduced to 11.5%. In calculating the operating margin ExpressJet cannot take into account unanticipated changes in labour costs nor the costs associated with any "controllable" cancellations — i.e., it has to take full responsibility for its union negotiations and labour relations. The current agreement with Continental runs through to the end of 2004.

ExpressJet’s net profit in 2001 was $28m, equivalent to 4.9% of revenues, after $25m of government subsidy but also a one–off reduction of $33m in Continental’s payments. Moreover, Continental is the lessor of almost all of ExpressJet’s fleet, the terms of the leasing agreements reflecting "the context of a parentsubsidiary relationship". ExpressJet has opted for an all–jet strategy with its remaining turboprops scheduled for replacement by the beginning of next year. The airline has currently 145 Emb 145s in service and has placed firm orders for a further 129 Emb 145s for delivery during 2002–05. In Pinnacle’s case the operating margin target on their capacity purchase agreement is 14%, with a minimum of 12%. The agreement runs through to 2007 when the new target will be set at somewhere between 10% and 14%. Pinnacle didn’t enter into the capacity sharing agreement with Northwest until March this year, having previously revenue shared with its parent.

Its net profit was $14.2m or 6.9% of revenue in 2001, but in order to illustrate the effect of the new capacity purchase agreement and of course to boost the sales message, the 2001 P&L accounts have been restated under the assumption that the new agreement was in place a year previously. The result is to increase operating profit from $17m to $35m and net profit from $14m to $21m.

These pro–forma accounts for 2001 could have an impact on the valuation of the airline. If, for instance, potential investors are persuaded that the pro–forma rather than the actual results are more relevant to the valuation of the airline, then the price would be pushed up from around $550m to over $800m, assuming that Pinnacle achieved roughly the same historic price/earning ratio as ExpressJet. Northwest intends to sell up to 87% of its stake in the carrier, and will take all the proceeds from the sale.

Pinnacle’s fleet is supplied by Northwest. It has committed to increasing Pinnacle’s current jet fleet from 30 CRJs to 83 by 2004, while the turboprops will be phased out by the end of this year. Northwest has an additional 221 CRJs as firm orders or as options, which it has not yet allocated to any regional carrier. Pinnacle, naturally, expects to receive a significant proportion of these regional jets.

Logical ratings?

The ratings associated with the regional carrier IPOs do seem to be very high (as is JetBlue's), and it is difficult to get fully comfortable with the relative capitalisations of parent and subsidiary.

There is a recent precedent for subsidiaries of airlines being considered far more valuable than their parents — during the dotcom boom, the theoretical valuation of priceline.com dwarfed that of its owner Delta while travelocity.com was worth much more on paper than AMR Corp.

On the other hand, the regional carriers do offer a unique investment proposition. Their operating profits are guaranteed at a reasonable level as long as the capacity purchase agreements with their parents remain in place, and their rate of revenue growth is confidently expected to remain strong — at least 25% a year.