Orbitz cleared for take-off

May 2001

Orbitz, the US travel portal owned by the five largest US majors, has cleared the first hurdle set by the regulators. The US DoT has stated there was no justification for preventing operation of the Web site, but it has required the Orbitz backers to submit a report six months after operations begin, and it warns that it will take action if the site operates in violation of antitrust laws.

Other regulatory hurdles remain for Orbitz, notably inquiries being conducted by the Department of Justice (DOJ) and the Federal Trade Commission (FTC). With the proposed consolidation of the airline industry, Orbitz owners would control 85% of domestic air travel. As is normal in the US, an academic, in this case Prof. Jerry Houseman of MIT, has been hired by the venture’s opponents to prepare by an objective report.

Houseman argued that by collectively exercising their substantial market power through Orbitz, the airlines hoped to eliminate or severely weaken independent Internet travel distributors. Anti–competitive weapons included: a no–advertising policy, an exclusivity provision, and a most favoured nation (MFN) clause This MFN clause, he claimed, would ensure that discount fares of new entrant airlines will become less visible; Orbitz airline–owners will become aware instantly of any secret price–cutting off published fares; and only Orbitz and its airline–owners' Web sites will have access to Internet "e–fares."

Based on airline travel data during 1990- 1999, Houseman estimated an aggregate demand curve, and using DOT’s own fare premium data contained in its most recent studies, inputted assumptions as to both the percentage of those paying higher fares in a post–Orbitz environment and the discount rate, and hence calculated the consumer welfare loss from decreased entry to be $3.2bn on a discounted present value basis. (Although the professor did not make the comparison, this figure to about 80% of US passenger internet sales last year.)

In any case his arguments did not prevail, which is potentially good news for the prospective European and Asian multi–airline portals. And Orbitz will be launching into a still favourable market.

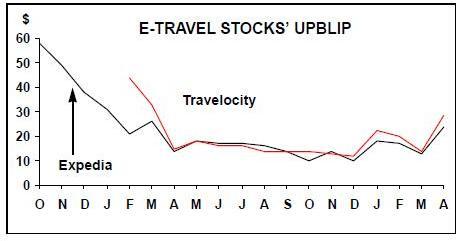

Just about the only sector of the e–business market which is recovering from the collapse in confidence in internet stocks is online travel. As the graph on page 3 shows both Travelocity and Expedia stock have moved sharply back up, although they are nowhere near their inflated launch prices. Expedia, which is 70% owned by Microsoft, has surprised analysts by reporting its first quarterly operating profit more than 12 months before it was expected to.

Orbitz will be tested in the consumer marketplace in competition with Expedia and Travelocity, Priceline, E–bookers, FyCheap and the airlines' own sites. It claims that the technology it is using will shift online travel from the DOS to the Windows era; it claims the fastest search times and the most comprehensive results; it claims that it will provide fares from all airlines, including the low cost operators. It launches in June — go to www.orbitz.com.