Alitalia - junior partner to Air France?

May 2001

Alitalia’s financial results are deteriorating badly and it remains outside any global alliance. Air France would appear to offer a promising partnership, but will Alitalia be willing to accept the implications of being a junior partner?

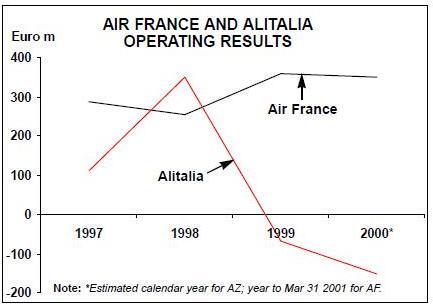

Alitalia Group reports an operating loss of €26m and a net loss of €250m for the year 2000. It blames ongoing problems with the new Milan Malpensa airport, the break–up with joint venture partner KLM plus fuel and US dollar pricing problems. At present no improvement is envisaged for 2001.

Air France, by contrast, is on target to repeat last year’s operating profit of €340m in 2000/01 and net profit should be significantly higher than last year’s €200m. Exploiting the strength of the CDG hub, Air France has managed to contain unit cost inflation, despite the fuel price increases, push up average load factor from 76.1% in 1999/2000 to 79% in the first nine months of 2000/01 while, at the same time, increasing unit revenues by 5.7%.

For Alitalia the need for an alliance becomes more and more urgent. The airline states: "The delay in setting up a competitive alliance also makes it difficult for the company to deal on even terms with the competition which is increasingly better organised and aggressive."

The new CEO Francesco Mengozzi, who took over from Domenico Cempella in February, is hoping for a decision on a new partner before the end of May. Talks have been held with KLM, which has decided not to repeat its previous frustrating experience in Italy, with Swissair, which has more than enough problems of its own at present and with Air France, which almost by default has become the most likely partner.

Indeed, there are many attraction for Alitalia in the Air France/SkyTeam grouping. For a start there should be a business culture empathy, with Air France having successfully completed the transition from inefficient flag–carrier to a commercially- orientated company. Language barriers would be quite low facilitating the transfer of management skills.

The two airlines combined would have a dominant position in the southern continental European market, counterbalancing Lufthansa/SAS/Austrian in the north. The Milan and Rome hubs would tend to complement CDG rather than compete with it. Fleet plans based on the A320 family and 777/A330s are compatible. Air France would bring in an established, powerful US partner, Delta, and a potentially powerful Asian partner, Korean.

The problem is: how would an Air France alliance solve Alitalia’s fundamental financial problem? The main issue concerns where Alitalia is making its losses.

About 40% of Air France €9bn airline revenues are earned domestically and intra- Europe while Alitalia generates about 60% of its revenues in these regions. Depending of course on how one accounts for connecting traffic, both these core activities are profitable at the operating level, though not spectacularly so. They should be profitable given the comparatively restrained competition the two carriers face in their home markets — the failing AOM/Air Liberte/ Air Littoral amalgam in Air France’s case and the unaggressive Air One in Alitalia’s case.

However, there is a sharp contrast on the long–haul routes, in particular the transatlantic operations. Both Air France and Alitalia generate about 15% of their revenues on the North Atlantic but whereas Air France probably earns an operating margin of 10%-plus in this sector thanks to the CDG hub and the Delta connection, Alitalia is believed to be losing about 25% of its sales in this sector. This is the result is limited frequencies, low yields and high flight crew costs.

On Asian routes Air France is probably again profitable, perhaps a 5% operating margin, but Alitalia is very heavily loss–making.So the logical conclusion of an Air France/Alitalia alliance might be for Alitalia to downscale substantially its intercontinental operations and concentrate on feeding the CDG hub. In other words, follow current demand patterns — the major Italian corporations (Olivetti, Fiat, etc) are in any case negotiating their corporate travel accounts with the airline alliances that can give them genuine global reach rather than relying on the national carrier.. Long–hauls would then be rationalised to a relatively few direct routes where Alitalia would have a competitive advantage.

This is essentially how the Lufthansa/SAS relationship evolved, with SAS feeding Lufthansa at Frankfurt though it later restored some of its own point–to–point long–hauls. However, Italy is not Scandinavia, and such a rationalisation strategy would meet huge opposition from unions, management and politicians.