Airline consultancy: advice for the advisors

May 2000

Twenty years ago airline expertise in branding, revenue management, customer service, supply chain management, and training was eagerly sought by others either directly or through the consultants they used. Today there are still significant skills in airline management but other industries have developed faster and further, most notably in financial services, telecommunications, distribution, and retail. More recently, few airlines have delivered consistent profits. Yet the consulting business, meanwhile, has continued to aim at double–digit growth and high stakeholder returns, but without airline experience being so highly prized by other clients.

The five challenges

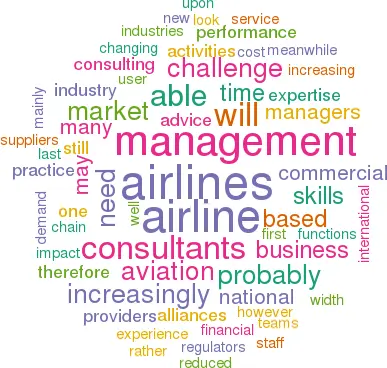

The theme of this article is the impact of airline industry changes on the need for general management consultants. Of necessity the article is subjective and selective, but it postulates that the expertise now required by airlines demands skills and resources that consultants may not be able to provide easily or economically. The current context of civil aviation is still one of most airlines competing within very defined markets. Whether because of regulation, history, limited capital, or choice, many airlines still limit their activities to operating scheduled passenger business (or charter or freight transport business) mainly from national bases with strong home demand. The creation of a genuinely global market is slow, led mainly by one or two of the major partners in the new alliances. Most other airlines seem to be concentrating on incremental improvements to networks, route management, brand alignment and cost sharing — looking to survive until the market stabilises.

Similarly, there is still a tendency by some airlines to regard agents, hotels, resorts, airports, information providers, distributors and surface travel providers as suppliers to airlines. In other industries it may be salutary to remember that the true competitive predators often came from other players in the supply chain, and probably only the last remnants of state control in protecting national ownership and bilaterals prevents many airlines from being in open play as takeover targets.

The first challenge for a consultant in this environment is therefore to be able to view aviation from the outside of an industry and challenge established thinking while being accepted within it.

Airline managers do recognise, however, the need to compete globally — currently mainly through alliances, aligning and integrating brands, products, networks, and therefore fleets, suppliers and systems — whilst retaining sufficient independence of action to satisfy anti–trust regulators, and shareholders. They face, however, stronger low cost entrants, renewed growth by integrated travel companies, diverging priorities by CRS providers, and, increasingly, new distribution and product offerings by web based providers.

They face these challenges, moreover, at a time when prolonged and successive downsizing has reduced both the width and the depth of their management teams. The width has been reduced by the progressive outsourcing of activities such as ground handling, catering, maintenance, and IT and latterly the merging of activities such as sales and marketing with partner airlines. This leaves fewer positions in which airline managers may gain a variety of experiences, especially close to the operation or customer.

The depth of management skill and time available meanwhile has been reduced by the de–layering of management structures, reduction in the use of expatriate staff, and the transfer of many staff functions such as personnel or planning into the line. All this just at the time when alliances, regulators, and service partners demand increased management participation on both broad and detailed issues, and globalisation demands a combination of international business skills and highly sensitive cultural awareness.

The second challenge for the consultant is therefore to be able to integrate all the relevant functions, balanced with insight and experience in the need to achieve this alignment across national and cultural boundaries.

Airline managers, however, are increasingly better prepared in terms of business skills, and are well able to complete analytical activities which previously they contracted to consultants. Confident managers now look for consulting advice which is not only knowledgeable about their business and the entire value chain, but is conversant with the impact of convergent technologies, of globalising markets, of changing buying patterns, and the relative attraction and flows of international capital. They demand the demonstration of knowledge and expertise beyond that based upon past airline experience.

So a third challenge is how to generate and maintain the width of insight required by this generation of airline managers and work enough in other industries to offer advice for the future rather than judgements based upon the past.

To underline this the international aviation market is probably moving faster than at any time in the last thirty years and there is a divergence between advising on maintaining best practice at economic cost and guiding airlines into new ventures or skills. Consultants active in the technical and safety areas for example are increasingly becoming auditors with specialist expertise based upon an ethic of prevention and protection rather than commercial success.

Such an approach needs a sharing of technical knowledge and best practice, and the self–belief to confront poor management practice. This can make a difficult fit with commercial advice where planning in secrecy and being first in the market may be crucial.

A fourth challenge is then to recognise this divergence of consulting needs, especially between industry and commercial practice, and to build practices which are ethically and commercially secure.

Meanwhile, user and public perceptions of airlines are changing. Airline product differentiation is increasingly hard to maintain and integrators, agents and airports increasingly regard users as their customers, and the airlines as suppliers for whom they will set the standards. At the same time airlines are finding that safeguarding the environment, and safeguarding the health of passengers are of increasing interest to more people.

These, and other user–driven factors, are reflected in two developments. First, a perceptible weakening in the public support for airlines being national entities has developed over the last decade similar to the disinterest in national ownership of utilities, financial institutions, computers, or motor manufacture.

Second, an increasing lack of tolerance of airline performance by passengers and shippers, and increasingly critical media coverage of this and financial performance. Crucially many journalists are no longer only aviation buffs but spend time with financiers, regulators, and lawyers and are well able to look at issues of competitiveness, profitability and service delivery and reflect this in their commentaries.

The fifth challenge is to understand rapidly changing political and user perceptions and the likely impact of these on the structure and performance of the industry, and to be able to advise accordingly.

General management consultants therefore need to be familiar with aviation, but expert outside aviation. They need to be able to align and integrate the management of the different airline functions and they need to be able to challenge performance from user and market perspectives. They also need to work with internal resources and reduce their client lists to protect commercial confidentiality. As a result there will be probably be fewer large aviation consulting practices — the market will not support many — and these may well become tied to one of the major alliances for reasons of commercial confidentiality.

There will probably be an increasing distinction between consultants who are advisers and consultants who are contractors. The latter will deliver specified products and will probably move away from a fee based approach into partnership or investment based methods of charging as a way of maintaining adequate returns and the relationships necessary for the lucrative follow–on assignments. The former will probably look to develop relationships where they increasingly operate as coaches or guides to in–house teams, with continuing assignments enabling them to increase revenues through personal utilisation, rather then the deployment of teams of junior staff.

Finally, there will probably be an increased blurring of the demarcation between consultants and other advisers such as lawyers and accountants — could one really advise on slots or market entry without all three skills? Perhaps it will be easier to consult elsewhere.