Making airport assets work harder

May 2000

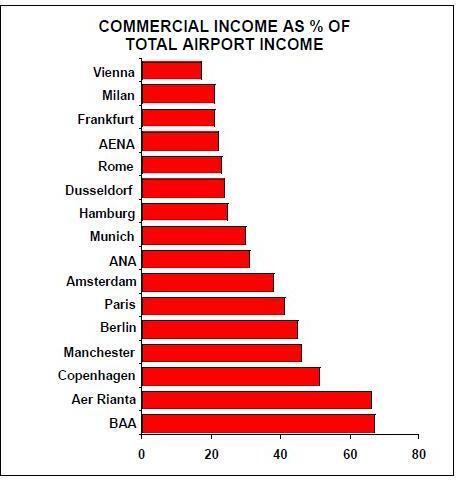

The global trend towards the privatisation or at least the corporatisation of airports, plus in Europe the abolition of duty free sales, means that airport operators are having to make their property assets work harder to increase revenue from non- aeronautical activities.

Nowhere is this more evident than in the passenger terminals where many services are offered to a wide range of potential customers including airlines, passengers, staff, visitors, meeters and greeters and to a lesser extent, local residents and businesses. In the terminals, lucrative retail and catering outlets compete for floor space with less valuable operational passenger handling uses and familiar high street brand names are now common place.

But can the commercial success of the terminals be extended to other parts of the airport? Income from commercial sources falls into two categories: concession fees and rent.

Rent premiums

Concession fees from retailers, caterers, hotel, car parking and car rentals generate the largest source of commercial income by allowing the airport operator to share in the turnover of the concessionaires' business. Concession opportunities are put out to tender at regular intervals, usually 3 to 5 years, to ensure that competition is maintained. The big revenue earners of retail and catering are usually terminal based although hotels and car parking uses are more flexible in terms of their possible location around the airport. Rents are the second most important source of commercial income and most airports have successfully created specialist property markets for airport–related organisations who are prepared to pay high rentals (relative to levels outside the airport) to reflect greater lease flexibility and the benefit of being close to their core operation. At Heathrow, average office rents in the terminals are in the order of £45.00 per sq ft (Euros 780/sq. metre), and new high quality offices in Terminal 3 are attracting rents as high as £54.00 per sq ft. These compare to £33.00 per sq ft for similar quality offices located just outside the airport.

Apart from the spending power of the passengers, the key to commercial success outside the terminals is availability of land capable of being developed. However, even with an abundance of available land, airports face stiff competition from neighbouring landowner/developers to attract commercial occupiers for whom an on–airport location is attractive but not essential. Offices, hotels, car parks, flight kitchens, light industrial engineering, warehouses and distribution centres are all potentially lucrative airport tenants but which are often attracted to off airport locations.

Airside advantage

Property development at airports is usually complicated by safety zone restrictions, height limitations or planning conditions stipulating that only airport–related users may occupy property on airport land. For airports to maximise rental income from commercial occupiers, they must act like property developers to put in place a clear commercial property development strategy. Commercially successful airports already have detailed master plans in place. Airports have at least one major advantage over their competitive neighbours; airside access. This is a crucial requirement for properties such as maintenance hangars and air cargo warehouses, which serve the core activity of airports. These are operational properties for which an airport location is often essential.

Dramatic air cargo changes

Airports can also work in partnership with neighbouring landowners to accommodate operational properties. Coventry Airport is a good example where Parcelforce has recently built a 430,000 sq ft (40,000 sq m) national and international sorting facility on land immediately adjacent to the airport with direct access on to the apron. Air cargo operators are increasingly important airport tenants. E–commerce is transforming the way people buy, but a big barrier to growth in this sector is the quality of the logistics infrastructure to fulfil the sale, and this is driving rapid changes in terms of industry consolidation and operating methods.

With their need for fast delivery the e–tailers are looking to the integrator sector to perform. UPS and TNT have set up e–commerce subsidiaries to serve this growth sector. In addition, other air cargo carriers such as KLM, Alitalia and Lufthansa are now starting to offer time–definite products. From its new cargo hub at CDG2, Air France is also moving into the fast delivery sector and has recently launched a range of time definite services.

At the moment, the overnight logistics market within Europe relies extensively on the integrators and air transportation for high–value, time–sensitive deliveries. This may change if the European Directives which provide for open access to rail infrastructure lead to the break–down of national barriers in the rail sector to provide a viable alternative transport mode.

What do these proposed industry changes mean for airport property? Larger, modern sorting and distribution warehouses will be needed to meet expected growth and accommodate new operators to the fast delivery sector. Frankfurt airport already operates an air/rail cargo hub and this type of facility may be necessary at other key European airports to provide transfer points for air to rail modes.

For this type of operational property to be developed, a sound freight strategy is needed to demonstrate the capabilities of the airport and create demand by attracting the operators to use it as a base.

Master planning

In the UK, for example, DHL has recently developed a 400,000 sq ft (37,000 sq m) sorting facility at East Midlands airport which will allow its cargo throughput to triple from the current level of 400 tonnes per day to 1,200 tonnes per day. Airports with valuable land assets must undertake a master planning exercise to properly assess the appropriate mix of operational and commercial uses and the phasing of their implementation. Where on–airport land is in short supply, partnerships with adjacent landowners can be the key to success.

Equally as important, is the financing of any future development, which will need to be planned to take account of acceptable levels of risk. In this way, the commercial success of the terminals can indeed be extended to other parts of the airport.