Air France: partly-privatised, but fully-commercialised?

May 1999

Finally, Air France has returned to profitability and has part–privatised. But can the airline make it into the top ranks of the commercial airline business?

Air France’s public share offering in February of approximately 20% of the company was hugely oversubscribed and the current share price stands at €16.6, capitalising the airline at approximately €3.8bn (or $4.1bn).

This represents a 25% discount to Lufthansa on a cash flow/price comparison. Stockmarket analysts suggest that such a discount is the minimum expected because the French government has only sold a minority stake in its airline and at present has no plans to relinquish its majority holding. State ownership now stands at 64% (down from 94%), while employees have 13% of the shares and private investors 23%.

Interestingly, Air France’s current market value is approximately the same as the state aid injection it was permitted by the EC in 1994 (the earlier Ff5bn payment into the airline by the French government was deemed not to be state aid).

The turnaround

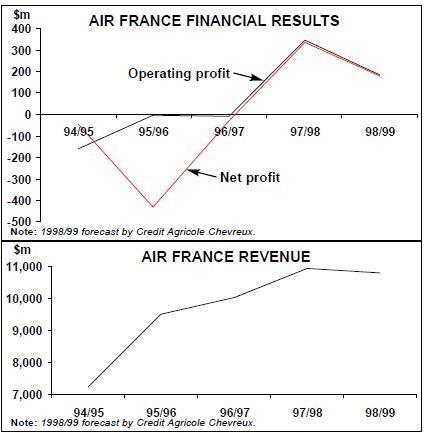

In 1997/98 Air France reported its first net profit for seven years — Ff1.9bn ($338m) representing a margin of 3.6% on revenues. This mainly resulted from an increase in unit revenues associated with good demand conditions and better application of yield management. For strike–impacted 1998/99 the net profit is forecast to decline to Ff1bn ($181m), or 1.6% of revenues, with revenues falling slightly and operating cost growing very slightly. The decrease in fuel prices last year was critical; without that factor the airline would have struggled to break even.

There have been three major influences on the Air France turnaround. The first was Christian Blanc’s administration (1994–97), which confronted the management and unions at the airline with the reality of European liberalisation and which implemented the EC–sanctioned recovery plan.

The second was the administration of Jean–Cyril Spinetta, who replaced Blanc in 1997. Spinetta has succeeded in pushing through the airline’s part–privatisation, in the process reaching an accommodation with the pilots unions, perhaps because he comes from the dirigiste tradition, having held high–level posts in the French government.

For example, in a very influential article published in Le Monde in May 1998, Spinetta focused on the what he saw as the key issue for Air France: the divergence in labour costs between Air France and its major European competitors, yet he still refused to accept the possibility that a flag carrier could go bankrupt. Rather, Spinetta referred to Air France’s future as “a slow death, through gradual asphyxiation: this will inevitably be the fate of Air France in the next 10 to 15 years if the company does not definitively solve its problems of competitiveness”. In the commercial world, a 10–15 year timescale is a great luxury.

The third and most nebulous influence was that of Steven Wolf and Rakesh Gangwal, now chairman and CEO respectively at US Airways, who played key advisory roles during the Blanc administration. It is possible to discern their influence in the restructuring of Air France’s routes and also in the employee participation at the airline.

Route rationalisation

One of the most impressive elements of Air France’s turnaround has been its willingness to abandon loss–making routes — something that flag–carriers traditionally find very difficult to accept. Since 1995 Air France has closed 41 of its 120 long–haul routes and 15 of its 121 medium–haul routes. This process is still continuing, with Air France recently withdrawing from Nagoya and Cape Town.

The airline has concentrated on increasing frequencies on the routes which are regarded as having growth potential, moving up to daily service whenever possible. Air France has also worked on simplifying its route structure, increasing the proportion of non–stop long–haul flights from 53% in 1994 to 76% last year. And it has streamlined its operations by allocating one type per route, improving the efficiency of crew rostering and boosting the utilisation of the long–haul fleet.

The success of this approach is reflected in Air France’s load factor. In 1998/99 its passenger load factor was 75.5%, against the AEA average of 72.0%.

The fleet too is being harmonised into five main types -747, 777, A340, 737 and A320. The 727s and A300s are been eliminated, and the F100s have been leased out to the franchisee partners. Growth in the next few years will be concentrated in the 777/A340 category.

Hub building,

Air France’s greatest asset is its hub at Paris Charles De Gaulle, where it has quickly built up a six wave system. As a result the airline can claim that it has the best hub in Europe. Connecting possibilities between short- and long–hauls (defined as connections in less than two hours) will total 10,300 a week this summer, following the opening of the third runway, compared with 4,000 at London Heathrow.

Moreover, at CDG there is room for expansion without virulent environmentalist opposition. A fourth runway due for opening in 2001 and the imminent completion of a new terminal will increase capacity by about 50%, potentially making CDG a larger airport than Heathrow. (Before getting too carried away with the brilliance of the CDG hub, it is worth remembering that this airport has still some way to go to catch up with Heathrow: terminal passengers in 1997 at CDG totalled 35.1m, compared with 57.8m at LHR, while domestic and intra–EU passengers totalled 18.9m at CDG against 29.3m at London Heathrow.)

Expansionism

At the core of Air France’s strategy is expansion. On long–haul routes Air France is forecast to grow by around 11%, somewhat less than Lufthansa but over four times British Airways’ rate. On the North Atlantic, the airline is going to increase capacity by 15% whereas BA will grow at less than 5%.

Air France is quite clear about its aims. In a recent interview, Pierre Gourgeon, the president and COO, stated that the aim simply was to grow at twice the rate of the market. The dangers of such a market share attack, especially at this point in the aviation cycle, should be evident, so what could be the drivers behind Air France’s chosen strategy?

The official rationale is that the airline has to recapture the traffic it lost, both domestically and internationally, during the years when it was constrained by EC conditions attached to its state aid (and by the suspension of the France–US bilateral). Yet the downsizing of the network in recent years is a key element of its financial recovery. And the risk of over–expansion is yield dilution — even modestly growing European carriers are experiencing unit revenue declines of 5- 10% this year.

It may simply be that Air France has no choice but to expand rapidly. Its greatest asset — Charles De Gaulle — could also be a liability. It has got to fill the new slots there or risk the entry of a competitor at its home base, in the same way as American and British Airways (through Air Liberte) have established an important presence at Paris Orly.

The expansion is also closely tied in with its alliance strategy. With its two US code–sharing partners, Delta and Continental, Air France is now able to offer daily service to 10 gateways and 26 interior points, and its growth rate is partly being determined by these two US Majors — on the Atlantic Continental is expanding at 21% this year and Delta at 13%.

In the March issue of Aviation Strategy we speculated that a Delta/Air France core to a global alliance capable of competing with oneworld and Star would be more likely than an Air France/Continental amalgam which would also tie in Northwest/KLM/ Alitalia. Air France’s current strategy would tend to reinforce this viewpoint — the carrier has to win traffic from other carriers if it is to meet its growth target, and the airport from which it is most likely to win traffic is Schiphol, a direct threat to KLM/Northwest/ Continental. Similarly, Air France’s build–up of its hub at Lyons poses a threat to the incipient KLM/Alitalia hub at Milan Malpensa.

Then there is the effect of growth on unit costs. Air France has the aim of reducing unit costs by 10% by 2001. Identified cost savings of Ff3bn are to come from such sources as the recent pilot agreement, network rationalisation, process engineering, the optimisation of purchasing power, revenue protection measures and lowering commission rates.

The problem is not only that some of these cost saving sources sound pretty vague, it is also that Ff3bn equates to a maximum of only 5% of Air France’s operating costs. So the other half has to come from economies of scale resulting from growth. This is always a risky strategy, especially when yields start to deteriorate badly.

Labour relations

Air France has had the archetypal state airline problem: expensive and stroppy unions, particularly pilots’ unions. The pilots went on strike in the summer of 1998 threatening the football World Cup ($1!), but the consequent deal has been presented as a solution to these problems. The deal includes:

- A wage freeze to 2001, then a reassessment, with the possibility of a further three years of zero increases;

- Wage give–ups in turn for shares (the low offer price was certainly influenced by the pilots);

- The alignment of working practices with those of British Airways, Lufthansa and KLM; and

- A scope clause that allows the outsourcing of operations of less than 100–seat aircraft to franchisees and others.

Inter–airline pay comparisons are very difficult to make because of the complications of taxes, work rules, actual productivity etc, but Spinetta’s own assessment of the difference between the labour costs of his pilots and British Airways’ pilots is 40%. Officially, it will take up to seven years to close this gap under the current agreement.

However, it is expected or hoped that share ownership by the pilots will contribute to a change in corporate culture. As in many flag–carriers, there is the feeling that the unions exercise ultimate control while top management is changed too often to effect fundamental reform. Indeed, key strategic decisions at Air France have been driven by the unions — for instance, the unions blocked the project to merge Air Inter with Air France’s European operations to create a potentially lower cost subsidiary, in effect forcing Air France to merge Air Inter into the parent. And, unfortunately, any new union/ management harmony has been dealt a blow by a strike by Air France employees at Nice over outsourcing and other issues.

Nevertheless, Air France’s scope agreement, whereby up to 5% of total capacity can be flown by other operators in aircraft of less than 100 seats, is a major achievement. The problem may be a shortage of other operators. In France itself the main regional airlines — Air Liberte, Air Littoral and Regional — have been tied in by British Airways, Swissair and KLM respectively. This leaves Air France with just Brit Air and Proteus as franchisees, plus Gill Air and Jersey European in the UK.

In this regard Air France’s launch order for A318s may be significant. The 100–seater jet, due for delivery in 2003, could theoretically be flown by a partner airline under the terms of the scope agreement. Then, as there is complete cockpit crew communality throughout the A320 family, Air France could have an embryonic low–cost subsidiary.

Commercialism and alliances

Just how commercial is Air France? Much of France continues to resist Anglo- Saxon notions of unbridled capitalism, and all the mainstream politicians still believe in some form of state ownership and control over the economy, a model which, it must be said, worked well for the country up to about 10 years ago and has produced higher per capita income than in the UK.

Throughout the tortuous period preparing for the part–privatisation it seemed that the transport minister was less than enthusiastic about the process — hardly surprising as he is a member of the Parti Communiste.

A glance at the composition of Air France’s board of directors would also tend to suggest that the national role of the airline is at least as important as the commercial. Of the 18 board members, five represent the state (minister of economy, head of the CAA, etc), six are appointed as CEOs of nationalised companies (Spinetta himself plus the CEOs of French railways, the steel industry, etc) and seven are elected by employees.

There is therefore a fundamental difference in corporate governance between Air France and British Airways or Lufthansa or KLM. One wonders how much the potential US partners of Air France appreciate the full implications of this difference, and whether they would consider it a serious obstacle to forming an integrated global alliance. Or could Air France’s top management use the leverage of a potential US investor to persuade the state to dispose of a majority shareholding, a move which is probably a pre–requisite for the full commercialisation of the flag–carrier?

| Current | Orders | Delivery/retirement schedule/notes | |

| fleet | (options) | ||

| 737-200 | 19 | 0 | To be retired by 2000 |

| 737-300 | 6 | 0 | |

| 737-500 | 19 | 0 | |

| 747C | 14 | 0 | |

| 747-100/200 | 4 | 0 | To retire in 1999 |

| 747-400 | 7 | 0 | |

| 747-400C | 6 | 0 | |

| 747F | 12 | 0 | |

| 767-300 | 5 | 0 | |

| 777 | 0 | 7 (10) | For delivery in 1999/2000 |

| A310 | 11 | 0 | |

| A318 | 0 | 15 (10) | Delivery from 2003 onwards |

| A319 | 9 | 20 (16) | To replace 737-200s |

| A320 | 61 | 0 | |

| A321 | 11 | 5 (4) | To replace 737-200s |

| A340-200 | 14 | 0 | |

| A340-300 | 0 | 4 (4) | To replace A340-200s in 1999 |

| Concorde | 5 | 0 | |

| F-27 | 10 | 0 | |

| F-100 | 5 | 0 | Transferring in 1999 to franchise |

| TOTAL | 218 | 51 (44) | partners BritAir and Proteus |

| Ff bn | 1996/97 | 1997/98 | 1998/99 | FY98/97 FY99/98 | |

| Total revenues | 55,602 | 60,716 | 59,943 | 9% | -1% |

| Operating costs | |||||

| Staff | 4,639 | 4,858 | 5,170 | 5% | 6% |

| Fuel | 5,642 | 5,753 | 4,723 | 2% | -18% |

| Maintenance | 799 | 1,125 | 1,308 | 41% | 16% |

| En-route | 4,798 | 4,691 | 4,682 | -2% | 0% |

| Handling | 2,739 | 3,234 | 3,085 | 18% | -5% |

| Sales | 3,838 | 4,598 | 4,820 | 20% | 5% |

| Leasing | 3,158 | 4,015 | 4,217 | 27% | 5% |

| Depreciation | 4,639 | 4,858 | 5,170 | 5% | 5% |

| Others | 25,401 | 25,661 | 25,728 | 1% | 6% |

| Total operating costs | 55,653 | 58,793 | 58,903 | 6% | 0% |

| Operating profit | -51 | 1,923 | 1,040 | n.m. | -46% |

| Other income | 252 | 507 | 391 | 101% | -23% |

| Interest etc | -1,071 | -1,114 | -534 | 4% | -52% |

| Taxes etc | 723 | 558 | 106 | -23% | -81% |

| Net profit | -147 | 1,874 | 1,003 | n.m. | -46% |

| ASKs (m) | 92,073 | 95,168 | 101,086 | 3% | 6% |

| RPKs (m) | 68,083 | 71,553 | 75,919 | 5% | 6% |

| Load factor | 73.9% | 75.2% | 75.1% | +1.3pts | -0.1pts |