KLM and the $1.1bn bonanza

May 1998

Through necessity, KLM is probably Europe’s leading airline in terms of strategic thinking. Without the intrinsic advantages of British Airways or even Air France, KLM has put a great deal of management effort into predicting how markets will evolve and how the airline can best position itself to exploit these changes.

Some of the strategies KLM has developed have worked out well, such as the Northwest alliance (although not in the way that was expected). Other initiatives have failed totally — a merger with BA mooted in the early 1990s and the Alcazar project, for example. But underlying all of KLM’s strategic moves seems to be the imperative of maximising its share of European traffic in order to compensate for the airline’s limited domestic market.

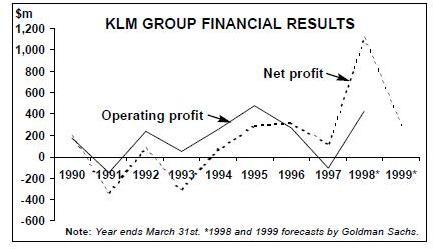

Following a doubling of net profits in the first nine months of its 1997/98 financial year, KLM is set to post record results in the full year (see graph, right). 1997/98 results will be boosted by sustained cost–cutting and revenue enhancement programmes, an improving economic climate (including a weak guilder), lower fuel prices, a growth in traffic (up 9% in the first three–quarters of 1997–98) and better demand for business class. KLM predicts that operating profit will surpass the airline’s previous record of DFl 772m in 1994/95 ($481m). But net profit will receive a huge boost — approximately $810m — from the Northwest share sale.

Northwest cash-in

KLM has now sorted out its disputes with Northwest over their eight–year old alliance. In September 1997 the two airlines signed a 10- year co–operation agreement on the North Atlantic, with a three–year notice period afterwards. Additionally, the alliance was also broadened into other geographical and operational areas — for example, in June all 70,000 European members of Northwest’s FFP (WorldPerks) will be transferred to KLM’s scheme (Flying Dutchman), although KLM’s FFP is not as generous as Northwest’s. KLM is also taking over Northwest’s European reservations and ticketing.

Prior to this agreement, Northwest contributed $150m each year to KLM’s operating profits, but new synergies such as the merging of revenue management systems, rationalisation of sales and marketing etc, is forecast to increase KLM’s bottom–line benefit to $300m a year.

As part of the September deal Northwest agreed to repurchase KLM’s remaining 19% stake in the US airline in four annual tranches, with KLM receiving a total of $1.2bn as well as substantial book profits. In January 1998 this timetable was replaced by a new agreement, whereby the sale of the last three tranches was accelerated and completed by May 1 this year (although the full effect will be included in the 1997/98 results, released later in May).

In total, in the 1997/98 financial year the sale will give KLM a book profit of $810m, cash reserves will be boosted by $758m and KLM will also own $340m of Northwest senior unsecured notes (redeemable in September 1998 and 1999 — see table, page 11). Although the accelerated deal ($1.1bn in cash and securities) is not quite as generous as the September 1997 agreement, the earlier settlement substantially reduces KLM’s risk and gives the airline a big cash pile much earlier than would have been the case.

Focus 2000

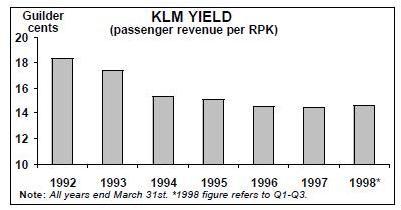

In 1991 KLM started a cost–cutting programme that in five years raised productivity by 60%. But according to the airline, the "limits of such an approach" were reached in 1996, and there was a realisation that KLM’s break–even load factor (around 70%) was still too high. Although KLM has certain structural advantages — a well–developed long–haul network and a modern fleet, for example (see table, left) — cost pressure is rising. Yields too, are eroding — see graph, page 10.

Therefore a new programme, called Focus 2000, was launched in November 1996. Its target is to improve operating results by $769m (DFl 1.5bn) over 3 years, $513m through increased income and $256m through cost savings.

"Quick wins" have already been achieved, including a wave system at Schiphol, the closure of unprofitable routes (e.g. to Marseilles, Lusaka and Calgary) and an enhanced revenue management system. KLM is also adopting a more focussed approach to growth, with the emphasis on depth of network rather than spread. Frequencies to popular destinations have therefore been increased.

The results of cost–cutting and revenue enhancement so far are encouraging — in the first half of 1997/98 Focus 2000 improved operating income by $77m, KLM claims, and at least double that is forecast for the full year.

But according to KLM, Focus 2000 is about more than just cost–cutting, and the programme also has non–financial targets. In particular, KLM talks about introducing a "different way of working", with the airline becoming a simpler, more flexible company. For example, within certain parameters managers are being given responsibility for individual projects that contribute to set targets.

On a larger scale, KLM claims it will introduce its version of process re–engineering — but this is a notoriously difficult practice to adopt in large companies without a systematic rethink about a firm’s entire operations. Whether KLM can achieve widespread process re–engineering remains to be seen, and careful explanation of what senior management is trying to achieve will need to be made to staff and unions if the airline is to achieve radical change.

The European challenge

With a small catchment area for O&D traffic, KLM has to concentrate on transfer traffic — and transfer traffic is much more vulnerable to competition than O&D traffic. This competition comes from rival hubs like Heathrow, Frankfurt and Paris. Because of the generally strong market conditions in recent years, more transatlantic city pairs have become viable non–stop operations, and every time one of the European airlines introduces a new direct service it potentially competes with KLM.

In addition, much of KLM’s Europe/North America traffic goes through a double hubbing system, with passengers changing aircraft at Schiphol and Detroit or Minnesota. While double hubbing opens up a myriad of destinations to European passengers, these routes are very vulnerable to competition from single hub routes.

KLM claims that its double hub routes will compete with single hub flights through price and service, but the price differential will have to be substantial to persuade passengers to change aircraft in the US and Europe when the alternative is just one changeover.

KLM is trying to defend its double hub position through improving the quality of connections at Schiphol (higher frequencies, quicker transfers etc) — in particular by changing from a daily three–peak system at the airport to a multiple peak, or wave system, which double transfer options.

However, this will only temporarily shore up KLM’s transfer business as competing hubs will gradually be built up elsewhere in Europe, in addition to traditional rivals. The recent US–France aviation deal, for example, is sure to cream off French passengers who currently take the short–hop to Schiphol; as more US destinations are opened up direct to France, passengers will switch away from Schiphol to routes where they change just once or even fly direct.

A European partner?

As part of a strategy to defend its position in Europe, last year KLM decided to find a major partner. Alitalia was the choice. Although Alitalia had been under political pressure to ally with Air France, KLM managed to beat off the French challenge (and a possible Alitalia–Swissair alliance) by signing a strategic passenger and cargo MoU with Alitalia in December 1997.

Details are sketchy at present, but the basic idea is that KLM and Alitalia will develop a multi–hub system, linking Milan Malpensa, Rome Fiumicino and Schiphol. Equity links appear out of the question at the moment, following KLM’s Northwest experience.

Theoretically, the benefits to KLM will be twofold. Firstly, by co–operating with KLM’s partners — Northwest and its new ally, Continental, across the Atlantic — Alitalia should start to attract a greater share of Italian long–haul passengers (at present Alitalia captures just 20% of intercontinental Italian passengers). And, presumably, KLM will gain a slice of this increased revenue at Alitalia and its North American partners. Secondly, there is scope for re–routing some long–haul flights out of Europe via the multi–hub system (Italy to Netherlands to the US east coast, for example, or Netherlands to the Middle East via Milan).

Clearly the two airlines have plenty of work to do in turning the MoU into a workable agreement (the alliance is scheduled to begin in November, once Malpensa opens). The rushed MoU also raises the question of whether Alitalia is the best possible strategic partner in Europe for KLM — or whether it is just the best partner available among the few European airlines not already linked up elsewhere.

However, the full potential of the KLM/Alitalia deal will not be realisable until a US–Italy open skies agreement is signed and some form of antitrust immunity is extended to Northwest and/or Continental.

Low-cost challenge

Even if the Alitalia deal does prove to materially strengthen KLM’s European position, the airline also faces the prospect of increasing competition — particularly from low cost carriers — at what has been, until now, a relatively uncontested home base at Schiphol.

This is part of the reason why KLM launched regional brands in January 1998. Air UK (which is building up its Stansted network) was renamed KLM uk, Air Exel became KLM exel, and they were joined by KLM cityhopper. The regional branding and KLM livery gives greater association with the KLM core brand, and clearer position within the Northwest alliance. The concept also fits neatly into KLM’s three tiers of partners: global (Northwest), network (the regional brands and other equity airlines such as Kenya Airways) and individual route partners KLM also has considerable charter interests and, importantly, 15% of revenue comes from cargo. The airline combines cargo and passengers within the same aircraft, but cargo performed badly in 1996/97. Cargo capacity has now been reduced, and KLM intends to focus on more profitable routes.

Elsewhere, KLM claims that it will not be affected too much by the Asian slump, since it completed a rationalisation of its Asia/Pacific route network in 1997. Hence load factor has actually risen in this market in the first three quarters of 1997/98 (see table, above). Planned capacity increases to Indonesia and Hong Kong have been delayed, so that in 1998/99 capacity will rise by just 2% on its Asia/Pacific routes. KLM is helped by the fact that 80% of flights to the region are on 747–400 Combis, allowing cargo to be increased when passenger demand is weak.

KLM is looking for further partners in Asia. In January 1998 an MoU was signed with Malaysia Airlines. A more detailed agreement is due soon, but essentially the deal focuses on linking route networks and code–sharing, perhaps even on beyond destinations.

A cash bonanza

The cash that KLM has raised from its Northwest shares is a significant sum, equal to KLM’s entire cumulative operating profit in the 1990s. Just how that cash is used will be an important indicator of KLM’s strategic intentions.

The airline insists that it will not be rushed into making any decisions, but it has indicated that a buy–back of the Dutch government’s remaining stake in KLM is a possible option. In December 1996 the Dutch government reduced its stake from 38.2% to 25%, but it is tempting for KLM to buy out this remaining portion as not only would KLM join the ranks of BA and Lufthansa as an all–privatised airline, but the price of the outstanding shares would rise.

As the Dutch state’s role in guiding KLM is now minimal, the purchase of this stake would mostly bring about a psychological boost to the airline. That boost should not be underestimated, particularly to the ranks of middle management at KLM — some of whom still act as though KLM is a state–owned carrier.

But surely, it could be argued, there are better options available to Leo van Wijk and the rest of KLM’s management? The purchase of the Dutch government’s stake can be seen as a traditional share buy–back, returning cash to shareholders (via a rise in the share price of the remaining stock). It can be argued that share buy–backs are essentially options for managements with little strategic choice. In effect, KLM would be saying it could find no worthwhile investment for the cash pile elsewhere.

Yet, that may well be the right decision to make. KLM could purchase a stake in a European airline, although the experience of Northwest will stay long in the airline’s corporate memory. KLM could also revamp its European fleet. But, as Guy Kekwick of Goldman Sachs points out, returns on airline investments in Europe are never as profitable as returns on investments elsewhere.

So although investing the $1.1bn Northwest windfall on KLM’s European operations looks tempting, in reality there may not be a profitable enough opportunity available. Defending KLM’s vulnerable European transfer traffic via alliances may seem an essentially passive strategy — but it may be the correct one.

| Current Fleet | Order (Options) | Delivery/retirement schedule/comments | |

|---|---|---|---|

| 737-300 | 17 | 0 | |

| 737-400 | 19 | 0 | |

| 737-800 | 0 | 8 | Delivery in 1999/2000 |

| 747-300 | 3 | 0 | |

| 747-300 Combi | 10 | 0 | |

| 747-400 | 8 | 0 | |

| 747-400 Combi | 11 | 0 | |

| 767-300ER | 10 | 0 | |

| MD-11 | 9 | 0 | |

| ATR 72-22 | 5 | 0 | Operated by KLM uk |

| Saab 340B | 6 | 0 | Operated by KLM cityhopper |

| Fokker 50 | 19 | 0 | 10 operated by KLM cityhopper, 9 by KLM uk |

| Fokker 70 | 10 | 0 | Operated by KLM cityhopper |

| Fokker 100 | 20 | 2 | 15 operated by Air UK. Two deliveries to KLM UK in late 1998 |

| BAe 146-300 | 10 | 0 | Operated by KLM uk |

| TOTAL | 157 | 10 (0) |

| Original agreement | |||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

|

|||||||||||||||||||||

| Accelerated agreement | |||||||||||||||||||||

|

|||||||||||||||||||||

| Capacity (ATK m) |

Change | Traffic (RTK m) |

Change | Load factor |

Change | |

|---|---|---|---|---|---|---|

| North America | 2864 | 9% | 2,332 | 11% | 81.4 | +1.8 |

| Asia/Pacific | 2,599 | 3% | 2,122 | 6% | 81.6 | +2.4 |

| Latin America | 1,457 | 14% | 1,108 | 20% | 76.0 | +4.1 |

| Europe | 952 | 12% | 635 | 19% | 66.7 | +4.0 |

| Africa | 712 | 1% | 548 | 10% | 77.0 | +5.8 |

| Middle East/S. Asia | 699 | -20% | 555 | -16% | 79.4 | +3.4 |

| TOTAL | 7,300 | 9% | 9,283 | 5% | 78.6 | +2.8 |