THY: A test of its

resilience

March 2017

THY’s decade of rapid expansion and consistent profitability came to a juddering halt in 2016. Short term prospects are at best mixed, but the Turkish flag-carrier’s narrowbody-orientated global hub model still appears resilient in the longer term.

Until early last year Turkey was seen as an oasis of stability in the Middle East, with the prospect of an agreement between the EU and Turkey to extend visa-free travel, for up to one year, for all Turkish citizens to, from and within the Schengen area. There was ongoing speculation about EU membership. Then in July there was an ineffectual attempt at a coup to depose President Erdoğan, followed by a clamp-down, arrest and sacking of those implicated, however tentatively, in the coup, increased involvement in Syria and terrorist attacks. Relations with European countries, notably the Netherlands and Germany, have been strained, and President Erdoğan has appeared unnecessarily belligerent towards the country’s major trading partner. Meanwhile, European officials have called for reforms to civil rights in Turkey to reverse what is seen as a move towards authoritarianism, pushing Turkey further away from the Western world. On April 16, there will be a referendum which could consolidate President Erdoğan’s position for a decade and extend his administrative powers. The outcome is finely balanced.

Buffeted by political, social and economic turmoil, THY’s total revenue in 2016 fell by 7% to $9.79bn; this time last year, management were forecasting a 12% increase in turnover. The operating result was a loss of $291m compared to a profit of $895m in 2015. PBT income was a loss of $59m against a profit of $1.41bn in 2015. In summary, 2016’s operating margin was -3.0% against an average profit margin of 6.3% for the period 2011-15; the net loss margin of 0.6% contrast with an average profit margin of 7.8% for 2011-15.

The CEO since 2005, and architect of THY’s transformation into a global carrier, Temel Kotil, quit last October, moving to Turkish Aerospace Industries, a $1bn turnover state-owned corporation, while the former head of the civil aviation authority, Bilal Ekşi, has taken over at THY. The challenge for Ekşi is to continue Kotil’s commercial dynamism in a changed political climate.

The full privatisation of THY has been removed from the government’s agenda. In February the 49% of THY’s stock owned by the state was transferred into a sovereign wealth fund, along with state-owned assets in Türk Telekom, Halkbank and other companies. The idea is to leverage this equity to provide funds — $200bn has been indicated — for the government’s ambitious infrastructure projects. Critics of the fund have described it as an example of the “Erdoğanization” of the economy, raising concerns that capital will be directed more by political rather than economic aims.

There has been no perceptible impact, either way, from the transfer on THY’s share price, which has declined by a third over the past year. The airline is currently valued by the equity market at $2.1bn, slightly more than the Air France Group but less than a third of Lufthansa Group’s $6.3bn. The Lufthansa comparison has been psychologically important for THY — its stated aim had been to overtake Lufthansa as Europe’s premier hub airline by 2020 (but on what measurement?). Recently THY and the Turkish CAA have tended to focus on the contrast between London Heathrow’s third runway saga and the scale, and civil engineering efficiency, of the new İstanbul airport.

Turkish tourism collapsed in 2016; visitor arrivals fell by 30% to 25.3m from 36.2m in 2015. Germany remained by some margin the largest origin country but volumes dropped to 3.9m from 5.6m. Russia, the biggest growth market in the 2000s, imposed a travel ban with the result that tourist arrivals evaporated to under 0.9m from 3.6m the previous year.

Yet the Turkish economy has performed reasonably well. Real GDP growth in 2016 is estimated at just under 3% compared to 4% in 2015. The OECD in November commented that “uncertainties are high but fiscal and monetary policies are supportive”, but GDP growth is forecast to improve to 3.3% in 2017 and 3.8% in 2018.

In fact, THY managed an overall 3% increase in traffic in 2016 — 62.8m passengers against 61.2m in 2015. The tourism collapse did have a direct impact but only on the two smallest segments of THY’s network — international direct traffic and international/domestic connecting traffic — while domestic traffic was solid and, importantly, THY’s global hub operation continued to expand — international to international connecting traffic was up a remarkable 14%. In short, the political situation does not seem to have had had a profound impact on THY’s role as a super-connector.

However, THY’s traffic growth last year was significantly outpaced by capacity growth, 10.7% in ASKs against 6.3% RPKs. Overall load factor fell to 74.6% from 77.6%. The domestic load factor was reasonable, 82.1%. down from 83.3%, but international loads slumped to 73.5% from 76.8% (continuing a decline from 79.3% in 2014). So, despite parking 21 aircraft in the second half of last year, THY international network is operating at roughly ten percentage points below optimal levels, and management is planning for only a two point improvement this year.

Unit revenues suffered: RASK slumped by 15.8% (14.3% if the effect of the depreciating Lira is excluded). The severest falls were in the regions where THY comes into close competition with the super-connectors: Middle East -24%, Americas, -19% and Asia/Far East, -16%

Unit costs did fall too — CASK was down by 3.8% but only because fuel costs were down 19%. Disturbingly, if fuel and currency effects are factored out, CASK would have risen by 3.1%. THY has put in place a $500m across-the-board cost reduction programme. Also, management has recently reached an agreement with the Turkish Civil Aviation Union for a pay freeze in 2017 in return for a guarantee of no redundancies (Turkish price inflation rate is running at about 8%).

THY has an cost advantage in labour costs against its European network carrier rivals, but perhaps not as much an vantage as might be expected — according to its own calculations, personnel costs per ASK were US cents 1.1 in 2016 against 1.3 at Lufthansa. The concern for THY is that exponential network growth, where adding a destination would add a multiple of connecting city-pairs and hence traffic — THY calls it diagonal growth — is slowing down.

THY vs Emirates

As well as its local problems, THY is being impacted by overcapacity in the super-connector sector; Emirates, Qatar and Etihad have all seen supply outstrip faltering demand, and their financial performance has deteriorated (Aviation Strategy, December 2016). A rumour about a rationalising merger between Emirates and Etihad has been stoutly denied.

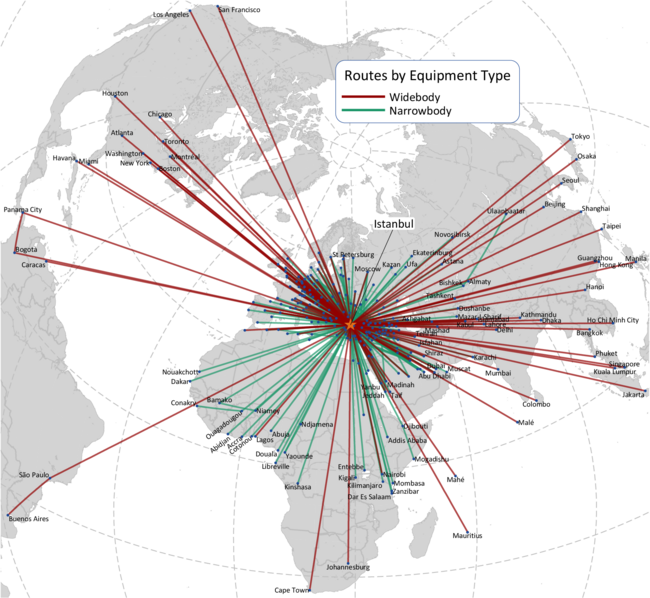

Whereas Qatar and Etihad are basically smaller scale copies of the Emirates model, THY’s hub system is distinct, based on narrowbody aircraft, and with a broader geographical scope — THY has 117 country markets against 77 for Emirates.

A comparison of Emirates’ and THY’s route networks, summarised in the table, condenses some of the key differences between the two models.

Although Emirates’ international seat capacity is more than double that of THY, THY has an important domestic market, accounting for 43% of its total traffic. And whereas Emirates relies on connecting traffic for about 85% of it total passenger throughput, THY’s international connecting traffic is only 33% of its total.

Turkey is, after the US, the most important aviation market for the EU, with about 40m passengers a year. Whereas Emirates concentrates on European global hubs and main cities using widebodies, THY coverage extends over large, medium and small cites (for example, Friedrichshafen and Leipzig in the core German market).

THY’s strategy is to consolidate numerous thin traffic flows from Europe, where it offers roughly the same seat capacity as Emirates but more than twice the frequencies, through Istanbul to numerous Asian and African destinations, bypassing both European and Middle Eastern hubs. This appears to be a robust niche but the risk is intensified by competition from LCCs.

Last year an EU-Turkey open skies agreement seemed to on the cards but political developments have stymied that development, leaving in place the current system of horizontal EU bilaterals, which permit EU carriers to fly to/from any EU state to Turkey, but which excludes EU carriers, ie LCCs like Ryanair, from the Turkish domestic market.

THY dominates the Central Asian market operating in effect as flag carrier for many of the “Stans”, while Emirates focuses solely on Moscow and St Petersburg, where THY offers roughly the same overall capacity but at much higher frequency.

Sub-Saharan Africa illustrates an important aspect of THY’s approach — offering service to a wide number of cities that have very expensive or non-existent direct flights from Europe and elsewhere. Whereas THY goes into countries like Chad, Niger and Angola. Emirates concentrates most of its widebody capacity on South African points.

Looking east, THY appears to be at a disadvantage relative to Emirates’ network. In the Indian, Chinese, Southeast and Northeast Asian markets, THY is not only eclipsed by Emirates in terms of capacity and frequency, but also it generally serves the same airports, and its lower average aircraft capacity must place it at a cost disadvantage to Emirates.

Finally, there is the North American market where THY, despite being a super-connector, has not been targeted by the US Big 3’s “open and fair skies“ campaign. But it has now been caught up in the US’s, followed by the UK’s, laptop ban (incidentally, no US carrier flies to Istanbul). The Turkish Minister for Transport has complained to the US authorities about the ban, pointing out the high standard of security at Istanbul; THY to its credit has come up with a good solution whereby laptops are handed in on boarding and securely protected during the flight.

Short and longer term outlook

Emirates and the other Middle East super-connectors have all reined in the fleet expansion, but THY has gone one step further — it is planning for zero seat capacity growth this year and next, a contrast from the 15% growth rates of recent years. It will probably dispose of some of the 16 remaining parked aircraft, especially the A340s. Deliveries of about 40 737MAXs and A321neos have been shifted from 2018-2020 to 2021-2023.

The fleet plan (see table) is based solely on narrowbody growth with the widebody fleet likely to decline in size. Putative orders for 787s and/or A350s appear to have been put on hold, and there is no chance of THY opting for A380s, new or used.

Management is “cautiously optimistic” (always a dubious phrase) about 2017, noting that forward bookings for April are well up in the previous year. If passenger volumes do perk up, then THY should be in a relatively good position, as, with no capacity growth, the effect will feed through directly into load factors, and, hopefully, unit revenues. The airline has addressed controllable costs, personnel and sales/marketing/distribution (and it is apparently looking at changing depreciation, which will have no fundamental benefit) but it is exposed to fuel. It has hedged about 47% of its 2017 requirements at around $53/barrel of Brent Crude (currently $52/barrel).

Aircraft capex, PDP net payments and debt service will increase from $1.6bn in 2016 to around $2bn in each of 2017 and 2018, which, according to THY’s own projections will double free cash outflow from $290m in 2016 to $587m and $697m in 2017 and 2018.

There is also $1.2-1,5bn in costs associated with moving operation from Ataturk to İstanbul New Airport (INA), which is tentatively scheduled for 2018.

The aim is for INA to overtake Heathrow as Europe’s largest global hub by the late 2020s, even if Heathrow complete the third runway by then. Initially, INA will have capacity for 2,000 daily flights and 90m passengers; this will rise, when the third phase is completed INA will have six runways and a capacity of 200mppa.

The long term vision of shifting Europe’s centre of aviation gravity to İstanbul is clear, but recent events have revealed just how vulnerable Turkey (and many others countries, including those in Western Europe) are to political unpredictability.

| US$ millions | 2016 | 2015 |

|---|---|---|

| Fleet and Property | 13,456 | 11,415 |

| Investments and Intangibles | 1,434 | 1,822 |

| Fixed Assets | 14,890 | 13,237 |

| Cash etc | 1,815 | 962 |

| Other Currents Assets | 1,786 | 2,184 |

| Current Assets | 3,601 | 3,146 |

| TOTAL ASSETS | 18,491 | 16,383 |

| Short Term Debt | 2,421 | 1,013 |

| Other Short Term Liabilities | 2,076 | 2,858 |

| Current Liabilities | 4,497 | 3,871 |

| Long Term Debt | 8,907 | 7,670 |

| TOTAL LIABILITIES | 13,404 | 11,541 |

| Retained Profit | 3,551 | 3,628 |

| Other items | -61 | -383 |

| Share Capital | 1,597 | 1,597 |

| EQUITY | 5,087 | 4,842 |

| TOTAL EQUITY & LIABILITIES | 18,491 | 16,383 |

| Debt as % of Assets | 72.5% | 70.4% |

| 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | ||

| Widebodies | A330-200 | 20 | 18 | 18 | 16 | 13 | 13 | 8 | 5 |

| A330-300 | 31 | 37 | 37 | 37 | 37 | 37 | 37 | 29 | |

| A340 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | 4 | |

| 777-300ER | 32 | 33 | 33 | 32 | 30 | 30 | 30 | 30 | |

| Total | 87 | 92 | 92 | 89 | 84 | 84 | 79 | 68 | |

| Narrowbodies | 737-900ER | 15 | 15 | 15 | 15 | 15 | 15 | 15 | 15 |

| 737MAX-9 | 5 | 10 | 10 | 10 | 10 | ||||

| 737-800 | 110 | 108 | 97 | 96 | 88 | 86 | 82 | 78 | |

| 737-700 | 1 | 1 | 1 | 1 | |||||

| 737MAX-8 | 7 | 19 | 38 | 53 | 65 | 65 | |||

| A321 neo | 3 | 21 | 39 | 59 | 77 | 92 | |||

| A319 | 13 | 7 | 7 | 6 | 6 | 6 | 6 | 6 | |

| A320 | 29 | 22 | 19 | 12 | 12 | 12 | 12 | 12 | |

| A321 | 66 | 68 | 68 | 68 | 66 | 64 | 64 | 64 | |

| Total | 234 | 221 | 217 | 243 | 274 | 305 | 331 | 342 | |

| Cargo | A330F | 8 | 9 | 9 | 9 | 9 | 9 | 9 | 9 |

| 777F | 2 | 2 | 2 | 2 | 2 | 2 | 2 | ||

| Wet Lease | 5 | ||||||||

| Total | 13 | 11 | 11 | 11 | 11 | 11 | 11 | 11 | |

| TOTAL | 334 | 324 | 320 | 343 | 369 | 400 | 421 | 421 | |

| Seat Capacity % change | 0% | -1% | 5% | 5% | 7% | 4% | 2% | ||

| Cities served | Annual Seats (000s) | Round trips | Average Aircraft Capacity | |||||

| Emirates | THY | Emirates | THY | Emirates | THY | Emirates | THY | |

| Western Europe | 31 | 66 | 20,726 | 20,006 | 23,683 | 56,640 | 447 | 178 |

| Southeast and Northeast Asia | 15 | 11 | 11,585 | 2,270 | 13,379 | 3,592 | 433 | 316 |

| Indian Subcontinent | 17 | 6 | 12,211 | 1,291 | 15,734 | 2,190 | 388 | 295 |

| China (inc Hong Kong) | 5 | 4 | 3,124 | 978 | 3,485 | 1,402 | 448 | 349 |

| Sub-Saharan Africa | 13 | 18 | 6,070 | 1,930 | 7,599 | 5,236 | 399 | 184 |

| North America | 13 | 11 | 5,592 | 2,626 | 6,595 | 4,015 | 424 | 327 |

| Russia and Central Asia | 2 | 28 | 4,136 | 2,604 | 1,085 | 12,200 | 430 | 169 |

Note: Azimuthal equidistant map projection based on Istanbul. Great circle routes appear as straight lines.