Wizz Air: Patience rewarding ULCC investors

March 2015

Finally, investors behind Europe's fifth largest LCC and second largest ultra low cost carrier (ULCC) have been able to extract some value from their patient perseverance. Wizz Air Holdings plc surreptitiously floated on the London Stock Exchange in February through an IPO, allowing serial airline investor Indigo to sell down some of its substantial holding and realise returns from its decade long investment.

The company sold 23.4m shares (13.8m from existing shareholders) at £11.50 representing 45% of the enlarged issued equity capital and valuing the group at £600m. After the issue largest shareholder Indigo Partners retains a near 20% stake. However, it also holds €26m in convertible debt and 48m non-voting,non-participating convertible shares which on full conversion would represent an additional 58% of the total equity and provide a fully-diluted market capitalisation of £1.5bn. The issue appears to have been reasonably successful — the shares are currently quoted at £13.90, 20% above the issue price.

Wizz Air started operations in 2004. Established in late 2003 by József Váradi, former CEO of the former Hungarian flag carrier Malév it has pursued the strategy of developing a route network connecting the “poorer” Central and Eastern European (CEE) nations with the “richer” mainstream EU markets. Starting from a base in Budapest and tagging on the coat-tails of the 2004 and 2007 EU expansion which saw the accession of ten former Eastern European nations to the trading bloc, it has pursued the ultra-low-cost-carrier model, targeting demand from CEE markets deemed too weak for the likes of Ryanair and easyJet (who up to now have had more lucrative targets to pursue). It was given a significant boost from the demise of the Hungarian flag-carrier Malév in 2012.

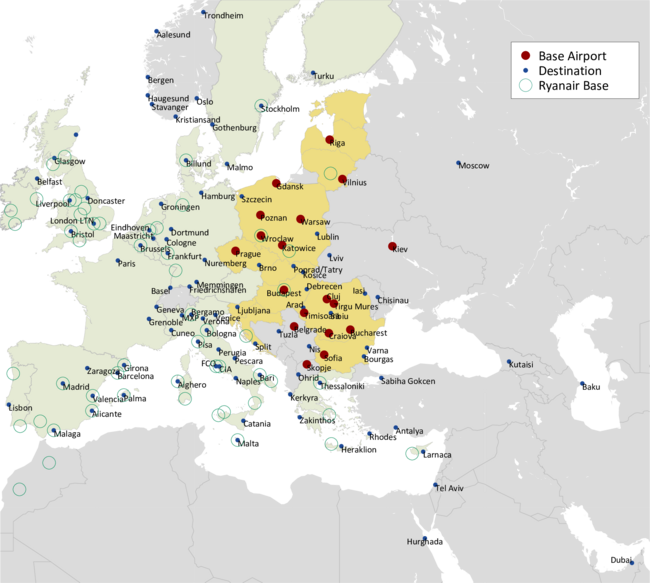

Operating in a niche area it has been able to build a network of 18 bases in ten CEE countries, mainly to secondary and tertiary airports in Western Europe, and operates to 91 destinations in 33 countries on 300 routes with a fleet of 54 A320s (and 57 further on order). With a prime AOC in Hungary, it also has an operation in the Ukraine with its own AOC through Wizz Air Ukraine (and formerly ran a subsidiary in Bulgaria before that country's accession into the EU). In the past eight years it has grown at a compound annual rate of nearly 20%. For the calendar year 2014 it achieved booked traffic of 15.8m passengers making it the fifth largest LCC in Europe.

Revenues have grown to just over €1bn for the year to March 2014. Profits were elusive until three years ago. However, in the financial year ended March 2014 it achieved operating profits of €103m and net profits of €88m. Its EBITDAR margin of 24% for the period is admirable while its operating profit of €6.37 per seat is only slightly below competitor Ryanair's for the same period. For the six months to end September 2014 it achieved a 23% year on year growth in revenues to €727m, operating profits of €166m (up by 40%) and net profits of €158m (compared with €109m in the prior year period).

The strategy is firmly based on ULCC principles: point-to-point services radiating from bases to secondary (ie cheap) airports; single fleet type; a truly terrible aircraft paint scheme; high aircraft utilisation (12.7 hours a day in the twelve months to Sept 2014); high load factors (86.3% for the same period); no GDS; full unbundling of fare structures to present the lowest possible fare on the market-place shelf, while encouraging passengers to “trade up” by buying ancillary services. In the year to end March 2014 the group achieved an average fare of just over €47 per booked passenger but average ancillary sales of €25 representing 33% of total revenue — the highest rate published by any of the European LCCs. One of the more intriguing service fees they offer is an “on-time performance guarantee” for €10. It should perhaps be noted that they have unbundled the fares so much that ancillary fees include inescapable booking fees and check-in fees of €18 per pax.

It has a uniform single type fleet — firmly based on the A320 family. The group currently has 54 A320s in operation with a full economy high density 180 seat configuration. It has plans to double the size of the fleet to 106 units by end of 2018: 27 of the new aircraft to be delivered over the period are expected to be the higher density A321. This is likely to provide a continued 15-20% annual growth in capacity for the foreseeable future.

The strategy is also firmly based on the core principle of transporting passengers between CEE countries and Western Europe. The newly acceded CEE countries to the EU have substantially lower per capita income than the more mature Western European nations, but their economies are growing at a significantly faster pace and as the per capita income grows Wizz sees the propensity to travel by nationals of these countries to expand.

At the same time the company has recently started to increase the number of routes from CEE eastwards to countries outside the EU in Eastern Europe, the Caucasus and the Middle East as part of its “Go East” initiative with routes launched to Georgia, Israel and Macedonia in 2012, Azerbaijan, Bosnia and Herzegovina, Moldova, Russia, Turkey and the UAE in 2013 and Egypt in 2015.

LCCs are not known for adhering to established norms. Wizz Air seems to have taken this one stage further. The holding company is incorporated in Jersey (in the UK but outside the EU), the corporate head office is based in Geneva (outside the EU but in the EEA — but we understand they got a good tax deal), the main AOC is in Hungary (outside the Euro-zone but in the EU) while the majority of traffic is generated in Poland (29%) and Romania (24%); Hungary accounts for 17% of passengers. It reports its results in Euros and is quoted on the (Sterling oriented) London Stock Exchange. All weird and presumably wonderful .

Wizz remarkably operates with a unit cost not too dissimilar from that of Ryanair — the paragon ULCC in Europe — of €¢3.68/ASK, some 3% higher than that of the Irish carrier (although it does have a slightly higher average stage length) and 25% lower than other LCCs. On a per seat basis, however, for the year ended March 2014, its operating costs of €56 per seat were some 25% higher than Ryanair's — the greatest difference being in aircraft ownership costs where Wizz has little real hope of achieving Ryanair's economies of scale — (see table below). However, not surprisingly, its staff costs are some 10% below that of Ryanair's on a per seat basis.

Ryanair is also its main real competitor. The two carriers compete head-to-head on eight routes and indirectly on a further 59 routes accounting for 30% of Wizz Air's seat capacity (but 5% of Ryanair's) although they only share two aircraft bases: Wrocław and Budapest. However, 38% of Wizz's capacity is operated in 160 market pairs where there is no scheduled competition and a further 20% in 60 market pairs with no low cost competition. For most of the CEE markets in which it operates it has the advantage of having weak (or non-existent) local flag carrier competition.

Unlike Ryanair, there is no need nor desire to turn cuddly. In the current stage of the cycle and while Ryanair's attention is focussed on lucrative Western markets, Wizz looks set to be able to provide strong returns. There will however come a point when Indigo Partners look to sell (they as non-Europeans are not officially allowed to own more than 49% of a European airline). Although at an investor day a few years ago Michael O'Leary stated that he would not even pay €2 for the whole of Wizz Air, there may come a day when he changes his mind.

| Aircraft | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 |

| A320 | 45 | 54 | 63 | 63 | 63 | 79 |

| A321 | 2 | 11 | 23 | 27 | ||

| Total | 45 | 54 | 65 | 74 | 86 | 106 |

| €/seat | Wizz Air | Ryanair |

| Ticket revenue | 40.53 | 38.51 |

| Ancillary revenue | 21.73 | 12.68 |

| Total Revenue | 62.26 | 51.19 |

| Staff costs | 4.20 | 4.71 |

| Fuel costs | 22.19 | 20.46 |

| Dist & marketing | 0.67 | 1.96 |

| Maintenance | 2.98 | 1.18 |

| Rentals | 6.92 | 1.03 |

| Handling | 15.40 | 11.58 |

| Depreciation | 1.56 | 3.58 |

| Operating cost | 55.89 | 44.49 |

| Op Profit | 6.37 | 6.69 |

Note: Year end March

Note: Financial year ending March