flydubai: Aiming to be an LCC giant.

March 2014

Already the largest LCC in the Middle East, flydubai signalled its long-term ambitions by placing a firm order for 86 737s earlier this year. How much further can the Dubai-based carrier grow — and will it remain an LCC?

Based at Terminal 2 of Dubai International airport, flydubai was launched by the Dubai emirate in July 2008 and made its maiden flight in June the following year. Though not part of the Emirates Group, flydubai and Emirates have common owners and the latter gave considerable assistance during the launch phase of the LCC.

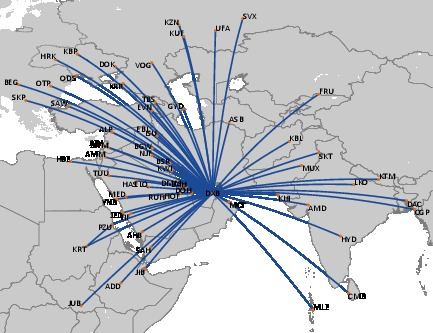

An order for 50 737-800s (with flexibility to change future models to the 737-900ER) was placed at the Farnborough air show in 2008, with the first aircraft arriving in May of 2009. Based on that initial order, today the airline operates to 68 destinations across the Middle East, Europe, Africa and Asia. These comprise 25 destinations in the Middle East, 20 in eastern Europe and the Caucasus region, 17 in Asia (of which 11 are in the Indian sub-continent) and six in Africa.

In late 2010 flydubai signed a sale and leaseback deal with Avolon for four more 737-800s, and today the fleet stands at 35 737-800s with an average age of 2.6 years. Deliveries from that initial order of 50 aircraft will be completed later this year, and so in November 2013 — at the Dubai air show — flydubai committed to an order for 75 737 MAX 8s and 11 737-800s, valued at some US$8.8bn at list prices and the largest ever narrowbody Boeing order in the Middle East.

flydubai apparently considered replacing its 737 fleet with A320neos, but this is unlikely to have been anything other than a negotiating tactic by the airline, and the Boeing order was confirmed in January 2014. The first of the 737-800s will arrive in 2016 or 2017, with the MAX8s arriving from second half of 2017 and the last aircraft arriving towards the end of 2023.

Currently the MAX development is on schedule according to Boeing, with the first flight scheduled for 2016 and deliveries to customers beginning the year after. flydubai also has purchase rights for an additional 25 737 MAXs. The actual price paid for the 86 aircraft is believed to be in the region of US$6.2bn, some 30% less than list prices, according to one source.

Altogether flydubai has 26 737-800s and 75 737 MAX 8s on order, but the airline believes it will have no problem in finding routes to place them on within its strategy of focussing on destinations within a five and a half hours flying radius from Dubai — a radius within which 2.5bn people live. flydubai believes there are a multiple of underserved point-to-point routes out of Dubai, and indeed more than 70% of its existing destinations never previously had a direct link to Dubai via a UAE national carrier (i.e. Emirates). Ghaith Al Ghaith, flydubai’s CEO, says: “There are not enough flights in the region compared to places likes Europe, but there is demand. People of these cities have barely flown to the Middle East, or anywhere outside these countries, for that matter.”

The immediate target is to increase destinations served to 100, and during 2013 flydubai launched 17 routes, including Dubai to Malé (Maldives), Ha’il and Medina (Saudi Arabia), Odessa, Juba (South Sudan), Sialkot and Multan (Pakistan), and Volgograd and Krasnodar in Russia. During the year flydubai doubled its network in Russia to eight destinations, and it also operates to four cities in Ukraine.

Already this year flydubai has launched routes between Dubai and Al-Ahsa airport in Hofuf, Saudi Arabia (its eleventh destination in a country that opened up is aviation market in 2012). Looking forward, India is a key expansion target for flydubai, and late last year the LCC held talks with Indian aviation officials over an expansion of services, although the current bilateral is restrictive and flydubai (and other airlines) are waiting for a new bilateral to be signed between India and the UAE so that routes can be expanded into secondary destinations in India.

In fact within its target five and a half hour flying radius there are many countries with which flydubai is restricted by current bilaterals with the UAE, such as Pakistan, Iran and India. The UAE of course is pressing those countries to sign new bilaterals, and the state is also helping flydubai (and other UAE airlines) by gradually easing visa restrictions on visitors to the country, either by abolishing them altogether or by simplifying the process of getting a visa.

Interestingly, last summer flydubai said it was open to the idea of entering into an alliance with easyJet in order to open up routes into western Europe. flydubai operates a route to Amman in Jordan, a destination that easyJet has been serving from London Gatwick since 2011. However, flydubai’s ambitions here have been thwarted by easyJet’s recent announcement that it will be closing the three times a week route to Amman in May this year, a move that is believed to be related to increased air taxes, with a departure tax of JOD40 (US$56) per person at Amman, plus another JOD6 (US$8) in ‘terminal usage fees’.

Although Terminal 2 at Dubai International is now used exclusively by flydubai and is being refurbished and expanded, the airport is at full capacity and so flydubai is likely to move its base to the new Al Maktoum International at Dubai World Central at some point later this year. Al Maktoum International opened late last year with capacity for 7m passengers a year, but this will rise to 160m passengers a year by the mid 2020s.

Although Emirates is not planning to move operations there until 2020, flydubai will switch later this year according to the Director General of the UAE General Civil Aviation Authority, speaking in January — though flydubai has not yet officially confirmed this schedule.

With unofficial sister airline Emirates operating a widebody-only fleet, flydubai might be expected to develop a feeder role, and so operating out of a different airport for so many years would be illogical. The two facilities are 40km (25 miles) apart. However, the vast majority of flydubai’s passengers will be flying point-to-point, with many incoming passengers to Dubai visiting friends and relatives, taking a leisure trip or going as foreign workers in the UAE’s major construction projects.

flydubai carried 6.8m passengers in 2012 (38% up on 2012), making it the second largest carrier — by passengers carried — operating out of Dubai International. However 57m passengers travelled through Dubai International in 2012 (the last full year with available figures), with 39.4m on Emirates aircraft, which dwarfed the 5.1m carried by flydubai in that year. The other 12.5m were carried by more than 100 foreign airlines, though rival LCC presence at Dubai is small. They include LCC WizzAir, which operates routes into Dubai from eastern Europe, and Norwegian, which operates to Oslo, Stockholm and Copenhagen. A more local competitor is Air India Express, the quasi-LCC subsidiary of Air India, which operates 21 737-800s and has routes from Dubai International to 11 destinations in India.

flydubai competes against four other LCCs in the Middle East — Air Arabia, Jazeera Airways, Flynas and Felix Airways. Air Arabia is based in Sharjah and operates 34 A320s (with 10 on order) to approximately 90 destinations in the Middle East, Africa, the Indian subcontinent, Europe and Asia, while Kuwaiti-based Jazeera Airways operates eight A320s to 19 destinations in the Middle East. Flynas was previously known as Nas Air and is a Saudi airline based in Riyadh that operates 24 A320s and assorted Embraer types domestically and to Middle East destinations, while Felix Airways is a Yemeni carrier with four Bombardier aircraft.

LCC to hybrid?

flydubai operates a standard LCC business model, with high utilisation of a young, single type fleet (with the carrier saying it will dispose of all aircraft before they reach eight years of age) but there are signs that flydubai may be turning into a hybrid carrier. Frills have also been creeping into the economy product and passengers can now pre-book in-flight entertainment and meals on select routes online. And while the majority of bookings are made direct via its website, in 2012 flydubai signed deals with three major global distribution systems — Amadeus, Sabre and Travelport. flydubai also began cargo operations in 2012, carried in its 737-800 hold capacity as well as to another 150 destinations through cargo interline agreements.

Most significant though was the launch of a business class product in June 2013, which the airline says was motivated by the fact that few of the routes it operates on have ever had a business class option.

The product includes a dedicated check-in, a business class lounge, a business cabin with 12 42-inch pitch leather seats, and in-flight meals and entertainment. Business class had been added to 13 aircraft by the end of 2013, operating on selected routes such as Dubai to Baghdad, Kuwait, Riyadh, Istanbul, Kabul, Kiev and Bahrain. The business cabin will be standard on all new aircraft joining the fleet. In introducing a business class, overall seats on the 737-800s will decrease from 189 to 174, though clearly flydubai believes overall revenue will increase through the higher margin business class passengers.

flydubai says it moved into profit during the second half of 2011, after just three full years of operation, and it has just announced a net profit of AED 222.8m (US$ 60.7m) for 2013, 46.7% up on 2012, based on revenues of AED3.7bn (US$1bn), a third higher than the year before. Ancillary revenue for 14.6% of total revenues in 2013.

A cost breakdown has not been released, other than the fact that fuel accounted for 39.5% of all costs in 2013. flydubai currently employs 2,250 staff (including 499 pilots and 922 cabin crew) from almost 100 different nationalities, and is in the middle of a recruitment drive to attract 600 pilots by 2016. The airline has also launched its own internal “Cadet” training programme for young Emiratis to produce licensed pilots, with 100 pilots expected to come through this route over the next five years.

flydubai has been diversifying its funding sources and — after financing thee 737-800s via an Export-Import Bank loan — last November flydubai agreed a US$228m deal with five local and international banks to finance six 737-800s on order — two of which had recently been delivered and the rest of which are arriving this year. The funding is structured as a finance lease with loan repayments over a 10 to 12 year period. As at the end of 2013 a total 42 aircraft out of its initial order of 50 Boeing aircraft had been funded.

The airline is also planning a major fund raising in 2015, possibly through the issue of sukuk (Islamic bonds), and a sum in excess of US$500m is expected to be raised that will finance general operating expenses as well as to fund some of the new aircraft orders.

With more than 100 new aircraft arriving over the next few years flydubai will gradually establish itself as a major airline in the region, though whether it will still follow an LCC model by the end of the decade is debateable. In some respects the business model it follows is irrelevant — based at a new airport with massive capacity (and without legacy infrastructure and business models to hold it back) and with the deep pockets of the Dubai emirate behind it, flydubai is a carrier that will keep growing however and at whatever pace it wants to.