THY: Intercontinental narrowbody super-connector

March 2014

Turkey is one of the MINTs (Mexico, Indonesia, Nigeria and Turkey) which are being promoted as forming the second wave of dynamic emergent economies after the BRICs (Brazil, Russia, India, China). THY is a potent symbol and driver of Turkey’s resurgence, and one of the most innovative global airlines.

2013 was the tenth consecutive year of traffic growth for THY, producing a remarkable set of statistics:

- Total passengers carried increased by 24%, to 48.3 million; domestic passengers were up 26% and international 22%.

- Premium passengers increased by 23% while international-to-international transfer passengers increased by 29%

- System load factor increased by 1.4 points to 79.0%.

- Nearly 370,000 sectors were flown, up 22% on 2012, and the number of destinations served grew to 243 compared to 217 in 2012

- Cargo/Mail was strongly up as well — by 20% to 565,000 tons

In early March THY released its 2013 financials which generally were also impressive, though slightly disappointing on the bottom line. Revenue grew strongly by 19% to US$9.83bn in 2013 (THY normally reports in US dollars), but operating expenses boosted by higher fuel and lease costs rose by 21%, with the result that operating profit slipped to $577m, 7% down on 2012’s $648m; the operating margin, 5.9%, was respectable, given the large amount of capacity added in 2013. Below the operating line, THY’s accounts get a little opaque but financial charges and exchange rate losses amounted to $307m pushing pre-tax profit down to $502m, 36% down on the previous year. After taxes the result was a net profit of $357m, about half that of the previous year.

THY issued some guidance for 2014 — notably passenger volume to grow by 24% to 59.5m and revenues up 16% to $11.4bn — with the caveat that these projections were made before the recent financial problems that have hit the Turkish economy. Turkey has been the emerging market success story, with GDP rising from $230bn in 2002 to $800bn last year. However, markets have begun to question how much of this 8% pa growth in dollar terms has been due to an overvalued lira and to worry about the country’s widening balance of payment deficit. Also, the strong lira had started to undermine Turkey’s competitiveness with wage rates now comparable to those in the Baltic states, for example. In February the lira fell to record lows against the dollar and euro forcing the government to respond by pushing up base interest rates to 10%. The economic effect may be to normalise Turkey’s growth rate — to around 3% a year for the next few years, less than half the super-growth levels. THY’s mix of currencies in its P&L naturally hedges it against the impact of lira depreciation, but the economic slow-down might dent its prospects. Politically, there have been the protests in Taksim Square this year and an horrendous civil war in Syria just to the south, plus unresolved Kurdish issues (and the government attempting to ban twitter, futile but damaging to its liberal credentials).

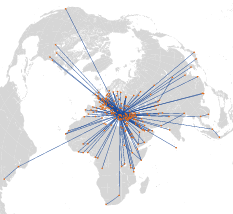

Although THY used to be a traditional state-run airline its strategy now is that of a super-connector, competing against Emirates, Qatar, and Etihad. The operating model was developed under Temel Kotil, who joined THY in 2003, just after the state sold off a 50.9% share in the airline, and became CEO in 2005. Essentially THY takes advantage of Istanbul’s geographical position in the middle of what it calls the “Europe--Asia corridor” --- more than 40% of global international traffic and over 55 capital cities are within narrowbody range from the city.

In 2013 24% of THY’s passengers were on international to international connecting flights and a further 15% were international-domestic transfers. Only 19% of passengers were international direct.

Domestic passengers accounted for 42% of the total. Unlike the Gulf carriers THY has a huge home market. Turkey’s population is about 75 million and total domestic passengers were estimated at 37m last year, and are forecast to rise to 54m by 2016, according to the DHMI (the Turkish airport authority). With 77m total international passengers, underpinned by Turkey’s position as the sixth most popular tourist destination in the world, the total Turkish market amounted to 114m; so a ratio of 1.5 air passengers per head of population which compares to 3.2 for the UK, and is perhaps an indicator of the potential business for THY.

However, the domestic market contributes only 14% of THY’s revenues. Europe is the most important market with 33% of the total, followed by Asia, 21%, Middle East, 13%, Americas, 10% and Africa, 8% (these figures refer to true O&D passenger revenues rather than point of sale revenues). This geographical split reflects Istanbul’s strategic position — partly in Europe, partly in Asia with historic links to central Asia and a new foothold in Africa.

Relations between THY and the Turkish government are close — too close according to Pegasus, its main local rival and another very successful airline, which complains about preferential treatment afforded to THY. Turkey is not in the EU common aviation area, but it has a “horizontal” bilateral agreement with the EU, which allows any European airline to operate between a EU member state and Turkey, so in effect a series of open or almost open skies agreements. Turkey has a longstanding open skies agreement with the US while its other bilaterals are a mix of the liberal and the restrictive, but THY almost always is the sole Turkish carrier operating non-EU routes. What is not clear is when Ryanair, Wizzair or easyJet will be allowed to penetrate the domestic market.

From a brand recognition perspective THY Turkish somehow does not rank alongside the international images projected by Emirates and Etihad, with the prestigious football stadiums in the UK and high profile advertising. THY is rightfully proud of its Skytrax award for Europe’s best airline in 2013 and again uses sports stars in its advertising — Lionel Messi and Kobe Bryant (the problem is the former probably won’t be widely recognised in North America, the latter isn’t instantly identifiable in Europe).

In terms of passenger numbers Business Cabin passengers accounted for only 4% of THY’s total last year, 5% if the premium economy (Comfort class) passengers are included. But in revenue terms these business passengers contributed 20%. This suggests a major upside for THY given that the super-connectors and European carriers like BA rely on premium passengers for almost half their revenue.

THY benchmarks itself against the super-connectors and contrasts its performance with that of the European and US legacies. In the 2013 results presentation THY used the slightly unusual metric of share of world scheduled traffic (as indicated by ASKs). THY’s is 1.6%, just above Qatar’s though only half of Emirates’. More importantly, the rapid upward trend over the past ten years for THY and the super-connectors is very similar, while the US majors and European network carriers’ shares have stagnated or declined.

In what it describes as diagonal growth, THY’s passenger growth — from 11.9m in 2004 to a planned 59.5m this year — is linked to an increase in destinations served — from 73 to a planned 265. Remarkably, this means that the THY hub network, in terms of cities served, is now larger than Delta’s at Atlanta; indeed on this measure it is number one globally. The network incorporates many minor cities which could not support intercontinental service without the Istanbul hub system. In 2013, for example, the new points instigated by THY were:

- Africa: Libreville, Douala, Kano, N’Djamena

- Asia: Colombo, Kuala Lumpur, Kathmandu, Mazar-i-Sharif, Lahore

- North America: Houston

- Middle East: Aqaba, Gassim

- Europe: Friedrichshafen, Salzburg, Santiago, Malta, Marseille, Constanta, Tallinn, Vilnius, Luxemburg

- Turkey: Isparta, Kastamonu, Bingol, Sirnak

Almost all these routes will be operated with narrowbodies — A319s, A320s, 737-800s, 737-900ERs — which is a unique feature of the THY intercontinental network. The contrast between THY’s orderbooks and those of the three super-connectors is illustrated below. While all four have phenomenal number of aircraft on order or option, the three Gulf carriers are focusing heavily (totally in Emirates’ case) on widebodies for their growth, THY’s plans are centred around narrowbodies, although this year a significant part of the planned growth will comes from widebodies — A330s and 777s — on the Atlantic.

THY can avoid direct competition with the super-connectors on most of its network as their equipment is too large for the THY routes, but it also means that THY is at a disadvantage in terms of economies of density. THY’s average load factor has improved from 72.7% in 2007 to 79.0% in 2013, which indicates that demand has significantly exceeded its 20% annual capacity increase. Unit revenues have declined slightly — 8.67US¢ to 8.30US¢ — while unit costs have been stable — 8.04US¢ in 2007, 7.94US¢ in 2013.

In what it describes as its peer group — Air France, Lufthansa, IAG, United Delta, American and Emirates — THY, unsurprisingly, emerges as the lowest cost operator (see chart on page 2). Air France’s unit operating costs, for example, were nearly 60% higher than THY’s in 2013; Emirates unit costs, despite the advantage of having an all-widebody fleet, were slightly above THY’s. Interestingly, THY’s labour efficiency is much superior to Emirates’ — 2,084 passengers per employee against 826.

When THY announced in 2008 that it intended to become Europe’s largest airline by 2020, surpassing Lufthansa, this was widely dismissed as a publicity stunt, or just not understood. The target passenger volume is around 100m; given that THY’s 2014 total will probably be nearly 60m its takes only 10% pa growth, much lower than in the past decade, to attain this total. Meanwhile, Lufthansa Passenger Airline has stated that it will grow at “market” rates, say 4% pa, and as a result the two traffic curves (see page 9) cross at around 2020. (THY seems to have given up on the idea of developing a THY Group like the Lufthansa Group as none of its rumoured European airline purchases came to fruition, and it has left that strategy to Etihad.)

In fact THY has revealed some quite detailed medium term expansion plans. As at the end of last year 37 new points were expected to be added to the network: 13 in Africa, 10 in Europe, 8 in the Americas, 4 in Asia and 2 in the Middle East. Almost all the European and Asian service will go to minimum daily service, from about 80% today, Africa, America and the Middle East will have daily services on about 75% of city-pairs, compared to about 60% today. Overall planned capacity increases to 2021 are: Asia, 92%; Americas, 65%; Middle East, 58%; Africa, 56%; Europe, 41%.

The phenomenal traffic growth rates have meant that Istanbul is starting to face serious capacity constraints. At Ataturk airport, THY’s main hub, annual throughput is around 52m passengers while capacity is just over 60m; at Sabiha Gökçen, where THY has recently expanded throughput is nearly 18m passengers. At projected growth rates they both will be full around 2016. There is, however, a second runway scheduled for 2016 at Sabiha Gökçen, which should double capacity there.

The, as yet unnamed, new Istanbul airport is planned to become operational in 2018, though this may drift to 2020. Costing $30bn, the BOT project was won by a Turkish civil engineering consortium; capacity is planned for 150m passengers a year, making it potentially the largest airport in the world. One of the advantages that THY holds over its European rivals is that the infrastructure planning process in Turkey is speedier than in western Europe, although environmental objections to the new airport have been raised and construction of the airport has not yet begun.

Currently, THY operates a fleet of 233 aircraft — 182 narrowbodies, 42 widebodies and 9 cargo jets — at high levels of efficiency. The narrowbodies on medium haul routes achieve 12.14 hours utilisation a day, comparable to the best of the European LCCs while the widebodies average 14.53 hours, comparable to the best of the network carriers.

THY’s fleet plans are compatible with a passenger volume of around 100m by the end of the decade. The target is a net addition of 202 aircraft by 2021, bringing the total fleet to 435 units. Almost exactly the same proportion of narrowbodies and widebodies will be retained. Firm orders and options (that THY states it will convert) add up to 265 units, including mega-orders, for both the A320/321NEO and the 737-800/900MAX, more than enough to cover the additional capacity requirement. Despite persistent rumours, the A380 does not fit into THY’s future, at least for the present.

However, this is a huge financial commitment, in the order of $18bn, for a carrier with a net profit of $357m in 2013 and financial expenses of $307m. THY will have to manage its balance sheet carefully. At the end of 2013 it had net debt (including lease obligations) of $8.0bn and $3.3bn of equity, a debt/equity ratio of 2.4/1, which could be regarded as high.

The other problem facing THY is that of finding the optimal balance between competing with and cooperating with the European network carriers. Lufthansa had sponsored THY’s membership in the Star Alliance and formed an own extensive codeshare and frequent flyer agreement with THY (Germany is by far the most important country market for THY, largely because of the gastarbeiter traffic). Then at the end of last year Lufthansa announced it would terminate the codeshare agreement with THY by the end of this March, brutally stating that it didn’t make commercial sense. This in effect ended THY’s expectation that it could be Star’s super-connector partner, in the same way as Etihad has linked with Air France in SkyTeam and Qatar has allied with IAG in oneworld.

For the European network carriers, particularly Air France and Lufthansa, Emirates and THY pose the same sort of challenge; they bypass their global hubs at Paris, Amsterdam, Frankfurt and Munich, collecting traffic from European points behind these hubs and funnelling traffic to a range of destinations beyond their own Dubai and Istanbul hubs, offering connectivity that the Europeans just cannot match. To illustrate: THY offers services from 11 German cities to Istanbul while Lufthansa concentrates all its operations on Frankfurt, Munich and Düsseldorf. Hence it loses its feed traffic not just to Turkey but to Asian and African points as well.

| In Service | Firm Orders | Options | ||

| Widebodies | A330 | 20 | 18 | |

| A340 | 7 | |||

| 777--300ER | 12 | 20 | ||

| Wet leased | 3 | |||

| Sub-total | 42 | 38 | 0 | |

| Narrowbodies | 737-8/900 | 94 | 35 | |

| 737-8/9MAX | 50 | 25 | ||

| A320/321/319 | 88 | 25 | ||

| 320/321NEO | 57 | 35 | ||

| Sub-total | 182 | 167 | 60 | |

| Cargo | A310/330F | 7 | ||

| Wet leased | 2 | |||

| Sub-total | 9 | |||

| TOTAL | 233 | 205 | 60 |