Flybe: shareholder confidence

March 2014

With a new management team, a simplified organisational structure and signs that initial restructuring and turnaround plans have started to work, Flybe has been given a significant boost of confidence by its shareholders. It has just managed to raise £150m in new equity through a market placing — a sum almost equivalent to twice its market capitalisation before the issue. The hope is that this will provide sufficient space for the UK regional carrier to survive and grow.

Flybe started operations in 1979 as Jersey European Airways based in the UK’s Channel Islands, flying on inter-island routes and to the UK mainland. It was acquired in 1983 by multi-millionaire Jack Walker and merged with his corporate air taxi service in 1985 at which time the airline re-based to Exeter. In 2000 it was renamed as British European. After a series of losses in the downturn at the beginning of the noughties it reinvented itself again as a “hybrid” regional carrier — retaining some elements of the short haul legacy business model but introducing some elements (particularly one-way fares, yield management and pricing) of the emerging low cost airline model: a full-service low fares airline. In the process it once again renamed itself as “Flybe”. At this time it was operating 31 aircraft on 38 routes to 21 destinations and carrying 2.2m passengers.

In 2007 it was handed a step change in its development with the acquisition of British Airways’ regional services BA Connect. In fact BA effectively paid £130m to Flybe and took a 15% equity stake in the airline to ensure it could get rid of its loss making UK regional services. Flybe was able to incorporate the operation quickly: in its financial year to March 2008 it achieved an EBITDAR margin of nearly 19% (see chart below) and profits of £35m on revenues of £536m (nearly 50% up on the year before). The acquisition provided a significant increase in fleet, a well-trained workforce, and access to slot constrained airports such as London Gatwick, Paris CDG, Düsseldorf and Frankfurt.

In 2010 the Flybe group listed on the London Stock Exchange main market through an IPO priced at £2.95 a share, valuing the company at £215m and raising £60m in the process.

The following year it signed a 60:40 joint venture agreement with Finnair through which it acquired a Finnish regional airline Finncomm with 16 aircraft operating a mixture of commercial and ACMI services on behalf of Finnair. The following year Finnair injected another 12 aircraft into the operation all operated as ACMI “white label” services.

By 2013 Flybe had grown to carry 7.6m million passengers, operate 98 aircraft (E175, E195 and Q400s) on 242 routes to 112 destinations. However, since its IPO it had lost significant amounts and its share price touched a nadir of 48p in mid 2013. For the year ended March 2013 it announced an annual net loss of £42m on turnover of £614m; net equity (excluding imputed capitalised lease obligations and intangible assets) had fallen to £36m and the group only had £4.6m in net unrestricted cash — somewhat short of the three months’ of revenue reserve implicitly required under its UK AOC license.

Early in 2013, faced with significant losses on operations, Flybe announced restructuring moves to attempt a turnaround in fortunes. As part of this — angered by a change of charging structure which severely changed the economics of operating smaller aircraft operations at the airport — the company sold all its Gatwick slots to easyJet for £20m (25 slot pairs = £0.8m a pair). It also reached an agreement to defer 16 E175 deliveries originally due from Embraer in 2014 and 2015 until 2017-2019. In addition it announced plans to reduce total headcount by 22% (out of 2,730) with a 20% reduction in administrative positions, forced and voluntary redundancies of 290 positions and outsourcing (of line maintenance, ground handling and check-in) involving a further 300 people. The target was to provide a reduction in total running costs of £35m in the financial year 2014/15.

In August 2013 the company hired Saad Hammad as CEO (formerly COO at easyJet from 2005 to 2009) replacing one of the roles of Jim French who had joined the airline in 1990, became Chief Executive Officer in 2001 and Chairman in 2005. Hammad initiated a complete change of senior management. A new non-executive Chairman was brought in to replace Jim French; the existing management board was culled — with the exception of the CFO Andrew Knuckey (who promptly said he would leave once a successor were found). The group’s organisation was significantly simplified into two operational reporting units: the Flybe UK and Flybe Finland. Saad Hammad brought in new blood with Paul Simmons as Chief Commercial Officer and Ronnie Matheson as Director of Revenue Management — both ex easyJet. Meanwhile, Rosedale Aviation, the investment vehicle of the Walker Trust disposed of its entire 48% shareholding. All change.

The restructuring plans put in place by the former management seemed to have been starting to work. In the six months to September 2013 the group saw a return to profits of £13.6m (after restructuring costs) on turnover up by 3% to £351m reflecting a 5.6% increase in passenger numbers and a 3.6 improvement in load factors to 68.6%. Having said that the UK airline was operating with an average revenue per seat of only £50.35 against operating costs of £51.17 per seat. The Finnish join venture meanwhile returned a small profit for the first time. In the third quarter interim management statement the company highlighted that it was on schedule to provide full year cost savings of £40m.

However, as the new CEO emphasised in an investor briefing, Flybe was still woefully inefficient in comparison with peers. As a regional airline with low capacity aircraft operated on very short haul routes it will automatically have a relatively higher cost base. However, it had been achieving a paltry 5.2 hours a day aircraft utilisation and its pilots were only flying a meagre 374 hours a year. Overall 40% of its routes were badly loss-making — not even covering DOCs, crew and aircraft costs.

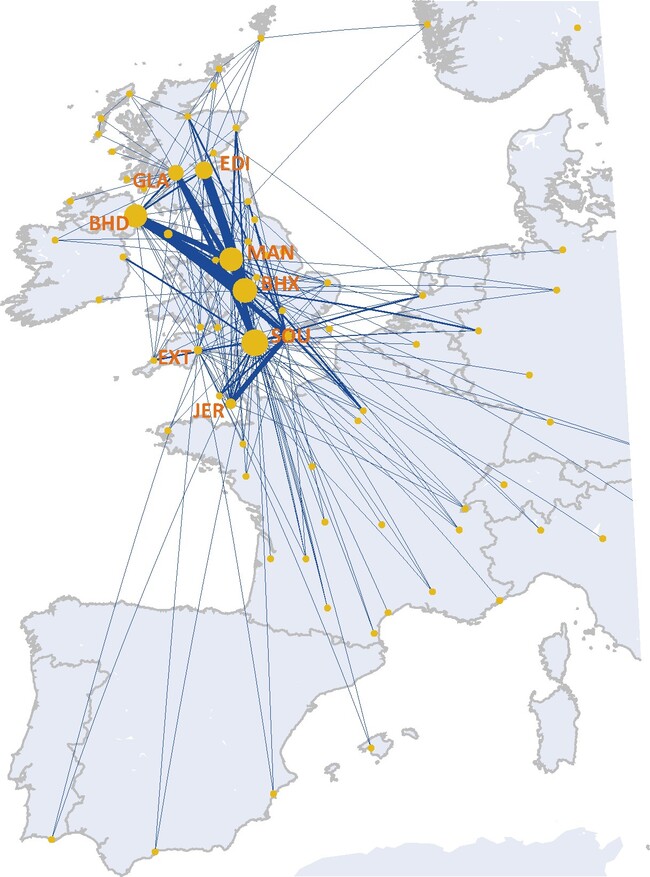

Having said that, Flybe UK does appear to have a strong regional niche position. It is the largest operator at Southampton, Exeter and Belfast City by frequency and passenger numbers (and Southampton has the advantage of a short runway where larger aircraft such as the A320 or 737 can only operate with weight restrictions, providing defence against attack from LCCs). Flybe is also the largest operator by frequency at Birmingham and Manchester. It has a 26% share of total UK domestic air traffic, and a near 50% of total UK domestic traffic when excluding London.

Hammad emphasised an immediate concentration on optimising the structure at Flybe UK to get it into a position to be able to grow. He initiated a new round of cost savings: an additional 450 job cuts; rationalisation of the Summer 2014 network affecting 55 routes including the cutting 30 loss-making routes; the closure of six out of 13 aircraft bases in the UK; grounding 10 aircraft (out of a total fleet of 70 aircraft at the end of December) at the beginning of the Summer season, and a further four at the end.

The £150m new equity raised is being used primarily to boost liquidity — nearly half of the funds earmarked to boost working capital. In addition the new management wants to rebalance the ownership structure of the fleet (currently all but ten aircraft are on operating leases) and it is looking to use £14m to reduce ownership costs. A further £5m each are to be targeted at IT and customer service (aka brand image). The remainder is to be used to grow: £35m to expand the Flybe UK commercial operations with new routes and bases over the next two years (it states that it has identified nine new routes through its route allocation model for which it would need ten aircraft); £25m to seek expansion of white label ACMI flying for other legacy flag carriers in Europe (in the prospectus the company states that it is in on-going commercial discussions with several airlines). These two latter sums refer to a 25% equity investment in new aircraft needed to operate the new routes.

The first signs of a resumption of growth has come with the announcement of a major expansion at Birmingham: Flybe is opening six new routes with an additional 3 E175 based at the airport for the Summer 2014 season. This will now make Birmingham Flybe’s largest UK base with a total of 12 aircraft at the airport (and incidentally making Flybe Birmingham’s largest customer).

There is a basic problem for any airline pursuing a niche strategy: if you are any way successful at it you will attract competition. With regional aircraft with their naturally higher unit costs of operation, you cannot afford direct competition from operators of full size single aisle jets, and need to have a route network where the higher unit costs of regional aircraft can be sustained and there are sufficient defensive barriers to entry to keep out the LCCs. Flybe is concentrating regional connectivity, operating niche routes which are below the radar screen of larger jet operators — and retains a significant defensive position at Southampton.

However, in the prospectus the company also states that is will target routes with traffic volumes below 400,000 pax pa (that upper level of traffic volumes would still be attractive to a 737 or A320 operator) and that it is “pursuing opportunities at airports such as Manchester to to develop their capacity as domestic and international hubs”.

Applying the low cost hybrid principles from the easyJet model should provide the increase in load factors and revenues per seat that it needs to return the UK airline to profitability. Meanwhile as the European flag carriers continue to withdraw from small aircraft regional operations, there may well be a good opportunity to expand ACMI white label services. The new and old shareholders obviously believe so.

| Number of seats | Owned | Operating lease | Total (Orders) | Lease Expiry next five years | |

| UK Airline | |||||

| Bombardier Q400 | 78 | 2 | 43 | 45 | 26 |

| Embraer E175 | 88 | 7 | 4 | 11 (24) | |

| Embraer E195 | 118 | 14 | 14 | 5 | |

| 9 | 61 | 70 | |||

| Flybe Finland | |||||

| ATR 42 | 48 | 2 | 2 | ||

| ATR 72 | 68-72 | 12 | 12 | ||

| Embraer E170 | 76 | 2 | 2 | ||

| Embraer E190 | 100 | 12 | 12 | ||

| 28 | 28 | ||||

| Total | 9 | 89 | 98 |