Scandinavian battles: the SAS and Norwegian saga continues

March 2011

Scandinavia may be out of the mainstream battle, but it is still a very important part of the European market. Even though the three countries Sweden, Denmark and Norway have relatively low populations (of 9.2m, 5.5m and 4.9m respectively), distances are large, physical geographical barriers can favour air travel, personal incomes are high (with GDP per head of $44,000, $56,000 and $79,000 respectively in 2009). Norway in particular portrays the highest propensity to travel by air of all nations — with an average number of seven air trips per head of population per year. However, it is also an area which relies on very short–haul air trips; and therefore a market which is highly open to attack from the low–cost model.

The legacy incumbent SAS — formed originally in 1946 as the world’s first multinational air carrier as the consortium of the then national flag carriers of Sweden, Norway and Denmark — has for many years enjoyed the (relatively) protected market of a niche local market. Over the years it has tried to expand out of the core “natural” market — and in the good times has targeted long–haul route expansion (through its network hub at Copenhagen), leisure oriented growth, acquisitions and partnerships — but in each cyclical set–back the company has had to refocus back to the core intra–Scandinavian domestic and intra–European business oriented routes.

Back in 2001 SAS made (in hindsight) a disastrous strategic decision. Bowing to political pressure it acquired its Norwegian competitor Braathens SAFE — which then had half the domestic Norwegian market.

On the face of it, this acquisition could have allowed SAS to maintain control over the majority of the Scandinavian market, but in reality provided the opportunity for a low cost upstart — Norwegian Air Shuttle (formerly a feeder for Braathens) — to start operations in direct competition. Unlike the other major carriers in Europe, SAS has a relatively small natural long–haul market and has been far more heavily dependent on short haul point–to–point demand — while shuffling medium–haul through its hub at CPH. It was reliance on this short haul point–to–point market that made it so vulnerable to new low–cost entrants.

In the regulated era SAS had developed CPH as a transfer hub — to try to make commercial sense out of its long–haul routes. Passengers of course prefer direct services where possible: and Norwegian has now started direct longer haul competition — from Oslo to Dubai on 737–800s — and with an order for two 787s has ambitions to compete directly with its legacy competitor.

This then is an evolving saga of the low cost insurgent pushing the patience of the incumbent dinosaur. By 2010 Norwegian had grown to be half the size of the SAS Group in numbers of passengers carried and a fifth the size in terms of annual revenues.

For 2010 Norwegian produced a pre–tax profit of NOK 243m (€30m) — although well down on the prior year’s NOK623m, not that dissimilar from SAS’s SEK258m “income before non–recurring items in continuing operations” — but its net profit of NOK143m was significantly above SAS’s SEK2.2bn net loss for the period.

SAS — 2010 a year showing recovery

For 2010 as a whole, SAS Group capacity in ASK terms fell by 2.6%, traffic grew by a modest 1.9% and load factors grew by 3 points to 74%. The closure of European airspace following the eruption of the Icelandic volcano last spring had a greater than average impact on operations in Scandinavia; in the first half of the year SAS’s capacity was down by 9% and traffic by 4% whereas in the second half of the year capacity was up by 5% and demand by 8%, with an acceleration of the growth in the fourth quarter. Unlike the other European majors SAS did not benefit as much from any improving yield environment.

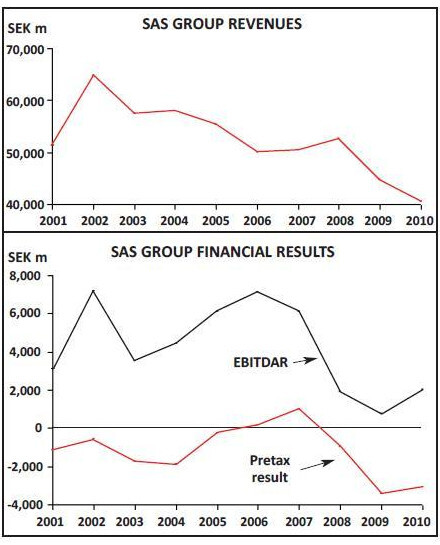

For the full year, underlying (currency adjusted) traffic yields fell by some 7%, and in its press release the company blames severe competitive pressure in the domestic Danish and overcapacity in the Norwegian markets. Total group revenues fell by 10% to SEK40bn (€4.4bn), and are now some 40% below the peak achieved in 2002, albeit in a simpler group structure.

Costs also were down reflecting the implementation of the new restructuring plan “Core SAS”. Total operating costs (and unit costs) fell by nearly 8% despite the jump in fuel prices in the fourth quarter.

EBITDAR was up 150% to SEK3.9bn — but still represents a paltry 5% of revenues. As a result the group managed to reduce its operating losses by a third from the prior year period to SEK1.9bn and published pretax losses of SEK3bn up from losses of SEK3.4bn in 2009. However, these figures include certain non–recurring restructuring costs, fines (for its part in the cargo cartel and for industrial espionage against Norwegian) amounting to some SEK2.6bn in all. Trying to get to a positive figure, the company has further estimated that the ash cloud over Northern Europe last spring cost it a further SEK700m, suggesting that it could have achieved an underlying profit of SEK265m. It is perhaps worth noting that in the past ten years SAS has achieved a published pre–tax profit in only two (2006 and 2007) and has generated total pre–tax losses since 2001 of some SEK12bn (see chart, below).

“Core SAS” — the strategy

A new strategy was unfolded at the beginning of 2009 entitled “Core SAS”. It is based on five pillars:

- focus on the Nordic market;

- focus on business travellers;

- improve cost base;

- streamline organisation; and

- strengthen capital structure.

The programme was envisaged to generate some SEK7.8bn in cost savings by 2012. As part of the focus on the home region, the group has divested stakes in Spanair, bmi and Estonian along with certain peripheral support operations outside Scandinavia; it has reintegrated what had become SAS Sweden, SAS Norway and SAS Denmark into the core SAS brand. It retains its holdings in Wideroe and Blue1 as core Nordic carriers (interestingly Blue1 returned an increased operating loss of 11% of revenues while Wideroe, helped by parent capacity shifts, reported an operating profit margin of almost 6%). A large part of the total cost savings is targeted to come from employee costs (with flight and cabin crew providing some SEK1.9bn of the total) — total payroll costs in 2010 fell by 25% from those in 2009. The group states that it has implemented 87% of the cost saving programme — but as usual it is not easy for an outside observer to be able to verify the assumption — and that results in 2010 benefited by SEK3.6bn as a consequence; and the group anticipates further benefits of SEK1.5bn accruing in 2011.

For the final pillar of the plan there is still some way to go. The group completed another SEK5bn rights issue last year and ended 2010 with SEK5bn in cash (12% of revenues — although it has another SEK5bn in available facilities) despite a small operational cash outflow. It has a target to achieve a cash flow return on equity of 25% — these results represent a mere 6%.

One of the more important strategic decisions last year was to implement a simplification of the fleet structure. The group had 230 aircraft of 14 different types at the end of last year (and sub–configurations of some of those types) — of which 23 are leased out to other carriers (including a bundle of MD80s to Spanair) and probably 20 in storage. Among these it still owns 49 twenty–year old MD80/90s and 13 eighteen-year old 737 Classics. It has started the process to phase out the older generation single aisle jets at Stockholm and Oslo to concentrate on pure 737NG operations there. It is phasing out the remaining Fokker 50s replaced with Wideroe’s Q400s.

Blue1 is phasing out its RJs and MD90s replacing them with 717s. The replacement of the short–haul single aisle older generation fleet was always going to be a financial burden — the group has no orders currently but states that it has started negotiations with manufacturers and leasing companies.

On the outlook for 2011, SAS retains some optimism. Capacity is set to grow by 6% in actual terms — with an underlying 2% growth after allowing for the ash–cloud effects. It does not expect the non–recurring items of SEK2.6bn to recur; and on the basis of continuing benefits from the cost cutting programme and an assumption of $85/bbl fuel it assumes that it will be able to produce a profitable year.

Meanwhile, the usual rumours surfaced again recently that SAS could be in discussions to sell out to Lufthansa. This may be a longer term option for the consortium carrier (it has a long standing joint venture on routes into and out of Germany, was closely involved in the disastrous ECA with LH and bmi, and is closely involved in the Star Alliance). However, with the three nation states retaining their joint 50% stake in the flag carrier any ownership change is fraught with political sensitivities; Lufthansa itself has got a belly–full of undigested recent acquisitions and is unlikely to be interested until SAS has its finances back in order.

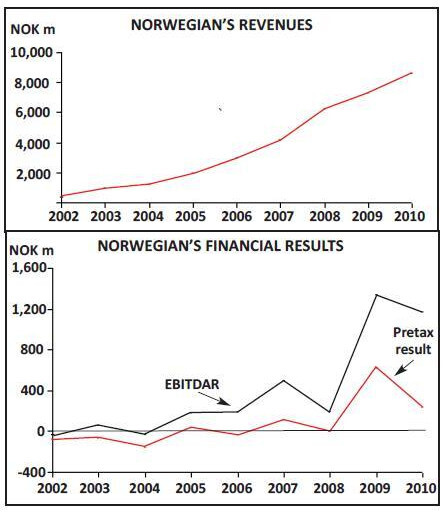

Norwegian — growing and profitable LCC

Unlike some other LCCs in Europe Norwegian continues to grow strongly. In 2010 it took delivery of another 12 737–800s (five replacing older 737–300s) giving a year end fleet of 53 aircraft. It increased seat capacity by 31% year on year (with a 10% increase in stage length). Total passenger demand increased by 30% and the load factors dipped slightly to 76%. Hardly surprisingly yields were under pressure — not just from the significant increase incapacity and increased sector length , but also the strength of the Norwegian Kronor against the Euro — falling by 13% year on year, although there was a further growth in ancillary income of around 8% per passenger. Total operating revenues increased by 18% to NOK8.6bn (€1.1bn).

Unit costs were down by 5% overall — and by 11% excluding fuel — reflecting in part the increasing proportion of 737–800s in the fleet (the company disposed of the last of its MD80s in the first half of last year) and a near 10% increase in average stage length. Total costs were up by 24% and EBITDAR fell by 12% to NOK1.2bn — a 14% margin — and pre–tax profits fell by 60% to NOK243m. As with everyone else, Norwegian was badly hit by the closure of European airspace in April — which it estimates to have cost it NOK170m — and the very weak resulting second quarter played a major part in the disappointing full year figures. In the first half of the year the company had reported a loss of NOK460m against a profit of NOK94 in the prior year period — whereas the second half pre–tax profits were up by a third to NOK700m — even despite the severe winter weather in the fourth quarter. However, these figures also reflect the award of NOK180m in compensation from SAS for industrial espionage.

Year–end cash and cash equivalents stood at NOK1.2bn (down from NOK1.4bn at the end of 2009) equivalent to only 13% of annual revenues.

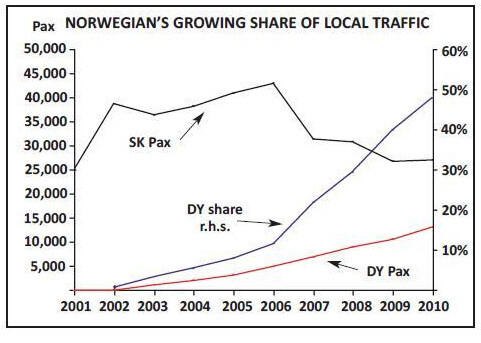

Norwegian’s traffic share

Although SAS bemoans overcapacity in the Norwegian domestic market, Norwegian only increased domestic capacity by 5% with the rest of the growth apportioned on international routes and to bases outside its home country. However it did increase capacity at its main base in Oslo strongly — and proudly states that it generated 96% of the total growth in passenger throughput at Oslo Gardemoen with a 14% increase in the number of its passengers there. It maintained its 45% share of domestic traffic and improved its share of international to 32% of the total. It is in the process of developing bases in the other Nordic capitals — and this is where it is likely to push a large part of the future increase in capacity.

At Stockholm Arlanda (SAS’s home base) it now has a 16% share of the traffic on domestic routes and a near 14% share of the international — doubled in two years. At Copenhagen (SAS’s network hub) it has taken further advantage of the withdrawal of Transavia to build an 18% domestic share and 10% international share of the market. Starting this March it is opening a base in Helsinki (it does have an agreement with Finnair forged following the takeover of its Swedish operations and which gave Finnair a stake in NAS) with an initial three aircraft. At the end of 2010 Norwegian had 53 aircraft in its fleet — 23 737–300s and 30 737–800s. It took delivery of another six B737–800s in the first quarter of this year and has another 54 outstanding on order with an additional 30 options. Part of these new aircraft deliveries will go to replace the older leased 737 classics (all of which are due to leave the fleet this year) — and the current plans appear to allow the fleet to grow by a net 4–6 aircraft a year to build to a fleet of 73 aircraft by 2014. The company claims an annual average 10.4 hour daily utilisation which it could raise further as the classics leave the fleet and as it develops longer routes. Total seat capacity in 2011 is likely to grow by another 20–25% and under current plans the company could continue to generate similar but slightly reducing rates of growth over the next four years.

In addition to the 737–800s Norwegian has placed an order for two 787s to be delivered at the end of 2012. This will allow it further to develop its long haul aspirations — the longest current route it operates is to Dubai — and the 787 would be provide a significant cost advantage in competition with SAS’s A330 operations out of CPH. Intriguingly SAS has countered its fear of the impending competition by announcing the re-establishment of a direct route from Oslo to New York (which would presumably be the first natural choice for Norwegian).

Norwegian is now the third largest LCC in Europe behind Ryanair and easyJet in terms of passenger numbers (excluding that is Air Berlin, which is probably not really an LCC) — closely followed by Vueling and Wizz. Norwegian has a unit cost base some 15% higher than easyJet’s (partly explained by a shorter average stage length and partly by its very base in Norway), but still 25% lower than Finnair’s and half that of SAS. Intriguingly it achieves an average revenue per passenger of nearly NOK700 which (depending on the exchange rate used) could be 20% higher than that of easyJet (and still 50% lower than that of the SAS Group). It, like easyJet, has a policy of targeting primary airport destinations, and states an aim that at these airports it should achieve cost leadership.

Ragnarok?

In some sense Norwegian portrays the way in which the classic LCC model is evolving. Norwegian is actively promoting self–transfer through its effective “hub” at Oslo; it is directly targeting the business oriented routes of SAS at each of its three main bases; it could — like Air Asia in KUL — successfully generate feed onto longhaul operations through its main base in Oslo (or for that matter any of the other Nordic capitals?). SAS meanwhile is finding that this upstart is increasingly biting into its home operations with a young, fuel efficient and well utilised fleet. The battle royal is yet to come as Norwegian develops its long–haul network.

| Model | In Active Service | On Order | On Option | In Storage |

|---|---|---|---|---|

| A319-100 | 4 | — | — | — |

| A321-200 | 8 | — | — | — |

| A330-300 | 4 | — | — | — |

| A340-300 | 6 | — | — | — |

| Avro RJ-85ER | 1 | — | — | — |

| 717-200 | — | — | — | 1 |

| 737-400 | 3 | — | — | — |

| 737-500 | 9 | — | — | — |

| 737-600 | 28 | — | — | — |

| 737-700 | 19 | — | — | — |

| 737-800 | 18 | — | — | — |

| CRJ900 | 12 | — | 15 | — |

| Dash 8 Q400 | — | — | — | 3 |

| MD-82 | 23 | — | — | — |

| MD-87 | 2 | — | — | 2 |

| MD-90-30 | — | — | — | 5 |

| Total | 137 | 0 | 15 | 11 |

| Model | In Active Service | On Order | On Option | In Storage |

|---|---|---|---|---|

| 737-300 | 22 | — | — | 1 |

| 737-800 | 35 | 54 | 30 | — |

| 787-8 | — | 2 | — | — |

| Total | 57 | 56 | 30 | 1 |