JAL and ANA: contraction in 2009, expansion from 2010?

March 2009

Japan’s two global carriers, Japan Airlines (JAL) and All Nippon Airways (ANA), are scrambling to cut capacity and costs in response to sudden sharp declines in international passenger and freight volumes due to recession. How severe will the financial damage be in 2009? Will the airlines need government aid? And will their balance sheets be strong enough for post–2010 growth?

Until late last year it looked like the Japanese carriers would escape the worst effects of the global recession. Their international traffic had continued to grow, albeit at a slower rate in the autumn. In early November JAL and ANA still released forecasts that anticipated profits in the current fiscal year. But after that the situation deteriorated rapidly.

In recent weeks, JAL and ANA have stood out for their truly dismal monthly traffic results. They are not just seeing steep declines in international freight and premium traffic, but their leisure traffic is no longer helping to offset the impact. JAL’s total international RPKs fell by 19.6% in December – the biggest monthly drop since the SARS scares in August 2003. ANA’s international RPKs declined by 15% in November and December. Since capacity was down only marginally, the airlines saw load factors fall by 10–11 points in December.

Those were probably the worst passenger traffic results among global airlines in December. According to IATA statistics, Asia Pacific carriers’ international RPKs fell by 9.7% that month, with North American and European carriers seeing 4.3% and 2.7% declines, respectively.

December quarter losses

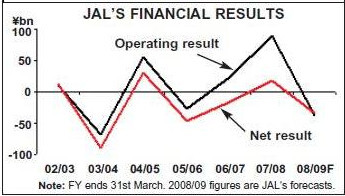

JAL and ANA are impacted so severely because Japan now has far worse economic woes than the US and Europe. Japan’s real GDP shrank by 12.7% in the fourth quarter, roughly twice the US rate. The dramatic decline was caused by the collapse of exports. Amid job cuts and rising unemployment at home, consumer spending has evaporated. Inbound tourism has been hit by the yen’s appreciation (caused by the global financial turmoil). Therefore the Japanese carriers are seeing sharply weaker demand in all of their segments – international, domestic, passenger, freight, business, leisure, inbound, outbound, etc. As a result, JAL and ANA posted operating and net losses for the December quarter, contrasting with profits in the year–earlier period. Both airlines will now be reporting net losses for the current fiscal years ending on March 31.

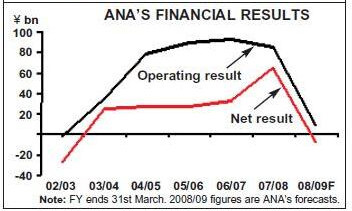

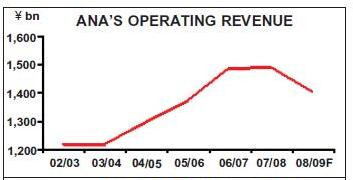

ANA expects to report a net loss of around ¥9bn (US$92m) for 2008/09, which would be its first annual loss in six years, contrasting with a net profit of ¥64.1bn (US$657m) last year. Revenues are expected to decline by 6%. Still, the net loss would be only 0.6% of revenues and the operating result is expected to be positive to the tune of ¥8bn (US$82m).

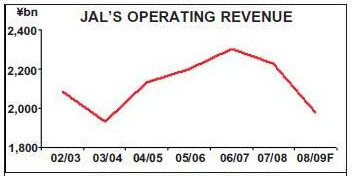

JAL expects to report operating and net losses of ¥37bn (US$379m) and ¥34bn (US$348m), respectively, for 2008/09. The losses will account for less than 2% of revenues, which are expected to fall by 11.3%. But it will be JAL’s third annual net loss in four years and particularly disappointing in light of the promising recovery that the airline saw last year, just one year after embarking on a four–year restructuring effort.

At the end of February most analysts were forecasting increased losses for both airlines next year. The consensus estimate (five analysts) for ANA is a loss of ¥7.90 per share in 2009/10, up 71% from this year’s Y4.62. JAL is expected to lose ¥21.49 per share in 2009/10, up 63% from this year’s ¥13.21. However, not surprisingly in light of all the economic uncertainty, the range of individual analysts’ estimates is rather wide.

Although there are no specific concerns about the Japanese carriers’ near–term liquidity, there are potential issues if the demand slump worsens or continues for a prolonged period.

First of all, JAL and ANA have weaker cash reserves than global carriers generally and their balance sheets may not be able to withstand an extended period of cash burn. This is particularly the case with JAL, whose year–end liquidity (cash and readily–convertible securities) amounted to just ¥200bn (US$2bn) or 10% of this year’s revenues. Most global carriers consider 20% to be the minimum adequate liquidity level these days.

JAL’s main problem it that it has significant debt payments, bond redemptions and aircraft capital expenditures in fiscal 2009/10 that its cash flow will obviously not cover. It may not be able to raise funds through normal commercial channels if the demand environment remains weak and the credit crisis continues.

Another potential issue is that JAL and ANA have heavy new aircraft order commitments and significant growth planned from 2010. They will have some rare growth opportunities when major expansion projects are completed at Tokyo’s congested Haneda and Narita airports.

In particular, the opening of a fourth runway at Haneda in October 2010 will be a watershed event, because it will mean a dramatic 40% increase in slots. Haneda will also be formally opened up for international flights. The airlines have been planning for what they call the Haneda “big bang” for many years. In the run–up to 2010, JAL was supposed to be consolidating profitability and both airlines were supposed to be building up cash reserves and strengthening their balance sheets. Will they now be able to fund post–2010 growth?

To meet its obligations in the next 12 months, JAL may have no option other than to seek state aid. The airline is reportedly considering applying for up to ¥200bn (US$2bn) in long–term low–interest loans from the Development Bank of Japan. This would be in addition to ¥50bn of cost cuts and a likely reduction in non–aircraft capital expenditures (which JAL plans to announce in its 2009/10 business plan at the end of March).

The low–interest loans would be part of an aid package that the government hopes to unveil by March 31 to help Japanese companies cope with the economic crisis. The package is expected to include capital infusions to struggling companies, which JAL might also be able to access. JAL and ANA took advantage of similar low–interest DBJ loans during the 2003 SARS outbreaks.

While ANA is in a stronger financial position than JAL, it too has significant new aircraft commitments and could therefore also opt to apply for the DBJ loans. Like JAL, ANA is looking to defer all but strategically necessary investment. As of late February, ANA and JAL were still reportedly looking at all options.

It is hard to see that tapping the DBJ low interest loans would carry much stigma at a time like this. Capital injections from the government would, of course, be more controversial.

Demand and revenue challenges

The airlines’ main focus in recent weeks has been to adjust capacity and cut costs further for what JAL executives called a “radically different environment”. There will be a near–10% reduction of international capacity at the two carriers, as well as a major new cost–cutting effort at JAL. JAL and ANA are fortunate in that they effectively have a duopoly of Japan’s huge, lucrative, business–oriented domestic market – the world’s third largest after the US and China. It is a mature, stable market and JAL and ANA are very good at matching capacity to demand and using pricing to stimulate demand. Both airlines have been restructuring their domestic operations for years to enhance profitability. So even though domestic demand has been soft all year and weakened further in late 2008, JAL and ANA managed to keep their domestic load factors stable and JAL even saw its domestic passenger revenues inch up by 0.6% in the December quarter.

JAL said that it reduced domestic capacity slightly in the December quarter but that demand and yield were broadly unchanged. ANA saw a 5.8% decline in domestic passenger revenues, reflecting a 6% reduction in both capacity and demand.

The two airlines are similarly sized in Japan, with ANA earning ¥177bn and JAL ¥168bn revenues from domestic passenger operations in the December quarter. However, ANA is better positioned for this economic crisis because it has much less exposure to the more volatile international markets. This partly explains why ANA’s profits have historically been higher and more stable than JAL’s. In the latest quarter, ANA’s international passenger revenues (¥74bn) accounted for 24% of its total operating revenues, compared to JAL’s 41% (¥176bn).

Internationally, the airlines saw weak leisure demand on China routes through much of last year (the Sichuan earthquake, food–related scares, etc) and softening leisure traffic on European and North American routes from mid–2008 due to high fuel surcharges. In late 2008, following the US financial crisis, business demand plummeted on European and US routes. In the fourth quarter, JAL’s worst–affected markets were Oceania (RPKs down 37%), Europe (19.6%), China (19.5%), Southeast Asia (17.9%) and the Americas (14.9%).

JAL’s international capacity has been declining for the past year, due to route restructuring and aircraft downsizing particularly on its US and China routes. Its international ASKs were down by 4.5% in April- December 2008 and by 4.4% in the fourth quarter. Of course, the capacity reductions paled in comparison with the 12.5% and 17.9% RPK declines in those periods. ANA only began tentatively reducing its total international capacity in the fourth quarter (down 1.3%) and saw RPKs decline in the low teens.

Oddly enough, the Japanese carriers’ international yields have surged in the past year. JAL’s was up by 13.8% in both April- December and the fourth quarter. Around half of the increase was due to hikes in fuel surcharges. IATA fares also rose twice last year, by 10–13% in April and by 5–10% in October. The rest of the yield increase was due to the yen’s appreciation and changes in route–mix.

The Japanese carriers have had fuel surcharges on international tickets since February 2005. Raising them became an almost quarterly event (for which government approval was needed) and for a long time there was seemingly little impact on demand, so the airlines benefited greatly. But the method did not work so well in the unusual circumstances seen last autumn: because of a time lag, the fuel surcharge was raised (and actually peaked) in October, just as fuel prices were falling dramatically and consumer sentiment was worsening.

The fuel surcharges are obviously now coming down. The first reduction was in January, and from April the surcharges will come down quite dramatically; for example, the Japan–US mainland routes will see a reduction from US$204 to US$34 each way. The surcharges will be removed completely when the three–month average price of Singapore kerosene falls below US$60.

As a result of the yen’s appreciation and the lowering of the fuel surcharges in January, JAL reported a slight recovery in outbound leisure demand on short haul routes such as Korea, Guam and Hong Kong. The airlines are obviously hoping that the more dramatic surcharge reductions in April will have a greater positive effect.

But business demand has shown no sign of recovery, as economic indicators have continued to worsen. The current quarter is again expected to see a double–digit decline in real GDP in Japan. IATA reported that passenger and cargo traffic declines worsened in January.

Dealing with the crisis

JAL’s cargo revenues were down by 26.8% in the fourth quarter, which was in line with what other Asian airlines reported. ANA saw only an 8.3% decline in cargo revenues in the latest period, but that was because it expanded its fleet and freight network. JAL and ANA earn 9–12% of their revenues from cargo operations, so they are not as heavily exposed to freight as some of their Asian counterparts. JAL and ANA have scrambled to deal with the sudden escalation of the economic crisis. First, they have implemented what they call “emergency” measures, including some immediate route suspensions, frequency reductions and cost cuts. Second, they have outlined extensive network and service changes, resulting in sizeable temporary contractions internationally, in their business plans for the fiscal years starting on April 1. Third, the airlines are planning additional cost cuts for FY 2009/10.

ANA’s emergency measures have included immediate suspension of one China route (Osaka–Dalian–Shenyang) and frequency reductions on its Mumbai, Shanghai and Bangkok routes from Narita. The airline also scraped together ¥2bn (US$20bn) of extra cost cuts for the current quarter.

In fiscal 2009/10 ANA plans to cut international ASKs by 8% and domestic ASKs by 4.3%. Internationally, it is looking to reduce capacity particularly in the Japan–China market (by 11%) through route suspensions, frequency reductions and aircraft down–gauging. Paris and Frankfurt flights will be switched from 747–400s to 777–300ERs and Washington from 777–300ERs to -200ERs (some of them only for 2009).

Domestically, ANA wants to allocate resources more effectively and improve profitability and its competitive position. This will mean a couple of new routes, some frequency increases, many route suspensions or service reductions and increased reliance on code share partners and seasonal flights in smaller markets.

ANA is in the process of building cargo into its “third core business” and is sticking with plans to start a cargo hub operation at Okinawa in October 2009. It will employ eight 767–300 freighters to link Seoul, Shanghai, Taipei and Hong Kong with Narita, Haneda and Kansai via Okinawa.

Cost-cutting plans

In March 2010 another 767–300 freighter and Tianjin will be added to the operation. In response to the slump, ANA is delaying the introduction of widebody freighters by six months and considering other measures, but its cargo ATKs are still expected to grow by 31% in 2009/10. On the cost–cutting front, ANA is asking its employees to agree to a temporary 10% average pay cut from April, which would save ¥14bn (US$143m) in FY2009/10 and only apply for one year. The brunt of the cuts would be taken by upper management, with non–managerial employees only seeing a 3% reduction. Senior executives took 20- 30% cuts in compensation in January. ANA has not disclosed how the unions have responded, but in late February, in an effort to boost worker morale, it announced plans to start an employee share incentive plan.

ANA now expects to receive its first 787 in February 2010 (21 months behind the original schedule) and start commercial flights the following month, initially on domestic routes for ETOPS rating and pilot training purposes (it is the type’s launch customer). It would appear that not having the 787 this year has turned out to be a blessing in light of the economic crisis. ANA looks likely to have excess aircraft in 2009 anyway, with 17 deliveries (including two 787s) compared to seven retirements. The result is likely to be reduced aircraft utilisation.

JAL has pencilled in cuts adding up to a near–10% international capacity reduction in 2009/10, much of it taking place at the start of the fiscal year. The plans include suspension of Osaka/Kansai–London and some China routes, frequency reductions on the New York, Bangkok, Seoul and some China routes, and aircraft downsizing on five Asian and two US routes. However, JAL is adding a second daily flight from Tokyo to London and increasing domestic feeder flights to and from Narita.

JAL is also increasing the role of two of its lower–overhead cost subsidiaries, JAL Express and J–AIR. JAL Express will launch international operations with 737–800s in May, starting with three routes to China, while J–AIR will expand domestic operations with its newly–introduced E–170s.

Overall, JAL’s domestic capacity is expected to decline by 2–3% in 2009/10. JAL aims to improve domestic profitability through route suspensions and flight frequency increases using smaller aircraft.

On the cargo front, JAL is looking at a major pullback at the start of the fiscal year. Plans include termination of all services to Manila, suspension of seven routes worldwide, frequency cuts to Los Angeles and downsizing from 747–400Fs to 767–300Fs on several routes. But there will be new service to northern China. JAL is in talks with Nippon Cargo Airlines regarding possible code share operations.

JAL continues to renew its fleet, phasing out larger, older aircraft in favour of more small and medium–sized aircraft – a key part of its cost–cutting plan. Fiscal 2009/10 will see 19 deliveries and 20 retirements. The airline is adding 737–800s and E–170s and retiring its last 747 classics, as well as MD–81s and 737–400s.

JAL is targeting ¥50bn (US$512m) additional cost cuts in 2009/10, including ¥9bn of savings achieved ahead of schedule in the current fiscal year. The cuts, which will be outlined in detail later this month (March), are expected to come from a multitude of sources, including labour. JAL reportedly wants to eliminate 2,140 more positions in the next two years.

JAL has already reduced its workforce by 4,300 or 8% in the past two years through natural attrition and early retirements. In November it implemented a 5% reduction in wages and benefits, and this year hundreds of workers have taken unpaid leave under a new programme.

Major expansion from 2010?

Some analysts regard the ¥50bn a tough target to hit, given all the cuts already made. But, given its still–undesirable cost structure and with a severe recession likely to persist through 2009, JAL needs the additional cuts. In any case, ¥50bn is only 2.5% of this year’s total operating expenses. A slide in a recent ANA presentation summarised well how the Japanese carriers see the way forward: “Respond to crisis and get ready for Haneda and Narita expansion”. In other words, while contracting in 2009, JAL and ANA are determined to take advantage of the significant growth opportunities available from 2010.

The airlines’ post–2010 plans have been covered in past issues of Aviation Strategy, most recently in July/August 2008 (JAL)and in September 2007 (ANA). In summary, ANA wants to maximise Haneda’s potential and focus on Asian growth to become “one of Asia’s leading airlines”. JAL, already Asia’s largest carrier, also wants to build Asian international service out of Haneda, as well as strengthen Narita as a global hub.

Neither carrier released new mid–term plans at the end of January, as they often do. First, they needed to focus on the economic crisis. Second, longer–term fleet plans are currently being re–examined in light of the crisis and the latest (December) 787 delivery delays. Third, capital spending plans are under scrutiny. ANA said recently that its next mid–term plan would be for the three–year period starting in 2010/11.

In December JAL talked of a possible 25% reduction in capital spending plans in the three years to March 2011. ANA reportedly was considering cutting planned capital spending by ¥100–200bn (US$1–2bn) or 11- 22% in the four years to March 2012.

In December ANA firmly shelved its long–awaited large aircraft decision. The choice had been between the A380, the 747–8 or not acquiring a new fleet at all. The obvious question now is: will there be less demand for very large aircraft?

However, there have been no changes to existing order commitments and both airlines remain firmly committed to the 787. ANA has 50 firm orders for the 787, while JAL has 35 firm orders and 20 options. In February ANA said that it had decided to speed up the rate of 787 introductions (evidently facilitated by other airlines’ order cancellations or deferrals), with 20 now expected in service by March 2011.

Under September 2008 deals with Boeing, ANA agreed to take nine 767- 300ERs and JAL two new 777s and nine 767s as interim aircraft in 2010–2011 fiscal years – those arrangements just might give the airlines some flexibility if the economic environment worsens.

In the event that JAL and ANA needed to slow their post–2009 growth plans, they would probably not lose major growth opportunities because other large Asian carriers would be in the same boat. JAL and ANA could lose some slots and market share to LCCs, but the government would then step in to protect them from any serious incursion.