Iberia – BA: marriage of equals

March 2009

Despite Spain being one of the worst performing European economies in this current downturn, Iberia, of all the European airlines may be in one of the best positions, and worthy of an equal share in a merger with British Airways.

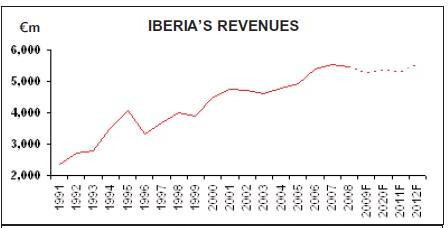

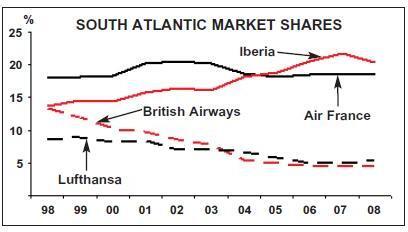

The transformation in the operations of the company has been remarkable over the past decade. Formerly heavily dependent on short haul and domestic traffic, with very little in the way of valuable long–haul operations and a disparate and aged multi–type fleet structure, it now generates more than half of its revenues from a lucrative niche long–haul operation on the South Atlantic. It links efficiently into the Hispanic markets in South America with a leading market position. The fleet now consists of only two aircraft types – the A330/340 and the A320 families. It has withdrawn from the highly competitive market to and within Spain that avoids its home base at Madrid (or at least passed those routes on to its affiliate LCC Clickair/Vueling), and helped by the new runways and terminal has been able to create a true network hub at its base in Barajas.

Through all this it has maintained an unusually cash oriented financial strategy – with the majority of aircraft off–balance sheet through leases or synthetic leases – and enters this downturn with cash balances of €2.3bn (excluding its stake in BA), equivalent to over 40% of revenues, and an enviable on–balance sheet net cash of €1.5bn.

Many airlines come up with imaginative names for their usual medium–term restructuring plans as if they glitzily need to sell them to their stakeholders. Iberia more staidly refers to its target plans as the “Director Plan”. The last one was created for the period 2006–2008 and could be termed a success.

The original plan created four years ago was based on four basic strategic aims: optimising the network, improving productivity, boosting revenues and cutting costs. Over the period of the budgeted plan the group increased overall capacity by a modest 4% — slightly higher than originally envisaged — but within this group figure, domestic capacity was cut by a third, overall medium–haul operations (i.e. within Europe) grew by 4% but capacity between Madrid and other destinations jumped by 45%, and long–haul capacity (mainly to South America) grew by 19%.

The result of this network restructuring led to a sustained increase in revenues from long–haul operations: whereas in 2005 the domestic, medium haul and long–haul networks contributed roughly a third each of total revenues, by 2008 the long–haul revenues accounted for half of the total and the domestic operation a mere quarter.

Importantly, while it has continued to increase its share of the South Atlantic market – overtaking AF–KL (excluding the French and Dutch “domestic” destinations in the Caribbean), in 2004 it has built a 20% share of the market but maintained a higher 24% share of the business and premium markets on the routes. Over this three–year period total passenger numbers on longhaul grew by 19% but business passenger numbers jumped by 42% and unit revenues improved by 23%.

Meanwhile, the mainstay of improvements in productivity arose from the final stages of the fleet harmonisation programme that has been going on for the past decade. Ten years ago the group had a fleet of 10 disparate aircraft types with an average age of 12 years. In 2008 the last of the MD80s left the fleet, leaving the company with two aircraft families: the A320s for short–haul and A340s for long–haul. The average age meanwhile has fallen to seven years and utilisation has risen to 10 hours a day (and 14.5hr for long–haul) with concomitant improvements in both ownership, maintenance and fuel unit costs.

Although the passenger business accounts for 80% of revenues, there are two other relatively important divisions to the business. The MRO operation accounts for about 6% of turnover; and in the 2006–08 business plan the company had set out to increase significantly its third–party sales. The operation appears to have some unusual competitive strengths and – now that the Iberia fleet is all concentrated on the A340 and A320 families – expertise that is unrelated to the needs of the Iberia operation (inter alia they hold licenses for overhaul of RB211 engines). The third party revenues have nearly doubled to €310m in 2008 from 2005 levels.

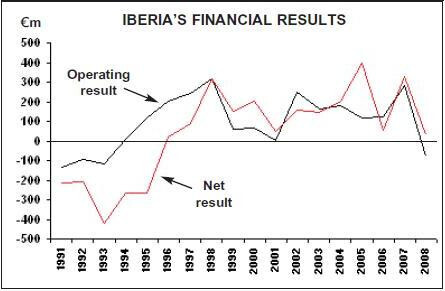

A difficult 2008

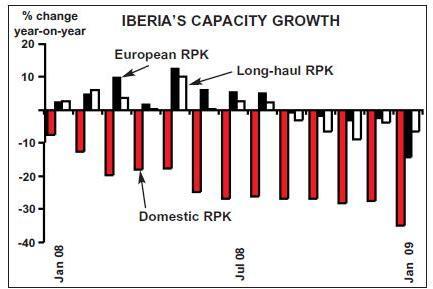

The less successful side of the business is that of handling. Following the liberalisation of the handling business in Spain and the requirement to open up the business to other operators, Iberia has suffered the loss of a handful of ramp–handling licenses in some airports – the most significant being at Barcelona. As a result the performance of the division has been far worse than expected and third–party revenues have fallen by 15% since 2005, with the division being in loss for the last two years. Along with the rest of the industry 2008 proved a very difficult year for Iberia – first with the extraordinary strength in the price of fuel and then, as the recession started to bite increasingly from mid–year, with an accelerating weakness in traffic. For the full year capacity fell by 0.5%, year–on–year demand was down 2.5% and the load factors dipped 1.5 points to a still respectable 80%. This was almost totally skewed towards the retrenchment in the domestic market where there was a full year 17% fall in capacity (against a 2–3% increase across the rest of the network) – principally reflecting the impact of the high speed train link between Madrid and Barcelona as well as the withdrawal from routes not touching Madrid Barajas. In the first half of the year capacity had actually increased marginally, but the group increasingly removed capacity from the system in reaction to the market conditions.

They were helped in one sense by the flexibility provided by being able to accelerate the disposal of the MD80 fleet, and the reduction accelerated in the last quarter of the year to show year–on–year declines of 5% in ASK. Given the continued switch in operations away from domestic and medium- haul routes that do not touch Madrid, and the further emphasis on the network hub operations, the new route structure generated an automatic increase in average stage length — with the resulting difficulty of being able to analyse a consistent progress in unit revenues and costs, exacerbated by the strength of the Euro against the Dollar in the period. Passenger unit revenues on the face of it fell by 3% year–on–year (but would have up on a constant currency basis) – albeit with a declining rate of fall through the year – while total revenues per ASK actually rose in the fourth quarter to end the year less than 1% down.

Unit costs excluding fuel, helped by the Euro strength and the increase in stage length, fell by a useful 5% year–on–year – but the development of the fuel price, along with ineffective hedges in the second half of the year meant that overall unit costs increased by 6%. (These hedges continue into the current year, so the company along with many others in Europe will not get the full benefit of the current low oil price). As a result, EBITDAR halved to €500m (a 9% margin) for the full year.

Barajas hub plan for 2009-11

Given the exceptionally high level of leased aircraft in the fleet the reported operating profit is not readily comparable with other carriers, and Iberia tries to adjust the reported €79m loss to show an economic €40m profit at that level for the period. The company nevertheless even managed to report a pre–tax profit from operations of €5m (down from €415m the previous year) and a net income of €32m, decimated from the 2007 results but representing the thirteenth consecutive year of profits. Despite everything in the current environment the management even expressed the idea that 2009 would also be profitable. At the group’s investor day in Madrid last month the management presented their new strategic plan and targets for the next three years. Once again there are four main planks to the strategy: recover profitability in the main passenger business; accelerate profitable growth in the maintenance business; return the handling operations to a sustainable long–term profitability; and be involved in the “consolidation” process.

On the passenger business once again the group is concentrating on optimising the hub at Madrid Barajas and the size and structure of its route network. Without taking material measures the company foresees underlying operating losses continuing (and increasing) through to 2011, and is setting itself the target of recovering profitability to the peak achieved in 2007. This involves improving results by at least €370m over the next three years – the group has identified that it should be able to achieve half of this from further network and capacity optimisation and the remainder equally split between improving revenues and reducing costs.

On the network, it will continue to expand the relative share of the long–haul network with a modest average 3% rate of growth over the period against flat capacity on short- and medium–haul: there are only a handful of aircraft scheduled for delivery over the next few years, but the preponderance of leased equipment in the fleet provides substantial flexibility for them to adjust capacity depending on market conditions.

The transformation of Barajas into a true network hub is to be taken a stage further. Already 53% of the total passenger traffic connects through the hub; and on long–haul operations this rises to 70% — even though only 8% of domestic passengers and 20% from medium–haul operations transfer onto long–haul routes. The company currently operates three main waves at the airport and is looking to improve the connecting banks – taking advantage of the current slowdown to acquire slots where needed – aiming to increase connecting opportunities by some 12%. At the same time they are reinforcing seasonal differentiation of the yearly, and even weekly, schedule and improving the balance of North Atlantic/South Atlantic capacity across the year. At the investor day there were comments about im proving and maintaining product and brand to be the “best in class” for the premium offering (including flat–beds by 2011) and “as good as the rest” for economy. But the main element for improving revenues through this planned period appears to be the implementation of a true O&D yield management system (which was initiated last September) and the application of best practices in revenue management – for others who have done this, once the system has learnt, it can provide a healthy one–off boost to yields.

On the cost side, the group is looking to generate savings of some €90m over the next few years – a third of which is expected to come from employee productivity (including crewing levels and crew /fleet operational commonality among other things). One mild danger in this may be a planned cabin crew redundancy programme – which has yet to be agreed with the unions – and maybe there could be the danger of strikes. The net impact of these measures is to retain and reinforce Iberia’s apparent competitive cost advantage. Iberia structurally has traditionally held a relatively low cost position in the industry (primarily because of the historic competition from specialist tourism–carriers). The group’s aim is to maintain its unit cost advantage but improve albeit modestly the revenue unit cost gap.

On the maintenance side the aim unsurprisingly appears to be to continue further to target third party revenues – currently 45% of total volume. Of this external revenue 65 % of turnover is provided by engine overhaul – primarily RB211 and CFM56 – and only 10 %-15% from components and airframe maintenance. The company is looking to build on these two areas – and among other things is exploring the opportunities of its links into South America to put off–shore the more man–hour intensive airframe works (which would only really work for widebodies, and could provide up–to 30% cost advantage even after transport costs) while developing a competitive maintenance base in Barcelona (helped by the captive customer of Clickair/Vueling) for narrowbody fleets across the Mediterranean.

Regarding Iberia’s handling operations, the group maintains optimism that it should be able to return the division to profitability. The liberalisation of the Spanish handling market in 2006 brought in a plethora of new competitors and for Iberia a loss of some major contracts (although they have gone back into JVs with some of the license–winning bidders). After a profit of around €20m in 2007 the operation collapsed to losses of €25m in the past two years. The company’s hope is that it will see a reversal of the decline in average ramp–handling charges that this increased competition brought in, while at the same time is looking to “rightsize” the operation through managed redundancy programmes.

The net target of all these measures aims for a return to EBITDAR margins of over 15% within three years and a return to an RoE of over 12%.

Strategic consolidation

The past few years has seen intense competition within the Spanish domestic market – one of the largest within Europe. Not only home–grown – with a monumental fight between Spanair, Air Europa, Vueling and Iberia’s own Clickair – but also from the incursion of the likes of easyJet, Ryanair and Air Berlin, and there has been some particularly intense capacity growth and yield pressure. Since 2003 the domestic market grew by over 30% (even with the introduction of the Madrid–Barcelona high speed train last year) and Iberia’s share of that market fell from over 50% to 35% while the LCC share has grown from virtually nothing to 20%. In one sense the current downturn is an opportunity for a long–anticipated rationalisation of this market; the Clickair and Vueling merger should now go ahead (in which Iberia will have a stake of over 40%) providing a strong Iberia family base in the Catalonian capital of Barcelona. Spanair on the other hand particularly has some hard choices to return to profitability – although it has cut back capacity considerably after its haemorrhages of the past two years and now has new majority owners, even though SAS retains a minority stake. Air Europa meanwhile remains highly dependent on group travel.

This is relatively minor compared with the plans on the Atlantic. Following the introduction of the first phase of transatlantic open skies last year, Iberia, American and British Airways started their application for ATI on all routes across the Atlantic, to include a joint business agreement (aka joint venture) between the three. If granted this will create a business of around €6bn covering 42 routes and 10m passengers – on an equivalent base to the four–way joint venture established by AF/KL/DL/NW of the SkyTeam alliance, and the potential Star agglomeration around UA/LH.

Spain was one of the few European countries (along with the UK) that did not have an open skies agreement with the US before last year – and this had effectively previously precluded any hope of anti–trust immunity. At the British Airways investor day in March, the BA management were fairly confident that ATI for the JV would be granted by the autumn – the DoT and DoJ having recently requested a mass of additional information. Meanwhile, Iberia might look to improve penetration into its niche market in South America through link–ups with one or more of the regional players.

As it stands Iberia has a tremendous niche market position into Latin America but remains under significant pressure from new model entrants into its domestic and medium–haul markets. Niches however are always attractive to others; and the multi–hub powers of the two main European network carriers could be turned to attack (and AF/KL already have a similar share of the market to that held by Iberia). Albeit a relatively small player, Iberia naturally wants to be involved in the core of one of the developing “super” alliances. With the significant changes in the European landscape created by AF/KL and the LH grouping, the natural choice for Iberia would be a more permanent link with British Airways. The two have been in deep negotiations for over a year (delayed a little by BA’s proposal to Qantas) while Iberia has cemented its intentions by building a cross–stake in the UK flag carrier.

The two have been connected for over a decade (with BA taking a core stake in the privatisation process) and have had joint operations between London and Madrid/Barcelona for some time. There should be considerable synergistic benefits – with various estimates pointing to joint results improvements of some €400- €500m annually (a conservative 3–4% of combined revenues). Given the geographical position of the respective hubs and the nature of the route networks, these are more likely to come from cost synergies than from revenue improvements (as realised for example by AF/KL following their merger in 2004), although there could be some surprising benefits to Iberia’s MRO business from the effective merger. The plan is to establish a new holding company into which will be folded the two existing quoted groups – retaining the separate brands and market identities, and to be listed on both London and Madrid exchanges.

Relative shares?

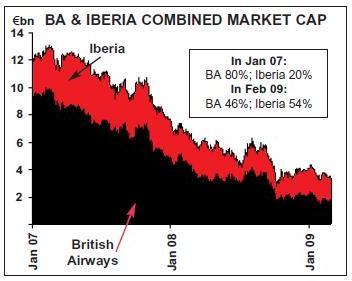

There have obviously been some major translation difficulties in the negotiations – and to outsiders the complications of the UK defined–benefits pension schemes and the accounting thereof (there will undoubtedly be another massive shortfall from the £1.5bn deficit to be announced after the BA pension funds' next valuation at the end of the month) must be almost incomprehensible. However, both management teams at their respective investor days emphasised that the pension question is no longer an issue and that they have identified and quantified the expected synergies. Given the respective performance of the two group’s share prices, and the weakness of sterling against the Euro, there has been much press comment suggesting that there would be a major problem in negotiating the relative share of the combined group. The Iberia share price has significantly outperformed the rest of the industry in the past eighteen months and whereas BA’s market capitalisation would have represented 80% of the sum of the two at the beginning of 2007, at the beginning of February this year it fell below 50%. However, although Iberia’s CEO Fernando Conte (slated to become the chairman of the combined group) mentioned last month that this was under negotiation, BA’s CEO Willie Walsh in early March stated that it was no longer a problem; many pundits are suggesting that the agreed ratio is likely to be 55% BA/45% Iberia.

The last remaining issue is believed to be one element of corporate governance, which Willie Walsh said in particular related to the degree of control by the holding company of the treasury and cash resources of the underlying operating companies. Given that it is Iberia that has the cash (grossly representing nearly 150% of its current market capitalisation) it is understandable that the core Iberia shareholders may fear the worst. Having come so far however it would appear very unlikely that this last remaining issue will be an irresolvable deal–breaker.

Even so if the fusion of companies takes place it will be a first for Europe: both are well–managed; both are negotiating from a position of strength; and, it is likely (despite BA’s history of failed espousals) to be a marriage of equals.

| Turnover | Third party | |

| US$m | % | |

| HAECO | 550 | 100.0 |

| Snecma | 786 | 100.0 |

| British Airways | 795 | 4.4 |

| Continental | 849 | 1.9 |

| Northwest | 983 | 2.2 |

| Iberia | 995 | 47.4 |

| Iberia & BA | 1,789 | 28.3 |

| SR Technics | 1,368 | 100.0 |

| Delta | 1,410 | 25.4 |

| ST Aerospace | 1,738 | 100.0 |

| United | 2,155 | 6.5 |

| American | 2,336 | 10.7 |

| Air France | 3,832 | 32.4 |

| Lufthansa | 4,857 | 60.7 |