Tough times ahead for AirAsia Group?

March 2008

With a massive 140 A320s on firm order, the AirAsia Group is set to become the largest operator in the world of the model.

But while the self–styled "lowest cost airline in the world" has a significant advantage over MAS and other legacy carriers, will AirAsia be able to place these new aircraft profitably once ASEAN countries adopt an open skies regime, after which existing and new LCCs are certain to increase their capacity too?

AirAsia was launched by a government–owned conglomerate in 1996 as a regional airline, but operations were scaled back to domestic services before Tune Air — a holding company owned by AirAsia Group CEO Tony Fernandes and ex–Ryanair director Conor McCarthy — bought the loss–making and heavily indebted airline in September 2001 for a nominal fee of RM 1 (US$0.27). The airline was relaunched as an LCC in January 2002, and the AirAsia Group raised US$227m in an IPO on the Kuala Lumpur market in November 2004.

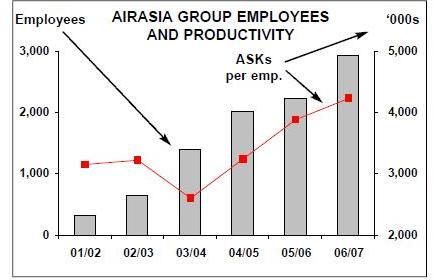

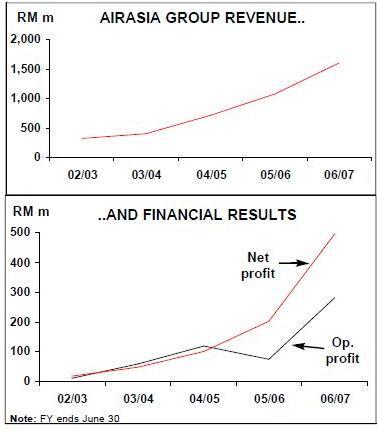

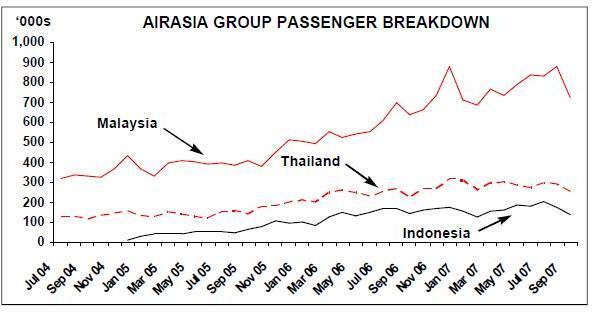

Today the shareholders include not only Tune Air (which has a 30.9% stake) but also a number of investment companies and private shareholders, and they have seen the Kuala Lumpur–based AirAsia Group rack up substantial profits over the last few years (see charts, page four). In the 2006/07 financial year (ending June 30th), AirAsia Group recorded a 50% increase in revenue to RM 1.6bn (US$463m), and a net profit of RM 498m (US$144m), compared with RM 202m in 2005/06. The group carried 14m passengers in the 12 month period, 51% up year on- year, with load factor up 2.1 percentage points to 79.6%. Yield rose 11% in 2006/07 (although the average fare was down 2%, due largely to a 6% reduction in average trip length). However, cost per ASK rose 7% due to rising fuel prices and higher average user and station charges from more international routes, though after stripping out fuel, unit costs fell by 4% thanks to the effect of fewer leased aircraft in the fleet, the impact of low cost terminals at Kuala Lumpur and Kota Kinabalu (the latter opening in February 2007), and productivity improvements (see chart, page six). Impressively, net margin rose from 18.8% in 2005/06 to 31.1% in 2006/07.

Today the AirAsia Group operates 90 routes to 11 countries: the three "home countries" of Malaysia, Indonesia and Thailand, plus China, Myanmar, Philippines, Vietnam, Laos, Cambodia, Brunei and Singapore. The group employs 3,000, most of which are stationed at six bases: Kuala Lumpur, Kuching, Kota Kinabalu and Johur Bahru in Malaysia, with Jakarta in Indonesia and Bangkok in Thailand.

The stunning success enjoyed by the AirAsia Group since 2002 has been due largely to the problems at the legacy carrier, Malaysia Airlines (MAS), where a high structural cost base and ineffective management just couldn’t compete with an aggressive LCC that quickly became profitable in the domestic and international Malaysian market.

But AirAsia Group has wider ambitions than just the Malaysian market, since the Asia/Pacific region has 250 cities with a population of half a million or more, few of which have any significant international routes, let alone an LCC service. Furthermore, within south–east Asia a large majority of the region’s population has never travelled by air, so the AirAsia Group wants to create the so–called "Ryanair effect", with low fares encouraging people to fly who have never previously flown.This analysis encouraged the group to set up subsidiaries in Indonesia and Thailand (see below), and build a huge order book. The first A320 order (for 60 aircraft) was only placed in March 2005, so the order book has built up rapidly, with the latest addition coming in December 2007 when the AirAsia Group ordered another 25 A320s (firmed up from existing options), bringing total orders for the model to 175 aircraft (of which 140 are outstanding), with another 50 on option.

The first two A320s arrived in December 2005, and the group will receive 23 aircraft in the 2008 financial year, 14 in 2009, 23 in 2010, 24 in 2011, 24 in 2012, 24 in 2013 and 10 in 2014. Of the 175, just under half will be used for "frequency additions", 33 will replace the 737s that the group currently operates, while the rest will be put onto new routes.

Even given the potential of the Asia/Pacific market, that’s a large amount of additional capacity — particularly since the group has experienced different levels of success in the three main markets it has already entered. Whereas in the Malaysian market the group has faced weak competition, in both Thailand and Indonesia the group’s subsidiaries have been exposed to far greater competition — and in both countries the subsidiaries have found it difficult to make a profit.

Indonesia

The Indonesian subsidiary was launched as Awair in 2000 before becoming Indonesia AirAsia in December 2005, a year after AirAsia Group made a 49% investment (the other 51% is owned by Indonesian investors).

The Jakarta–based carrier operates a fleet of 10 737–300s, with a final 737 transferring from the Malaysian AirAsia in March before the airline starts receiving A320s as direct replacements for the 737s, with the first coming in the summer. Indonesia AirAsia serves 10 domestic and three foreign destinations out of Jakarta (to Kuala Lumpur, Johor Bahru and Bangkok), and a second hub is being set up at Bali this March, which will develop domestic routes to eastern Indonesia and international services to destinations such as Malaysia, Thailand and even Australia.

Indonesia AirAsia made an operating loss in the 2005/06 financial year but — frustratingly — AirAsia Group gave little detail of results at subsidiaries in its 2006/07 annual report, and the group even stopped reporting passenger numbers at its subsidiaries after September 2007 (see chart, page seven). The lack of information can only raise doubt on AirAsia Group’s previous prediction that the Indonesian affiliate was "turning around" and would break even in 2006/07, even though the airline was boosted significantly in 2006 by the government’s allowing of fare advertising for the first time, which enabled Indonesia AirAsia to launch aggressive promotions and advertising. However, it is known that AirAsia suffered a high number of unscheduled maintenance and aircraft delays and cancellations at the Indonesian operation in 2006/07, and so it’s unlikely that the Indonesian operation has broken even yet — and this was confirmed in February when AirAsia said that its "portion of losses" at the Indonesian operation for October–December 2007 was RM 3.3m (US$1m).

Additionally, Indonesian LCC Lion Airlines is expanding rapidly: it currently operates a fleet of 28 aircraft, but it has a hefty 178 737- 900ERs on order. The carrier will base 60 aircraft in Indonesia and the rest across the Asia/Pacific region — including Thailand — and will prove a major challenge to AirAsia Group in the region.

Thailand

Thai AirAsia was launched in November 2003, and AirAsia Group currently holds a 49% stake. Already though, the Bangkokbased airline has had a chequered history.

It was launched as a joint venture with the Shin Corporation, a telecommunications group owned by the family of former Thailand prime minister Thaksin Shinawatra (who was deposed by a military coup in September 2006 after allegations of corruption) that subsequently sold part of its 50% stake to Thai businessmen Sittichai Veerathummanoon in order to get around foreign ownership limits (since Shinawatra’s stake was bought by Temasek Holdings, the Singapore government’s investment vehicle in January 2006). Sittichai and Shin then sold their entire shareholding to six of Thai AirAsia’s management team in the summer of last year.

The airline received its first A320 at end of 2007 and Thai AirAsia will be an all–A320 operation sooner than originally planned thanks to rising fuel prices, with the last of its current 14 737–300s leaving the fleet in 2010.

Within the Group (and prior to the ASEAN open skies agreement) Thai AirAsia was originally seen as a "launch pad" for new routes into Indo–China, as Thailand has a series of open skies deals with countries throughout the region, and Thai AirAsia became the first LCC to operate into China, from 2005. But, although Thai AirAsia is helped considerably by a 50% discount on airport fees in the country as well as an eight year tax exemption, like its Indonesian cousin the Thai subsidiary is struggling to make a positive contribution to AirAsia Group.

While Thai AirAsia currently operates to 10 domestic and nine foreign destinations, most new routes have been put on hold for at least 18 months thanks to rising fuel prices. The situation hasn’t been helped by the rise of other LCCs in Thailand, including Nok Air (a subsidiary of Thai Airways International that has 12 aircraft) and One- Two–Go (owned by Orient Thai Airlines). Additionally, the political situation in Thailand has affected demand there, both from Thai travellers and from visiting tourists, and for 2006/07 AirAsia said that the "financial result from the operations in Thailand is not significant compared with the Malaysian operations".

According to Tassapon Bijleveld — Thai AirAsia’s CEO — revenue rose by 40% in 2007 (the calendar year), but the carrier still could not post a profit. Figures just released show a RM 8.2m (US$3m) loss for Thai AirAsia in the October–December 2007 period, although Bijleveld insists that the airline will make a profit in January–December 2008. The airline has also been hit hard by financial penalties for breaking leases on 737–300s returned to lessors, while Bijleveld also blames "intense competition in Thailand through rampant undercutting". But although the group adds that the "current operational pressure" at the subsidiary airlines "is a temporary blip", the medium–term goal for Thai AirAsia of an IPO around 2010 or 2011 must be in some doubt.

Other countries

The AirAsia Group has been linked to a large number of new subsidiaries in other Asian countries — although many of its plans have come to nothing:

- Sri Lanka In 2006 the group was reported to be in negotiations to buy 49% of Sri Lankan carrier Holiday Air, an LCC that planned to launch operations to domestic and international destinations out of Colombo in 2007. A "technical partnership" was agreed whereby Holiday Air changed its name to AirAsia Lanka, with AirAsia Group agreeing to train the pilots of Air Asia Lanka and with the SriLankan airline also using AirAsia’s internet booking system, but despite plans for a fleet of seven aircraft, this project did not progress.

- Bangladesh Again in 2006 an MoU was signed with the Orion Group — a Bangladeshi conglomerate — to analyse a joint venture carrier provisionally called East West Airlines. This venture also appears to have come to nothing.

- Singapore AirAsia Group seriously considered buying Singaporean LCC Valuair in 2005, and an offer was put to Valuair’s shareholders in that year. However, some of Valuair’s shareholders were unhappy with the price and with AirAsia’s plan to drop some of Valuair routes, and instead Valuair merged with Jetstar Asia.

- The Philippines Negotiations have also been held between the AirAsia Group and Manila–based Asian Spirit over establishing Philippine AirAsia at Clark airport (which is close to Manila), but apparently any potential deal collapsed following Asian Spirit’s insistence that a Philippine AirAsia should focus on domestic trunk routes, leaving Asian Spirit to continue its regional routes.

- Vietnam An LoI was signed with the Vietnam Shipbuilding Industry Group (also known as Vinashin, and which is owned by the Vietnamese state) in August 2007. Although the idea is still subject to formal Vietnamese government approval, the so–called Hanoibased Vinashin AirAsia would operate initially on domestic routes before expanding into international services.

But unless the Vietnamese government changes the current limits on foreign ownership (which it says its is considering), the AirAsia Group will be restricted to a 30% ownership stake in the Vietnamese carrier — and in any case reports out of Asia suggest the plans are facing considerable opposition from both Vietnam Airlines and Pacific Airlines (the former of which is owned 100% by the state, and the latter 82% by state bodies and 18% by Qantas). Currently Thai AirAsia operates between Bangkok and Hanoi and has been trying — unsuccessfully — to win permission from the Vietnamese authorities to operate routes to Ho Chi Minh City.

- China Launching an airline in China is believed to be at the very top of AirAsia Group’s wish list, but Fernandes believes that the political power held by the Big Three Chinese airlines means that no local AirAsia subsidiary will be possible within the next five years at least.

Given this reality, the group is making do with a furious expansion on routes into the country, and most of the 15 routes being launched by the group in 2007/08 are to China, with new services to Hong Kong, Haikou, Guilin, Xiamen and Shenzhen from Kuala Lumpur, Bangkok or Kota Kinabalu. A Kuala Lumpur–Guangzhou route was launched this January, where it competes against China Southern and MAS (which code–share with each other). The airline expects to carry 130,000 passengers a year on the route, which is the fourth Chinese destination out of Kuala Lumpur, joining services to Shenzhen, Xiamen and Macau, and with routes to Hainan, Gueling and Hong Kong also being planned.

AirAsia X

Long–haul LCC AirAsia X was set up last year as a separate company from the AirAsia Group, although it is now owned 48% by Aero Ventures (which includes many of the main shareholders in AirAsia Group,including CEO Tony Fernandes and deputy CEO Kamarudin Meranun), while 16% is held directly by the AirAsia Group and 16% by the Virgin Group. AirAsia Group paid RM 26.7m (US$7.6m) for its initial 20% stake, while the Virgin Group is believed to have paid a similar sum for its initial 20%. The original investors have now been diluted but in return experienced a massive paper profit because in February this year the Manara Consortium — a Bahrain–based investment company — and Japanbased financial services group Orix Corporation (which owns Dublin–based lessor ORIX Aviation) each bought a 10% stake, for RM 125m (US$39m) each. AirAsia X considers these as "strategic investors", and the funds raised will be used to finance aircraft purchases.

Sarawak–based AirAsia X launched an initial four–flights–a-week route between Kuala Lumpur and the Gold Coast in Australia in November 2007, chosen partly because it is close to Brisbane, at which the LCC Virgin Blue (in which the Virgin Group has a 25% stake) is based. Fernandes says that links with Virgin Atlantic may be developed in the future, though this would stop short of code–sharing.

A second route was launched this February: a five–times–a-week service between Kuala Lumpur and Hangzhou (near Shanghai) in China, which is operated with the single A330 that is AirAsia X’s only aircraft so far. This is on a six–year lease from AWAS, but in January the airline said it had decided against expanding its fleet in the short–term thanks to a shortage of available A330s, and with those that are available having lease rates that are too expensive.

This is obviously a blow to the carrier’s long–term plan to build up a network of up to 50 destinations in the Asia/Pacific and European regions, and further routes will now have to wait until AirAsia X receives the first aircraft from its order for 15 A330–300s (in a high density, 400–seat configuration), the first two of which are due to be delivered in the fourth quarter of this year, after which two more will come in 2009, three in 2010, four in 2011 and four in 2012. But it’s possible that alongside this delivery schedule AirAsia could lease more A330s if lease rates start to come down (which should happen once airlines start replacing the model with 787s).

Ten A330–300s are also under option and these are expected to be upgraded to firm orders at some point in 2008. AirAsia X will place an order for 25 further aircraft (plus 25 options) in the second half of this year, with negotiations to buy A350s or 787–900s already under way.

Among routes believed to be under consideration at AirAsia X are other Chinese destinations (such as Tianjin), Japan and services to the UK via the Middle East (probably Dubai or Sharjah). While Fernandes has hinted that an interline agreement is out of the question, AirAsia X may co–ordinate its flight times in order to connect in with other European LCCs. However, a stopover in the Middle East will bring AirAsia X into competition with Emirates and others, although the LCC is confident this will not be a problem thanks to the feed it has in Asia. Routes are also planned to India, and AirAsia X has already carried out negotiations with the airport authority at Amritsar.

Despite these ambitions, and although AirAsia X expects to be profitable in its second year of operation, there are question marks over how much of the LCC business model can be applied to long–haul. While passengers have to pay for frills such as food and in–seat entertainment, AirAsia X operates alongside Air Asia out of Kuala Lumpur’s Low–Cost Carrier Terminal (LCCT), which is 20km away from the airport’s main terminal. AirAsia X obviously believes it is crucial to connect with short and medium–haul AirAsia Group passengers, but Air Asia X must lose some passengers who would prefer to connect at the main terminal.

And whereas the various AirAsia airlines have turnaround times of around 25 minutes, AirAsia X has a turnaround time of at least 75 minutes. Curiously, as part of an "agreement", AirAsia X has vowed never to operate competing flights of less than four hours duration, while the AirAsia Group will not operate competing flights longer than four hours. This will lead to the strange situation in India that AirAsia will serve destinations only in the south of the country, while northern cities will be served by AirAsia X. At least four destinations will be served in India by each of AirAsia and AirAsia X by 2010, Fernandes says.

While AirAsia X is a separate operation to the AirAsia Group, it is doubtless distracting the attention of Fernandes and others from focussing 100% on AirAsia Group. The long term intentions of Fernandes and the other investors for AirAsia X is almost certainly to make a profitable exit once (or if) the longhaul LCC is established and profitable, and Fernandes has already mentioned a possible float by 2010 at the very earliest.

Cost leadership

Assuming AirAsia X does not become a distraction, the key to AirAsia Group’s continued success will be to maintain its low cost base and place its new aircraft successfully, with ASEAN being the immediate focus for AirAsia Group according to Fernandes, as bilateral restrictions are eased ahead of ASEAN open skies.

On the former issue, the group still claims to have the "lowest unit cost in the world", thanks to its location and LCC strategy. Taking a closer look, by far the biggest difference between AirAsia Group’s unit costs and its LCC peers is in two key areas: employees and aviation charges. At 0.33 US cents/ASK in 2006/07, AirAsia Group’s staff costs are around 0.8–0.9 US cents/ASK lower than the average of rival LCCs Gol, JetBlue, Southwest, Air Tran, EasyJet, Ryanair, WestJet and Virgin Blue — thanks entirely to Asia being such a low cost region. That’s a huge cost advantage, and in addition the group’s user station/aviation charges of 0.22 US Cents/ASK are 0.7–0.8 US cents lower than the same LCC peer group, thanks again to lower Asian user charges.

But AirAsia Group is not competing against these other LCCs, but against airlines in the Asia/Pacific region, and while the local legacy carriers will never be able to match the unit costs of AirAsia, the region’s lower structural costs are available to all LCCs — so the real test of AirAsia Group will come once the challenge from Asian LCCs increases. With roughly the same unit costs as AirAsia Group, the other LCCs will be racing to place capacity on the key Asia/Pacific routes under ASEAN open skies — and so the key indicator for AirAsia Group will be how its yields hold up as it places its massive A320 order into the market.

A foretaste of what AirAsia Group will face will be shown on the Kuala Lumpur- Singapore route, on which AirAsia started a daily service this February after the Malaysia and Singapore governments partially eased the restrictions on their existing air services agreement, in order to allow LCCs to operate on this key route against Singapore Airlines and Malaysia Airlines.

All restrictions on the route will be lifted by December (when the open skies deal between the 10 ASEAN countries — which have a combined population of 500m — starts to come into effect). AirAsia had been lobbying hard to get onto this lucrative route, but while AirAsia Group is undercutting the legacy carriers' fares substantially, it also faces competition from Jetstar Asia and Tiger Airways (owned 49% by SIA), and as HSBC says, "we anticipate Air Asia struggling to rival the more efficient full service carriers and differentiating itself from the other low cost carriers which will also gain access to the routes". There may also be competition from Firefly, a domestic LCC set up by MASthat aims to launch international services, including Kuala Lumpur–Singapore.

Certainly until recently the AirAsia Group has faced little or no LCC competition in its main markets, but that is changing, and this will inevitably result in yield erosion. SIA’s Tiger Airways, for example, started a Singapore–Kuala Lumpur route in February this year, and has 58 A320s on order.

AirAsia Group faces other challenges too, including constraints at its key operational base, at Kuala Lumpur. An LCC terminal costing US30m was only built in 2006, but now that AirAsia has transferred all its operations there from the main terminal (charges are 40% lower at the LCC terminal than the main one), the LCC terminal has already fully used up its capacity of 10m passengers a year, and Malaysia Airports Holding (the government- controlled airport operator) is frantically increasing the capacity to 15m at the moment. But that too is likely to prove insufficient within a few years, so there are further plans to increase annual capacity to 30m.

Fuel challenge

Perhaps the biggest short–term challenge to AirAsia Group comes from rising fuel prices. The group previously forecast higher profits in 2007/08 as long as fuel price rises were not too high — but this is exactly what has happened, and to make matters worse, the group’s management of this risk has been nothing short of disastrous. Essentially, Air Asia Group sold call options that bet that oil prices would not break through the US$90 per barrel, but the group called this wrong, and one analyst predicts that Air Asia’s "wrong" bets on the price is cutting group profits by around US$3m a month.

Fernandes says that although in the past hedging had "ultimately benefited the company", the current volatility of oil prices "is a nightmare".

The group’s wish to mitigate risk here is understandable, as each extra US$1 change in the actual price per barrel paid by AirAsia translates into a RM10m (US$3.1m) fall in profits before tax, but the group’s hedging of this risk has simply been erroneous.

Additionally, the group’s hedging policy has led to some investors selling the group’s shares, leading to a 15% fall in the share price at the end of 2007, and to some downgrading by analysts.

AirAsia’s senior executives were unhappy at the group’s share price fluctuation in late 2007, but although Fernandes says that "the stock market needs to understand AirAsia better", the market is only reflecting concern that the group’s derivative trading was well outside its area of expertise.

Shareholders should also be concerned that AirAsia Group is benefiting tremendously from the weak US dollar, as only a tiny percentage of its revenue is in dollars, whereas at least 60% of its costs are dollar based. At some point in the future that advantage may disappear, and this will have a significant impact on the profit level.

In the second quarter of 2007/08 (October–December 2007 — although from now on the group will change its FY to January–December) Air Asia Group recorded a 43% rise in revenue to RM 632.8m (US$197m), with operating profit of RM 154.8m (US$48m), compared with RM 86.8m in 2Q 2006/07. Net profit was RM 245.7m (US$76m), compared with RM 142.1m in 2Q 2006/07. It’s an excellent result, and furthermore the AirAsia Group is strong financially. Cash and cash equivalents stood at RM 426m (US$132m) at December 31st 2007, while long–term debt rose from RM 2.3bn (US$714m) at June 30th 2007 to RM 3.4bn (US$1.1bn) as at the end of 2007, thanks largely to aircraft purchases.

Nevertheless, it’s the medium–term challenge of placing the huge increase in capacity that is the real test of AirAsia Group’s strategy. Though Fernandes says that rising costs will slow the establishment of LCCs in the region, he acknowledges that competition is increasing. As the group’s track record has shown, entering new markets will not be easy, and Mark Webb of HSBC Global Research says AirAsia yields are expected: "to remain flat amid a saturated domestic market and stiff competition outside Malaysia ….if [Asian economic] growth slows significantly, AirAsia — with its aggressive expansion plans — may find itself unable to generate sustainable levels of return".

| AirAsia | Fleet | Orders | Options |

| A320-200 | 32 | 140 | 50 |

| 737-300 | 9 | ||

| Thai AirAsia | |||

| A320-200 | 3 | ||

| 737-300 | 14 | ||

| Indonesia AirAsia | |||

| 737-300 | 10 | ||

| AirAsiaX | |||

| A330-300 | 1 | 15 | |

| Total | 69 | 155 | 50 |