TAM: investors hope for new Brazilian success

Feb/Mar 2006

TAM, Brazil’s largest domestic airline, raised almost US$700m through a global share/ADS offering on March 10, which also gave the company a listing on the New York Stock Exchange (NYSE). The management has reiterated plans to expand the modest international network to key cities such as Lima, Caracas and London in 2006. Does TAM have a viable long–term strategy? The airline has traded on the Bovespa (Sao Paulo stock exchange) since its June 2005 IPO, which raised R$547m (US$257m) from the sale of 30.4m preferred shares to local and international investors. The stock has performed well, rising from the IPO price of R$18 to almost R$50 in mid–February, when the global offering was announced.

On March 10, TAM and some of its shareholders sold 35.6 million preferred shares, including 11.7m preferred shares in Brazil and 23.9m preferred shares in the form of American Depositary Shares (ADSs) in the US and other countries.

The price was R$42 per preferred share and US$19.43 per ADS, based on the previous day’s closing price on the Bovespa. The offer price was lower than originally expected, reflecting a 15% decline of the Bovespa share price since the offering was announced. TAM began trading on the NYSE on March 10, becoming the fourth Latin American airline to do so (after LAN, Gol and Copa).

Unfortunately, the bulk of the shares (30.6 million) were part of a secondary offering by TAM’s shareholders, including investment funds and members of the founding Amaro family. The airline itself raised only US$94m in net proceeds from 5m shares, though it will raise an additional US$100m if underwriters exercise fully their over–allotment option of 5.3m shares.

But, importantly, TAM established a foothold in the much larger US capital markets, which it can tap for further funds in the future. While Credit Suisse Securities and Pactual Capital Corporation were the joint book–runners on the global offering, TAM began the relationship- building by also bringing in Merrill Lynch, Citigroup, JP Morgan and UBS.

Nevertheless, the proceeds, which will be used for fleet renewal and expansion and general corporate purposes, come in handy for an airline that is highly leveraged, has all of its fleet on operating leases and has significant aircraft order commitments.

The share/ADS offering has increased TAM’s free float from 21% to about 45%. The Amaro family’s stake declined from 59% to 55%, while the five investment funds that previously held 20% got out entirely.

However, the Amaro family remains firmly in control through its ownership of 99.97% of TAM’s common shares, which carry voting rights. The company’s eight–member board includes three family members: the wife, daughter and son of founder Rolim Amaro, who died in a helicopter crash in 2001. Mrs. Noemy Almeida Oliveira Amaro is chairman. The CEO since January 2005 has been Marco Antonio Bologna, who was previously the company’s investor relations officer and before that held executive positions in major financial institutions.

The holders of preferred shares or ADSs have no general voting rights but have the right to receive dividends equal to holders of common shares. Brazilian corporate law requires a company to distribute at least 25% of its annual adjusted non–consolidated income to shareholders.

Although TAM previously escaped that requirement (because it was able to set profits against prior losses), the company has approved the distribution of R$29.4m (US$13.7m) in dividends based on 2005 earnings.

That said, international investors are mainly hoping that TAM might in some degree repeat Gol’s success story. Gol has more than tripled its share price since its NYSE debut in 2004 and is now achieving 30%-plus operating margins.

Gol and TAM are completely different entities.

While Gol is a new entrant and a brilliant adaptation of the Southwest–style LCC model, TAM is an older–established, full–service airline and a great turnaround story. TAM is also more than twice the size of Gol in terms of 2005 ASKs.Calyon Securities analyst Ray Neidl, when initiating coverage of TAM late last year, observed that TAM was "the first to admit that it had to rapidly reform or perish, as have other Brazilian carriers in recent years". Its story is a nice contrast to VASP and Transbrasil’s demise and Varig’s bankruptcy and shrinkage.

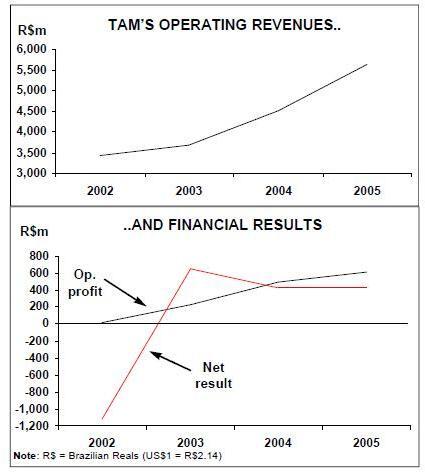

Founded in 1986, with scheduled operations by predecessors going back to 1976, TAM attracted fresh capital from private equity funds in the late 1990s and spent several years restructuring its fleet and operations. The result was a modern cost–competitive airline with a growing fleet of A320s and A330s. Profitability was restored in 2003.

In the past seven years, TAM has grown at a much faster rate domestically than its competitors. Since mid–2003 it has captured most of the market share that Varig has lost and the bulk of VASP’s, which had 8.8% of the domestic market when it ceased operations in September 2004. TAM’s domestic market share surged by 7.7 points in 2005. In December, it accounted for 46.1% of domestic RPKs, compared to Gol’s 29.8% and Varig’s 21.7%.

Varig’s struggles have also meant new longhaul international expansion opportunities for TAM. Last year the airline increased its international market share by 4.4 points to 18.9%, partly a result of the addition of new routes to Miami, Paris and New York.

The past two years have seen strong revenue and profit growth, thanks to the market share gains, resumption of robust GDP growth in Brazil and continued cost cutting. TAM achieved a 10.9% operating margin in both 2004 and 2005. Last year it earned a net profit of R$427m (US$200m) on revenues of R$5.6bn (US$2.6bn). Capacity rose by 33% and the load factor by 4.6 points to 70.6%.

TAM continues to benefit from cost savings and efficiency improvements resulting from restructuring. Last year its ex–fuel unit costs declined by 16.4%, helped by an increase in average daily aircraft utilisation from 8.98 to 11.36 hours. Including fuel, unit costs fell by 7.4% to 18.63 centavos (8.7 US cents) per ASK.

Like other Brazilian carriers, TAM has been able to increase its fares to compensate for higher fuel prices. The airline believes that over 50% of any increase in fuel costs may be passed on to customers in fares — a contrast to the US situation.

The biggest negative in last year’s results was that TAM’s domestic and international yields fell by 10.8% and 16.1%, respectively. The airline admitted that it sacrificed some yield for market share improvement.

TAM intends to continue to focus on the business segment, which accounts for around 80% of its traffic domestically, while also operating leisure–oriented and cargo services (to maximise aircraft utilisation). This may not sound dramatically different from other airlines' strategies, because 70% of all domestic trips in Brazil are for business purposes. However, TAM’s business model specifies "service levels superior to competitors and charging higher fares".

The airline rightly pointed out in the offering prospectus that one of its key risks is that there is a significant demand shift in favour of low–fare operations. In other words, there is some uncertainty about the long–term viability of TAM’s full–service, higher–fare business model.

Then again, if TAM has a competitive cost structure and other LCC characteristics, such as a strong corporate culture and highly motivated workforce — which appears to be the case — there is no reason why it could not simply make adjustments to the model.

TAM believes that it can hold onto business traffic because it offers "value–added service at competitive prices", meaning a larger network of destinations, more direct flights, more frequencies and more convenient schedules than Varig and Gol. It has a strong brand and "espirito de servir" (spirit of service). It was the first airline in Brazil to introduce an FFP (1993) and, among other things, the only airline to offer video and audio entertainment on domestic flights.

Curiously, TAM listed "liquidity and solvency" as one of its competitive strengths, which is not really the case even though the balance sheet has improved steadily in recent years. For example, the current ratio (current assets over current liabilities) rose to 1.57 at year–end 2005 from 0.80 two years earlier. Cash position improved from R$297m at year–end 2004 to R$996m (US$465m) at year–end 2005 — the latter represented an adequate 17.6% of annual revenues. Total debt is not excessive at R$641m (US$300m), but lease–adjusted debt–to–capital ratio before the share offering remained high at 89%.

It seems likely that international investors — quite justifiably — overlooked some of those weaknesses because Brazil’s aviation market is so promising. The market is relatively undeveloped with huge growth potential. According to the prospectus, Brazil had only 32.2m domestic enplanements out of a population of 182m in 2004, compared to 587.5m domestic enplanements in the US out of a population of 293m in 2003. The Sao Paulo–Rio de Janeiro shuttle is one of the busiest shuttle routes in the world. Furthermore, regulatory policies in Brazil continue to protect the airline industry’s financial performance; the rules limit route entry, addition of capacity or frequencies, acquisition of new aircraft and the entry of new carriers.

The market is so large and undeveloped that there are probably plenty of good growth and profit opportunities for three efficient and well–managed major airlines — TAM, Gol and Varig, if the latter gets its act together.

International growth plans

TAM operates throughout Brazil, serving the largest number of domestic destinations (46), plus another 27 through regional alliances with other airlines. International services cover eight destinations in Latin America — Buenos Aires and Santiago, as well as smaller cities served through Paraguay–based subsidiary TAM Mercosur — and three business routes to the US and France (Miami, New York and Paris). In addition, TAM has code–shares with American, Air France–KLM and others.

The strategy is to expand selectively in international markets. According to the prospectus, TAM plans to begin daily flights to Lima (Peru) in a code–share with Taca on March 18. The airline also recently obtained authorisation to serve Caracas (Venezuela), which is likely to begin in mid–2006. After that the focus will be on London, which TAM hopes to begin serving before year end with seven weekly flights (subject to government approvals).

TAM’s all–leased operational fleet consisted of 76 aircraft at year–end (see table, above) — seven A330–200s, 36 A320–200s, 13 A319–100s and 20 Fokker 100s. In addition, eight aircraft (three A330s and five Fokker 100s) were on short–term subleases to other airlines. With an average age of 7.5 years, the fleet is the youngest in Brazil.

There are firm orders for 29 A320s, plus 20 options, for delivery over the next five years. In December TAM also firmed up an order for ten A350s, plus five options, to replace its current A330s from 2012.

The airline is still evaluating the A318 and the E190 for Fokker 100 replacement; the decision has been delayed several times and could come at any time. In 2003–2004 TAM converted ten Fokker 100 finance leases into operating leases and negotiated the return of 19 aircraft — the final two of that batch will go this year, leaving the Fokker 100 fleet at 18 aircraft.

| Type | 2005 | 2006 | 2007 | 2008 | 2009 |

| A330* | 7 | 8 | 8 | 8 | 8 |

| A319/320 | 49 | 59 | 62 | 66 | 70 |

| Fokker 100** | 20 | 18 | 18 | 18 | 18 |

| Total | 76 | 85 | 88 | 92 | 96 |