US Airways: another 25% cost cut needed

March 2004

Despite its apparently successful Chapter 11 reorganisation only a year ago, US Airways again faces serious survival challenges.

First, it may find it difficult to meet the financial covenants on its $1bn government- guaranteed loan in the next quarter — the reason it is considering asset sales. Second, its longer–term survival prospects again look poor because its costs remain too high for the East Coast environment — hence a new aim to cut unit costs by "at least 25%".

Since cost cuts of that nature would almost certainly require a new round of labour concessions (the third since mid- 2002), US Airways has spent the past month explaining its problems to its workforce. What went wrong? Why is the company in trouble again so soon?

The current troubles are surprising in light of the impressive Chapter 11 restructuring carried out in the toughest economic environment the industry had ever faced.

Under the guidance of its new CEO, David Siegel, US Airways accomplished an enormous amount in terms of restructuring and strategic initiatives in a short period of time. First, in June–July 2002, US Airways quickly negotiated concessions from its pilots and flight attendants and obtained conditional approval from the ATSB for federal loan guarantees to cover 90% of a $1bn private sector loan.

The bankruptcy filing followed in mid- August 2002 because US Airways wanted to quickly restructure aircraft–related liabilities. The airline completed its "fast–track" restructuring in a record 7.5 months, emerging from Chapter 11 on March 31, 2003.

The restructuring achieved all the key objectives in improving US Airways' cost structure, reducing its debt and lease burden and strengthening its liquidity position. Cost savings were expected to average $1.9bn annually over 6–7 years. Of that, $1bn came from labour, which exceeded the original target and meant a 30% reduction in labour costs. Lessor, lender and supplier concessions reduced annual aircraft ownership costs by $500m, substantially exceeding the $150m target.

US Airways estimated last year that the $1.9bn cost cuts gave it unit costs at the bottom of the range for the large network carriers on a stage length–adjusted basis.

The Chapter 11 process reduced US Airways' total debt and leases by 30%.

The airline restructured finance agreements related to 200 aircraft. It was also able to terminate its pilots' pension plan and replace it with a less costly version, reducing pension funding requirements by about 25%.

When emerging from Chapter 11, US Airways had an adequate $1.3bn in cash and bank credit facilities, $240m in new equity from Retirement Systems of Alabama (RSA), the $1bn ATSB–backed loan and a $360m credit facility from GE Capital. It also secured a solid "B" credit rating from S&P (the same as Continental’s and Northwest's).

Last summer US Airways staged what it described as an "orderly return to the capital markets" by selling $34m shares to three institutional investors (including Goldman Sachs) at the RSA purchase price. This was an important vote of confidence in the company’s prospects from sophisticated investors. In late October, US Airways began trading on the Nasdaq under the symbol UAIR. However, that coincided with the initial warnings that recovery was stalling, so the shares have performed poorly and there is no analyst coverage.

The Chapter 11 process contributed to US Airways' downsizing. The fleet size declined rather dramatically: from 421 in August 2001 to 280 at the end of 2002 (since then it has remained roughly at that level). Mainline ASMs fell by 23% between 2001 and 2003.

However, within two months of emerging from Chapter 11, US Airways put in place two key components on the revenue side of its business plan. First, after earlier obtaining permission from its pilots to operate up to 465 RJs, in May 2003 it placed orders for 170 RJs from Bombardier and Embraer and arranged financing for 90% of the aircraft. Second, it took the first step towards joining the Star alliance by signing a code–share agreement with Lufthansa (it is due to formally join Star in the second quarter of this year).

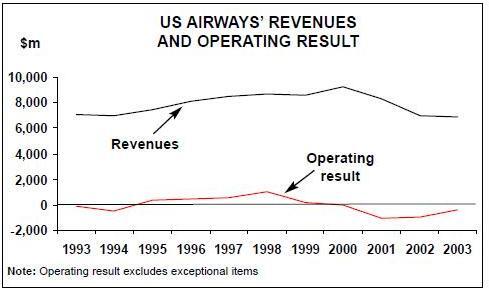

Since emerging from Chapter 11 US Airways has reduced its financial losses significantly and maintained strong liquidity.

In the fourth quarter of 2003, its pretax loss excluding special items narrowed to $129m (7.3% of revenues) from $352m a year earlier.

However, the past two quarters' results have been disappointing relative to competitors' performance and in light of the heavy Chapter 11 restructuring. Admitting that it was behind its original plans, US Airways announced further restructuring measures in the fourth quarter.

First, it initiated measures to cut non labour operating costs by an additional $200–300m in 2004. The savings would come from maintenance efficiencies, flight operations, human resources initiatives, insurance costs and Express operations.

Second, it went back to its key unions to sound out about further cost reductions. The initial reaction from union leaders in mid- December was extremely negative, with ALPA calling for the removal of Siegel and CFO Neal Cohen for mismanaging the airline.

Third, US Airways hired Morgan Stanley to explore the possibility of selling various assets. This action was prompted by concerns about potential debt covenant issues and the ability to maintain RJ financing.

In early January, US Airways suffered the blow of seeing its corporate credit rating (along with debt ratings) downgraded from "B" to "B–minus" by S&P. Citing increased LCC competition and the debt covenant issues, the agency also warned of a further possible downgrade.

What happened?

US Airways has blamed its current troubles mainly on significantly escalated LCC competition on the East Coast and "dramatic and fundamental changes in corporate travel practices". The magnitude and the rate of change of the LCC threat have increased since the Chapter 11 restructuring, and consequently the original cost cuts are no longer sufficient.

While few could have foreseen this year’s competitive frenzy on the East Coast, LCCs have been such a serious threat to US Airways for such a long time that it is surprising that the airline did not take into account more competitive scenarios when setting its CASM targets.

Some in the industry believe that US Airways simply committed the classic mistake of rushing into short–term labour deals in its eagerness to complete the restructuring process. Delta’s CEO Gerald Grinstein, who is under considerable pressure to secure a lower–cost pilot contract, remarked recently that he would not "cripple" the company for the long–term in order to achieve a short–term deal, noting that "the current situation at US Airways is a cautionary tale that we’ll all heed well".

US Airways' post–Chapter 11 revenue performance has not yet reflected the increased LCC threat. This is because industry RASM recovered slightly in 2003, following a sharp decline since 2000.

Also, US Airways' RASM has recovered at a greater rate because the year–earlier levels were depressed by the Chapter 11 status. Its system PRASM surged by 10% and 7.4% in the third and fourth quarters, respectively. System RASM in 2003 rose by 3.6% to10.75 cents — the first annual improvement in five years.

However, 10.75 cents is low by historical standards — some 22% below the peak of 13.80 cents seen in 1998, when LCC expansion began to gather pace. Furthermore, RASM pressure is now expected to build rapidly with the accelerated LCC expansion on the East Coast this year.

Much of the current upheaval at US Airways is the result of Southwest’s plans to start building service on May 9 out of Philadelphia — US Airways' primary hub and international gateway that accounts for a quarter of its total revenues.

Southwest will begin with 14 daily flights to six cities and one–way fares starting at $29. Two weeks later, Frontier will introduce low–cost transcontinental services to Philadelphia from Denver and Los Angeles.

US Airways believes that Southwest’s initial service will not have much detrimental impact on its revenues, because most of the routes chosen already have low fares (Southwest is targeting other LCCs). But the airline knows that this will change as Southwest grows in Philadelphia.

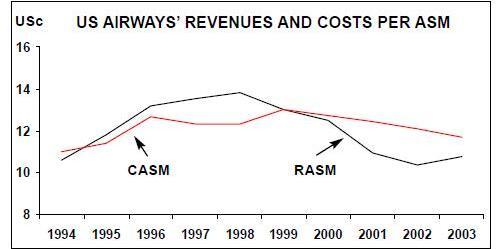

US Airways' management claimed late last year that the airline had reduced its unit costs (CASM) by 15–17% since the restructuring process began in early 2002.

However, there have been no statistics to support such a decline (though it is possible that some of the cost savings only showed up in special items last year).

In the third and fourth quarters of 2003, mainline CASM before fuel and special items (but including aircraft ownership costs, since there was a major shift from debt financings to operating leases) declined by 8.5% and 9.2% respectively. Looking at the annual unit cost figures, the progress made seems rather pitiful.

Last year’s mainline CASM excluding unusual items was 11.70 cents. This was only 3.3% below 2002’s 12.10 cents, 6.1% below 2001’s 12.46 cents and 8% below 2000’s 12.72 cents. It would seem that the cost reductions were mainly due to increases in average sector length resulting from international expansion. US Airways' average stage length rose by 11.1% in 2003 and by 20% between 2000 and 2003 (from 633 to 761 miles).

Debt covenant issues

The ATSB loan covenants require US Airways, first of all, to maintain at least $1bn of unrestricted cash through the second quarter of 2004 (only $376m thereafter).

Second, it must have fixed–charge coverage of at least 1.0 (first measured on June 30).

Third, it must have seven times adjusted debt to EBITDAR (also from June 30).

In an early January report, S&P suggested that the latter two covenants may be difficult to meet, depending on operating performance in the first half of this year.

With the ATSB loan being a lifeline, US Airways intends to take "the necessary actions to remain in compliance".

It is considering the sale of assets, which could include gates and slots at East Coast airports, routes, aircraft, aircraft delivery positions, some RJ operations and the Boston- New York–Washington shuttle. As of March 5, it had not taken any decisions.

If it turned out to be necessary to sell any assets, US Airways should be able to find the buyers and raise enough cash to solve any covenant problems. Of course, any asset sales would have to be approved by the ATSB and the proceeds would have to be used to reduce the size of the government- guaranteed loan.

US Airways has been in discussions with the ATSB and is expected to obtain covenant waivers (at some price). As many analysts have pointed out, the ATSB is unlikely to force the airline back into Chapter 11 in an election year. Such a scenario could mean the ATSB taking a loss on the deal since the 7.6m stock warrants that it received as added security are currently worthless, with US Airways' share price languishing at some 30% below the $7.42 warrant purchase price.

The other current concern is that any further credit rating downgrade by S&P could jeopardise US Airways' RJ financings. The deals negotiated last year with GE Capital, manufacturers and others (on 90% of the 170 RJs ordered) require US Airways to maintain a minimum credit rating of "Bminus" or "B3". The problem now is that when S&P downgraded the rating to "Bminus" in January, it kept the rating on review for a further downgrade.

US Airways is not expected to lose the RJ financing commitments. In a worst–case scenario, it could probably transfer some of the RJ orders to an affiliate like Mesa, which has publicly expressed strong interest in acquiring assets that could be operated in partnership between the two airlines.

Getting these issues resolved would buy time for US Airways to get its cost structure in line, because there are no other pressing balance sheet issues. The company had $1.84bn in total cash at year–end, of which $1.29bn was unrestricted.

This is considered to be adequate, given modest near–term debt maturities (just $132.4m in 2004).

Total debt and capital lease obligations amounted to $2.98bn at year–end.

The survival plan

US Airways presented the key ingredients of a revised business plan to its ALPA leaders on February 19. According to the pilots, the plan, which was still very much a work in progress, called for more point–to point services (to create a "hybrid" of hub–and- spoke and point–to–point flying, like some LCCs have done) and promised an aggressive response to LCCs in the markets affected. However, the main focus would be on cutting costs by "at least 25%" — a subject already discussed in the earnings conference call two weeks earlier.

The airline chose the 25% figure after noting that consistently profitable carriers have "established a new benchmark with cost levels at least 25% lower than ours". In other words, it now wisely compares itself to LCCs rather than other legacy carriers.

Siegel explained that there is roughly a 4- cent ex–fuel CASM gap between US Airways and the lowest–cost LCCs (10 versus 6 cents, excluding fuel and special items).

US Airways believes that it will be able to sustain a RASM premium in the 10–15% range, given its stronger network and hub–and spoke system. In its calculations, that would leave a 25% cost premium to be eliminated.

This is broadly in line with Delta CEO Grinstein’s recent estimate that the RASM premium for his airline is currently 15%, compared to 35–50% in the past.

US Airways estimates that 2.5 cents of the 4–cent ex–fuel CASM gap is labour costs.

Its mainline labour costs accounted for 42% of total revenue in the fourth quarter, compared to an average of 33% for LCCs.

Consequently, getting labour cost reductions will be critical. Amazingly, US Airways' ALPA–represented pilots appear to have had a complete change of heart.

In late February they agreed to negotiations on a comprehensive package of new concessions, which could include wage and benefit reductions.

Many people view it as an example of new labour attitudes in a drastically changed environment. When survival is genuinely at stake, management and labour have common objectives. Merrill Lynch analyst Mike Linenberg, referring to the pilots' earlier hard stance, noted that "that was before Southwest had announced its Philadelphia markets and fares". It has also been suggested that the pilots have been promised a key role in the design of the revised business plan.

The other unions have so far taken a harder line, which may reflect poor morale at least in the case of the flight attendants. Late last year the company inexplicably violated their contract with some involuntary fur–loughs, which led to the union filing a lawsuit in January.

This year’s non–labour cost initiatives focus particularly on the distribution side.

They include a major effort to improve the functionality of the airline’s own web site. US Airways feels that, after what it calls "UAL merger and Chapter 11 limbo", it is behind competition in technology initiatives.

The labour dealings will be helped by the fact that US Airways is resuming growth this year (after "right–sizing" itself) and that it intends to respond aggressively to LCC challenges.

System ASMs are expected to increase by 6–8% in 2004. Half of that will be mainline growth, mainly internationally.

US Airways regards both the Caribbean and the transatlantic as important assets that really leverage its East Coast network.

The Caribbean has seen 40% growth in the past year and US Airways is now the second largest US carrier there after American. The operations are profitable. The transatlantic "niche position" will also grow, with Philadelphia- Glasgow being the next addition in May.

Mainline aircraft deliveries are due to resume next year. US Airways has currently 19 A320–family aircraft on firm order for delivery in 2005–2009, plus 35 purchase rights, though it has indicated that it may not take all of them.

There are also firm orders for ten A330–200s, plus ten options, for 2007–2009 delivery.

US Airways has responded to the Philadelphia challenges by matching the new entrants' fares and announcing increased service in five of the six markets initially planned by Southwest. The news release also mentioned: great airport facilities, first class cabins, assigned seating, a broad array of US and international service and an outstanding FFP.

The airline does not intend to retreat or cede market share.

RJs are a key part of US Airways' revenue–boosting strategy, in that they will help penetrate new markets and strengthen hubs.

The group had 103 RJs in its fleet at year–end and has seen some very encouraging early financial benefits when substituting RJs for larger jets. The RJ fleet will triple over the next two years. The strategy is to grow both internally and with regional partners.

Can US Airways make it?

In early March, according to a filing with the SEC, US Airways was still in the process of having general discussions about its problems with the leaders of its unions and work groups.

But it is early days yet — the leadership has talked about 12–18 months as the time frame for getting the right cost structure in place.

However, although there is reason to be optimistic about the pilot talks and labour concessions generally, getting CASM down by another 25% in the wake of a Chapter 11 restructuring would be an unbelievable feat for any airline.

Competitive pressure will intensify further as ACA launches its Independence Air operation at Washington Dulles later this year and as JetBlue and AirTran continue to grow rapidly.

JetBlue’s EMB–190 expansion in low–to–medium density markets in the East from mid–2005 could also hurt US Airways' RJ strategy. US Airways can expect to be pummelled from all sides by aggressive new LCC entrants and lower–cost legacy carriers.

S&P’s Philip Baggaley suggested in a recent research note that "acquisition by another airline or some other form of close integration into a broader alliance remains the best ultimate solution for US Airways". CEO David Siegel acknowledged that possibility in a late–February speech, arguing that "it is incumbent on US Airways to achieve a competitive cost structure, in order to be a profitable standalone company, or an attractive partner, should consolidation occur".