WestJet: The Southwest formula, expertly executed

March 2000

WestJet Airlines, the successful Canadian low–fare operator which went public in July, was quick to announce ambitious growth plans after Air Canada’s acquisition of Canadian Airlines was approved by the regulators in late December.

The Calgary–based carrier, which has so far focused on the Western region, will start a major expansion drive into eastern Canada this month (March). This will include developing a new hub in Hamilton (Ontario). WestJet has also decided to replace its fleet of old 737–200s with new aircraft. It has just signed an LoI with Boeing to purchase up to 50 new 737–600s or 737–700s and made arrangements with GECAS to lease another 10- 20 aircraft of the same type.

These moves are a strong signal of WestJet’s intention to grab all the new domestic route opportunities that will result from the current industry restructuring (the two largest carriers rationalising and integrating their operations). In the words of CEO Stephen Smith, "It is our intent to become Canada’s low–fare, short haul carrier".

Another advantage from WestJet’s point of view is that the regulators will be extra vigilant of predatory behaviour or anticompetitive practices, now that the domestic market will be 80% controlled by Air Canada. The government has just introduced legislation, which is expected to pass with little opposition, giving the Canadian Transportation Agency new powers to monitor and prevent Air Canada from abusing its virtual monopoly.

While most of the conditions attached to the merger (surrendering some slots at Toronto, for example) had no direct relevance for WestJet, there was one important issue: Air Canada’s plans to operate a low–fare subsidiary in the East.

This issue was resolved to WestJet’s satisfaction as Air Canada was ordered to delay any such plans until at least September 2000.

This will give WestJet a useful head–start in a new and unfamiliar region. But otherwise, since commencing operations in February 1996, the upstart carrier has not only proved that it does not need protection — it has been financially successful and inflicted severe damage on the incumbents.

Despite its small size, WestJet successfully fended off concerted attacks from Canadian in 1998. Faced with plummeting yields and heavy losses, the larger carrier was forced to pull back, realign its key Western network and match fares on a more selective basis. Simply, WestJet was one of the factors that led to Canadian’s downfall.

Had Canadian found a way of continuing as an independent entity, it would have probably stayed out of WestJet’s way by focusing on the high–yield segment and forgetting about plans to introduce its own no–frills service in the West. Air Canada, in turn, would have continued to court WestJet as a potential ideal code–share partner in western Canada.

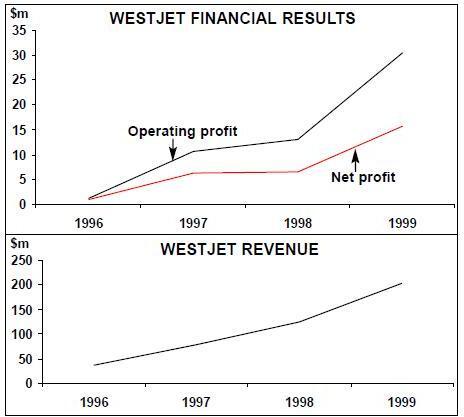

WestJet has been profitable since its inception, and in the past three years its operating margins have exceeded 10%. This is remarkable by low–fare new entrant standards, particularly in the light of the negative publicity following the ValuJet crash in May 1996 — just three months after WestJet took to the air.

The company has continued to perform well despite the relatively weak economic climate in Canada and the imposition of substantial Nav Canada charges on the airlines a year ago. Its third–quarter operating margin of 17.7% was among the best reported by airlines of any size in North America. In 1999 WestJet more than doubled its operating and net profits to C$30.5m and C$15.8m respectively, representing 15% and 7.8% margins. Revenues rose by 62% to C$203.6m. Fully–diluted earnings per share also more than doubled from 28 cents to 58 cents, which was in line with expectations.

Much of WestJet’s financial success is attributable to its relatively conservative growth strategy of adding 3–5 aircraft per year. This has enabled it to steadily increase revenues, maintain strong load factors and retain low unit costs. After four years, it still operates only 15 aircraft, serving 12 cities.

Of course, year–over–year capacity growth continues to be impressive as the base is still so small. In 1999 ASMs surged by 40%. Since that was more than matched by traffic growth, the load factor was a healthy 72.3%. And, despite all that, yield improved by 15% to 22.5 Canadian cents per RPM.

Although WestJet’s unit costs surged by 10% to 13.9 Canadian cents last year, much of that was due to the introduction of the second phase of Nav Canada charges and a sharply higher employee profit sharing payment (up from C$1.7m to C$6.6m). Excluding those items, unit costs rose by just 3% despite the hike in fuel prices.

Adequate capitalisation has also helped. Around C$28m was raised from the original investors in 1995 and through a rights offering to institutional and retail investors in January 1996. This and the subsequent strong cashflow enabled WestJet to buy all its aircraft while keeping debt to a minimum, making it possible to go public successfully at an early stage.

The July 1999 IPO, which gave WestJet a listing on the Toronto Stock Exchange, sold 10% of the equity and raised C$25.8m in net proceeds. The bulk of those funds were earmarked for aircraft purchases. The share price has risen by more than 70% since the offering.

Successfully replicated business plan

WestJet’s balance sheet remains strong with long–term debt of C$29m (just 21% of total capitalisation) and stockholders' equity of C$94m at the end of 1999. Cash and short term investments were C$51m, up from $13m a year earlier. WestJet’s business model is a close replica of Southwest’s. Both utilise 737s and operate point–to–point, single–class, no–frills service in niche markets. Like Southwest, WestJet looks for under–served and over–priced markets, enters them with fares 50–70% below what was previously available and offers one–way peak and off–peak fares. It strives for a fun and friendly image and an informal, people–focused corporate culture. It is ticket–less and relies mostly on direct sales.

The main differences — WestJet’s small size and lower flight frequencies (1–3 per day on most routes) — reflect its younger age and the much smaller size of the Canadian domestic market. Another difference is WestJet’s supplemental strategy of operating charters to serve smaller cities, develop new markets and boost aircraft utilisation.

In the past, WestJet’s leadership has often talked about the pre–1986 Pacific Western, Canadian’s predecessor, as another role model. PWA, which also operated 737–200s, was very successful in the West before it overstretched itself with acquisitions.

Like Southwest, WestJet places much emphasis on quick turnarounds (about 30 minutes, compared to Southwest’s 20) and high aircraft utilisation (9 hours daily, compared to Southwest’s 12). It also tries to minimise ground handling and other airport service costs by subcontracting those activities.

Its main advantage are unit costs that are much lower than those of competitors on a stage length adjusted basis. According to SunTrust Equitable Securities, in January- September 1999 WestJet’s unit costs were 9.2 US cents per ASM, compared to Air Canada’s 11.8 cents and Canadian’s 7.9 cents. But its average stage length was just 380 miles, compared to Air Canada’s 1,012 and Canadian’s 1,470 miles.

Adjusting to Southwest’s average stage length of 440 miles and excluding the high Nav Canada charges would appear bring WestJet’s unit costs within one cent over Southwest’s level, despite the differences in fleet sizes.

Perhaps, one of WestJet’s biggest accomplishments has been to come closer than any other low–fare carrier to emulating the way Southwest treats its people. It recruits service–oriented workers, trains them well and motivates them to outperform through productivity and profit- based incentives. The workforce benefits from profit–sharing and stock ownership programmes, and there are no unions.

Analysts have praised WestJet’s management for its focus and discipline about sticking to the business plan, rather than being tempted to experiment with new markets and strategies (which many other new entrants have done to their peril). For example, WestJet was just as hesitant to move into eastern Canada as Southwest was about braving the US Northeast.

Much of this credit goes to Clive Beddoe, WestJet’s founder and chairman, who has kept a tight rein on costs and the pace of expansion. Beddoe also had the foresight to bring in one of the highest–calibre low–fare airline experts, David Neeleman, to provide the blue print for a successful operation. Neeleman had co–founded Morris Air, which Southwest bought in 1993, and now looks likely to repeat the success with JetBlue in New York.

One of the biggest surprises has been WestJet’s ability to reproduce the famous "Southwest effect" in western Canada. Traffic volumes in many of the markets doubled or tripled between 1995 and 1997, following WestJet’s entry. Even the largest markets, like Calgary- Vancouver, grew by 40–80%.

Expansion to the East

WestJet’s strategy has been to "educate the market about how economical air travel can be", as its advertising budget is rather limited. To its amusement, the encumbents matching the fares spent heavily on advertising, which actually helped everyone. Furthermore, WestJet was soon the main beneficiary of all that publicity as the bigger carriers had to withdraw from the markets or limit the availability of the low fares due to losses. The eastward push represents a major strategy change for Westjet. Only a year ago, its leadership seemed determined to avoid the East and the transcontinental markets for fear that such operations would stretch the organisation, increase costs and compromise on–time performance.

But the markets are now less crowded — no longer the main battleground between two large carriers. WestJet said that it now sees a "window of opportunity" to connect eastern Canada with its network in the West and that the past four years have proven that the demand is there for its service in a variety of markets.

The carrier will start by linking Hamilton with two of its existing cities, Winnipeg and Thunder Bay, when an additional aircraft becomes available this month. It will be the first airline to provide jet service in those markets. Ottawa and Halifax will be added in the spring and Montreal by midsummer, subject to airport negotiations.

By the summer, those five routes will each have 1–3 daily frequencies. There will also be two daily flights linking the hubs, Calgary and Hamilton, with one–stop service via Thunder Bay and Winnipeg. Plans for 2001 envisage strengthening the connection between the East and West networks.

Hamilton, a steel town just 44 miles from Toronto, was chosen as a hub for its central location and large local market on the densely populated western shore of Lake Ontario. Air Canada is thinking of making Hamilton the base for its own proposed low–fare venture (see pages 4–5).

These plans have received a unanimous thumbs–up from analysts, who see eastern Canada as a major source of earnings growth for WestJet. There appear to be no concerns at all about WestJet entering Air Canada’s prime domain.

Then again, WestJet is determined to stick to the strategy that has worked for it in the West. It can also be trusted not to overextend itself. The fact that the Canadian market does not seem big enough for two major carriers probably means that WestJet will remain a niche operator.

Fleet plans

In the IPO prospectus, WestJet ruled out scheduled transborder expansion for the foreseeable future on grounds of current market conditions, the relative value of the US dollar and the wealth of domestic opportunities. However, as for Southwest, it may only be a matter of time. WestJet’s intention has always been to rejuvenate its old 737–200 fleet, which currently has an average age of 23 years. It has been adding some 1980s–vintage aircraft and retiring some of the oldest ones, with the aim of moving to new generation used 737s and, eventually, brand new aircraft. This year’s plans call for five more 737s, to bring the fleet to 20 aircraft by year–end.

But the days of utilising old aircraft are coming to an end for low–fare new entrants everywhere, because of image considerations and the higher fuel prices. Carriers like Frontier have now ordered new aircraft, while JetBlue decided that starting with brand new A320s was the most viable option.

For WestJet, the prospect of becoming a nationwide carrier tipped the balance in favour of new aircraft. After evaluating the latest 737 models and the A320 family aircraft, the carrier announced in late February that it would acquire 737–600s or 737–700s, powered by CFM56 engines. This was a welcome boost for Boeing, which has lost many orders to Airbus over the past year. Like JetBlue, WestJet will purchase most of the aircraft from the manufacturer but, in order to secure some early deliveries, has made separate arrangements with a lessor to take some on operating leases.

It has signed some type of LoI with Boeing to place firm orders for 20 aircraft, either the 125–seat 737–600 or the 142–seat 737–700, valued at around C$900m including spares. There are 30 options, all with delivery slots before 2008. The agreement with GECAS covers 10 firm and 10 options on the same aircraft type, with deliveries beginning in the second quarter of next year.

Prospects

These deals will enable WestJet to add up to 70 new aircraft over the next eight years. The plan is to use the first four leased aircraft arriving in 2001 for growth, while the six leased aircraft due in 2002 will facilitate the retirement of some of the 737–200s. The plan is to operate just one aircraft type once the fleet replacement process has been completed by 2008, and that type looks likely to be the 737–700. The new fleet will significantly help WestJet retain its unit cost advantage over competitors. Analysts see continued strong profit growth for WestJet in the foreseeable future. The First Call consensus estimate is a 35% increase in earnings per share in 2000. SunTrust Equitable Securities believes that earnings growth will be 20–25% annually over the next several years.

The main drivers will be additional aircraft and expansion in eastern Canada, which is likely to produce continued 30–40% annual capacity growth. Parallels are being drawn with Southwest’s expansion on the US East Coast, which seemed risky initially but turned out a huge success as the carrier stuck to its proven formula.

Like Southwest, WestJet is regarded as a good long term investment. However, in the short term, WestJet has an edge in one important respect. It is extremely well hedged for fuel, having locked 90% of its fuel requirements through June 30 into a maximum price of $16 per barrel. After that it will pay $18 per barrel, though if the price of crude falls below that level, it is expected to get the lower price

| Number of aircraft at year end: | |||||||

| 1996 | 1997 | 1998 | 1999 | 2000E | 2001E | Plans after 2002 | |

| 737-200 | 4 | 6 | 11 | 15 | 20 | 20 | To be phased out in 2002-2004 |

| 737NG leased | 0 | 0 | 0 | 0 | 0 | 4 | 6 delivered in 2002. 10 options held

for delivery by 2008 |

| 737NG purchased | 0 | 0 | 0 | 0 | 0 | ? | LoI on 20 firm orders and 30 options.

No specified delivery date |

| TOTAL | 4 | 6 | 11 | 15 | 20 | 24? | |

| Number of passengers (000s) | ||||

| Pre-WestJet | % | |||

| 1995 | 1997 | change | ||

| Edmonton-Kelowna | 14.5 | 85.9 | 491% | |

| Regina-Kelowna | 3.5 | 14.4 | 317% | |

| Saskatoon-Kelowna | 4.2 | 14.8 | 250% | |

| Kelowna-Victoria | 12.2 | 40.9 | 236% | |

| Calgary-Kelowna | 25.8 | 78.9 | 206% | |

| Edmonton-Victoria | 43.2 | 123.3 | 185% | |

| Calgary-Victoria | 63.3 | 161.7 | 156% | |

| Top three markets | ||||

| Calgary-Vancouver | 422.2 | 674.0 | 60% | |

| Edmonton-Vancouver | 243.2 | 437.9 | 80% | |

| Calgary-Edmonton | 271.6 | 374.6 | 38% | |