How to sell an airport

March 2000

Recent announcements that both Zurich Airport and the Irish airport group Aer Rianta, will be seeking public listings (the former this year, the latter probably not for a couple of years) has once again turned the focus of attention of governments, investment bankers and investors to the airport sector. In this article Aviation Strategy outlines the important issues in considering an IPO in the airport sector.

Two recent privatisations in Asia in the airport sector highlight the differences between success and failure. In November 1999, Malaysia Airports, which operates 37 airports in the country, including a 50 year concession to run the new Kuala Lumpur International Airport (KLA), was successfully floated on the Kuala Lumpur stock exchange, the issue being twice oversubscribed. The first stage of the privatisation involved the sale of 18% of the shares sold to domestic retail subscribers raised some M$495m (US$130m). The Malaysian government is eventually expected to sell down its stake to 52% with international institutional investors invited to participate in the secondary offering.

In sharp contrast, the IPO of Beijing Capital International Airport (BCIA) was met with investor indifference. One problem with the share issue was perceived as overly optimistic pricing. The shares in BCIA were priced at only a modest discount to the overall Hong Kong market on a current year price–to–earnings multiple basis. Previous privatisations in China have had mixed fortunes, and international investors want to see attractive rather than aggressive pricing of new issues.

The main difference between the two issues however can be summed up in two words, growth and strategy. KLA presented a clear company strategy, and investors were comfortable with Malaysia’s economic recovery story. But fund managers looking at BCIA were concerned that funds raised were being used to repay debt rather than improve and expand facilities. Concern also was voiced as to whether the Chinese economy and its airlines would be able to generate attractive traffic growth rates for the airport.

So what are the main issues that confront an airport when coming to the market? What do retail investors and professional fund managers look for when making an investment decision? A thorough understanding of the following items is a prerequisites for a successful flotation:

- Current commercial performance;

- Future capital expenditure requirements;

- Passenger and cargo growth expectations;

- Regulation regarding the determination of aeronautical charges; and

Current performance

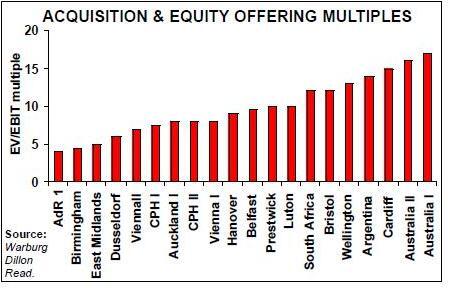

- Competition from existing or new airports. Investors will gain confidence from a management team whose track record bears favourable comparison with a peer group of other airports. To carry out comparisons, analysts will use a variety of measures usually relating various types of profit or cashflow (EBITDA) to price (stock–market valuation) or, the current vogue, EV (Enterprise value — stock–market capitalisation plus debt plus capitalised leases).

On the operational side, relevant measurements include:

- Total revenues per work load unit;

- Aeronautical revenues per work load unit;

- Operating costs per work load unit;and

Capital expenditure

Growth and internationalisation

- Average spend per passenger. Investors will want to understand the planned capital expenditure plans of the airport and feel comfortable that the plans are warranted by expected traffic growth. Capital expenditure can have a profound impact on an airport’s cash flow and capital structure,and hence on an airport’s self–financing capability and its user charges. It is sometimes useful to plot historic capital expenditure rates of different airports against incremental passengers gained in order to benchmark capex projects. A natural selling point is a strong growth rates. Aer Rianta will score well here given the recent and forecast GDP growth rates for the "Celtic Tiger" economy. One important factor here is the strategy adopted by the main airline serving the airport — privatisation candidate Schiphol Airport is a harder sell now that KLM has adopted a downsizing strategy.

Success in international markets may be an important factor. For instance, Aer Rianta, through Aer Rianta International, has already made successful investments in airports such as Birmingham and Dusseldorf.

Regulation

For Zurich, the omens look well set. The partial privatisation of the airport is set for autumn with the Canton of Zurich expected to raise some SFr500m ($333m) from the sale of a 28% stake in the airport. The growth story is strong. Passenger numbers rose 8.3% in 1999 to 21m, and the airport has plans to double its capacity to 34m by 2004. Forecasts suggest that passenger numbers could reach 42m by 2020 if the airport can successfully target transfer traffic. It is vital the government gets the right balance between preventing market abuse (most airports are natural monopolies), encouraging efficiency and quality for airport users (passengers and airlines), and providing an adequate return for investors and allowing for further investment requirements.

Competition

Investors, and indeed the management of the airport, prefer to see a regulatory system that is fair, transparent, and predictable. It should also be flexible enough to take account of major market changes — for example, BAA was given scope to increase aeronautical charges to compensate for the loss of duty–free revenue. Competition can come from the development of new or existing airports or from hubs in different countries. In the case of Aer Rianta there has been some speculation regarding the development of a new Dublin airport, and this will have to resolved before an IPO can take place. In the case of Zurich, which has a prime focus on attracting transfer traffic, investors will need to understand how the airport will compete against Charles de Gaulle.

Pricing

In Europe investors also have to make a judgement on how airports will be able to recover in the medium–term from the loss of duty–free sales. As duty–free was only abolished in July last year, it is too early to tell how successful the different retail strategies adopted by different European airports have been at clawing back lost revenue. European airports with a high percentage of intra–EU traffic, such as Aer Rianta (85%), will be less attractive to investors than those that enjoy a high proportion of intercontinental passenger traffic, such as Schiphol (55%). In terms of pricing of the equity offered, investors in Europe at least have a reasonably broad range of airports to act as a peer group. As well as quoted airports/airport groups such as BAA, Copenhagen, Vienna and Aeroporti di Roma, investors are able to glean from reports and accounts from airports such as Brussels, Frankfurt, Manchester, and Aeroports de Paris, financial and operational data.