Sunset for turboprop manufacturing?

March 1999

The end of another year, and yet another manufacturer exits the turboprop market. The last new–build ATPs and Jetstream 41s were delivered in December 1998, bringing to an end a 50–year era in turboprop production by British Aerospace.

British Aerospace’s exit — joining Fokker and Saab — means that the question now may be not whether there is a long–term future for turboprops, but when will the new turboprop market disappear. As regional jets gain more and more popularity, turboprop orders in developed markets are becoming rarer. The remaining turboprop manufacturers probably realise this, although publicly they all claim to be confident abut the future of the turboprop market. Nevertheless, they appear to be developing regional jet products as fast as they can.

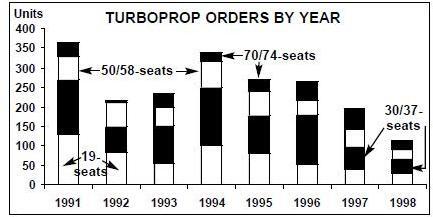

In calendar year 1998 there were just 112 turboprop orders recorded, compared with 195 in 1997. The 1998 figure was the lowest yearly total in the 1990s, and all seat–size categories suffered a substantial drop in sales compared with the year before (see chart, below).

The manufacturers

Embraer believes that Latin America in particular will remain an important market for turboprops for another five years, before a mass changeover to regional jets takes place. However the market for new orders in Latin America may still be tough as many second–hand turboprops may become available from the North American market as regional jet deliveries there begin to rise. Embraer has also opened a sales office in Melbourne as it seeks out turboprop and jet orders in the Asia/Pacific region.

The Emb–120 managed just one (large) order in 1998 — for 20 aircraft, from SkyWest — and it faces increasing competition from Embraer’s own ERJ–135 and Fairchild Dornier’s 328JET. These latter aircraft look set to do to the 30–37 seat turboprop market what regional jets have already done to the 50/58 seat and 70/74 seat markets in the late–1990s.

Increasingly, jets appear to be core to development plans at Embraer. In addition to the ERJ–135 and ERJ–145, only last month (February 1999) the Brazilian manufacturer announced plans for 70- and 90- seat jets — the ERJ–170 and ERJ–190. Interestingly, Embraer forecasts demand of 2,500 ERJ–170s and ERJ–190s over a 10- year period.

The only manufacturer developing a significant new turboprop product is Bombardier, which believes its 70–78 seat Dash 8–400 — now renamed the Q400 — will prove popular due to its reduced noise and vibration. The manufacturer still insists that turboprops are the best aircraft for short–haul, low yield routes of an average stage length of 340–350 kilometres — particularly if the aviation cycle downturn is steep. Bombardier is hoping for a market of 400 Q400s, although sales are slow at present. Bombardier recorded 25 orders for its Dash family in 1998, compared with 44 in 1997.

Bombardier is also developing its jet range. Roll–out of the CRJ–700 is on target for May this year, with initial deliveries scheduled for late 2000.

The French–Italian ATR consortium had to re–focus on turboprops following the dissolution of Aer International (Regional) in 1998. Twenty–one ATR 42 and 72s were sold in 1998, compared with 54 in 1997. ATR aims to reduce operating costs on ATR 42/72s by around 30% by 2003.

If a possible marketing agreement with Fairchild Dornier does go ahead, the two entities would jointly market the ATR42/72, Fairchild Metro and Dornier 328. However it is highly likely that any alliance will depend primarily on plans for jet products, with the turboprop market being only a secondary concern.

The future of the ATR turboprop product line may rest on further local assembly deals similar to an agreement with Xian Aircraft for partial building of the ATR 72 in China. Last month (February) a preliminary agreement was also signed for the manufacture of the ATR 42 in India by Hindustan Aeronautics.

However, ATR also claims that there is still a market for turboprops, particularly in Asia where the recession may force airlines on marginal routes to change to turboprops from jets. That may be so, but cash–strapped Asian airlines are much more likely to lease or buy second–hand aircraft than place new turboprop orders.

Fairchild Dornier recorded 25 turboprop orders in 1998, for the Metro 23, Do–228 and Do–328, compared with 29 in 1997. On the jet side, deliveries of the 328JET start this year, while the future of the 528JET, 728JET and 928JET may depend on the outcome of talks with ATR. The latest information was that final negotiations over a new marketing company for both manufacturer’s jet and turboprop products were due to be completed by the end of February or early March.

Elsewhere, Indonesia’s IPTN is still searching for partners for its N–250 turboprop project, but potential investors are likely to be wary not only about the turboprop market in general but about the future of IPTN in particular.

Raytheon says its 1998 firm order figures for the Beech 1900D are confidential (Aviation Strategy has estimated 1998 orders as 15, compared with 20 in 1997), but the pressure from the mass of second–hand 19–seaters that are now available must be immense.