How to create a successful and long-lasting alliance

March 1998

Airlines have three basic growth options: organic (i.e. independent growth); a non–equity or equity–based joint venture/alliance; and mergers and acquisitions. In this article Louis Gialloreto looks at the option that almost all airlines have attempted at some point: joint ventures/alliances:

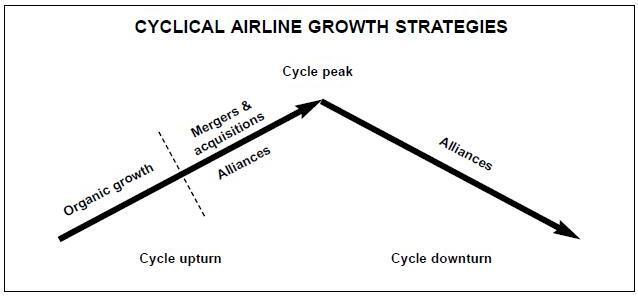

Joint ventures/alliances are carried out in all stages of the economic cycle (see diagram, right). In times of economic downturn, when consolidation is a key concern, joint ventures/alliances offer a "cheap" cooperation- based method of maintaining some small growth in a declining market, or at least keeping revenue erosion at a rate of decline that is less than the general market decline. Indeed, sharing production assets in order to maintain market presence became a popular strategy in the last downturn, at least until markets turned around, at which point many airlines reverted to a predominantly organic growth strategy. However, even in upturn alliances retain their popularity, eclipsed only (in domestic or regional circumstances) by M&A potential. The perceived — and in many cases real — lower cost /unit of alliance growth continues to attract airline strategists’ attention.

But just how do airlines establish and maintain an ongoing alliance that provides substantive competitive advantage over a protracted period of time? The time factor is key, because often alliances seem to be a short- or medium–term interlude to an otherwise independent/organic growth strategy.

Alliance considerations

The initial premise of any alliance should be incremental gain for both sides. An alliance that yields discrepancies in early results (i.e. where one airline clearly gains revenue and one airline loses revenue) has been put together badly.

Not all airlines are good partner fits. For example, an airline in need is rarely a good partner, just as a very strong airline may not feel that it ever needs help. Thus an alliance based on a much stronger and a much weaker airline will not stand the test of time unless the weaker partner has unique access to a market. Therefore, some form of incremental benefit accruing in roughly equal share to two market players of roughly equal strength is optimal. The fact that so few alliance attempts have actually had these criteria as basic parameters could explain why there have been so many alliance failures to date.

The purpose of the alliance can vary in terms of both ultimate objective and timeframe expectation. Some carriers use alliances as a tool of temporary truce in a market where otherwise there is intense market competition. Leveraging initial market position off the assets of others has worked as a short–term play for some airlines, but eventually these carriers become known for this short–termism, thus discouraging potential new partners.

Theoretically, one way around this problem is via the inclusion of equity tranches in an alliance agreement, indicating some sense of permanence to the arrangement. These tranches can be small or large, although not large enough to have effective control. Yet the so–called “cementing with equity” concept has not proven itself as a reliable indicator of intent — in fact it is quite the contrary. Airlines must therefore seek out partners where there are short- and long term reasons for staying together. This requires a rather sober review of market, environmental and competitive parameters, and then coming to a joint determination as to how the alliance could outperform the two airlines operating on their own.

The worst situation of all is the copycat phenomenon, whereby an airline enters an alliance with whoever is available in order to react against an alliance entered into by a rival. It can be argued that copycat scenarios drive at least 50% of all alliance attempts, even though these alliances always prove to be less successful than thought–out alliances. So an objective view of initial intent of an alliance often provides a good barometer of the arrangement’s longevity.

The "test-of-intent"

So how can an airline test the intent of a potential alliance partner? Walk–away penalties are one method to weed out the short–termers. Similarly, the degree to which each partner is prepared to invest in the initial relationship is a key indicator. Another test is the expected timeframe to fruition of anticipated benefits. A mix of early and later expected returns provides incentive to continue building value. And setting specific goals (qualitative and quantitative) prior to alliance start–up helps set and measure expectations. Adding in some form of managerial bonus based on overall performance of the alliance over time is a technique some airlines use. Indeed, gaining consensus to the alliance from not only those who design but who actually implement the agreement is essential. Finally, an understanding of how a potential alliance will impact an airline’s overall growth strategy is also a key consideration.

Another major impediment is the multiple alliance or alliance portfolio problem. As an airline adds partners, existing alliances/ alliance partners may not fit in with the newly blended partners. Some airlines have tried to overcome this by selecting a block group of partners, ceasing the search for new ones and refocusing on building up from within the block. The cost of wooing and adding any new partners is to a certain extent split among the block. Nonetheless, a majority of airlines still play the "add two drop one" game of alliance management. And even at block alliances such as Star, the recent haggling over Asian partners shows just how hard it is to achieve a harmonious block.

So what kind of timeframe is necessary before an alliance can be deemed truly successful? There are few examples, but it would seem that five years is a minimum timeframe to establish “intent”. In fact, the ability to maintain an alliance throughout what have been 10 year aviation cycles would seem to be the appropriate test of success. Over this period the partners should have established a particular alliance or alliance block as part of an integrated growth strategy, thus making it far more difficult to walk away from. Over such a period of time the alliance group will probably have forged its own separate business culture via management swaps, joint training etc. Similarly, the integration of back office functions also indicates relationship maturity.

In summary, the use of joint growth mechanisms has a sound conceptual underpinning. However, practice has proven less positive. Confusion or misrepresentation of intent, cyclical pressures and an inability to manage an alliance portfolio have all contributed to the poor track record of alliances/ joint ventures. Even so, alliances remain an attractive strategic option for airlines.