The continuing fall of the turboprop manufacturer

March 1998

After Fokker came Saab. Following the Swedish manufacturer’s announcement that it too was withdrawing from the turboprop market, the remaining turboprop manufacturers can now almost be counted on the fingers of one hand.

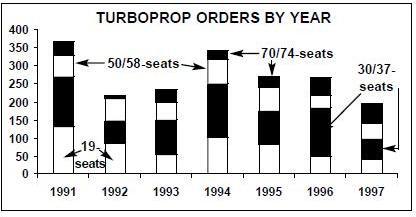

With the demise of Saab and the end of the line for BAe’s Jetstream 41, 1997 was a bad year for turboprops. Orders totalled 195, well down on the 266 orders recorded in 1996, and in direct contrast to the jet market where orders rose in 1997 (see Aviation Strategy, January 1998). Many of the 1997 orders were undisclosed and, as with jet orders, undisclosed orders have to be taken with the proverbial pinch of salt. The totals here are also for gross orders, and do not take into account cancellations. One manufacturer told Aviation Strategy that half its reported 1997 orders had already been cancelled; other companies will not even discuss the subject.

Many analysts highlight the relentless advance of jets into previously turboprop–only markets as the cause of the turboprop demise, and this is certainly a key factor. But turboprop manufacturers sometimes ignore the real reasons for this trend — many turboprop products are poor in terms of the price/performance ratio, and, perhaps most important of all, most frequent flyers prefer roomier, quick jets to cramped, slow turboprops.

Turboprop manufacturers still in business may disagree with that statement, but if their products are so good, why are they selling so few aircraft at something like a peak in the aviation cycle? And, more importantly, with so few units sold can any turboprop manufacturer realistically claim to be making a profit?

The 19-seat market

The 19–seat market has continued its slow but steady decline (see chart, below), but Raytheon’s Beech 1900D remains a solid seller, with 20 orders in 1997. Its rivals (apart from all the second- hand 19–seaters that can be easily picked up, such as the Jetstream 31) are Fairchild Dornier’s Metro 23 and Do–228, which achieved sales of 18 between them in 1997.

The Metro 23 airframe is well proven and is the basis for several models at Fairchild, but the Do–228 looks vulnerable. The 228 has been in service since 1982 and even though it is now available with TPE 331–10 engines, it only sold five units in 1997. Now that the Dornier is integrated into Fairchild, the necessity to offer two 19- seat models may be waning. On the other hand, Fairchild Dornier has little debt and a cash pile of more than $150m, so it has no pressing reason to pull the Do–228 from the market just yet.

30/37-seats

The Do–328 fared slightly better than the 228 in 1997, with 11 orders. The 30–37 seat category is in a sorry state following the exit of the Saab 340 and Jetstream 41, with just the Emb–120, the Dash 8–1/200 and the CN–235 remaining to compete with the D–328. More than 120 aircraft were sold in this market in 1996, but demand halved in 1997 to 60 units, due to a combination of a strong second–hand market and the encroachment of jets such as the Emb–135 and the Do–328JET.

The market, therefore, now appears too thin for four turboprop models, and unless the parent companies stay determined to maintain a market presence whatever the cost, the remaining products on offer are likely to thin down within a year or two. 1998 will be a crucial year, and competition between the three models for orders will be intense.

50/58-seats

The 50/58–seat category is really a 50–seat category now, following the exit of the Saab 2000. Here the ATR 42 faces the Dash 8–300 and the IPTN N250. The real competition comes from jets, where the challenge of the CRJ–100/200 and the Emb–145 is likely to prove too great in the long run. In the meantime, the reduction of available models from four to three should help the ATR 42 and the Dash 8–300 pick up reasonable sales in 1998, although what margin will be made on these units is open to question. As for the N250, its future may depend on whether government subsidies to IPTN continue.

70/74-seats

The 70–74 seat category includes the ATP, ATR 72 and Dash–8–400. In terms of volume, 1997 was another good year for the 70/74–seater, which has seen increasing sales despite the trend towards declining demand in all the other turboprop seat categories. So can the 70/74 seat–market continue to defy the general decline in turboprop sales in 1998? Even the ATR 72, which sold 34 units in 1997, making it the turboprop bestseller of the year, only has a backlog of around 20–30 aircraft. That backlog is relatively good compared with other turboprop models, but in absolute terms the total is small, meaning that one poor sales year could see the ATR 72 face some serious problems.

The robustness of the 70/74–seat category was the only good news for the turboprop industry in 1997. Elsewhere, production of Saab 340 and Saab 2000s will halt in mid–1999. Despite respectable orders, these two models cost Saab at least $100–200m per year recently. Although redundancies will be minimised, regional aircraft production accounted for almost one–quarter of the group’s 8,000 employees.

What must be worrying for the surviving turboprops is that Saab exited the market despite recording 33 orders in 1997. That total was beaten by only two manufacturers — Bombardier (44) and AI(R) (62). And with BAe cancelling the Airjet, the future of AI(R) is not certain.

| Beech | Emb | ATR | ATR | BAe | BAe | BAe | Metro | Dornier | Dornier | Saab | Saab | Dash | Dash | Dash | ||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1900D | -120 | 42 | 72 | ATP | J41 | J32 | 23 | 228 | 328 | 340B | 2000 | 8-1/200 | 8-300 | 8-400 | ||

| European airlines | ||||||||||||||||

| Air Caledonie | 1 | |||||||||||||||

| Air Dolomiti | 1 | 3 | ||||||||||||||

| Air Iceland | 2 | |||||||||||||||

| Air Nostrum | 4 | |||||||||||||||

| Air UK | 5 | |||||||||||||||

| British World Airlines | 2 | |||||||||||||||

| Eurowings | 5 | |||||||||||||||

| Rheintalflug | 1 | 1 | ||||||||||||||

| SAS Commuter | 15 | |||||||||||||||

| TAVAJ | 4 | |||||||||||||||

| Tyrolean | 3 | |||||||||||||||

| European total | 47 | |||||||||||||||

| North American airlines | ||||||||||||||||

| American Eagle | 12 | |||||||||||||||

| Horizon Air | 10 | |||||||||||||||

| Midroc | 2 | |||||||||||||||

| North American total | 24 | |||||||||||||||

| Asian airlines | ||||||||||||||||

| CASC/Xingiang AL | 5 | |||||||||||||||

| Great China Airlines | 2 | |||||||||||||||

| Hainan AL | 10 | |||||||||||||||

| Pearljet Corp. | 1 | |||||||||||||||

| Asian total | 18 | |||||||||||||||

| Others | ||||||||||||||||

| Air Guadeloupe | 2 | |||||||||||||||

| Aeromar | 2 | |||||||||||||||

| Club VIP | 2 | |||||||||||||||

| Iran Asseman | 2 | |||||||||||||||

| Linea Area IACCA | 1 | |||||||||||||||

| Rio-Sul Linhas Aereas | 7 | |||||||||||||||

| Undisclosed | 20 | 11 | 2 | 1 | 4 | 1 | 3 | 9 | 21 | 12 | 1 | 4 | 1 | |||

| Others total | 106 | |||||||||||||||

| TOTAL | 20 | 7 | 20 | 34 | 3 | 4 | 1 | 13 | 5 | 11 | 21 | 12 | 17 | 10 | 17 | 195 |