Environmental issues —

Taking them really seriously

June 2019

The aviation industry for some time has been saying that it is taking global warming issues seriously; now it has to be seen to be really taking them seriously. The issues of climate change, the pollutive impact of transport and the damage to the environment imposed by the continued growth of air travel has been climbing up the social and political agenda, and activists have been getting increasingly aggressive.

Pressure group, Extinction Rebellion, formed in the UK in 2018, held London almost to ransom for two weeks in April this year, with students gluing themselves to railings and trains. The group apparently have backed down from plans to deploy drones in and around London’s Heathrow airport for a week in June. The idea apparently was to disrupt air operations until the airport abandoned the idea of a third runway.

The Swedish based flygskam (fly shame) movement has possibly been instrumental in a reduction in domestic air traffic demand in their country (although the introduction of Swedish air transport tax in April 2018 may also have had an effect). Sixteen-year-old Greta Thunberg has made appeals to the Swedish, British and German parliaments demanding action against climate change, and has been nominated for a Nobel peace prize for her efforts.

The Green Party in the UK (echoed elsewhere in Europe) has suggested that individuals should be allowed one flight a year, but that frequent fliers should be taxed on an escalating scale according to the number of flights they take in order to counter the effects of aviation on climate change. (Strangely enough this is exactly the model for passenger departure taxes used by Iran, but only for Iranian nationals and not for the same reason).

In the US, the Sunrise Movement has focused on peaceful protests demanding decarbonisation, but has also initiated a court action against the federal government.

France has recently suggested banning domestic air travel connections altogether (prompting a response from Air France that global tyre manufacturer Michelin, based in Clermont Ferrand, would be “cut off from the world”) and has proposed a European-wide aviation tax “to reduce demand for air travel”. This follows a call by the Dutch Government for an EU-wide common stance on taxation of aviation to counter greenhouse gas emission growth and help reach the targets laid down in the 2018 Paris Agreement on Climate Change. In June it hosted a conference in Amsterdam exploring among other things the legality of imposing taxes on aviation fuel for cross border flights.

Meanwhile, Ryanair and Wizz have started a self-promoting counter-attack by publishing details of total CO₂ emissions along with their monthly traffic statistics each claiming to have the lowest level of emissions per passenger kilometre.

Air transport pollutes

Aviation currently accounts for around 2.3% of man-made CO₂ emissions. But it is a relatively high growth industry and one that relies on the burning of carbon-based fuels to generate the thrust sufficient to ensure that aircraft can stay up in the air. Burning carbon fuels produce carbon dioxide.

Apart from CO₂ aircraft also generate nitrous oxides (NOx) and particulates at altitude which help to form vapour contrails with the side effect of generating ozone, and perhaps seeding cirrus cloud formation.

These contribute to global warming: but the science behind any understanding of the full impact is still not fully understood. It has been estimated that total greenhouse gas emissions from airlines account for up to 4% of total radiative forcing.

On the ground, airports attract transport operators to bring the passengers to their flights. This generates further CO₂, NOx and particle emissions concentrated around the ground infrastructure.

The chart shows the growth in global man-made CO₂ emissions by sector since 1990. Total emissions have grown by 63% in the period — a compound annual growth rate of 1.7%.

Power Generation accounts for roughly 50% of the total. Transport originating emissions have grown by 70% in the period, or 2% pa. Air transport emissions have doubled, equivalent to an annual average increase of 2.5%. As the developed world wrests with the concepts of battling with climate change and limiting global warming it is hardly surprising that Aviation, reliant on carbon-based fuels gets a bad name.

Targeting sustainability

The industry has not been negligent to the problem. In 2009 IATA adopted a policy of ambitious targets to mitigate the impact of CO₂ emissions from air transport:

- a 1.5% annual increase in fuel efficiency between 2009 and 2020;

- carbon-neutral growth and a cap on net CO₂ emissions from 2020;

- a reduction in net aviation CO₂ emissions of 50% by 2050, relative to 2005 levels.

This policy was also based on four pillars: new technology, including the deployment of sustainable alternative fuels; more efficient aircraft operations; Infrastructure improvements, particularly including modernised air traffic management systems (the European Single Sky initiative was launched 20 years ago but is still a long way from implementation); a single Global Market-Based Measure (GMBM) to fill the remaining emissions gap.

In the last ten years the performance on fuel efficiency has been a bit better than planned: there has been an annual average fall in fuel consumed per RTK of 2.2% since 2009 with a similar annual reduction in CO₂ emissions per RPK (see chart).

But over the period passenger demand has grown by an average annual 6.8%, with RPKs nearly doubled to 8.6tn, while fuel consumption has grown by over 40%.

Pricing carbon

From 2012 the EU tried to extend an emissions trading scheme to all airlines entering European airspace. Under the EU ETS, all airlines operating in Europe, European and non-European alike, are required to monitor, report and verify their emissions, and to surrender allowances against those emissions. They receive tradeable allowances covering a certain level of emissions from their flights per year. Somehow the EU ignored or forgot that such a unilateral move is contrary to the Chicago Convention and had to limit the regulation to European based operations. Technically they saved face by delaying the implementation on all airlines pending ICAO’s decision to develop a global scheme.

Carbon offset

In 2016 ICAO did just that. The General Assembly set up the Carbon Offsetting and Reduction Scheme for International Aviation (CORSIA). This aims to stabilise CO₂ emissions at 2020 levels by requiring airlines to offset the growth of their emissions after 2020. From January 2019 all airlines are required to monitor and report emissions on international routes. From implementation all airlines will be required to offset emissions from routes included in the scheme by purchasing eligible emission units generated by projects that reduce emissions in other sectors.

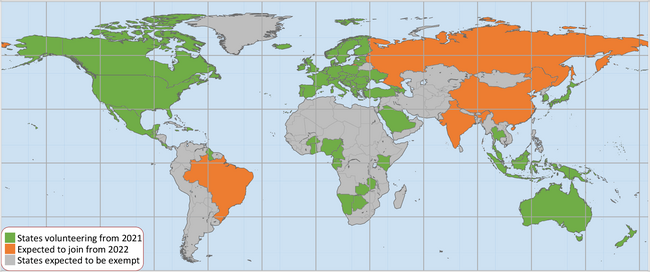

CORSIA will be implemented on a gradual basis encompassing three phases. In the pilot phase (2021-2023) and first phase (2024-2026) involvement is voluntary (see map for those who have so far volunteered). In these phases airlines will be required to offset emissions based on the average CO₂ growth of the aviation sector (penalising the larger, slower growing carriers to the benefit of the younger, faster growing new-entrants).

From 2027 inclusion within CORSIA will be mandatory (except for small islands, least developed countries, land-locked developing countries and states with less than 0.5% of international air traffic — unless they volunteer). It will cover all international routes involving at least one participating state in the scheme and be worked out on a route basis. From 2030 offset obligations shift to include over 20% of an individual operator’s growth. From 2033 that ratio will rise to 70%.

Criticisms

Both of these efforts have come under criticism from environmentalist groups. First of all, the industry’s forecast of an average improvement in fuel efficiency of 1-2% a year is not enough to offset the anticipated annual 5% increase in demand. According to Carbon Brief, aviation CO₂ emissions “could grow by between 2.4 and 3.6 times by 2050, depending on efficiency improvements. New technologies, such as supersonic and urban mobility aircrafts, risk increasing emissions even further.” Further, it is pointed out that these measures do not take account of other emissions (NOx and particulates) which further generate greenhouse gases and add to global warming.

Secondly there is a lot of doubt about how the offset scheme will work in practice, with concerns over the eligibility of individual schemes; who will be responsible for validating eligible emission units; the need to avoid “double counting” of individual schemes allocated to international aviation and then claimed by the country in which they are based as a national offset to the country’s own emissions; the difficulty of separating domestic aviation emissions (counted under the Paris agreement as part of a nation’s obligations) and those of international aviation (which will come under CORSIA).

More importantly, it only covers international routes. The large domestic markets of the USA, China, India, Brazil and Indonesia are excluded.

The ETS meanwhile also has been criticised as being an ineffective instrument. It is argued that too many emissions allowances are freely allocated — aviation still receives 85% of its allowances in this manner — and the price of CO₂ allowances is not sufficiently high. Structural changes to the system in 2018 have helped push the price up to €25/tonne (see chart) equivalent to a “tax” at current fuel prices of less than 2%.

Alternative fuels

One of the most important elements behind the industry’s goals is the pillar of technological change — apart from anything else involving the development of sustainable aviation fuels (SAF). The development of biofuels is still in its infancy, but the trials that have taken place (usually blended with jet kerosene) have been shown to reduce net CO₂ emissions by 50% and, importantly, lower levels of soot and other particulates at altitude. The IEA estimates that under its Sustainable Development Scenario (SDS) biofuels will reach 10% of total aviation fuel demand by 2030.

However, in 2018 there was SAF production of only 15 million litres — equivalent to 0.1% of total aviation fuel demand — and only five airports in the world had regular biofuel distribution (Bergen, Brisbane, Los Angeles, Oslo and Stockholm). Moreover, biofuels are expensive with production costs in excess of $100/bbl jet equivalent. Subsidies may be necessary to accelerate and derisk the build up of production of SAF.

The IEA suggests that a policy to subsidise SAF production would cost $6.5bn to achieve a target 5% of jet fuel requirements by 2025 under its SDS — which, it notes, “is far below the support for renewable power generation in 2017, which reached $143 billion”.

Perhaps the Dutch proposal to start really taxing fossil aviation fuel could be a rational policy to avoid subsidies from the public purse and help force the development of these “cleaner” fuels; but unfortunately the decision will rely on political realities and it is more likely that governments will increase per passenger taxes to “reduce demand” and swell their own coffers. As Alexandre de Juniac, Director General and CEO of IATA, points out “taxation is a red herring — not a penny of the billions raised in air passenger duty has been ringfenced for environmental action”.

Meanwhile, innovation in the industry continues. Israeli start-up Eviation Aircraft gained headlines at this year’s Paris air show by announcing a “double digit” order from Massachusetts-based Cape Air for its 9-seater electric aircraft — intriguingly named Alice. With a price tag of $4m it is designed to fly at around 260 knots (490kph) with a maximum range of 1,000km and an MTOW of 6.3 tonnes. Perfect for short commuter flights, but electric aircraft are not going to be able to replace large capacity fossil-fuel powered aircraft for a long time: batteries are heavy things.

One advantage of liquid fuel based aircraft is that they lose weight as they burn the fuel, and thus can climb in altitude to achieve greater flight efficiency in cruise (although a big disadvantage is that they need to carry extra fuel just to carry sufficient fuel to fulfill the flight). A real design challenge will be to create an electrically powered aircraft that is strong enough to carry heavy batteries on take-off but safe enough to land at the other end of the route at the same weight at which it took off.

And this design breakthrough may take a very long time: as BP stated in its recent sustainability report “by 2050, it’s unlikely that electric engines will play a significant role in commercial aviation”.

The industry’s global warming response is frought with difficulties: it is subject to international agreement; it is political; and its complexity is possibly beyond the comprehension of the man in the street.

At this year’s Geneva meeting of FEAMA (European aircraft manufacturing analysts), delegates were presented with a series of papers on the subject. All present were industry professionals, but many were confounded by the concepts presented by CORSIA. The resounding conclusion at the meeting (conducted under Chatham House rules, so we cannot say who said what) was that the industry really should do more to tell the world that it really is addressing its responsibility to be sustainable.

Source: ICAO, IATA. Note RPK includes freight RTK equivalent.

Source: EDGAR

GROWTH BY FUEL 2017-2040

Source: BP Energy Outlook 2019

GROWTH BY MODE

Source: BP Energy Outlook 2019