Perfect storm envelops the AirAsia Group

June 2015

AirAsia says it faced a “perfect storm” of aviation incidents, geopolitical unrest and natural disasters in 2014, which led to a sharp drop in net profits. Can the LCC recover in 2015?

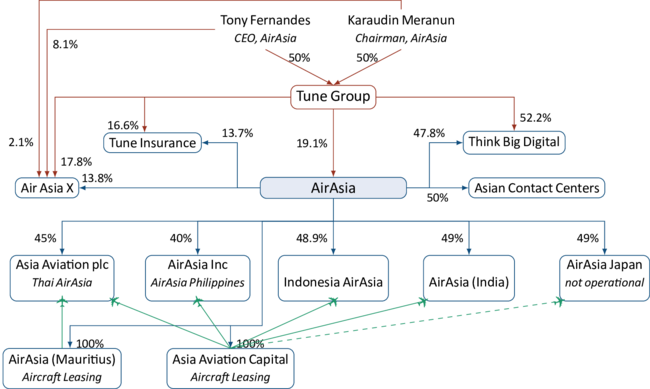

Launched only in 2001, the AirAsia group pioneered the LCC business model in the Asian region (with LCCs now accounting for more than half all seats in southeast Asia, compared with less than 5% in 2003) and today operates to more than 100 destinations in 22 countries, with affiliate carriers in other countries complementing the original and largest airline in the group, based in Malaysia.

Despite constant growth and substantial profits over the last 14 years, the AirAsia group had faced a tricky time recently, with Tony Fernandes — AirAsia founder and group CEO — saying: “2014 was indeed a tough year for the group. We faced so many challenges from the move to klia2, the high fuel price, irrational competition, weakening regional currencies, the political situation in Thailand and devastating aviation tragedies”. The pressure can be seen in the AirAsia share price, which has steadily declined from just under RM4 as of mid-2011 to around RM2.2 as of early June this year.

The Malaysian operation is the most important part of the group — still accounting for almost half of all passengers carried on the group’s short- and medium-haul airlines in 2014 (see chart, next page) — but it has been battling against immense pressure on yield and fares thanks to fierce competition that will only get worse once Flymojo — a start-up airline owned by the Malaysian state — launches operations out of Senai airport with 20 Bombardier CS100s in October 2015.

Average fares at Malaysia AirAsia have fallen for five years in a row, from 177 ringgit (US$54.9) in 2010 to RM165 ($50.5) in 2014. However, according to AirAsia “starting from 3Q14 we have seen the curve bottomed in and moved back to the positive side in 4Q14. This trend is continuing into 2015”. But while revenue per ASK rose in 2014 compared to 2013 — 15.66 sen (4.79US¢) versus 15.30 sen — the gap between unit revenue and cost continues to shrink, falling from 4.48 sen in 2011 to 2.47 sen in 2014. That is the result of a rise in unit costs, from 11.83 sen in 2010 to 13.19 sen in 2014. And even when fuel costs are taken away, the cost story is not great, with cost per ASK rising from 5.93 sen in 2013 to 6.67 sen in 2014.

That cost pressure has numerous roots. On the one hand are essentially one-off factors, such as the move to the new Kuala Lumpur International Airport low cost terminal (known as klia2) in May last year, which AirAsia says “required intensive operational restructuring”, but many more are structural, either external — such as a 9% rise in landing fees imposed by Malaysian airports and higher dollar denominated route charges — or internal, such as a larger workforce as the airline expands. As can be seen in the chart, next page, the rise in employees in Malaysia over 2013 to 2014 has not been accompanied by a larger relative increase in ASKs, and as a result productivity (in terms of ASKs per employee) has remained flat over the last two years, which may be a symptom of underlying problems.

As a result, while for calendar 2014 the Malaysian airline reported a 5.9% rise in revenue, to RM5.4bn ($1.7bn), operating profit fell 7% to RM853.6m ($261.1m) and net profit dropped 77% to RM82.8m ($25.3m).

While it’s still a profitable company, the fall in net profits in full 2014 in particular is worrying, and that has led to a number of strategic and tactical changes at the AirAsia group.

Changes

Perhaps the most important change is a re-balancing of growth against profitability, with a significant move away from the former towards the latter.

The AirAsia group fleet (excluding AirAsia X) totals 186 aircraft, all of which are A320-200s. There are 82 of the model at the Malaysian operation, 43 in Thailand, 29 in Indonesia, 28 in the Philippines and four in India. However, on outstanding order are 10 A320-200s and 304 A320 neos, with the latter entering into service from the end of 2016.

Yet the group added just 18 net aircraft last year, which was the first sign of an attempt to bring — as AirAsia puts it — more “discipline” to capacity management. That effort is accelerating through 2015, with a focus on sweating existing capacity even more. That means the group will expand the overall fleet by just five net aircraft this year (going to Thailand, India and the Japan), after it deferred delivery of some A320-200s to later dates.

This is just one part of a wider effort to improve the group’s cash position — as at the end of December 2014, deposit, cash and bank balances totalled RM1,338m ($409.3m), just RM8m ($2.5m) higher than 12 months previously, and more than 40% lower than the cash balance at the end of 2012.

Just under 80% of the fleet is owned outright, so older aircraft are now being sold and leased-back, while AirAsia is also selling other aircraft and some slots as well. In a further effort to boost the cash pile, in February this year the group reduced its stake in AirAsia Expedia, an online travel site joint venture started in 2011, from 50% to 25%, raking in US$86.3m by selling a 25% share to partner Expedia. These two businesses are just part of a growing portfolio of group “private equity investments” in adjacent businesses (many of them joint ventures), such as Big (a loyalty programme, with AirAsia’s stake valued at $120m according to AirAsia); Tune Money (valued at RM25m); Asian Aviation Centre of Excellence (airline simulators; RM250m); and a leasing company (which leases aircraft to AirAsia affiliates; $400m to $500m).

Surprisingly, given the focus on cash generation, the group has opened itself up to criticism by going ahead with the construction of a new 57,000 m2 corporate headquarters in Kuala Lumpur, to be completed in the summer of 2016.

Elsewhere, in the face of pressure on fares a continuing push will be made in the field of ancillary income. The group has finally achieved its long-held target of RM50 ancillary income per passenger, and that’s been helped by the sale of duty free goods on selected international flights from August last year, which has added RM2.66 ancillary revenue per passenger, plus paid-for wi-fi on flights from October. The average revenue was be boosted further by the launch of credit card payments on board in February this year, and a new duty-free website (to enable pre-flight ordering) in March.

Affiliate focus

A greater challenge for the group comes from its affiliates, all of which also faced a challenging 2014. An analyst note published by HSBC in June this year says that: “AirAsia’s associate ventures are turning out to be more problematic than we initially anticipated. With the exception of Thai AirAsia, all the other airline ventures are loss-making and are being increasingly funded by the parent. Consequently, loans to associates doubled in 2014 (more than 50% overdue) and equalled half of AirAsia’s equity value, the highest level in history.”

The group focus is now on turnaround plans for the Indonesia and the Philippines operations (in which it owns 49% and 40% respectively), as the group would like to launch IPOs for them sooner rather than later. Fernandes says he wants to raise up to $600m from selling 20-30% stakes in those Indonesia and Philippine associates, each of which he says are worth up to $1bn.

Facing, as AirAsia puts it, “irrational competition”, AirAsia Indonesia saw its operating loss almost quintuple to IDR 562.6bn ($56.3m) in 2014 and the net loss more than doubled, to IDR 856.3bn ($85.6m), although revenues were up 9% to IDR 6.34 trillion ($634m). However, he group believes the affiliate is on the “right track”, as it has been rationalising its route network, closing loss-making sectors and increasing frequencies to popular destinations. As a result load factors and fares improved through 2014, and that’s evidenced by the turning of an operating loss of IDR 369bn ($36.9m) in 4Q 2013 turning into an IDR 23.4bn ($2.3m) operating profit in September to December 2014.

Unfortunately the airline was then hit by the crash of Indonesia AirAsia’s flight QZ8501 in late December 2014 — although, after a subsequent dip, demand appears to have returned to normal levels through 2015. Indonesia AirAsia operates more than 30 routes (of which 21 are international) out of five hubs — Jakarta, Bandung, Bali, Surabaya and Medan, and the carrier will be helped by the launch of Indonesia AirAsia X at the end of 2014 (see page 10), between which it’s hoped that there will be substantial feed.

The Philippines AirAsia operation recorded a net loss of RM19.3m ($5.7m), in the fourth quarter of 2014. The Clark airport-based Philippine operation is a 2013 consolidation of the existing Philippines AirAsia and Zest Airways, and today operates on 16 domestic and international routes to 14 destinations. The group says a turnaround is well under way in the Philippines associate, with a move into the black forecast in the second quarter of 2015 following a major cost-cutting exercise and a network refocus onto leisure destinations.

Also of concern for the group is the Thai affiliate, which despite an 8% rise in revenue in 2014 to THB25.4bn ($780m), saw operating profit fall 87% to ฿300.7m ($9.2m) and net profit fall 82% to ฿344.6m ($10.6m) due to the unrest in that country. Thai AirAsia is aiming to increase load factor this year, but the political situation in the country is still tense, and until martial law is lifted the tourism market will stay suppressed.

Elsewhere, AirAsia India was launched in June last year and today operates to six domestic destinations out of Bengaluru airport, which is in the south of the country. The AirAsia group has a 49% stake in the airline, with 30% held by Tata Sons and 21% by Telestra Tradeplace. For the 2014 financial year it recorded a net loss of RM54.7m ($16.7m).

AirAsia India has four/five aircraft and the group believes that it will become profitable from the sixth aircraft onwards, which will arrive later this year as it focusses is on secondary domestic markets and routes that are currently poorly served. However the Indian affiliate can only operate domestic routes of the foreseeable future thanks to India’s “5/20 rule”, whereby a domestic airline has to wait five years and have a fleet of 20 aircraft being it is allowed to operate on international routes.

Fernandes says that “airlines have been inefficient in India but I don’t think we should be punished for two or three carriers making losses.” Those are the very same private airlines that objected to AirAsia’s entry into the Indian market.

Relief may be at hand given that the Indian government is proposing replacing the 5/20 rule with a so-called credit-based system, whereby an airline gains Domestic Flying Credits (DFCs) dependent on distances flown domestically, with extra points for routes to remote destinations. Once it receives sufficient credits, domestic airlines will be allowed to operate internationally.

But while accepting the proposed system is better than the existing 5/20 rule, Fernandes says this new system is even more complicated than the Duckworth-Lewis maths formula used for run chases in rain-affected cricket matches, and AirAsia has calculated it would need to operate 16 aircraft for 12 months to accumulate sufficient DFCs. Given its “pragmatic” plan for India it will realistically take the airline between two and three years to accumulate the points, with a fleet of 20 aircraft needed at the end of that period. However it’s believed the government may allow airlines to buy DFCs “at a market-driven rate”.

Looking further ahead, Japan is the next target for the group. A previous venture into the market in partnership with All Nippon Airways in 2012-13 ended in failure, but the group intends to try again in 2016, this time in alliance with online retailer Rakuten.

AirAsia X

The group also faces challenges at AirAsia X, the long-haul airline owned 14% by the AirAsia group (with a larger percentage controlled by Tony Fernandes). In 2014 despite passengers carried rising 33.8% to 4.2m and revenue increasing 27.3% to RM2.94bn ($899m), it reported an operating loss of RM212.2m ($64.9m) — compared with an operating profit of RM31.4m in 2013 — and its net loss increases almost six-fold, to RM519.3m ($158.9m). That was much greater than expected by analysts, many of whom then posted sell notes on the company’s shares. AirAsia X was listed on the Kuala Lumpur stock exchange in July 2013 at a share price of RM1.25, and this has steadily declined ever since, going under RM0.3 at early June 2015.

RHB Research noted that "2014 yields took a beating on its aggressive capacity expansion (33% up year-on-year) amidst intensifying competition". That expansion saw seven new aircraft arrive last year, bringing its fleet up to 23 A330s and A340s, which operate out of Kuala Lumpur to 18 destinations in Asia, plus Jeddah in Saudi Arabia. On order are 77 aircraft, comprising 12 A330-300s, 55 A330-900s and 10 A350-900s.

However the group says that in order to fill the new capacity “huge efforts of marketing as well as reduced promotional fares had to be offered — all of which carried a cost”. Load factor fell only fractionally, to 82% in 2014, but average fares and yield both came down.

As a result of its 2014 troubles new senior management was put in place at AirAsia X at the start of 2015, and they immediately conducted a strategic review, the outcome of which is a renewed focus on three areas — higher yield, cost savings (through reducing the workforce and renegotiating supplier contracts, all aimed at achieving a 5-7% improvement in unit costs ex-fuel in 2015) and a closer relationship with the group in order to get better efficiencies, and presumably greater feed.

Nevertheless, expansion will still continue for AirAsia X; the airline wants to launch a route to Honolulu in November — its first US flight — and to resume flights to Europe next year for the first time since 2012, when it cancelled unprofitable A340 services to London and Paris. London is likely to be the first route in 2016, though this time operated with A330-900s, for which it placed an order for 55 aircraft in December 2014.

More important, though, is the launch of AirAsia X affiliates throughout Asia, which the group hopes will enable passengers to transfer between the local Asian affiliates and the long-haul affiliate and giving a significant revenue boost to the group.

Thai AirAsia X started in June 2014 and today operates to Seoul, Osaka and Tokyo Narita with three A330-300s, while Indonesia AirAsia X uses two A330s and was launched in January this year with a route from Bali to Taipei, before adding a route to Melbourne in March 2015. Interestingly the group says that as the two offshoots grow then the main AirAsiaX will be “able to release more of its excess capacity onto its associates, thus help in its capacity rationalisation”. That’s a clear statement that the current fleet (plus outstanding orders) at AirAsia X is simply too large.

However, some analysts are not optimistic. Tan Kee Hoong from AllianceDBS is worried that AirAsia X’s Thai and Indonesian associates will be drag down profits, and if that occurs then the AirAsia’s troubles of 2014 may well be repeated in 2015.

A crucial year

2015, therefore, is a crucial 12 months for the AirAsia group. In the first three months of this year revenue fell by 0.4% year-on-year at the core Malaysian operation, to RM1.3bn, but operating profit was up 20% to RM273m and net profit increased 6.9% to RM149m. That’s just one quarter though, and the share price has continued to fall through the year, which indicates that investors are not yet convinced that AirAsia has responded sufficiently to the challenges that it faces.

That scepticism is shared by some analysts, with HSBC stating that “AirAsia’s recent attempts to push back capex, sell stakes in adjacency businesses, sell old aircraft and generate cash flow from sale & leaseback of aircraft should be helpful, these are unlikely to make a material difference to its stretched financial positioning”. AirAsia’s debt “has risen to unprecedented levels”, says HSBC, and unless substantial progress is made through 2015 in its refocussed strategy, it appears that the group may need a significant rights issue to bolster its equity position.

This view is emphasised by a recent research report from Hong Kong based independent GMT which aggressively accused AirAsia of manipulating its links with its associates artificially to boost the group’s earnings. The publication of the report has led to a further 20% decline in the share price and renewed efforts by CEO Fernandes to calm investor fears.

AirAsia has been remarkably successful in broadcasting the LCC model in SE Asia, despite the problems of ownership and control in a region yet to embrace full "open skies" or a common aviation area. However, it has yet to prove that the "associate" model under a brand umbrella will really work.

Note: * FY end June prior to 2008