Gee Wizz

June 2014

The IPO of Wizzair has been long awaited, rumoured, and seemingly oft abandoned. The announcement at the end of May that the Hungarian-based ULCC was planning to list on the the London Stock Exchange therefore was not a total surprise. However, following a handful of somewhat disappointing new equity flotations in London, exacerbated by a profit warning from Lufthansa, Wizz has withdrawn its immediate plans for a public offering because of “current market volatility in the airline sector”.

Wizzair is the fifth largest LCC in Europe with traffic in 2013 of some 13m passengers having grown at a compound annual rate of 10% in the past five years. Formed in 2003 by the former CEO of the (now defunct) Hungarian flag carrier Malév and based at Hungary’s Budapest airport, it has pursued the strategy of developing a route network connecting the poorer Central and Eastern European nations with the richer mainstream EU markets. It has pursued the ultra-low-cost-carrier model, targeting demand from CEE markets deemed too weak for the likes of Ryanair and easyJet (which up to now have had more lucrative targets to pursue). It was given a significant boost from the demise of the Hungarian flag-carrier Malév in 2012.

Operating in a niche area it has been able to build a network of 18 bases in Central and Eastern Europe to secondary and tertiary airports in Western Europe and operates to 97 destinations in 35 countries with a fleet of 52 A320s (and 63 further on order). With a prime AOC in Hungary, it also has an operation in the Ukraine through Wizzair Ukraine (and formerly ran a subsidiary in Bulgaria before that country’s accession into the EU).

Published financial and traffic data are sparse; it had been hoped that the IPO prospectus would provide some reasonable details of the operations. It is a member of the European Low Fare Airline Association through which it reports its passenger traffic trends on a half yearly basis. In 2010 it established a UK-based, Jersey registered plc holding company – presumably as a vehicle for a future planned IPO. From the accounts at this holding company it appears that revenues have grown from €390m in the year ended March 2009 to €850m for the year ended March 2013 – while press comments suggest revenues to the end of March 2014 touched €1bn. Profits up to the year ended March 2011 were marginal, but since then the group has started to achieve reasonable returns: according to press reports the group achieved net profits of €89m in the year to end March 2014 reflecting a very respectable EBITDAR margin of 24%.

The group’s major shareholder is Indigo Partners. Indigo is a US-based private equity business with a serial interest in developing low cost and ultra-low cost carriers round the world. Run by Bill Franke – former CEO of America West, and closely linked with other serial investors such as TPG’s Bonderman (chairman at Ryanair) – Indigo has been involved in the start-up and development of Spirit, Mandala, Tiger, Avianova, and last year acquired Republic to develop as a ULCC (see Aviation Strategy October 2013). Not all of its investments can be categorised as successful but part of its strategy is to build up a wide portfolio in the expectation the some investments will do very well. Having supported Wizzair for the past ten years (as a US investor it can only officially have a minority stake in the European airline) Indigo is obviously looking for an exit.

What are the options? An IPO is out of the question in the short run now. Having missed the February-June equity issue window on the London Stock Exchange a post-summer break introduction after September may be possible; but given the tenor of the announcement to withdraw this would possibly require a significant improvement in market sentiment towards the airline sector. Could the group revitalise an idea of selling the operation to another airline in Europe?

It has been over ten years since the last flurry of LCC take-over in Europe – EasyJet/Go and Ryanair/Buzz – so the timing may be apposite again. Memories too may have faded – Ryanair’s take-over of Buzz was followed by integration problems and caused the Irish carrier to issue a profits warning. Go caused a major dent in easyJet’s profitability, and there is a sound argument that, had easyJet just waited another year, rather than paying investment group 3i £374m, Go would have run out of cash and gone out of business.

There are three main strategic rationales for M&A in the LCC sector:

- Rapid expansion into a new or under developed market (in Wizzair’s case, east and central Europe);

- Removal of a competitor from the overall LCC market (or prevent another competitor taking over Wizzair);

- Cost savings and synergies, which make a good investment story and appeal to the regulators, but which usually prove elusive.

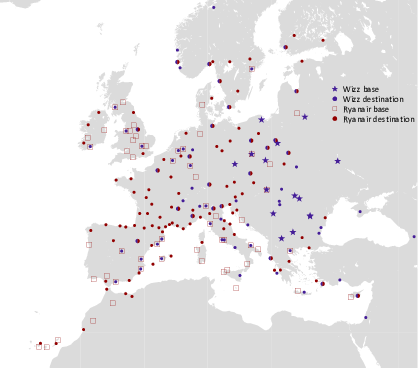

Ryanair?

In one sense Wizzair’s operation is close to that of Ryanair. It operates relatively low frequencies to secondary and tertiary airports in order to reduce the cost of operation to enable it to offer the lowest fares possible. It also seems to have a unit cost of operation not far from Ryanair’s ultra low cost base.

As the map on page 2 shows there is significant overlap between the Ryanair network and that of Wizzair – with two major bases in Warsaw and Budapest where they currently fly head-to-head. From Ryanair’s point of view it may feel that it can progressively move into Wizzair’s destinations without the any need to buy out the competition. Some years ago Micheal O’Leary in his pre-cuddly mode, derided the idea of buying Wizzair for any price.

In addition Ryanair is a 737 operator – although it might like to introduce competition for suppliers of aircraft. Its only interest may be piqued by the idea of another carrier acquiring Wizz.

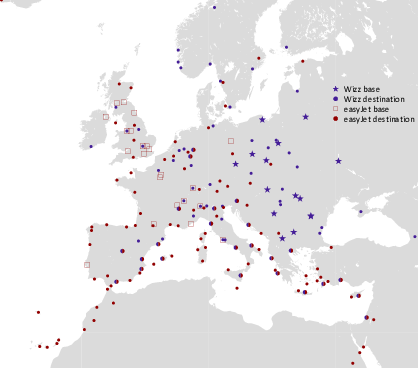

easyJet

The second map on page 2 shows a fairly complementary network between easyJet and Wizzair. Although there is a difference in philosophy towards destination airport category, the two carriers both operate A320 family aircraft, with identical layout. While easyJet is dedicated to turning Europe orange, and is seemingly successfully pursuing a strategy of providing a business-friendly alternative to the legacy carrier intra-EU offering, it may just be intrigued to acquire a separate brand.

Legacy Interest

IAG is probably the most likely of the Euro-Majors to be interested. It has successfully integrated Vueling into the Group, and there is no overlap between Vueling and Wizzair (and usefully both operate A320s). It is probably the only one of the legacy carriers to have the imagination to think of acquiring a pan-European brand seemingly in competition with another of its subsidiaries. That is unless Lufthansa decides that Wizzair is a fast track to building up its own planned LCC subsidiary to operate alongside Germanwings and attack the Etihad-backed airberlin.

Source: FYE March 2009-2013 Wizz Air Holdings PLC Annual Report. FYE March 2014 Reuters