Singapore Airlines: Under pressure

June 2013

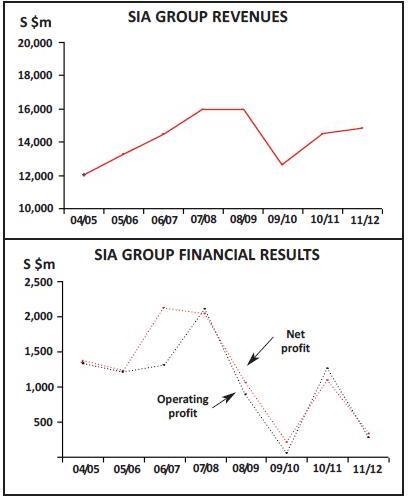

With increasing competition to its mainline resulting in a fall in operating profits of a third in its latest quarterly results, the Singapore Airlines Group is now urgently pursuing a “portfolio strategy” of different brands for different segments of the market. Will the change in strategy be enough to fend off the challenge of LCCs within Asia and from mainlines on intercontinental routes?

The Singaporean flag-carrier’s history dates back to the 1940s, but today it is facing perhaps its most serious challenge yet. In the third quarter of its 2012/13 financial year (the three months ending December 31st 2012), after a 0.4% drop in revenue the SIA group’s operating profit fell 17% to S$131m (US$105m). Net profit in the period rose 6% to S$158m thanks to the sale of aircraft and other equipment as well as higher net interest income, although the group was hit by a $$20m provision in the period for SIA Cargo due to penalties owed to the Australian Competition and Consumer Commission for its role in cargo price-fixing

What was particularly worrying in the third quarter results was a significant fall in operating profit at the mainline to S$86.8m – a reduction of SS$50m year-on-year (or 36.5%). This mainline profit erosion was due largely to a rise in non-fuel expenditure (hedging helped offset the rise in fuel costs), and specifically staff costs (up S$25m, or 6.8%), aircraft depreciation and rental costs (up S$20m/4.6%) and “passenger” costs (SS$15m/9.7%).

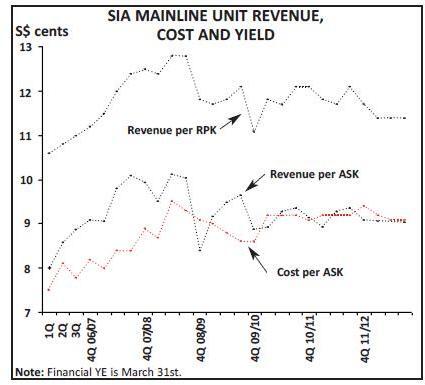

SIA said the outlook for the rest of 2013 was challenging due to the depressed cargo market, the troubled European economy and weak recovery in the US, with “loads and yields of both passenger and cargo businesses expected to remain under pressure”. Yield is a key problem for SIA. In the third quarter of its financial year the mainline saw a 7.4% rise in RPKs outstrip a 4.6% increase in ASKs, leading to a 2.1 percentage point rise in load factor to 79.3%, but yield fell by a huge 0.7 S$ Cents per RPK (to 11.4 Cents) compared with the same quarter of the previous financial year (October-December 2011).

Yield problem

As can be seen in the chart, on the left, the yield fall in the third quarter is just the continuation of a steady erosion from a high of almost 13 S$ Cents per RPK in the second half of 2008. At the unit level of analysis, the graph shows the dangerous coming together of unit revenue and unit costs lines — again since 2008 — that has the mainline on the brink of an operating loss almost every quarter. Looking at another measure, despite recent improvement the mainline’s passenger load factor trend line has been virtually flat for the last six years.

The reason for these worrying KPIs at the mainline is increasing competition. The percentage of Changi airport’s traffic that

While the SIA group is still (just) profitable and its position can by no means be regarded as dire, a strategic response from the group towards its challenges came late last year when it publicly acknowledged it was now following a “portfolio strategy” in order to compete better across differing market segments. Under this “four-brand” strategy, the SIA mainline and its regional subsidiary Silk Air will continue to cater for premium leisure and business passengers while two other airlines — Tiger Airways and Scoot — are targeting budget travellers. As one analyst puts it, this strategy “is hardly rocket science” and in fact strategically the SIA group is playing catch up with major rivals in the Asia/Pacific region, many of whom implemented similar portfolio strategies years ago.

On the full service side, the mainline SIA fleet currently has 101 aircraft, comprising 58 777s, 19 A330s, five A340s and 19 A380s, with an average fleet age of less than seven years. These operate a scheduled network through the Asia/Pacific region, Europe, Africa, the Middle East and North America. There are currently 68 aircraft on firm order for the mainline – eight 777s, 15 A330s, 40 A350s and five A380s. This January SIA firmed up an order for five A380s and 20 A350-900s, bringing its total order book to 40 A350s, which will start being delivered from 2015. At the end of May SIA ordered 30 A350-900s with 20 options, which will replace the 32-strong 777-200 fleet, which has an average age of 11 years.

Given that the mainline supplied fewer ASKs in 2012 than it did in 2008, the airline is cautious on expansion. In this summer’s schedule the mainline is increasing frequency to Adelaide and Melbourne, bringing the total group flights to Australia to 133 per week. Services to Fukuoka and Osaka will also increase over the summer, as well flights to Copenhagen and on the Singapore-Moscow-Houston route. On the other hand, non-stop services between Singapore and Los Angeles and between Singapore and Newark will close by the end of 2013 — in October and November respectively – although in March SIA extended a codeshare deal with Virgin America (that started in December 2012) to include an FFP partnership.

The direction of travel for the mainline is clear. Despite suspending the recruitment of cadet pilots and implementing a range of other measures such as voluntary unpaid leave, SIA currently has too many pilots on its books and is releasing 76 of them when their fixed term contracts expire through to the end of June this year. However, the mainline has also been investing significantly in upgrading its product via cabin redesigns, revamping in-flight entertainment systems and improving lounges, so contraction on the mainline side is being accompanied by improvement to product, in line with the new portfolio strategy.

Regional services for the SIA group are operated by Silk Air, which has 16 A320s and six A319s that will be replaced by outstanding orders for 23 737-800s and 31 737 Max 8s. Silk Air currently operates to more than 40 scheduled destinations out of Singapore, as well as to a handful of charter destinations for the SIA group tour operators. Also in the SIA group is SIA Cargo, which has 12 747-400 freighters (which will need to be replaced at some stage).

The SIA group’s LCCs

Tiger Airways was launched as an LCC in September 2004 by SIA, Indigo Partners, Irelandia Investments and Temasek Holdings (the investment vehicle of the Singapore government), and today the SIA group owns 32.7% of parent company Tiger Airways Holdings.

The Tiger group operates to more than 50 destinations in the Asia/Pacific region across 13 countries from bases in Singapore, Indonesia, the Philippines and Australia, using a fleet of A320 family aircraft. It has 19 aircraft stationed in Singapore and 11 at Tiger Australia, based in Melbourne. Tiger also has two associate airlines in Indonesia and the Philippines.

In the calendar year 2012, the Tiger group carried 6.3m passengers (compared with 5.7m in 2011), with 4.2m of them flying with Tiger Airways Singapore and the rest with the Australian operation. In the nine month period ending December 2012, despite a 36.9% rise in revenue to S$625.6m Tiger Airways Holdings made an operating loss of S$5.4m and a net loss of S$30m. However, whereas in the third quarter (October to December 2012) Tiger Singapore made an operating profit of S$27m on revenue of SS173m, Tiger Australia made a S$13m operating loss on revenue of S$73m, which Tiger said was “largely due to a 11.5% drop in yield due to stiff competition in the domestic market, and rising costs of operations”.

In fact Tiger Australia has never made a profit since launching in 2007 (instead recording accumulated losses of S$230m), and hopes of a turnaround recently disappeared when the airline was grounded by civil aviation authorities in Australia for six weeks in 2011 following safety fears, with ongoing capacity restrictions on Tiger Australia only lifted in the fourth quarter of 2012.

A partial solution to the problem was found when in October 2012 Virgin Australia announced a deal to buy 60% of Tiger Airways Australia (which is currently a 100% subsidiary of Tiger Airways Holdings) for approximately S$45.5m, with a plan for Virgin and Tiger to subsequently operate Tiger Australia as a joint venture in the domestic Australian market (though Virgin would be responsible for day-to-day operations), where it would compete against Qantas’s Jetstar. Under the terms of the agreement Virgin and Tiger would jointly invest S$65.6m into Tiger Australia to fund growth from 11 to 35 aircraft by 2018.

The deal was obviously subject to regulatory approval, and in January the ACCC (the Australian competition regulator) asked for further details after saying its initial analysis indicated that the agreement might reduce competition in the Australian market to just two groups (Qantas and Jetstar versus Virgin and Tiger). In March this year the ACCC postponed a decision yet again (it’s now likely to be given in May), and the longer the delay the more the likelihood is that the regulator will not allow the deal to go through unless conditions on guaranteeing or even increasing seat numbers on domestic routes are met.

If approved the deal is due to be completed by the end of June, which in the words of one local analyst would allows Tiger to “partially dump” Tiger Australia and focus in on more promising markets elsewhere in Asia (though previous attempts to launch subsidiaries or associates in South Korea and Thailand have come to nothing). But if the deal is not approved by the ACCC then it’s not clear what Tiger Airways Holdings would do next — although closing down the entire Australian operation may be the least bad option.

It’s critical that the Australian problem is sorted out one way or the other. Tiger carried out an IPO three years ago but the share is trading at levels around half the issue price, and although it raised another S$158m as recently as September 2011 (and only 20 months after it IPO’d), that cash has effectively been burned through by the troubles at Tiger Australia.

In March this year Tiger Airways Holdings revealed plans to raise S$77m through a rights issue and a further S$220m through an offer of convertible securities to existing shareholders. The funds raised will strengthen the balance sheet and repay debt (up to S$100m) and fund the airline’s expansion (with S$70m-S$90m going to the affiliate airlines and S$60m-S$80m to pay for aircraft). Tiger has 29 A320s on order, although at least eight of which will go to the Australian operation and others to the two affiliate airlines. SIA will subscribe for its full entitlement and has agreed to buy any excess not taken up by other shareholders (with a maximum limit of a 49.9% share) when the funding round is completed in May.

Before expanding elsewhere (and assuming the Australian problem is sorted out), of prime concern for the Tiger group is getting its associate airlines into profitability. Tiger group chairman Joseph Pillay says that the group has to “expand beyond the shores of Singapore in order to safeguard the future of the Tiger group… Indonesia and the Philippines are the two largest countries in Asean, where we believe our destiny lies.”

Mandala Airlines was launched in Indonesia in 1969 but went bankrupt before Tiger Airways bought a 33% stake in January 2012, after which the carrier was relaunched as a LCC in April of that year. Indonesian-based Saratoga Capital controls 51% of the airline, with the rest split among creditors of the airline. Today Mandala operates seven A320s, and the fleet will rise to 10-15 by the end of this year and 25 by 2015. It has 25 A320s on order, although in April this year Saratoga Capital said Mandala would convert Tiger Airways’ options for 18 A320 aircraft into firm orders, bringing the order book to 43.

Although Indonesia is a huge market, it is very competitive one and Mandala has to compete against LCCs that include Indonesia AirAsia and Lion Air, the latter of which has 88 737s and in February placed a firm order for 29 737-900ERs and 201 737 MAX aircraft, worth some US$24bn at list prices. That was the largest ever aircraft order in history until Lion Air placed another order, in March, for 234 Airbus aircraft worth approximately another $24bn at list prices.

Competition from LCCs is also an issue at Tiger’s other affiliate – the Philippine-based Southeast Asian Airlines (known as SEAir). SEAir was launched in 1995 and today operates two A319s and three A320s on domestic routes out of Manila and on international routes out of Clark airport to Singapore, Hong Kong, Thailand and Malaysia. Tiger Airways Holdings increased its stake in SEAir from 32.5% to 40% in August 2012 for S$2.5m (the rest of the equity is held by Filipino investors), although Tiger is also providing working capital of up to S$$40m over a five year period. However, SEAir has to compete against Cebu Pacific Air, which operates 48 aircraft and has more than 59 on firm order.

Some analysts worry that SEAir and Mandala will prove to be problematical for the Tiger group given the high level of LCC competition in these countries. Indeed Tiger recently stated that the two airlines "are unlikely to contribute positively to the group’s performance" for the financial year ending 31 March. In the quarter ending December 2012 SEAir contributed a S$8.3m share of losses to Tiger Airways, and Tiger adds that it “has not recognised its share of cumulative losses of Mandala amounting to S$14.3m as at 31 December”.

Tiger has been shaking up its senior management team recently — Koay Peng Yen (a shipping industry executive) became CEO of Tiger Airways Holdings in August 2012 and Ho Yuen Sang (previously COO of Jetstar Asia) was appointed managing director of Tiger Airways Singapore in December last year and they undoubtedly have a major challenge in sorting out this part of the SIA group.

Additionally, under the group’s new strategic doctrine Tiger has been tasked with working more closely with fellow LCC Scoot, although this was made easier when the terminal for budget airlines at Singapore’s Changi airport closed in September last year (so that it can be replaced by a brand new terminal in 2017), with Tiger Airways switching operations to Terminal 2, where Scoot is based.

Scoot

Ironically when plans for medium-haul LCC subsidiary Scoot were announced by Goh Choon Phong, CEO of the SIA group, there was considerable opposition from some SIA group executives, who were worried that the airline would cannibalise revenues at the mainline. But of course the risk of doing nothing as a response to the rise of AirAsia X and others is far greater, and Scoot is managing to win completely new (cost-conscious) customers for the group – which itself partly spurred the move to the new portfolio strategy.

Based at Changi airport, Scoot was launched in June 2012 and offers a two-class service with frills available on a paid-for basis. Today it operates four 777-200s (acquired from SIA and refurbished) to Bangkok, Tianjin, Taipei, Sydney and Tokyo, with routes to Shenyang and Qingdao due to commence in November. Although a fifth 777 will arrive in May or June ,Scoot has 20 787-9s on order, which were originally ordered by its parent SIA, although some of these may be swapped for 787-8 and 787-10 variants. The aircraft will arrive from late 2014 onwards and will replace the 777s in order to underpin substantial growth in its network, with ambitions for routes to Africa, Europe, India and the Middle East in the medium- to long-term.

With Scoot operating medium-and long-haul routes of more than five hours’ flying time (and where its main competition is AirAsia X and Jetstar) and Tiger Airways concentrating on short-haul, given the new group portfolio strategy it was no surprise when last October Tiger and Scoot agreed a wide-ranging partnership deal. The first phase of which includes joint itineraries on certain routes in the Asia/Pacific region. However both airlines are being somewhat cautious in how fast they expand this partnership, as they want to avoid having to obtain anti-trust immunity.

Too little too late?

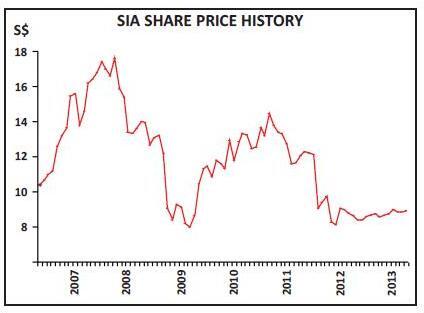

Full-year results (for the 12 months ending March 31st) are due to be released by the SIA group sometime in mid-May, but that set of financials will be too early to tell just how effective the new portfolio strategy will prove to be. Investors are yet to be persuaded – as can be seen in the graph, xxx, the share price has plunged since 2007 and it has remained flat since the new portfolio strategy was announced in late 2012.

As an analyst note from Citigroup in February puts it, the portfolio strategy and improvements to the SIA group’s mainline product are “necessarily defensive in mitigating the structural headwinds, but not effective in overcoming them”. Specifically Citigroup says that the “SIA/SilkAir premium business is on a structural decline”, so in effect what SIA is doing – although correct – may be too little, too late. At the very least the fact that the SIA group has had to announce such a strategy is an admittance that it had previously been poor in co-ordinating the operations and schedules of similar carriers in the group, whether within the full-service or LCC segments

Nevertheless the group has little option other than to press ahead with this new direction, and hope that the rate at which its full service business declines is compensated for as much as possible by its LCC operations. That’s made all the more important by the much anticipated “Open Skies” policy that is scheduled to be adopted by the Association of Southeast Asian Nations in 2015, where the current restrictions on airlines operating outside of their home country will be lifted, and which may encourage the SIA group to combine organic growth with another acquisition.

Last December SIA agreed to sell its 49% stake in Virgin Atlantic to Delta Air Lines for US$360m, subject to regulatory approval but expected to be completed by the end of 2013. SIA’s stake in the UK-based airline has never quite provided the strategic benefits and synergies that SIA had hoped for, and the group will recover far less than the US$975m it paid out back in March 2000. However the Virgin investment had already been fully written off in SIA’s balance sheet, and so the deal will generate cash for SIA that can be invested in new aircraft. After booking a profit on its disposal, ties between the airlines such as FFPs and codesharing will remain in place for at least the short-term.

After hopefully learning lessons from the Virgin deal, Goh Choon Phong says that SIA is “open” to making investments in other airlines, particularly within the Asia/Pacific area. Late last year SIA complete the purchase of a 10% stake in Virgin Australia for S$109m. The two airlines have co-operated since 2011, in a deal that has included joint market, schedule co-ordination, codesharing and reciprocal FFP benefits. SIA has recently agreed to top-up its stake in Virgin Australia by another 9.9%, in a move increasing its stake to 19.9%. The purchased is subject to approval from Australia’s Foreign Investment Review Board but the move does illustrate SIA’s commitment to the Australian market (notwithstanding the the proposed Tiger Airways Australia deal). Virgin Australia is challenging Qantas hard in the domestic Australian market and its shareholders also include the Virgin Group (26%), Air New Zealand (19.9%) and Etihad Airways (10%). Virgin Australia specialises in the business travel market within Australia, which is in contrast to the “budget” travellers targeted by Tiger Australia.

The SIA group says that the Virgin Australia deal will not be the last as it is “actively pursuing partnership opportunities in India, China and Southeast Asia”, according to Goh Choon Phong. Its choices are limited however. A joint venture between Tata and SIA to buy a stake in Air India was put forward 13 years ago but came to nothing and expansion into India now may be too late given that Etihad Airways aims to buy a minority stake in Jet Airways and AirAsia is launching a joint venture Indian airline in which it will have a 49% share and the Tata Group 30%.

The big prize remains China, where in 2008 SIA failed in a bid to acquire 15% of China Eastern Airlines after Air China successfully lobbied the Chinese government against the deal. Those “political” barriers to an entry into the Chinese market have not gone away, but some analysts believe that — free from the distraction that was Virgin Atlantic — SIA still has an appetite to take a stake in a Chinese airline.

| In service | On order | ||||

| SIA mainline | |||||

| 777-200 | 19 | ||||

| 777-200ER | 13 | ||||

| 777-300 | 7 | ||||

| 777-300ER | 19 | 8 | |||

| A330-300 | 19 | 15 | |||

| A340-500 | 5 | ||||

| A350-900 | 40 | ||||

| A380-800 | 19 | 5 | |||

| Total | 101 | 68 | |||

| Silkair | |||||

| A319 | 6 | ||||

| A320 | 16 | 2 | |||

| 737-800 | 23 | ||||

| 737 MAX-8 | 31 | ||||

| Total | 22 | 56 | |||