Emissions Trading System: One year of preparation left

June 2011

The EU Emissions Trading System (ETS) is the world’s first, and largest, cap–and trade system to cover emission of CO2. It is a cornerstone of the European Union’s policy to reduce greenhouse gas emissions and is a major part of the drive to meet international emissions reductions targets agreed in the 2007 Kyoto Protocol. From next year airlines will be part of the ETS, and will be bearing internally part of what were previously the external costs of pollution.

ETS works on the principle of capping the amount of permitted emissions across the sectors that are included in the scheme, and allowing the participants to trade allowances and import permits from outside the system in order to cover their emissions. In the process they create an international market for CO2 and a market mechanism whereby reducing emissions is financially rewarding.

ETS began in 2005 and has steadily expanded to include emissions from the heavy emitting industries across 30 countries.

In December 2006 the European Commission (EC) developed a proposal to include emissions from the aviation sector within the ETS, which worked its way through the EU legislative process, with agreement on the basic principles reached in mid–2008.

The final Directives provided for entry of aviation to the ETS in 2012, with some baseline data reporting required in 2010. On entry, aviation will be the fourth largest sector in the overall EU ETS (measured by the number of allowances allocated for free), after power and heat, metals and building materials.

Tighter caps on emissions will be introduced during the next phase, from 2013 to 2020, so the air transport industry has one year to get to grips with the trading element of ETS before entering a new era with fewer permits and, potentially, higher compliance costs.

How aviation works within ETS

Although the ETS is a multi–industry system, aviation operates within its own set of guidelines. These guidelines stipulate that all flights with origin or destination in the EU will be covered by the scheme, wherever the airline operator is registered. It extends to all airlines and operators with a narrow list of exceptions, primarily helicopters, very small aircraft, military and training flights. Other than those, airlines from around the world are included irrespective of whether they are a private business jet operator or a global carrier.

1. Establish cap The cap is based on an assessment by the Commission of baseline emissions from air transport activity averaged over the years 2004 to 2006. This figure has recently been released, following a delay of many months: 218m tonnes of CO2. In the starting year, 2012, the cap for aviation allowances has been set at 97% of this figure, or 211.5m tonnes. For the years 2013 to 2020, the cap will be 95% of the baseline, or 207m tonnes. 3% of the total allocation will be set aside for new entrants and ‘fast growing’ operators. After this amount is taken out, a further 15% of allowances will be withheld and auctioned in 2012.

2. Allocate free allowances. The amount of aviation allowances left after the auction and new entrant reserve is likely to be around 174m tonnes, which will be allocated to operators free of charge, based on the production of Revenue Tonne Kilometres (RTKs) in 2010. So if an airline flew 10% of total RTKs in 2010, it will receive 10% of the free allowances in 2012 but for each year through to 2020.

3. Report Emissions. Airlines were mandated to report CO2 emissions in detail from 2010, and have had the option of reporting RTKs if they were interested in applying for free allowances. The CO2 reporting for 2010 and 2011 has no compliance cost, it is more of a ‘dry run’ for 2012 when permits will need to be surrendered for each tonne of CO2 emitted.

4. Buying and selling. In the event that an airline receives more allowances than it needs to cover its emissions, it may sell those allowances on the carbon–trading markets, of which there are six worldwide: Chicago Climate Exchange, European Climate Exchange, NASDAQ OMX Commodities Europe, PowerNext, Commodity Exchange Bratislava and the European Energy Exchange.

More likely, airlines will have insufficient permits to cover emissions and need to procure allowances to cover their emissions.

There are various permit types that can be used to cover emissions, including Aviation Allowances (AAs); EU Allowances (EUAs); Certified Emission Reductions (CERs); and Emission Reduction Units (ERUs).

It is worth noting that the level of free allocation does not create an immovable cap on emissions. Rather, the industry would be able to emit 174m tonnes of CO2 in 2012 without incurring any cost. Beyond that level, emissions are still allowed, provided the relevant airlines procure credits to cover each tonne of CO2. The types of credits that can be used are defined in the Kyoto Protocol, but, because international transport is not covered by the Protocol, the allowances issued to airlines can be used for compliance by airlines only. So if an airline finds itself with a surplus of credits, these can only be used by another airline. There would be no value or compliance use for a power company to purchase AAs.

Within the mainstream EU ETS, operators may use credits from two of the Kyoto Protocol flexible mechanisms for compliance — the Joint Implementation (JI) and Clean Development Mechanisms (CDM), which issue new credits known as CERs and ERUs to projects in the developing world that reduce emissions, such as energy efficiency at a power plant. Use of these instruments for airlines is limited to 15% of the number of allowances they are required to surrender at the end of 2012, and an amount to be determined for the period 2013 to 2020. So, the CER/ERU limit for the aviation sector will be equal to 15% of an airline’s actual emissions, rather than the allocation. As an airline emits more, so it may use more CERs.

By way of illustration, if an airline is issued 100 allowances for free and in 2012 emits 200 tonnes of CO2, it will need to cover a shortfall of 100 allowances. It could buy 15 credits, comprising any combination of CERs or ERUs. The remaining 75 must therefore be EU aviation allowances (EUAAs) or mainstream EUAs, to be bought from the open market or from government auctions in any combination.

The Commission has published a list of operators to be included in the scheme which numbers almost 5,000, most of which are business and general aviation operators. Despite accounting for around 10% of operators by number, the vast majority of emissions arise from commercial airlines — estimated to produce 84% of RTKs and over 80% of CO2 emissions.

In fact, research conducted by RDC Aviation and Point Carbon suggests that the 50 largest airlines account for almost 70% of CO2 emissions, which raises the question: why have so many minor emitters been caught up in this programme? Undoubtedly for the business aviation community and small commercial operators, the proportional cost of compliance coupled with the administrative requirements far outweigh any potential environmental benefit that would be gained even if all of these carriers stopped flying all together.

Compliance, allowances and shortfall

As the carbon baseline has been retrospectively assessed on the basis of emissions between 2004 and 2006, and as only 82% of those emissions will be covered by free allowances, it comes as no surprise to learn that the industry will be ‘short’ once final reporting of 2012 CO2 has been made.

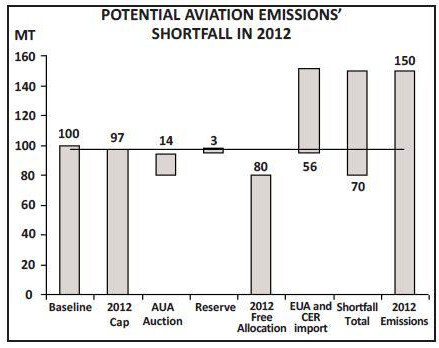

The chart approximates how the shortfall would look under a scenario whereby the industry generated 50% more emissions in 2012 than allowed for by the baseline of 100m tonnes. The free allocation of around 80m tonnes would then leave it with a total shortfall of 70m tonnes, of which 14m tonnes will be auctioned by government and 56m tonnes obtained through purchase of EUAs and CERs. Based on carbon emissions permits on the mainstream markets trading around €17 per tonne, the combined cost to airlines that fall within the EU ETS is significant, a minimum of €1bn in 2012. Taken in isolation this is a figure that the industry can ill afford at a time when margins remain under pressure; it is twice the net profit IATA expects for European airlines in 2011. On the other hand, when compared to the cost of jet kerosene, the cost to ‘offset’ the emissions from a tonne of Jet A is less than 15% of the cost of the fuel (based on Jet A at about $1000/tonnes and one tonne of Jet A being equivalent to 3.15 tonnes of CO2).

Mitigation options

The additional cost to obtain emissions permits is unwelcome for airlines; nevertheless, even with projected increases in the carbon price throughout Phase 3 of the ETS, it is difficult to see how the cost of obtaining sufficient permits to cover burning a tonne of jet fuel will rise to any more than 20% of the cost of Jet A.

Plotting the cost of carbon against oil prices suggests that there is no correlation — fluctuations in the price of oil do not tend to be reflected in the carbon price. This means that airlines need to adopt a different approach to the oil and carbon markets if they are to optimise their carbon procurement strategy, and this is an area where the large emitters can engage some expertise to minimise their financial exposure.

To date, whilst most carriers are only just getting to grips with their requirements, Lufthansa is already preparing to trade carbon on the European Energy Exchange (EEX); Cathay Pacific is involved in CDM projects in mainland China; and a number of the other major network carriers are claiming to be already looking at the carbon markets.

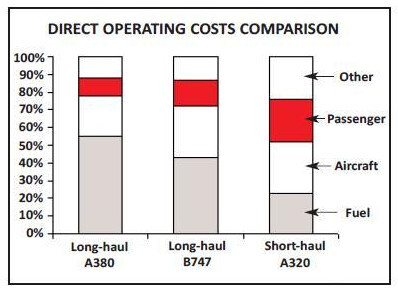

The simplest solution to the carbon cost burden is to reduce fuel burn — paradoxically for the regulators, not because of the CO2 emissions permit cost but because fuel represents the largest variable element of any airlines cost, and the biggest single component of direct operating costs.

Over the past twenty years, improving fuel efficiency has been the driving force behind airframe development for new aircraft types and upgrades to existing technology. The results have been largely successful, with modern airframes 20% more efficient than they were 10 years ago, according to IATA. However as the chart shows, on a sector between London and Bangkok, 55% of direct operating costs are accounted for by fuel burn with an A380, and with fuel costing more than ten times the cost of the carbon it produces, it is clear that the carbon cost is a consequence of fuel burn rather than the driving force of change.

There are some relatively quick wins — improvements in airways and flight paths through the single European skies and continuous descent save fuel and therefore emissions, but realistically these improvements are at the margins. Younger equipment is one route to emissions reductions and for any carrier about to replace an aged fleet of long–haul aircraft with more efficient types, there will be a fuel and CO2 benefit but to suggest that is cost effective to bring forward fleet replacement purely on carbon grounds is wrong. And whilst manufacturers have been keen to point out the improvements in fuel burn per available seat, often the overall fuel burn is greater with larger aircraft and so efficiencies are only seen where, for example, one A380 replaces two 747s, but in practice that is unlikely.

It would seem that the biofuels could offer that potential fix but unlike other modes of transport, the short term prospects for biofuel experimentation and integration are limited on many levels.

Certification of biofuel is yet to take place although Lufthansa is beginning test flights within Germany and several operators have experimented with running engines on various mixes of biofuel. However, the barriers are steep — from the risk of failure at altitude to freeze point and density; not to mention questions over cost, sustainability and supply chain feasibility.

Whether it is commercially feasible to produce biofuels on the scale required is far from certain — and in order to make them viable the cost needs to be lower than the combined cost of JetA and its associated carbon output. This seems unlikely, when estimates are that biofuel could cost upwards of US$3,000 per tonne.

Fears and challenges voiced

Aviation will be included in the EU ETS from 2012 and mitigation options are few.

However, since the inclusion of air transport in the EU ETS was first announced, airlines and their representative trade bodies have argued that aviation is a special case which justifies different treatment to the other constituent industries of the ETS. This position is particularly pertinent with the proposed inclusion of long–haul flights from outside of the EU where emissions do not occur within European air space. There is logic within this argument and the ATA has brought a test case initially against the UK, as the ‘competent authority’ to which most of the US majors report for ETS purposes.

The basis of their argument is that including international aviation in a unilateral European scheme contravenes the Chicago Convention, which provides for emissions trading only when the two nations at either end of the air route are in agreement. It also challenges the EU’s right to jurisdiction over airlines when not in European airspace.

The case has subsequently moved up to the European Court of Justice and is likely to be heard at some point in 2012.

Perhaps they have a point; there will be some testing legal discussions which, if the EU wins, could pave the way for sanctions from third party countries. Certainly if the EU loses and non–European carriers are excluded, ETS becomes a millstone around the necks of EU carriers, distorts competition and ultimately it is hard to see how it can continue, for aviation at least. AEA Secretary General Ulrich Schulte–Strathaus, in a joint letter with Airbus to the EC, voiced trepidation recently saying: “We want to avoid trade conflict, which could potentially damage Europe’s air links”. IATA’s outgoing Director General and CEO Giovanni Bisignani went further in a statement by labelling the EU’s ETS scheme “illegal”.