GECAS retains high margins despite the recession

June 2009

As AIG and the US government struggle to get a decent price for ILFC (see Aviation Strategy, May 2009), how is fellow megalessor GECAS faring as the aviation downturn rages though 2009?

In 2008 GE Commercial Aviation Services (GECAS) recorded revenue of $4.9bn, 1.3% higher than in 2007, and made a net profit of $1,194m, 1.4% lower than the previous year. It placed 232 aircraft in 2008 (146 from the current fleet, 42 new aircraft and 44 extensions of existing leases), which was a 10% increase on leasing activity in 2007. Although the 2008 figures also included an impairment loss of $72m for a downward adjustment of the fair value of the fleet ($110m in 2007), this was an excellent set of results for the full year.

Good start to the year?

Whether GECAS can continue that profitability into 2009 is the key question, and Henry Hubschman, president and CEO of GECAS (until July this year), warned that “the first quarter of the year proved to be as challenging as any we’ve faced”. However, financial results for the January- March period show that the lessor appears to be weathering the storm of the global recession reasonably well. In the first quarter of 2009 GECAS reported revenue of $1,140m — some 9% lower than the first quarter of 2008 — while net profits of $268m in January- March 2009 were 31% lower than in January- March 2008. While not as good as a year ago, this still gave GECAS a net margin of 24% in the first quarter of 2009 (compared with the 31% of a year earlier).

In the first quarter of 2009 GECAS placed 33 aircraft, extended the leases on nine aircraft currently with clients, and sold three aircraft. Of those 33 placed on new leases, 12 were in the “growth” markets (according to GECAS) of the Middle East, Africa, Russia and Asia. Of its total portfolio, as of the end of March just one was not placed with a client, although GECAS signed a letter of intent with an airline to lease this aircraft out soon afterwards.

Of course GECAS has faced a very tricky market over the past 12 months or so, as lease rates have fallen and some airlines have faced severe financial problems. For example, GECAS is in an ongoing dispute with India’s Deccan Aviation, after it terminated a number of A320 leases following the merger between Air Deccan and Kingfisher Airlines. Kingfisher says that there has been “a disagreement” with the lessor on terms and conditions for returning the aircraft, but the whole issue has now gone to the courts.

In early January GECAS rescinded six contracts covering 14 aircraft leased to SkyEurope Airlines after the Bratislavabased LCC faced financial problems at the end of 2008. SkyEurope had defaulted on lease payments for the 737–700s, and GECAS appears to have acted ruthlessly in recovering the aircraft. SkyEurope has since continued to operate normally and the airline was very critical of GECAS’s actions, saying that it caused operational problems, but GECAS countered by saying that it held a series of negotiations with SkyEurope that did not resolve the situation.

Elsewhere, in March this year the Civil Aviation Administration of China (CAAC) grounded private airline East Star Airlines after the Wuhan–based carrier missed lease payments to GECAS. East Star had a fleet of nine A320 family aircraft, all of which were leased from GECAS, and its routes have been taken over by other Chinese airlines.

Overall, however, GECAS is coping well with difficult market conditions and (like most lessors) appears to have avoided the need to renegotiate existing lease contracts — although that is not to say the situation won’t change through 2009.

GECAS also does a significant amount of engine leasing (a business that became wholly part of GECAS in 2005) and leased 120 units in 2008 out of a total portfolio of 350 owned and managed engines. The business is naturally counter–cyclical to the aviation industry, with Julie Dickerson, general manager of GECAS Engine Leasing, saying: “Despite challenging economic conditions, we expect airlines will lease more of their spare engines in 2009 instead of choosing the more capital–intensive ownership option.”

Financially, GECAS has very deep pockets in that it is a subsidiary of GE Capital, which itself is part of the massive GE conglomerate – a series of companies that has around 300,000 employees in more than 100 countries worldwide, with revenue of $182bn in 2008. Unlike ILFC’s parent AIG, GE has not got itself into funding problems over the last 12 months, and as a result the future of both it and GECAS appears solid – which means that the lessor’s management team can concentrate solely on placing its aircraft and financing its asset base, rather than have the distraction and uncertainty of a sales process, as is occurring at ILFC (and a number of medium- size lessors).

Asset sale

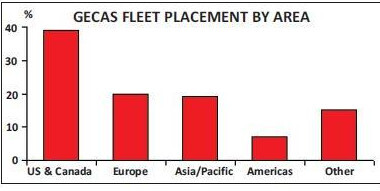

GECAS (which has 24 offices around the world) currently has a portfolio of 1,520 owned aircraft, placed with 250 airlines in 78 countries, and with an average age of seven years. 55% of the fleet are narrowbodies (and 88% of those are A320s and 737NGs), with 20% being widebodies (of which 91% are 767s, 777s or A330s), 16% regional jets and 9% cargo aircraft. GECAS also manages another 325 aircraft for clients, and the value of GECAS’s assets rose from $49.5bn as at the end of 2008 to $50.3bn as at March 31st 2009. However, in April Irish lessor Pembroke Group agreed to buy 13 737–800s and a single A320 from GECAS. The aircraft have an average age of just over one year, and all are currently placed with clients in the Asia/Pacific and Africa regions. It’s possible that selling such a tranche of young aircraft indicates that GECAS is coming under pressure on lease revenue though the year, and wants to boost 2009 results with sales – although a downside of the deal is that it will increase its traditional dependence on the US market even further (see chart, above).

In the January–May period GECAS received 18 new aircraft from Boeing and nine from Airbus, and though GECAS hasn’t placed any major orders with the manufacturers for a considerable time, as of end–May GECAS had outstanding orders for 85 737s and 18 777s, and for 51 Airbus aircraft (11 A319s and 40 A320s), which are worth around $17bn.

In November last year GECAS also placed a firm order for five ARJ21–700 regional jets produced by the Commercial Aircraft Corporation of China (Comac). The ARJ21 programme has suffered delays over the last few years but these aircraft will be delivered from 2013 onwards, and GECAS also has options for up to 20 more of the model. It’s likely that the aircraft will appeal mostly to Chinese airlines, and other firm orders for the regional model have come from Shanghai Airlines and Shandong Airlines. GECAS’s order was probably linked to GE’s production of the engines that will power the ARJ21, but state–owned Comac is also responsible for China’s anticipated larger commercial aircraft development programme, and GECAS’s regional jet order can be seen as a strategic move to cement its place at the heart of the Chinese manufacturing industry.

As for the rest of 2009, with lease rates softening further it’s inevitable that GECAS’s margin will come down through the year, which will be a challenge for Norman Liu, the new CEO of GECAS from July 1st (Liu is currently executive vice president). On the other hand GECAS (and other lessors) are benefiting from lower interest rates on the debt that they are carrying, and it looks well placed to take full advantage of the upturn in the industry, whenever that may be.