Singapore Airlines: The push into China

June 2008

Although Singapore Airlines is consistently one of the most profitable airlines in the world, it is devoting large amounts of management time to securing an expansion into the huge Chinese market via an equity acquisition at China Eastern, one of the country’s "Big Three" carriers. While completing this investment has been far harder than the SIA group has anticipated, Singapore’s flag carrier is determined to push through a deal that will be the cornerstone of SIA’s strategic plans over the next few decades.

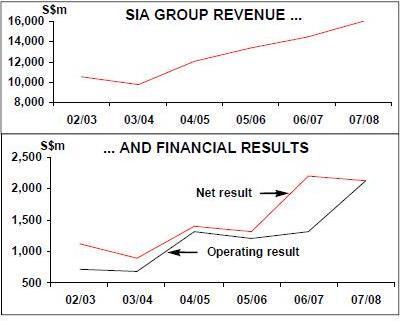

The SIA group is already substantial, employing 30,100 and currently operating to more than 75 destinations in the Asia/Pacific region and around the globe. In results just released, during the 2007/08 financial year (ending 31st March 2008), the group reported revenue of S$16bn (US$10.8bn) — 10% up on the 2006/07 financial year. But group operating profit rose even faster, up by a substantial 62% to S$2.1bn (US$1.4bn), of which S$1.6bn came from the SIA airline operation (61% up year–on–year).

Net profit for 2007/08 reached S$2.1bn (US$1.4bn), slightly down on the S$2.2bn net profit in 2006/07, but this was due to a large amount of exceptional items in 2006/07, including S$421m from the sale of assets, as well as S$247m from tax write–backs following a reduction in the Singaporean corporate tax rate. Excluding these items from 2006/07, SIA’s 2007/08 underlying net profit rose by a substantial 40%.

The SIA group includes the mainline SIA, SilkAir, SIA Cargo, engineering and airport services, but in 2007/08 airline operations (pre inter–segment eliminations) accounted for 87.6% of revenue, 85.9% of operating profit and 80.3% of net profit, and it is the airline business that dominates the SIA group.

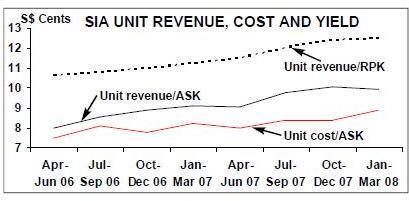

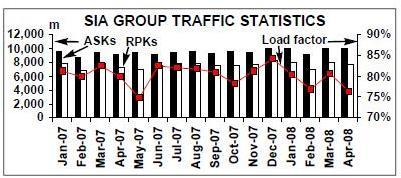

In the 12 month period to the end of March 2008 the mainline operation carried 19.1m passengers, 4.2% up on the previous financial year, and a 2.6% rise in traffic was greater than a modest 1.2% capacity increase, resulting in a 1.1 percentage point rise in load factor, to 80.3%. As can be seen in the chart below, although the difference between SIA’s unit revenue and costs was reduced in January–March 2008 compared with October–December 2007, the gap is still healthy, and yield is still heading upwards.

What recession?

Indeed 2007/08 results were better than most analysts expected, and despite an increase in capacity this year and what SIA says is some softening in leisure demand out of North America (but not business travel), the airline expects yields to hold up for the foreseeable future. SIA says that while "the combination of a global economic slowdown and record high fuel prices will make this a more challenging year for airlines", SIA is "well positioned to weather the storm".

Others are not so sure, and in early May Citigroup put a "sell" recommendation on SIA’s shares, saying that "even a quality, cash–rich SIA cannot fight slower global traffic, cargo overcapacity, record fuel prices and intense competition", adding that although the January–March quarter may show weakness, "the real pain would be in the 2008/09 financial year".

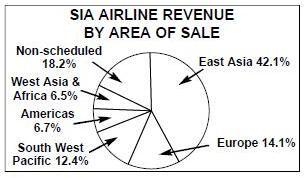

It’s true that SIA is particularly vulnerable to an economic downturn as the airline obtains at least 50% of revenue from first- and business classes, although SIA executives contend that their premium passengers tend to be more resilient and loyal to SIA than premium traffic at competitors due to SIA’s innovative first- and business–class products. Indeed from this May SIA has been converting its five A340–500s used on routes between Singapore and New York Newark and Los Angeles from a 181–seat two–class configuration (business and premium economy) to a 100–seat all–business class product (all of which are convertible into flat beds).

The two–class non–stop Singapore to Newark and Los Angeles services were launched in 2004 and have been well received by customers, claims SIA, even though SIA’s business fares on the route have gradually increased over the last four years into a 15% gap between the nonstop and one–stop services.

The first all–business class aircraft was introduced onto the Newark route in May, to be followed by the Los Angeles service in September and these all–business class transpacific flights will force economy passengers on SIA to use the airline’s stopping services to the US. SIA currently operates more than 50 flights a week between Singapore and the US, to San Francisco, Los Angeles, New York and Houston (the last route — via Moscow — being launched this March).

On long–haul, the group now has four A380s, with 15 more on firm order. The first was put onto the Singapore–Sydney route in October 2007, with the next two used on London–Singapore from this March and the fourth being used on Tokyo–Singapore from May. The aircraft are configured with 471 seats — 12 premium class (what SIA terms the so–called "beyond first–class"), 60 business class (with lie–flat seats) and 399 in economy.

Further A380s will be used on Asia–European routes, and although SIA will face stiff competition against capacity from Middle Eastern airlines on this sector, the SIA group may order up to 15 more of the model, according to Airbus.

| Fleet | Orders | Options | |

| SIA | |||

|---|---|---|---|

| A330 | 19 | ||

| A340 | 5 | ||

| A350 | 20 | 20 | |

| A380 | 4 | 15 | 21 |

| 747-400 | 18 | ||

| 777-200ER | 46 | 28 | |

| 777-300 | 12 | ||

| 777-300ER | 14 | 5 | 13 |

| 787 | 20 | ||

| Total | 99 | 79 | 82 |

| SIA Cargo | |||

| 747-400F | 14 | ||

| SilkAir | |||

| A319 | 6 | 4 | |

| A320 | 8 | 8 | 12 |

| Total | 14 | 12 | 12 |

| Group total | 127 | 91 | 94 |

Altogether the mainline SIA currently operates a fleet of 99 aircraft (see table, right), with an average age of six and a half years, and as well as the A380s, SIA received five 777–300ERs in 2007/08, and decommissioned five 747–400s. While there is now renewed uncertainty over A380 delivery dates, four more will arrive in 2008/09 (to add to the current four), although the delivery dates on the others may yet be put back by Airbus.

Four A330–300s and five 777–300ERs will also arrive in 2008/09, and with six 747–400s being sold, the airline’s capacity is forecast to grow by just over 7% in this financial year.

An order for around 20 A330s or A350s is also possible. SIA is to lease six A330–300s from AWAS from 2009 onwards, all of which are short–term stopgaps before the first of 20 A350–900s on order are delivered.

Elsewhere on long–haul, SIA wants to operate transpacific services between Australia and the US, but is excluded from doing so even under the new "open skies" deal that came into force between Australia and the US this year.

However, the unexpectedly liberal air services agreement between Singapore and the UK (called a virtual "open skies" deal) that was agreed late last year allows SIA to operate domestic UK routes and beyond services from the UK to other markets, such as the US. SIA has long wanted to launch transatlantic services, although even after this ASA several hurdles remain, including the acquisition of sufficient slots at Heathrow.

On the other hand, SIA has benefited significantly from more than 30 years of protection given to it and Malaysia Airlines on the lucrative Singapore–Kuala Lumpur route, where the two airlines operated a shuttle service in partnership, with co–ordinated flight schedules and split revenue from their joint 90+ flights a week.

However, LCCs were allowed onto the route in February 2008, and the route will be fully opened up in December this year, which led to SIA and MAS ending their partnership on June 1st.The SIA group also includes regional subsidiary SilkAir, which operates to more than 25 destinations in nine Asian countries with a fleet of 14 A320 family aircraft, with four A319s and eight A320s on outstanding order. The group’s cargo operation is Singapore Airlines Cargo, which operates 14 747–400s, and in turn this subsidiary owns 25% of Great Wall Airlines, a Shanghai–based joint venture cargo operator that operates three 747–400Fs.

Though not part of the SIA group, LCC Tiger Airways was launched in September 2004 by SIA (which now owns 49%), Temasek (11%) and two investment companies — Irelandia (16%, and owned by Tony Ryan and family) and US–based Indigo Partners (24%). The Tiger group operates 12 A320s to around 30 destinations in nine countries — Singapore, China, Australia, Malaysia, Indonesia, the Philippines, Thailand, Vietnam, and India.

Tiger also launched a subsidiary operation called Tiger Airways Australia in November last year, which is based at Melbourne, although Tiger is looking to open a second base in Australia. Tiger plans to open other subsidiaries around the Asia/Pacific region, though the only firm plans appear to be for Incheon Tiger in South Korea in 2009 (and this was originally planned to launch in 2008).

In October last year Tiger ordered another 30 A320s and took options on a further 20 aircraft, and these options were converted to firm orders in December, bringing the total order book to 58 aircraft. These aircraft will bring the Tiger group fleet (including the Australian and Korean operations) to more than 70 aircraft by 2016.

Although a full set of results have yet to be released, in the financial year ending March 31st Tiger recorded a net profit of S$10m — its first profit since it launched. The Tiger group saw passengers carried rise by more than 50% in the 12 month period, with revenue up 82%. Capacity rose by 39.6% in the financial year, but traffic increased at a higher rate, resulting in an 8% rise in load factor.

The SIA group maintains that Changibased Tiger operates completely independently from SIA, although in May Chin Sak Hin — a longstanding SIA group executive and previously CFO of SIA Engineering — became CFO of Tiger. The new CFO is a close associate of Chew Choon Seng, the SIA group CEO, and there are unconfirmed rumours that Hin has been parachuted in to keep close control on the LCC (which has also seen two previous CFOs leave in the previous 12 months).

Looking at the group as a whole, although SIA has capex commitments of S$8.3bn (US$5.6bn) over the next three financial years (largely for aircraft purchases) this is easily affordable for the group. As of March 31st this year, the SIA group had long–term debt of S$1.6bn (US$1.1bn) — S$200m lower than a year earlier — which was considerably less than the group’s cash and cash equivalents, which stood at a hefty S$5.1bn (US$3.5bn) as at the end of the 2007/08 financial year (the same level as 12 months earlier).

Indeed the only real downside for SIA going forward is oil prices. SIA increased its fuel surcharge on all types of flights in May (coming on top of an increase in the surcharge in March this year, and October and December of 2007), and in 2007/08 fuel costs rose by S$453m (US$307m), although SIA’s hedging policy reduced the cost rise by another S$232m. As of May, the group had hedged 36% of its 2008/09 fuel needs, at an average price of US$106, which is well below the current spot rate.

The China push

Fuel concerns aside, Chew Choon Seng — who has been CEO of SIA group since 2003 (and who has recently had his contract extended until the end of 2010) — has driven record profit levels at the group, and substantial profits are expected to come in year–after–year for the foreseeable future.

Nevertheless, Seng has aggressive expansion plans for SIA, and these centre largely around the massive potential of the nearby Chinese market. In September last year the SIA group and Temasek Holdings, the investment vehicle of the Singaporean government (and which owns 54.5% of SIA), announced a proposed deal to buy 24% of Shanghai–based China Eastern for HK$7.15bn (US$920m), with SIA owning 15.7% and Temasek 8.3%).

However, in early January their proposal was rejected by China Eastern’s minority shareholders, who said SIA’s bid of HK$3.80 was too low. Those shareholders included China National Aviation Holding (CNAH), the parent company of Air China, which has been building up a stake in China Eastern and now owns 4%, but which also wants to buy China Eastern. CNAH is keen for Air China to expand into Shanghai, the hub of China Eastern, and if it can’t acquire China Eastern itself then the last thing it wants is for China Eastern to be revitalised by someone else — even if SIA and Air China are both members of the Star alliance. SIA has undoubtedly suffered from China Eastern’s relative lack of support within the Chinese government compared with Air China, and the close ties between Air China and the government were made even closer in January when Li Jiaxiang, chairman of Air China, was made the acting head of the Civil Aviation Administration of China.

The SIA/Temasek bid needed approval from two–thirds of shareholders, but — encouraged by CNAH’s strident opposition — 78% of shareholders voted against the Singaporean bid. However, while this was an unexpected blow to SIA, the Singaporean group is determined to press forward with its bid, and this is reciprocated on China Eastern’s side, as the airline has a heavy debt level (see Aviation Strategy, May 2008) and needs both foreign management experience and financial support urgently.

In essence China Eastern is desperate for a strategic investor, and the airline says publicly that a partnership with SIA would be "superior" to one with CNAH, thanks largely to SIA’s global strength and expertise, whereas CNAH’s bid would face regulatory hurdles, and in any case there would be few synergies between Air China and China Eastern.

SIA’s earlier bid was rejected partly because of the anticipation of a higher bid from CNAH, even though it had support from the China Eastern board and from parts of the Chinese government, but a few weeks later China Eastern’s shareholders also rejected a higher CNAH bid (of HK$5 a share). Although in January SIA said that it would not raise its bid, it also said that it wanted to continue building a relationship with China Eastern.

That’s not surprising given that SIA and Temasek had negotiated the terms of a stake in China Eastern ever since 2006, and in March SIA confirmed what everyone else suspected: that negotiations had restarted between the Singaporeans and China Eastern.

While a SIA shareholding would give China Eastern protection against a takeover bid from China Southern or Air China (as China Eastern is perceived to be the most vulnerable airline of China’s "Big Three"), from SIA’s perspective a China Eastern stake is not only a sensible long–term financial investment but would open up the huge domestic market in China to the SIA Group — and, most importantly, business feed to/from China, particularly at Shanghai, the Chinese airline’s main hub.

Additionally, there is little overlap between the international routes of China Eastern and SIA, and the two airlines could develop a formidable international route network that would be a major challenge to Air China. A SIA/China Eastern equity link could even secure the Chinese carrier’s entry into Star, which would be a huge blow to oneworld as China Southern joined SkyTeam in November 2007 and Air China joined Star the following month.

Only the practicalities of the level of SIA and Temasek’s bid for China Eastern remain to be resolved. There has been concern that the Singaporeans would have to put together a significantly higher offer for China Eastern than previously in order to secure the support of the minority shareholders, with a danger that the price they have to pay would be as high as CNAH could force it, in order to reduce the value of the "strategic gain" to SIA of securing a major stake in one of China’s Big Three.

However, as of early June China Eastern’s share price was less than HK$3.50 — compared with the HK$7 share price when minority shareholders rejected SIA’s offer of HK$3.80, so — ironically — the CNAH–inspired blocking of SIA’s earlier bid may well have saved the Singaporeans a considerable sum of money.

Talks between SIA and China Eastern are continuing through the summer, and it’s possible that a revised bid will be put to China Eastern’s AGM, which is due to be held on June 30th. However, one senior executive at China Eastern indicated that a more likely timeframe for a renewed bid will be in the autumn, since top management at China Eastern was focussing on operations around the Olympic Games, which are being held in August. But it’s more a case of when the deal gets done, rather than if, and in May Li Fenghua, chairman of China Eastern, confirmed that a deal is very likely to be completed between the two.

Other deals…

While SIA group’s main strategic focus is on mainland China, it is also looking at other potential deals. There were rumours in March that SIA was interested in buying 25% of Taiwanese airline China Airlines. However, while SIA has previously been interested in acquiring a stake in this carrier, it’s highly unlikely to be considering such a move at the moment as this would undoubtedly lead to its renewed bid for China Eastern being vetoed by the Chinese government on political grounds.

In December 2007 SIA was also reported as being involved in a consortium interested in bidding for Alitalia, though this was swiftly denied by SIA. Again, with China Eastern the priority it is highly unlikely that the SIA group would be interested in taking a stake in a European carrier — at least in the short- and medium–term.

Meanwhile SIA’s 49% stake in Virgin Atlantic Airways (bought in 2000 for US$960m) is the source of much speculation, although in May Chew Choon Song confirmed that: "It’s not a secret that we regard it as an under–performing investment. We are still reviewing our plans and are open to all offers … but we are not desperate." Virgin has a right of first refusal, and last year Richard Branson said Virgin might buy back SIA’s stake before going for an IPO. The focus for the SIA group in the next few months will be completing the China Eastern deal, to be followed by the huge task of setting up deep–rooted co–operation between the two giant carriers. And there is one more pressing reason for SIA to conclude a China Eastern deal as soon as possible — SIA’s growing cash pile. If SIA does not seal a deal very soon then the group will come under pressure from shareholders to pay out another special dividend. The group paid a S$2bn special dividend as recently as 2007, but with S$5.1bn in cash and cash equivalents sitting in SIA’s coffers as at March 31st this year, the motivation for management to go out and gain kudos through the acquisition of a stake in a Big Three carrier rather than pay a dividend (and thereby allowing shareholders to make their own minds up on where to invest this cash) must be huge.