Alaska Air Group: It's better in the West

June 2008

Alaska Airlines, the smallest of the US major network carriers, is well positioned to make it through the current industry crisis because of its good fuel hedges and strong liquidity. But is there a place for a niche airline like Alaska in the longer term?

In the past couple of months, as fuel prices have continued their relentless climb, Alaska has been frequently portrayed alongside Southwest as a survivor at $150–per barrel oil. Analysts have come to that conclusion after carrying out detailed financial and liquidity analyses. And, not surprisingly, Alaska’s chairman/CEO Bill Ayer has made the company’s special survival attributes his main theme at recent conference calls and at the May 21 AGM.

Alaska Air Group (AAG), the parent of Alaska Airlines and regional carrier Horizon, will easily make it through 2008, first of all, because it has the industry’s second–best fuel hedge position (after Southwest). The group has hedged half of its 2008 fuel needs at the crude oil equivalent price of $76 per barrel.

Second, AAG has a conservative balance sheet, with strong liquidity. Cash reserves amount to more than $1bn, (29% of last year’s revenues) and there is an unused $185m credit facility. Debt leverage is low by network carrier standards, as indicated by an adjusted debt–to–capital ratio of 73%.

Third, AAG’s liquidity raising prospects seem better than average. There are some unencumbered aircraft in the fleet, including 737–800s. There are assets that could be monetised, including the FFP and regional carrier Horizon.

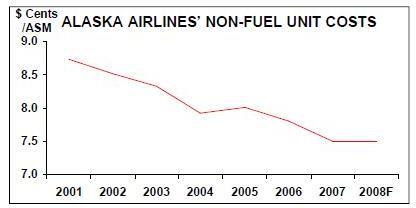

Fourth, Alaska has a good track record on controlling non–fuel costs. Its ex–fuel CASM has declined steadily in the past six years, from 8.73 cents in 2001 to 7.50 cents in 2007 (see chart, page 10). Fifth, Alaska benefits from a young, fuel efficient, single–type fleet. Horizon, in turn, has just embarked on a similar quest — one that has involved the very interesting decision to shed its 70–seat RJs in favour of focusing entirely on the Q400 turboprop. Finally, the Seattle–based carrier has various network advantages that will help it weather the current industry crisis.

Its core regions, the Pacific Northwest and the state of Alaska, are expected to fare better economically than other US regions.

There are promising new markets, such as Hawaii and transcon out of Portland (Oregon), where Alaska has been able to profitably redeploy capacity withdrawn from under–performing markets. And Alaska has a strong network of code–share partners and is poised to benefit from transpacific growth.

What makes Alaska uniquely interesting is that it would make a perfect "low–risk" partner for just about any of the large network carriers. Its route system will look increasingly attractive to the larger carriers if and when industry consolidation gets under way and as airlines grow internationally.

In the short term, however, the most interesting thing to watch for will be the battle with Virgin America. The San Franciscobased start–up entered the Seattle to Los Angeles and San Francisco nonstop markets this spring, creating the first head–to head clashes with Alaska. Alaska has responded by increasing capacity and creating a shuttle–type hourly service on the Seattle–Los Angeles route. One of its top executives explained the move as follows: "We're in this fight to win. We know how history has played out elsewhere in the country (LCCs winning market share) and we don’t intend to let it happen here."

Financial performance

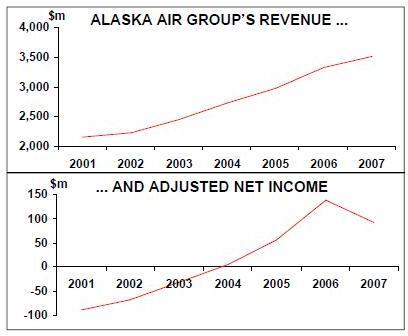

Alaska emerged from the post- September 11 industry crisis in relatively good shape. The group lost money for four consecutive years (2000–2003), but the losses were relatively modest, reflecting the resilience of the West Coast and Alaskan markets (the isolation factor) and Alaska’s successful positioning as a high–quality, leisure–oriented point–to–point airline with unit costs "a notch above the LCCs".

AAG returned to modest profitability in 2004, two years ahead of the industry. Profits peaked in 2006, when the group reported adjusted net income of $138m (4.1% of revenues), but last year saw profits decline to $92m due to higher costs. In contrast with its peers, AAG has seen a steady positive revenue trend since 2001.

This is because Alaska continued to grow at a 7–8% annual rate in 2002–2004 (capacity growth has since slowed to the 4% range). The airline never parked aircraft or furloughed workers; instead, it redeployed its fleet in new markets, including transcontinental routes.

CASM success

Alaska has done some impressive cost cutting. Under a 2002 plan, the airline sought to reduce ex–fuel CASM from 8.73 cents in 2001 to 7.25 cents by 2005. Although CASM was still at the 8–cent mark in 2005, the 7.50 cents achieved last year was not that far off the original target.

The 7.25–cent CASM target was part of a broader seven–year vision to transform Alaska into a profitable, larger airline with a greatly expanded network. The so–called "Alaska 2010" plan included employee and customer elements and growth and financial targets. The employee aims included providing "excellent job security" and making Alaska "one of the best places to work for in America". With service and brand, the aim was to provide "the best value" (a combination of product and price), build on an already strong brand and "maintain differentiation".

The plan set 10% annual pre–tax profit margin and ROI targets, which would permit annual capacity growth in the 8–10% range.

Alaska has made great strides towards many of those goals, except of course the financial targets. The best ROI achieved was 7.9% in 2006, followed by 6.1% in 2007. The financial goals are now obviously totally out of reach in the current fuel environment. AAG incurred a $36m net loss before special items in the March quarter, reflecting an $89m or 45% increase in fuel costs. On a pre–tax basis, Alaska lost $38m and Horizon $18m. Alaska saw an impressive 3.4% reduction in ex–fuel CASM, but its 3% RASM improvement lagged the industry — both evidently reflecting an increased average stage length and brisk 6.8% capacity growth.

Like its peers, AAG is now taking action on multiple fronts to try to offset the sharply higher fuel costs. The company recently unveiled a new package of cost and revenue initiatives that are aimed at improving annual pre–tax income by $150m.

First, Alaska has modestly reduced its planned 2008 capacity growth from 3% to 2% (down from 6% envisaged last year), while Horizon’s capacity is now expected to decline by 4–5%. The reason Alaska is still growing ASMs is that there continue to be opportunities to redeploy capacity in profitable markets.

The company has also decided to eliminate all of Horizon’s 20 CRJ–700s and transition the regional carrier to a single–type fleet of Q400s.

AAG has also put in place measures to boost ancillary revenues by $30–40m annually. The main focus is on increasing fees on items such as booking through reservations or airport sales agents, overweight baggage and pets. Like many other US carriers (with the notable exception of Southwest), Alaska has also started charging $25 for a second checked bag. The airline is determined to maintain its "simple, customer–friendly fare structure". Many of the changes went into effect in May or June, so there should be an immediate revenue boost.Alaska has been raising fares where it can, holding more seats open for its premium customers closer to flight departures and evaluating changes to its mileage plan. The strategy of focusing more on premium customers has helped: in the March quarter, first class revenues were up by $17m and the bucket mix in the main cabin also improved. Before oil prices surged to the $130–plus range, the fare increases needed by many of the airlines seemed surprisingly small. In late April, when oil hovered at around $118 (equivalent to $3.60 per gallon, assuming refining costs of 70 cents per gallon and no fuel hedges), Alaska’s executives calculated that the airline needed an average fare increase of just $10 per passenger to break even, or $25 per passenger to "achieve the kind of margins investors expect".

But Alaska is much better positioned than its peers this year simply because of its fuel hedges, which are mainly crude oil call options. AAG has hedged 50% of its 2008 needs at $76 and 20% of its 2009 needs at $92. This is nowhere near Southwest’s position (70% of 2008 needs and 55% of 2009 needs hedged at $51) but significantly ahead of the rest of the industry.

Like its peers, Alaska is implementing numerous fuel conservation measures. Recently announced initiatives include a new flight planning system to select more direct routings, single–engine taxi procedures and using more ground power for taxi procedures. Ongoing measures include transitioning to more fuel–efficient aircraft, installing winglets on the 737NGs, eliminating unnecessary weight on board and working with the FAA to pursue more direct routings and fuel–saving approaches and departures. The winglets alone will reduce the annual fuel bill by $20m at $118 oil price.

Alaska expects to maintain its mainline ex–fuel CASM flat at 7.50 cents in 2008. The primary goal is to continue to improve operational reliability. The company faces some labour cost pressures, especially because pilot contracts at both Alaska and Horizon have been open for more than a year. Somewhat unusually, Alaska’s pilots had to take a 26% wage cut in 2005 as a result of a binding arbitration ruling, and that contract became amendable in May 2007. The pilots understandably want a wage increase, but the management believes that Alaska’s current pilot unit costs are the second–highest in the industry for the size of aircraft operated and is therefore insisting on a strict trade–off for improved productivity. Negotiations continue, with the management presenting its latest counter–offer on May 20.

Alaska is likely to escape the worst brunt of the recession because the Pacific Northwest and the state of Alaska are expected to fare better economically than other regions. For example, real personal income growth is forecast to be at least one percentage point higher in Washington state than in the US overall in 2008–2009, while housing prices are stable in cities such as Seattle and Portland. In addition, Washington state exports are booming thanks to the weak dollar.

Consequently, AAG may see only minimal cash burn this year. The current consensus estimate is a loss before special items of around $40m in 2008 — only 1–2% of revenues. But much will obviously depend on fuel price developments. According to a May 12 earnings sensitivity analysis by Calyon Securities, AAG could break even this year if the fuel price averaged $100, but at $150 oil the loss could be as high as $127m (4% of projected revenues, so still manageable).

The Calyon Securities analysis suggested that Alaska would be fine even at $150 oil, because at year–end 2008 it would still have about $682m in cash or 18.6% of revenues. However, at $150 oil, by the end of 2009 cash reserves would have dwindled to $402m, only 10.7% of revenues.

JP Morgan’s May 19 liquidity analysis ranked Alaska as the second–lowest Chapter 11 risk in the US industry (after Southwest). Next year’s outlook for Alaska is much less certain, as the 2009 fuel hedges are not that good. But, as Southwest’s management has noted in the past, good fuel hedges in the near–term give an airline valuable extra time to adjust to a new environment of possibly permanently high ($130–plus?) fuel prices.

Horizon's fleet transition

In late April AAG’s board approved a plan to transition Horizon to a single–type fleet within 24 months. This will mean shedding the 20–strong CRJ–700 fleet, in addition to the previously announced phase–out of Horizon’s 12 remaining 37–seat Q200s by June 2009, in favour of concentrating on the Q400 turboprops. In other words, Horizon will simplify its fleet from three types to one, while also reducing the size of the fleet from 70 to about 50 aircraft by December 2009.

The latter is based on the Q400 firm order total of 48, but there are also 20 options that could be exercised.

The decision is interesting in that it confirms a new trend of turboprops gaining popularity at the expense of RJs in the new fuel environment, as turboprops are much more fuel–efficient than jets. At a recent conference, a representative from ATR noted a surge of interest in turboprops from airlines.

Could the prop–to–jet trend that began in the early 1990s soon be reversed? Horizon is already a leading operator of the Q400 and has come to know it as an "extremely flexible and capable aircraft" and a great match for the majority of its current and planned markets. The airline describes the type as "one of the most technologically advanced turboprop aircraft in the world" and one that offers "jet–like speed and cabin environment". The type burns 30% less fuel and produces 30% less emissions than a 70–seat jet.

The Q400 apparently offers the best economics of any regional aircraft in Horizon’s network. At the system average stage length of 365 miles, the Q400 has 10% lower CASM than the CRJ–700; on a 129–mile route such as Seattle–Portland, the Q400 offers 16% lower CASM, and even on a 600- mile route the differential is 7%. Of course, RASM will be lower, but the revenue differential should be much less, so profits will improve.

The 70–seat jets served a great purpose at AAG by improving the performance of markets previously served by larger Alaska jets. However, the management noted that the markets continued to under–perform, with no end in sight to the yield pressures and cost increases, particularly fuel. One problem that Horizon will face is that the 74–76 seat Q400 will be too large for the smaller markets and could preclude the carrier from developing new markets.

This means that Horizon may well eventually contract some services out to a smaller third–party operator, not unlike what Alaska currently does on particularly thin routes in the state of Alaska. At the same time, Horizon itself could do some third–party work as there is apparently potential demand from the legacy carriers for Q400 feed.

In addition to leveraging the favourable economics of the Q400, the new fleet plan will allow Horizon to reduce its annual operating costs through the reduced fleet size and achieve the favourable economics and efficiency of a single fleet type.

The beauty of the plan is that it should involve no additional capital spending. Horizon already had 15 Q400s on firm order (to bring the fleet to 48), and as those come in, the Q200s and CRJ–700s will leave, bringing in sales proceeds or lease income. The airline has already subleased out or is in the process of arranging such deals on the Q200s, but it will need to find a market for the 20 CRJ–700s, of which two are owned and 18 are leased. All the indications are that worldwide interest in 70–90 seat RJs remains strong.

Alaska's fleet plan

Alaska is nearing the completion of its transition to an all–737 fleet, with the return of its last MD–80 on September 30 — three months ahead of the original plan, which was announced in March 2006. The MD–80 fleet has been whittled down to 10 aircraft (March 31) from 26 aircraft two years ago. Last year the airline sold all 20 of its owned MD–80s and leased most of them back under short–term leases. Of the 10 still in the fleet at the end of March, six were under short–term operating leases that expire this year; the other four, on long–term operating leases, will simply be grounded and stored (or subleased) by October.

At the end of 2008, Alaska will have an all–737 fleet of 116 aircraft, consisting of 46 737–800s, 20 737–700s, 12 737–900s and 38 737–400s. The average fleet age will be 7.6 years — among the youngest in the US.

The airline is receiving as many as 17 737–800s this year (including one on operating lease), which means a relatively heavy $390m aircraft capital spending. However, after this year capex will start to fall quite dramatically, as 737–800 deliveries moderate to six in 2009, six in 2010 and three thereafter. As of March 31, Alaska had another 41 737 options. Currently, the expectation is that the mainline fleet will grow by one aircraft or not at all in 2009.

Promising new markets

Like its peers, Alaska is in the middle of a thorough route re–evaluation. So far, the airline has pulled out of two markets (San Diego–San Francisco and Orange County–Oakland) and reduced service in certain other West Coast markets. The aircraft have been moved to three markets: transcon out of Portland (Oregon), Hawaii and Seattle–California.

This autumn, Alaska intends to reallocate another 3–5% of its capacity. So far, the airline has disclosed that it will terminate Portland–Orlando and San Francisco–Vancouver, will not return to three seasonal Mexico routes out of San Francisco and will launch a new Seattle- Minneapolis route in October.

Transcon and Hawaii have received additional service because they are performing well. Alaska is particularly pleased with the response it is seeing on its new Hawaii routes from Seattle to Honolulu and Lihue and from Anchorage to Honolulu, which were launched in October 2007. Reduced industry capacity since ATA’s demise has helped and advance bookings are strong. The services appear to be profitable, though Alaska says that the fares could be higher to facilitate satisfactory returns. This summer will see Alaska adding service to its third Hawaiian island, Maui, to be followed by Kona in November.

Alaska’s greatly expanded Seattle- California schedule, in turn, is a direct response to Virgin America. The "West Most" schedule features 78 daily flights, with hourly service from Seattle to Los Angeles and flights every other hour to five other airports (Orange County, San Francisco, San Diego, San Jose and Oakland).

Alaska’s 15 and eight daily flights on the Seattle–Los Angeles and Seattle–San Francisco routes, respectively, this summer vastly outnumber Virgin America’s four and three daily flights. Those services represent only 4.6% of Alaska’s total daily flights. But, as Alaska’s management put it, "those markets are extremely important to us and we’ll defend them to the end".

Alaska’s strong portfolio of airline partnerships positions it well to capitalise particularly on transpacific growth. Its major domestic partners are American, Delta, Continental and Northwest, while international partners include Air France/KLM, LAN, Qantas and, on an FFP basis, BA and Cathay Pacific.

In the event of industry consolidation, Alaska believes that it will have a significant role to play almost regardless of what happens.

The management is enthusiastic about Seattle’s potential to act as a gateway to Asia; in a recent presentation, the executives noted Northwest’s possible growth to Asia and Europe out of Seattle with the 787, as well as Delta’s possible Asian expansion out of Los Angeles.