Air France/KLM: Challenges in the downturn

June 2008

Air France/KLM has suffered a series of blows in recent weeks, with its failed bid for Alitalia followed by the posting of its first quarterly loss since 2003 and a warning that operating profits will fall by a third in 2008/09. Yet although it faces challenges, the Franco–Dutch group is in a relatively strong position to weather the aviation downturn, and it may look to acquire other airlines over the next 12 months.

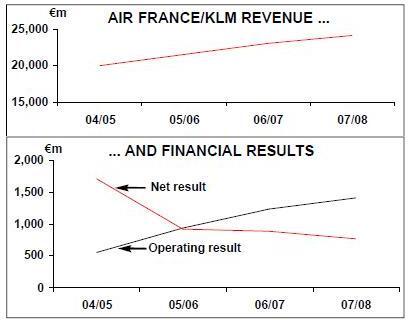

It’s been four years since the merger between Air France and KLM, and on an annual basis the group has delivered impressive financial results year–after–year (see charts, right), with results just released for the 2007/08 financial year (ending March 31st) including the group’s best ever operating profit — €1.4bn, 13.3% up on 2006/07.

The group’s airline business (excluding cargo) accounted for €1.3bn of operating income, 21% up on 2007/08.

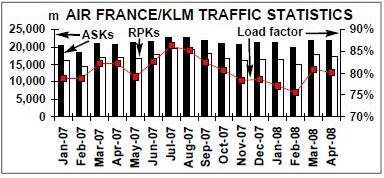

In the 12 month period to the end of March 2008, the Air France/KLM group carried 74.8m passengers, 0.7% up on 2006/07. Capacity rose by 4.6% in the year, just ahead of a 3.9% increase in traffic, thus leading to a 0.6 percentage fall in load factor to 80.8%.

Air France/KLM posted a 4.5% rise in revenue in 2007/08 to €24.1bn, although net profit was down 16% to €748m, affected by a massive provision of €493m post–tax for the US and European regulatory investigation into potential anti–competitive practices (i.e. alleged price–fixing on surcharges) at the group’s cargo business. Incidentally, Air France and KLM are two of the airlines (which also include Alitalia and Lufthansa) that are being investigated by the European Commission over alleged collusion on passenger flights between Europe and Japan, although no provision has been made for this.

Quarterly concern

However, the annual result includes Air France/KLM’s first quarterly loss since 2003, as in the January–March 2008 period the group posted an operating loss of €46m and a net loss of €542m (which included the cargo investigation provision), compared with an operating profit of €9m and a net profit of €44m in January–March 2007.

At an operating level the culprit is — of course — the rising cost of fuel. Overall in 2007/08 group fuel costs rose by "just" 7.4% to €4.6bn, but this was due partly to the US dollar’s depreciation against the Euro, which made the purchase of oil (as well as the leasing of aircraft) cheaper in Euro terms.

On the other hand, the rise in the Euro against the dollar effectively reduced group revenue by 2.3% over the 12 month period, so the currency effect worked both ways.

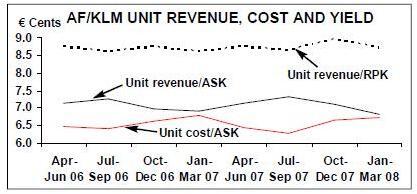

Passenger unit costs fell during the 2007/08 financial year to € Cents 6.52, while unit revenue per ASK rose by 0.3% to € Cents 7.09. Yield rose by 1% in the year, to € Cents 8.78. However, these figures are distorted by currency effects, and if the €/$ exchange rate had remained constant year on- year then yield would have risen by 3.2% and unit revenue by 2.5%. But the fourth quarter figures show the gap between unit revenue and cost narrowing significantly (see chart, left).

It’s clear that Air France/KLM needs to retain a focus on cost cutting. The group currently employs 104,700 but has already made a substantial effort to reduce costs over the last few years; in February Air France/KLM even de–listed its shares from the New York stock exchange in order to save €3.5m per year (the group’s main listing is on Euronext in Paris, which is now part of NYSE–Euronext).

More significantly, the merger of Air France and KLM has created more than €500m of synergies a year, and the group believes this will grow to €1bn a year over the next two or three years. In relative terms KLM has gained more from the Air France/KLM merger than Air France has, thanks to access to Air France’s larger business customer base and FFP. But — crucially — Air France has benefited from KLM’s better focus on keeping unit costs down, and many of KLM’s practices have — where applicable — been carried over into Air France. So while the "political necessity" to retain the ring–fenced KLM brand and operation is not as crucial now as it was in 2004, the two airlines are likely to remain separate for the foreseeable future, as the focus is still on driving through further synergies.

Air France/KLM’s main cost saving programme is called Challenge 10, and has a target of €1.4bn in savings over the three–year period to the end of the 2009/10 financial year, with €536m of the €560m savings targeted for 2007/08 being achieved. Labour is a crucial part of this effort, but the 2007/08 results came despite a five–day strike by cabin crew in October 2007, which was the most serious industrial action faced by Air France for 10 years. The strikes cost the group €60m-€75m of operating profit and were caused by union anger over a new long–term agreement on pay and conditions.

This was followed by industrial action in December from ground handlers at CDG, which cost the group another €15m. Air France/KLM has now reached agreement on 2008 pay and conditions (including an approximate 2.8% increase in salaries) with unions (although only after action by ground crew in January, after initially being offered a 2.3% rise). There was also a strike by air traffic controllers in February, which affected domestic Air France services, although the group says this had a limited impact on its finances.

One area where Air France/KLM should save costs over the next few years is its fleet, as older aircraft are being replaced by newer models and the group is investing around €2bn a year until 2020 on fleet renewal. The mainline group fleet is 365–strong (see table, page 6) and it has more than 50 aircraft on order, almost all of them being replacements for existing aircraft (with the mainline Air France and KLM fleets remaining static over the 2008/09 financial year).

The group is gradually disposing of its 747–400s over the period to 2013, and it will sell six 747–400s in 2009 and 2010 (which are being bought by Deucalion, a German investment company). These will be replaced partly by 17 777–300ERs, while also on order are 12 A380s. Air France/KLM is expected to place an order for A350s or 787s sometime this year, with up to 100 aircraft replacing older 747s, MD–11s and A340s from 2015 onwards. Overall group capacity will grow by around 4.1% in 2008 to 2010, with a 4.7% increase in long–haul ASKs and 2.7% growth in medium–haul.

Domestically, Air France/KLM is coming under increasing pressure not only from LCCs but from high–speed trains, as there are plans to shorten journey times on existing TGV routes to the south and east of the country on a rolling basis from 2013.

Earlier this year Air France/KLM said that it might reduce its 4,000 staff on domestic airport stations by as much as a quarter over the next decade, and the airline’s summer schedule includes the closure of routes from CDG to Rennes and Avignon, while frequencies have been reduced on other routes (although a new service between Bordeaux and Montpellier has been added). Interestingly, the airline is analysing the possibility of running its own high–speed trains into CDG — although even if this plan is adopted it will take many years to put into practice.

On medium- and short–haul, in February Air France/KLM bought Belgian regional carrier VLM Airlines for a reported €180m. VLM operates a fleet of 18 F50s and a single BAe 146 and its main base is London City, where it has a quarter of all slots. It will now work closely with Irish–based CityJet (which Air France/KLM acquired 100% of in 2000), which operates 23 BAe 146s and RJ85s and is already expanding routes to/from London City. However, the UK’s Office of Fair Trading said in February that it was investigating whether the deal will affect competition in UK markets. Air France/KLM also owns Brit Air and Régional, and last year bought 60% of Transavia France, which operates a fleet of six 737–800s out of CDG to leisure destinations in Europe and North Africa.

Long–haul remains the priority for the group, and long–haul now accounts for 60% of passenger revenue (with domestic revenue at 12% and Europe at 27%). Jean–Cyril Spinetta, group chairman and CEO, says the priority for growth is on routes to the Asia/Pacific region, where Air France/KLM will increase capacity by 8% in each of the next three years. Much of that growth will come from the Chinese market, where frequency has been increased this summer on routes from Shanghai to Schiphol and CDG.

Currently only 17% of Air France/KLM’s passenger revenue comes from the transatlantic sector, which is lower than BA or Lufthansa, but SkyTeam’s immediate reaction to the UK/US’s open skies (with Delta and Northwest gaining access to Heathrow) has been to increase capacity between London Heathrow and the US by 11 flights a day since March, with a new Air France route between LHR and Los Angeles and a Delta service between LHR and Atlanta.

However, BA and BAA’s problems at Heathrow T5 (with BA’s postponement of the transfer of its long–haul flights from T4 to T5) have led to SkyTeam holding crisis talks with BAA. The SkyTeam partners are developing Terminal 4 as their Heathrow base and the airlines will fully relocate to T4 sometime in early 2009, with Heathrow becoming a major hub for SkyTeam in Europe. SkyTeam will account for around 40% of passenger flows at T4 from next year (around 7m passengers a year).

Immunity at last

Significantly, in late May Air France, KLM and four fellow SkyTeam members (Delta, Northwest, Alitalia and CSA) received approval from the US regulator for extended antitrust immunity on transatlantic routes.

Although the airlines had applied back in June 2007 and wanted immunity granted in time for the summer 2008 schedule (which began at the beginning of April), there is relief at Air France/KLM that a positive decision was made eventually, given that in 2005 the US regulator turned down a similar request.

This time around the US DoT said that "a new and highly integrated joint venture will likely provide consumers with additional price and service options, such as lower fares and more non–stop and connecting flights".The six airlines have up to 18 months to start the partnership, and this approval may lead to a formal transatlantic joint venture between Air France, KLM, Delta and Northwest, which the airlines had planned to start in 2010, leading to expanded services across the Atlantic as well as expanded FFPs. The four (soon to be three) airlines would share revenue and profit on a combined network across the Atlantic, and together their capacity would account for around 30% of all North Atlantic RPKs, with joint revenue of around €12bn a year.

Essentially this would combine the existing partnership between KLM and Northwest with a new partnership just set up between Air France and Delta, which includes an equal profit share on additional revenue generated by the partnership. This mirrors the agreement that KLM has with Northwest, which was launched back in 1991 and currently generates 100s of millions of Euro profit for the two airlines.

Obviously these plans are now overshadowed by the proposed Delta/Northwest merger that — if it gets approval — will mean just one company (with 75,000 employees and a fleet of 800 operating to around 400 destinations in more than 60 countries) for Air France/KLM to partner with. Although Air France/KLM initially said it wanted to invest between €500m and €1bn in the proposed merger between the SkyTeam partners, (assuming that both unions and the US regulator will allow it), in April Air France/KLM quickly backtracked from this position, saying that it could gain the same benefits from a partnership as from an investment.

Nevertheless, the partnership with Delta/Northwest means that a key building block of the Franco–Dutch group’s strategy for the next decade or two is in place, which now allows Air France/KLM to return to the question of European consolidation. There’s little doubt that Spinetta needs to keep the group at the centre of the airline consolidation process in Europe, so missing out on the Alitalia opportunity was considered a real blow to the group by its senior management.

In time, however, the failure to acquire Alitalia (blame for which must go partly to Air France/KLM, which gave the impression that unions were an afterthought when the group made its initial offer) may be regarded as a lucky escape. The group would have had to spend a substantial amount of resources (both cash and management time) in turning round the Italian flag carrier, even if Air France/KLM believed the effort would have been worth it in order to access the lucrative Italian business market, as well as the cost savings that could have been made between Alitalia and the group.

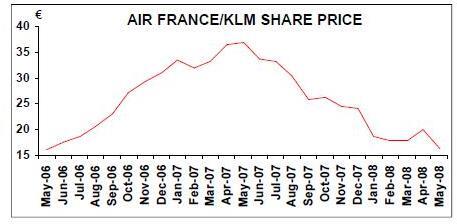

However, the bid for Alitalia (in which the group still has a 2% stake) unsettled Air France/KLM shareholders, and some analysts warned against short–term volatility in Air France/KLM’s share price if the bid had been successful, even if the long–term strategic impact of Alitalia might have been positive.

But Alitalia is history now, and there may well be better opportunities for Air France/KLM elsewhere in Europe. For example, the group is believed to be interested in acquiring a stake in Austrian Airlines now that the Austrian government is looking to sell its 42.75% stake to a strategic buyer before the end of 2008. If Air France/KLM does make a bid it is likely to face competition from Lufthansa, although unions at Austrian favour a deal with Air France/KLM as they fear Lufthansa has too much of an overlap with Austrian and would subsequently cut routes and jobs.

The future

In March unconfirmed reports out of Paris said that Spinetta will resign in October — when he reaches 65 — even though the group has approved him to stay on as chairman and CEO (roles he took up in 1997) until his70th birthday. Those same reports said that Pierre–Henri Gourgeon — the group COO — would replace Spinetta, but all Air France/KLM says on the matter is that it does not comment on rumours (which is a less–than–robust denial).

Whether or not Spinetta stays, it’s likely that Air France/KLM will continue to look for merger and acquisition opportunities in Europe. In the longer term — following the completion of strategic moves in North America and Europe — Air France/KLM is likely to look for equity tie–ups with Asian airlines.

One possibility is SkyTeam partner China Southern, with whom Air France/KLM is launching a cargo joint venture later this year. The Guangzhou–based cargo airline will be owned 51% by China Southern and 49% by Air France/KLM, and is likely to include a fleet of 777Fs, 747- 400Fs and A300–600Fs, which will be supplied by China Southern (either taken from its current fleet or from future orders). The venture will operate not only on Europe- Asia routes, but on the rapidly growing intra–Asian and transpacific routes.

Short-term versus long-term

However, although Air France/KLM appears to have a sound strategic path mapped out, it’s inevitable that both investors and analysts will concentrate more on the group’s short–term prospects. In late May the group said it expected operating profits to fall by a third in 2008/09, to somewhere "in the region of €1bn" and, although that is likely to compare very well with results of its main competitors, this news is not going down well with investors, with shares in the group falling by 10% on the day this announcement was made; as of early June shares were trading at under €17 — see chart, below.

Some investor unease is undoubtedly valid because the group’s 2008/09 forecasts are made on the basis of some crucial assumptions, including "new sources of synergies" between Air France and KLM, a €/$ 1.56 exchange rate and a $120/bbl oil price — the last of which already looks unlikely.

On the other hand, of all the European majors Air France/KLM is perhaps the most able to withstand rising fuel prices. The group has a track record in carrying out successful hedging policies, and Philippe Calavia — group CFO — says that as of late May the group has hedged 78% of its 2008/09 fuel requirements at around $80 a barrel. Air France/KLM also increased its fuel surcharge on all flights again in May, although interestingly it gave specific promises on reducing half the increase when the price of oil is "stabilised over time" below $110/bbl and the other half when the price falls below $105/bbl.

So although Air France/KLM is now unlikely to reach its previous target of an 8.5% return on capital employed by 2009/10, thanks to the rising cost of fuel (it achieved a 7.1% ROCE in 2007/08), the profit dip over the next few years will not be as severe as its European rivals. Spinetta says that "the current year is set to be challenging, but given our strategic advantages, the efficiency of fuel hedging and a tough stance on costs ….we will remain comfortably in profit".

Indeed financially the group is relatively strong. Long–term debt and other liabilities rose from €10.1bn at March 31st 2007 to €10.9bn a year later, but cash and cash equivalents rose by €0.9bn over the same period to €4.4bn as at the end of March 2008, partly thanks to the exercise of a warrant.

With plenty of cash available, the Air France/KLM group will be looking hard for opportunities in Europe over the next 12 months.

| Fleet | Orders | Options | |

| Air France | |||

| A318 | 18 | ||

| A319 | 45 | 15 | |

| A320 | 64 | 1 | |

| A321 | 20 | 1 | |

| A330 | 16 | 3 | |

| A340 | 19 | ||

| A380 | 12 | 2 | |

| 747 | 22 | ||

| 777-200ER | 25 | 1 | |

| 777-200LRF | 5 | 3 | |

| 777-300ER | 24 | 13 | |

| Total | 253 | 31 | 25 |

| KLM | |||

| A330 | 10 | 2 | 18 |

| 737-300 | 13 | ||

| 737-400 | 13 | ||

| 737-700 | 13 | 1 | |

| 737-800 | 19 | 2 | |

| 737-900 | 5 | ||

| 747 | 25 | ||

| 777-200ER | 15 | ||

| 777-300ER | 2 | 4 | 2 |

| MD-11 | 10 | ||

| Total | 112 | 21 | 21 |

| Group total | 365 | 52 | 46 |