bmi and LHR slot valuation

June 2008

bmi’s future has become increasingly topical as a host of factors have come to the fore simultaneously: the signing of US–EU Open Skies agreement, the surge in the value of slot trading at Heathrow, the recent statement by Lufthansa that it intends to exercise its call option on the 50.1% of bmi that its chairman Sir Michael Bishop owns and the recent communication from the EU indicating its support for secondary slot trading.

The European Commission launched a consultation process in 2004 to examine the prospect of establishing an EU–wide set of rules for the allocation and trading of slots at EU airports. At the end of April, Jacques Barrot stated that the EU "does not intend to pursue infringement proceedings against Member States where such exchanges (for monetary consideration) take place in a transparent manner". The overall tone of the communication was that slot trading encourages more productive use of slots and helps to highlight the opportunity cost for airlines operating services at slot congested airports. While slot trading has been ongoing in the UK for over a decade, there are probably some airlines that have been reluctant to engage in the process for fear that it may not be lawful. Therefore, the EU Communication could have the effect of adding liquidity to the slot market at LHR (among other airports) and thereby increasing overall activity.

According to EU data, 500 weekly slots (equivalent to 250 weekly slot 'pairs') have changed hands over the period 2001–2006. History has shown that slot exchanges at Heathrow (excluding intra–alliance transfers) typically result in a dramatic increase in the average aircraft size on the transferred/sold slot. Of the 500 slots transferred between 2001 and 2006, the average aircraft size increased 81% from 139 to 250 seats per slot.

bmi is in possession of 1,087 weekly slots (543 weekly slot pairs) according to ACL (Airport Co–ordination Limited), over twice the number that have been exchanged since 2001. Below we examine where demand for these slots is likely to originate, from both an airline and a route grouping perspective [continued on page 2].

Transatlantic

As mentioned in the March Aviation Strategy, there has been a surge in LHR–USA movements for the summer 2008 (S'08) season of over 20% from S'07. There clearly isn’t insatiable demand for transatlantic travel and now that the four non- Bermuda II US airlines (CO, DL, NW & US) have established a beach head at LHR, it could be assumed that they will strive to add incremental slots at a lower price than those paid initially. The fact that many of these carriers are either in the process of merging (NW/DL) or are otherwise considering their strategic futures (US/UA/ CO/AA) may also serve to dampen their desire to overpay for slots at a time when they are trying to conserve cash as much as possible.

Middle East

Middle Eastern carriers such as Emirates, Qatar Airways and Etihad are among the most rapidly expanding long haul carriers in the world and their desire to get access to Heathrow at almost any cost has been and will continue to be a contributing factor to the escalating price of slots.

Due to their base airports operating on a virtual 24 hour schedule, they can be much more flexible with the timings of their slots but yields are best on the overnight flights that depart London late in the evening. However, as the flight time is relatively short (6–8 hours typically), and a high percentage of their passengers are transferring, frequency will increasingly become an issue for these airlines.

Slot timing

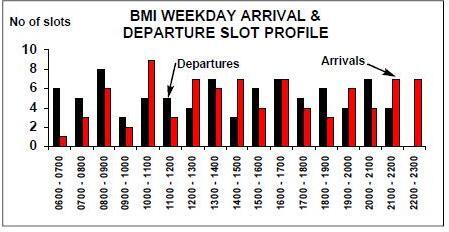

There are certain times of day when supply exceeds demand for slots at LHR. ACL data indicates that for S'08 departures, there is spare capacity in the 05:00–07:00 hours, 16:00–17:00 and 17:00–18:00. For arrivals, there is spare capacity in the following hours: 08:00–09:00, 11:00–12:00, 12:00–13:00, 13:00–14:00, 15:00- 16:00, 16:00–17:00, 20:00–21:00 and 21:00–22:00. However, any apparent spare arrival capacity during, for example, 08:00–09:00 is a function of the fact that demand for the departure block between 09:00–13:00 far exceeds supply. bmi bases most of its aircraft at Heathrow so its slot portfolio is heavily skewed towards a high concentration of morning departures and late night arrivals (between 05:00–09:00, bmi has 19 departure slots and 10 arrival slots — see chart, page 1).

The $209m Continental paid for its four daily Heathrow slots generated a substantial amount of publicity but it may be inappropriate to use this as a benchmark to value such a large block of slots.

bmi recently announced that the "significant increase" in slot trading at LHR post Open Skies has led its directors to conclude that the conditions now exist to include a value of £770m on the balance sheet in respect of the slots it operates.

Deloitte recently pointed out in an article on slot trading that IFRS3 accounting rules contain a requirement for listed airlines to record slot values on their balance sheets.

Slots are notoriously difficult to value as they are dependent on the airline securing an appropriate slot at the airport to which it wants to fly.

This issue strikes at the heart of the difficulty in assessing the value of bmi’s slot pool as the ability to maximise value will be highly dependent on who is actually the seller of these slots and what the opportunity cost of the slots are to that seller. Unless bmi were to take a major strategic step in advance of Lufthansa gaining control, we’ll assume for the purpose of this exercise that the 'seller' is Lufthansa. In some cases, it may make sense to realise a lower price for a single slot pair or a block of slots if the acquirer is a carrier with strategically aligned interests. In the event that price is the main driver of any sale process, it would need to be carefully considered whether to package slots together in such a way that selling one block of slots doesn’t make the 'shape' of the remaining potential blocks effectively unsalable. The table, right, illustrates the split of slots by hour block during a weekday. We have assigned value ranges to the different slots based on several factors:

1) Time of day 2) Ability of the most interested carriers to finance the purchase of the slots 3) Our understanding of the current demand of slots based on the growth plans of airlines in various regions of the world. These values have been assigned to the departure time and doubled on the assumption that for each departure slot there’s an operationally viable appropriate arrival slot.

Conclusion

Our range of £678m — £1.26bn slot value for bmi is highly conditional on the manner in which the sale process is conducted and the intended strategy that ultimately motivates the seller. The higher range of the valuation assumes that there is a very motivated buyer for the particular slot (or group of slots) and an element of competitive tension can be generated in the sale process.

Arguably the best way to maximise the value of the slots would be to sell them to an incumbent Heathrow–based carrier that could add the arrival and departure slots to its own slot pool and thus derive synergies (aircraft utilisation and improved turnaround times) through a more efficient allocation process within a bigger network.

Following the widely expected statement from Lufthansa’s CFO that the airline would exercise its call option on Sir Michael Bishop’s 50% +1 stake in bmi, the key question centres on what it would do with bmi. One likely option to be considered would centre around Virgin Atlantic as an 'independent' buyer of the slots (Lufthansa could also pool its sizeable LHR slot portfolio — 203 weekly slot pairs — together with bmi's). Another possibility would see Virgin and Lufthansa conduct the process as strategic partners with the intention of creating an LHRbased Star alliance entity that could compete with BA.

While this second option may seem attractive, the economics of a second LHR hub–and spoke carrier may not stack up in light of the runway and terminal layout constraints.

Heathrow is increasingly being marginalised as a hub in the face of increasing competition from Lufthansa/Star alliance in Frankfurt and Munich (each of which will add one runway within the next five years) and Air France–KLM with Paris CDG and Amsterdam and their combined nine runways.

However, London — and LHR in particular — is unquestionably an excellent source of longhaul point–to–point high yielding traffic and an enlarged Virgin Atlantic may represent the strongest economic case, with the remaining slots sold off in small blocks at the higher end of the value range to other transatlantic carriers, Middle Eastern 'super–connectors' and Asian and Australian airlines. BA would be a likely acquirer of those slots that most logically suit short–haul services operated by a Heathrow–based carrier.

| £m price | £m price | £m value | |||||||

| # of | per slot | per slot | of slots | £m value of | # of | ||||

| Departures | slots | Suitable route groups | (low) | (high) | (low) | slots (high) | Arrivals | slots | Suitable route groups |

| Short Haul (aircraft must arrive | Transatlantic (East Coast), | ||||||||

| 0600 - 0700 | 6 | previous evening & overnight) | 1 | 3 | 12 | 36 | 0600 - 0700 | 1 | Asia, S.Africa |

| 0700 - 0800 | 5 | Short Haul | 2 | 3 | 20 | 30 | 0700 - 0800 | 3 | Transatlantic (East Coast) |

| 0800 - 0900 | 8 | Short Haul | 3 | 4 | 48 | 64 | 0800 - 0900 | 6 | Transatlantic (East Coast) |

| 0900 - 1000 | 3 | N.America West/Central | 5 | 7.5 | 30 | 45 | 0900 - 1000 | 2 | Transatlantic |

| 1000 - 1100 | 5 | N.America West/Central | 5 | 7.5 | 50 | 75 | 1000 - 1100 | 9 | Transatlantic (West Coast) |

| 1100 - 1200 | 5 | N.America West/Central | 5 | 7.5 | 50 | 75 | 1100 - 1200 | 3 | Transatlantic (West Coast) |

| Transatlantic (West Coast), | |||||||||

| 1200 - 1300 | 4 | N.America East/West/Central | 5 | 7.5 | 40 | 60 | 1200 - 1300 | 7 | S. America |

| N.America East/West/Central, | Transatlantic (West Coast), | ||||||||

| 1300 - 1400 | 7 | East Asia | 3 | 7.5 | 42 | 105 | 1300 - 1400 | 6 | S. America |

| 1400 - 1500 | 3 | N.America East, East Asia | 5 | 10 | 30 | 60 | 1400 - 1500 | 7 | Far Mid East |

| 1500 - 1600 | 6 | N.America East, East Asia | 5 | 10 | 60 | 120 | 1500 - 1600 | 4 | Far Mid East, Asia |

| 1600 - 1700 | 7 | N.America East | 5 | 10 | 70 | 140 | 1600 - 1700 | 7 | Far Mid East, Asia |

| 1700 - 1800 | 5 | N.America East | 5 | 10 | 50 | 100 | 1700 - 1800 | 4 | Far Mid East, Asia |

| 1800 - 1900 | 6 | N.America East, Middle East | 6 | 12 | 72 | 144 | 1800 - 1900 | 3 | Far Mid East, Asia |

| India, Eastern Asia, Far Middle | |||||||||

| 1900 - 2000 | 4 | East, Australia, S.Africa | 5 | 10 | 40 | 80 | 1900 - 2000 | 6 | Short/Medium Haul |

| India, Eastern Asia, Far Middle | |||||||||

| 2000 - 2100 | 7 | East, Australia, S.Africa | 4 | 7 | 56 | 98 | 2000 - 2100 | 4 | Short/Medium Haul |

| India, E. Asia, Far Mid East, | |||||||||

| 2100 - 2200 | 4 | Australia, N.America (east) 'day' | 1 | 4 | 8 | 32 | 2100 - 2200 | 7 | Short/Medium Haul |

| Short Haul, N. America | |||||||||

| 2200 - 2300 | 0 | - | - | - | - | 2200 - 2300 | 7 | (east) 'day' flight, Mid East | |

| £678 | £1,264 |