US airlines: How are the industry fundamentals?

June 2007

Having returned to the black in 2006 after five years of heavy losses, US legacy carriers have been counting on being able to consolidate profitability in 2007. Now that Northwest has exited Chapter 11 (May 31), for the first time since 2002 there are no major carriers in bankruptcy. But, just as the picture was looking rosy, industry fundamentals began deteriorating.

Recent months have seen two particularly worrying developments. First, crude oil is back in the mid–60s (dollars per barrel), even topping $68 in mid–June. Second, airlines have been reporting weakening domestic demand, reflecting a slowing economy. This has made it hard to raise fares to cover the increased fuel costs.

On the positive side, however, the earlier fears of a significant demand slowdown have proved unfounded. Barring exceptional developments, a downturn in 2007 is unlikely, thanks to improved economic indicators, more optimistic GDP forecasts, some timely capacity reductions by airlines and continued strength of international revenues.

At this point, 2007 profits are still expected to be substantially higher than last year’s. However, because of the negative fuel and domestic RASM trends, profits will be less than what was expected a couple of months ago.

Calyon Securities analyst Ray Neidl, who revised down his estimates for several airlines on June 11 (citing oil prices rather than RASM concerns), still expects the six legacy carriers (AMR, UAL, Delta, Continental, Northwest and US Airways) to earn an aggregate net profit of $3.4bn in 2007, up from $889m last year. Aggregate EBIT (earnings before interest and taxes) is forecast at $6.8bn, roughly double last year’s $3.5bn. The 2007 EBIT margin would be 6.8%, compared to 2006’s 3.6%.

However, negative sentiment about the sector is likely to persist as more airlines issue profit warnings and more analysts revise down earnings forecasts for the second half of 2007 — and, of course, if fuel prices keep rising or spiking up. Everyone is keeping a very close eye on fuel, GDP, traffic and RASM trends — and whether LCCs will adjust their capacity and growth plans.

Oil prices: Crude oil prices, which hovered at around $65 per barrel in mid–June, have risen by 25% from the two–year low of around $52 in mid- January. The price is high by historical standards but below the summer 2006 all–time peak of about $77. The prices have been volatile and are notoriously difficult to forecast, though the consensus is that they will remain high — perhaps in the $60–70 range — for the foreseeable future.

According to S&P, crack spread (the cost of refining oil into jet fuel), at about $17, is quite high by historical standards. In the past seven decades it has averaged about $7.

GDP growth: Economic data released on June 1 indicated that US GDP growth amounted to a pitiful 0.6% in the first quarter — the lowest in over four years and in sharp contrast with the year earlier 5.6%. In that light, the modest profits earned by most of the major carriers in the first quarter — the seasonally weakest period — were an amazing achievement.

Reports have suggested that consumer spending increased and other economic indicators turned positive in May, and many economists foresee faster GDP growth for the remainder of the year. This would bode well for domestic demand trends.

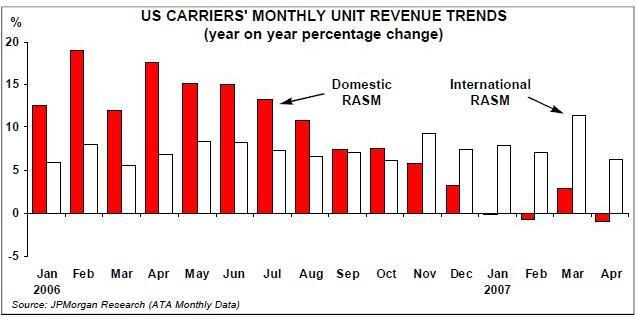

Demand and RASM: Numerous US airlines have been reporting softening domestic demand since March or April. In contrast with 2006, all of the recent attempts to raise domestic fares on a broad basis have failed, typically when LCCs refused to join in.

After two years of strong improvement, mainline domestic passenger unit revenue (PRASM) has stagnated this year. However, the absolute level of domestic PRASM is near its all–time peak of early 2001. Significantly, international PRASM growth has continued to be in the high–single digits.

Therefore overall PRASM remains at an all–time high. According to S&P, industry PRASM was 10.98 cents in the 12 months to the end of March, compared to 10.11 cents in early 2001 and a low of 8.55 cents in August 2002.

Capacity: One highly positive development is that airlines have begun to pull back domestic capacity, which should give them more pricing power. In recent weeks, US Airways, United and Northwest have all reduced their planned domestic capacity growth rates for 2007.

Continental has decided to defer the delivery of six 737NGs by a year from 2009 to 2010 and is also considering leasing out or selling up to 15 737–500s.

Merrill Lynch analyst Michael Linenberg estimates that industry domestic capacity will now grow by only 2% this year, compared to his earlier prediction of 3.4% (these figures exclude Virgin America, but VA’s impact to 2007 industry supply should be small).

Significantly, LCCs may soon also cut capacity. Southwest’s CEO Gary Kelly said in early June that the airline is considering slowing growth from its current 8% annual rate in response to softer than anticipated air travel demand almost across the board. Southwest needs 5% RASM growth to meet its target of 15% return on invested capital, which is now not likely to be achieved. However, a decision to slow growth may not be taken for a couple of quarters, as the airline tries to determine how long the sluggish revenue environment will last. It would mainly affect 2008 deliveries (32 firm 737s), where Kelly said he saw flexibility.

JetBlue’s new CEO Dave Barger said at Merrill Lynch’s annual conference that the airline is conducting a 60–day review of its growth plan, which may result in a further ASM growth rate reduction. The decision to slow growth in 2006, by deferring aircraft deliveries and selling five A320s, has paid great dividends. Currently, JetBlue’s ASM growth is running at 10–13%, compared to 20% in 2006.

The legacy carriers have continued to shift capacity to international routes, where the revenue picture remains generally stronger in the near term. The industry’s biggest fear must be that weakening demand could spill over into the international markets, though with the global economy going strong there seems little risk of that. All of the airlines at the ML conference said that international revenues continued to be strong.