THY Turkish Airlines: Big ambitions, tricky politics

June 2006

THY Turkish Airlines has ambitious expansion plans to become one of the world’s 10 leading airlines. But can an airline on the periphery of Europe and with a government owner still committed to retaining a controlling interest ever hope to fulfil such an aspiration? THY (Turk Hava Yollari) was founded back in 1933 and today operates to 28 domestic and 79 international destinations.

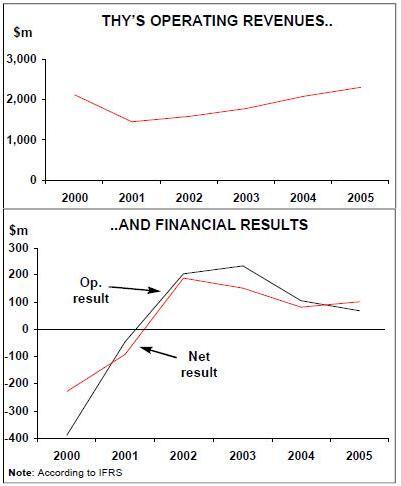

Many of those routes have been added in the last few years following the emergence from a tough period since the late 1990s. Turkey’s flag carrier dipped into operating losses in 1997 and 1998 (see Aviation Strategy, July 1999) and was then hit by the macro shocks of the early 2000s — the Gulf war, SARS and the Istanbul bomb attacks.

However, THY has posted both operating and net profits for the last four years (see chart — although accounting financial results are affected by significant exchange rate fluctuations of the Turkish Lira against the US Dollar, THY is largely hedged against Lira deprecation since approximately 84% of its revenue comes in the form of Euros, Dollars and other non- Turkish currency). Much of this profitability has been driven by the booming Turkish economy. After Turkey’s GNP shrank by a massive 9.5% in 2001, the economy recovered fast in 2002 and 2003 and then raced ahead in the next two years, with GNP growth of 9.9% in 2004 and 7.6% in 2005.

This has translated directly into increased passenger traffic. Although over the 1990–2004 period Turkey experienced a CAGR of 7.4% in domestic passenger traffic and 9.7% in international passenger traffic, it was in 2004 that aviation demand increased dramatically. International passenger traffic to/from Turkey rose by 21% in 2004 compared with 2003, but this was overshadowed by a massive 58% rise in domestic traffic as the economy boomed and competitors to THY emerged following the ending of the flag carrier’s monopoly and a realisation that Turkey’s population of 70m was relatively under–served by both domestic and international air links.

That market growth continued into 2005 and, according to IATA, Turkey will be the fifth fastest growing market in the world between 2005 and 2009 in terms of passenger traffic. Turkey’s forecast passenger traffic CAGR of 8.9% over that period is beaten only by Poland, China, the Czech Republic and Qatar. Despite a growing current deficit, the Turkish economy is expected to continue its growth over the next few years, and in the longer term a further boost will come from the expectation that Turkey will join the EU now that membership negotiations have started formally.

Another key driver is growing tourism to Turkey. Last year the country’s tourism revenue grew 14% to $18.2bn, and it is forecast to top $20bn in 2006. More than 21m tourists visited Turkey in 2005, and a quarter of them came from Germany, followed by British and Dutch tourists. The VFR market is also large, thanks to a large ethnic Turkish populations in Europe, and in particular the large Turkish gastarbeiter workforce in Germany.

THY ambitions

Given these factors, THY believes it is the right time to undergo a significant expansion phase. In February 2006 THY announced it aimed to increase passengers flown by 35% a year over 2006–2008 as part of an expansion plan that will see its fleet expand from 94 at present (see table) to 128 aircraft over the same period, with a target of 18m passengers carried in 2008.

| Fleet | Orders | |

| A300 | 1 | |

| A310 | 7 | |

| A320 | 14 | 17 |

| A321 | 7 | 12 |

| A330 | 2 | 3 |

| A340 | 7 | |

| 737-400 | 17 | |

| 737-800 | 32 | 17 |

| MD-83 | 3 | |

| Avro RJ100ER | 4 | |

| Total | 94 | 49 |

This expansion will take advantage of a new terminal at Ankara that will open in October and will enable the airport to handle up to 15m domestic and international passengers a year; there are also unconfirmed plans for another airport at Istanbul, probably to be built on the European side of the city.

THY’s fleet was effectively frozen in the 2000–2004 period at around the 65 aircraft mark, but a major renewal programme was launched in 2004 and aimed at not only replacing older aircraft but also putting in place capacity growth. A total of 57 aircraft were ordered in 2004, for delivery by 2009 and at a capital cost of more than $2.7bn. That figure understates the cost of fleet renewal to THY, as it excludes operating leases costs; at present less than 15 aircraft are owned by THY, with more than half its fleet on operating leases and the remainder on finance leases.

As replacements for 737–400s and after being attracted to the "operational flexibility" of the 737–800, THY ordered 15 737–800s in 2004 and then exercised options for another eight aircraft in August 2005. The first of these 23 aircraft arrived in December 2005, and at present 17 are still outstanding — nine will be delivered through 2006 and eight in 2008.

At the time the new aircraft orders were being finalised, the Turkish government was being put under intense political pressure from the EU to order more Airbus aircraft for THY, a move that would help ease resistance from France to Turkey’s potential EU membership. Indeed in 2004 the German foreign minister was reported as telling a senior Turkish politician that: "Let 80% of the aircraft you purchase be Airbus — you must do this".

Whether that pressure directly led to changes in the fleet orders is impossible to tell, but in 2004 THY ordered 36 Airbus aircraft — five A330s–200s, 19 A320s and a dozen A321s. The first of the A330s arrived in December 2005 to boost the long–haul fleet of seven A340s. The A330s will be used for expansion to the North America and the Asia–Pacific region, with the US a prime expansion target. THY currently operates to New York JFK and Chicago O'Hare, but would like to launch routes to Los Angeles and Washington Dulles and Toronto.

The next priority is routes to the Asia/Pacific region. A service to Melbourne and/or Sydney is likely, both of which have large ethnic Turkish populations, and served via Singapore or Bangkok. THY currently operates to 14 destinations in the Asia Pacific region, 10 in the Middle East, five in North Africa, two in North America and 48 in Europe. The existing long–haul network is an eclectic mix, and suffers because of no linkage into a global alliance, but THY is currently upgrading its long–haul premium product through installing in–flight entertainment systems and 60 inch seat pitches, while all its aircraft received a new livery in 2005. THY also has four Avro RJ100s (run down from an original fleet of 10), but these will be phased out by the end of 2006 and replaced by up to eight 70–90 seat regional aircraft. A319s were considered as replacements last year, but the Embraer 170 and the Bombardier CRJ are now believed to be the joint favourites for an order that is expected to be placed some time this spring or summer. THY is also believed to be analysing an order for up to 20 787s.

Altogether 22 aircraft will be delivered in 2006, 12 in 2007 and 19 in 2008, and by 2008 the fleet’s average age will come down from the current nine years to under six years — which will give THY the youngest fleet of any European airline at that time, THY claims.

International focus

In 2006 alone another 23 destinations will be added to the route network, including Dublin, Osaka, St. Petersburg, Bombay, Venice, Helsinki Addis Ababa and Lagos, bringing total destinations served to 130 by the end of this year, and operated by a fleet of 100.

Most of the expansion will be on the international network, and it’s clear that THY is prioritising international growth over the domestic market. That’s partly because in 2005 although just 46% of all THY passengers carried were on international services (with 50% being domestic, 2% charter and 2% classified as "pilgrims"), no less than 75% of revenue came from international passengers — and the difference in the profit contribution is probably much greater. Of all scheduled revenue in 2005, 43% came from Europe, 25% from the domestic market, 15% from the Asia/Pacific region, 10% from the Middle East, 5% from North America and 3% from North Africa.

The other reason — though related — for the shift in THY focus is essentially negative: because it is THY’s domestic traffic that is coming under most competitive pressure. Turkey is too distant for Europe’s two largest LCCs to have much of a presence — Ryanair has no routes and easyJet will launch routes to Istanbul from London Luton in June and from Basel–Mulhouse in May. However, intriguingly, sources at easyJet suggest that it is looking at either acquiring a Turkish airline or even launching an airline there in order to tap into the domestic market.

Among a myriad of Turkish–based competitors are Atlasjet Airlines, which operates 19 aircraft on charter routes but which now plans to turn into a scheduled operator; MNG Airlines, which operates 23 aircraft on long–haul and short–haul scheduled and charter routes; and Pegasus Airlines, a 13- aircraft strong charter carrier that launched low–fare domestic services in November 2005. But the biggest domestic challenge comes from Onur Air, whose fleet of 28 aircraft operates international charter and low fare domestic flights out of Istanbul.

Launched in 1992 by three Turkish entrepreneurs, Onur is now expanding its fleet by replacing A300B4–200s with A300–600s, adding a couple of A320s, and — most problematically for THY — putting four more MD- 83s onto domestic routes, where they will be fitted with leather seats and extra leg–room. Proposed start–ups in 2006 include Golden International Airlines, which plans to operate to the UK and Germany with A321s; Izmir Hava Yollari, which will fly to destinations across Europe with 737s or A320s; and TT Airlines, which will use 737–400s on international and domestic routes.

In 2004 the emergence of competition from Turkish airlines forced THY to cut domestic fares by as much as 25% and international fares by around 10%, but the fare reductions have not prevented THY from losing market share. In 2004 THY had a 43.2% market share of scheduled international traffic to/from Turkey and a 75.4% share of scheduled domestic traffic, but in January–September 2005, while international market share slipped only slightly, to 43%, THY’s domestic share fell by more than 11 percentage points, to 64.3%.

This is doubly worrying for THY as market share erosion is occurring at the same time as the whole market domestic market is booming, meaning that competitors are establishing a firm foothold in the Turkish market. While the Turkish domestic market grew by 58% in 2004, THY saw just a 16% rise in passengers carried. In 2005 the overall domestic market grew by another massive 38%, but again THY’s domestic passenger traffic lagged behind in rising by 23%, while domestic revenue increased by routes are believed to be loss making, competitors are — naturally — targeting the most profitable ones.

THY also owns 50% of Anatalya–based SunExpress, which was launched in 1990 as a 50:50 joint venture with Lufthansa (the stake is now owned by Thomas Cook AG). Today its 580 staff operate nine 737–800s and a single 757–200 on scheduled and charter flights to eight domestic and 89 international destinations (of which 24 are in Germany). For 2005, although revenue rose 21% to $241m, net profit fell by 11% compared with 2004, to $16m. In 2005 passengers carried rose 30% to 1.8m, and SunExpress had a passenger load factor of 81% (compared with 83% in 2004).

Anatalya–based SunExpress plans to increase its fleet to 20 aircraft by 2009 and opened a base at Izmir in March 2006, serving eight domestic destinations as well as seven international routes (six in Germany, plus Zurich). However THY is looking to sell its stake in SunExpress, although the government has so far refused permission.

Low costs?

In response to increasing competition, THY is aiming to launch a LCC called Turkish Express on October 2006, with routes planned domestically and to Germany, France and the Netherlands.

THY will transfer all its 737–400s (which number 17 at present, although some will be returned to lessors in the summer) and a handful of 737–800s, giving the LCC an initial fleet of up to 20 aircraft. THY believes it can lower units costs at Turkish Express by 15% compared with mainline operations thanks to implementing a series of typical LCC practices, such as by increasing the number of seat s per aircraft and through a no–frills on board service. THY has also bought a "Low Fare Manager" module from US software company Sabre to manage pricing and revenue at the new LCC.

The lower costs will enable fares to be similarly reduced, says THY, although how much of an impact this will have in stemming THY’s loss in domestic market share is unknown.

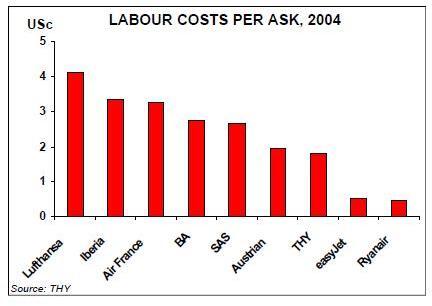

In this context, the switch in emphasis to international routes looks sound strategically, particularly as THY believes its costs relative to European competitors are low.

Turkish airline salaries are between one third and one–half of EU averages, although the gap will close fast once Turkey joins the EU, and after tortuous negotiations between management and unions in the first half of 2005, THY avoided strike action by the Aviation Workers Union only after agreeing a two–year pay deal with workers in July 2005. This included a 10% salary rise in the first year and a 3% rise in the second.

| $m | 2004 | % | 2005 | % |

| Labour | 461 | 23% | 536 | 24% |

| Fuel | 386 | 20% | 544 | 24% |

| Sales & marketing | 241 | 12% | 255 | 11% |

| Depreciation | 224 | 11% | 223 | 10% |

| Landing expenses | 179 | 9% | 183 | 8% |

| Ground handling | 121 | 6% | 117 | 5% |

| Passenger services | 96 | 5% | 109 | 5% |

| Other | 267 | 14% | 278 | 12% |

| Total | 1,975 | 100% | 2,245 | 100% |

Nevertheless THY claims that it has the lowest labour unit cost of any mainline European airline (see chart). THY’s labour costs as a proportion of total costs remain less than a quarter (see table), but this is due not only to lower structural costs in Turkey but also to relatively good productivity (in aviation terms) among THY’s staff.

As at the end of December 2005 THY had 11,121 employees, just 2.5% up on December 2004, and these include 2,780 pilots and cabin crew. THY has been working hard to increase productivity: passengers carried per employee rose from 945 in 2002 to 1,271 in 2005, due to a 36% increase in passengers carried over the period handled by virtually the same staff base (with employees up just 1.2% over the same period). Labour cost cutting was done primarily in 2001–2003, with 2,241 employees — representing 18% of staff as at 2000 — leaving THY in those three years.

In comparison, passengers carried per employee works out at 556 for Lufthansa, 722 for BA, 1,075 for SAS and 1,137 for Iberia — although THY is behind Air France/KLM, at 1,704 passengers per employee, and significantly behind easyJet (7,639) and Ryanair (10,158).

And by another measure — employees per aircraft — THY at 134 is again ahead of Iberia (159), BA (171) and Lufthansa (214), but again behind Air France/KLM (57) and Ryanair (31) — while THY’s lost baggage ratio is among the lowest of all AEA airlines. THY has also been working on non labour cost reductions in the last few years, but says there is "room for further cost reductions". In particular, THY has much work to do on distribution, as more than 80% of revenue comes via travel agents, with internet and telephone sales lagging behind. E–ticketing will not be introduced fully at all GSAs until 2007, as mandated by IATA. And there is further room for improvement in aircraft productivity, with flight hours per aircraft per day growing from 9.5 hours in 2002 to 10.2 hours in 2005, a CAGR increase of just 2.4%.

Long-term outlook

The need to cut non–labour costs becomes more important given that THY’s margins are under pressure — the EBITDAR margin has fallen for the last two years (from 27% in 2003 to 17% in 2005).

That’s less than almost of the major European airlines that THY is trying to emulate. THY’s EBIT margin has fallen too, from 13% in 2002 to just 3% in 2005.

In 2005 revenue rose 11.1% to $2.3bn, based on an 18% increase in passengers flown, to 14.1m. Capacity growth of 12.6% in 2005 was outstripped by a 14.6% rise in RPKs, resulting in a 1.3% percentage point rise in passenger load factor, to 71.5%. But although net profit for 2005 rose by 28.8% to $103m, operating profit fell 34% to $70m, due largely to a 41% rise in fuel costs in 2005, equivalent to an extra $158m in costs. In 2005 fuel accounted for 24% of THY’s total operating costs, compared with 20% in 2004.

However, financially THY is relatively strong. As at December 31st 2005 THY had long–term debt of just $796m (compared with $1.2bn as at December 2001), with $638m of that being long–term aircraft lease obligations (which have reduced from $1.1bn in lease obligations in 2001). Cash and cash equivalents as at the end of 2005 totalled $360m, a considerable improvement on the $65m cash position in 2001

The airline is targeting revenue of $3bn in 2006 and a net profit of $150m, but this appears optimistic given the growth in competition. Assuming non–labour costs cannot be cut significantly, THY’s future depends largely on successful revenue growth, which is the rationale for its ambitious expansion programme.

Outside of this expansion, THY is also looking to increase non–passenger revenue (which comprised 15% of total revenue in 2005). In maintenance THY is investing $200m in "Project Habom" via a partnership with ST Aerospace. A new facility at Istanbul’s Sabiha Gokcen airport will turn THY’s maintenance unit into a major service provider in the region, with forecast third–party revenue of $500m a year from 2011 onwards. And though cargo revenues are relatively small ($209m in 2005, 11.2% up on 2004), THYbelieves it has potential for much greater growth, particularly once Turkey join the EU.

Strategically, one of most important decisions THY has to make this year is which global alliance it will join. Since the early 2000s — after the collapse of Qualiflyer — THY has operated independently from global alliances, but some of THY’s senior management hold the view that the airline misses the credibility of being a global alliance member — particularly among the crucial business market — and that it is simply losing out on tens of millions of dollars worth of transfer passengers. Star and SkyTeam were believed to be the preferred options for THY, but recent reports out of Turkey indicate that oneworld has now become a possibility as well. Nevertheless Star, thanks to Lufthansa’s strong links with THY via SunExpress (see above) is still the most likely candidate, although a SkyTeam linkup would find favour with politicians eager to court favour with France over EU accession.

Although no executive wants to go on the record, THY’s management are believed to have to dissuaded from joining an alliance post–Qualiflyer by Privatization Administration (PA) — the government’s official privatisation arm, and the entity that has owned the state’s equity in THY since 1994. PA’s rationale was that if THY joined an alliance, it would put off potential bids from airlines in the other alliances during THY’s privatisation process (see below). THY’s executives apparently disagreed, and although there has now been a rethink of that strategy, the difference in opinion is indicative of the reportedly difficult relationship between PA and the airline.

State shadow

Although 1.83% of THY was floated in 1990, privatisation came onto the agenda seriously in 2000 when the government said it would sell up to 51% of THY — although the state would still retain a "Golden Share", enabling it to retain majority control. An attempted sale in the spring of 2001 failed due to lack of interest, but in 2004, in order to secure further funding from the IMF, the Turkish government pledged/was forced to raise up to $3bn from privatisation of state assets. In December 2004 the government sold a 23% stake in THY on the Istanbul stock exchange for $199m (bringing the free float to 24.8%), and the equity was five times oversubscribed. In late May Turkey offered another 25% with a further 3.75% available. The offering was 1.6 times oversubscribed and the government stake in THY now stands at 46.43% and there is a free float of 53.57% in THY. The country’s Privatization Administration says that it will generate 310m new Turkish Lira ($150m) from the sale of the stake.

Now the government needs to get rid of its Golden Share provision if the airline is to be considered as a serious player in the European aviation industry. This may be tricky politically, but is the price that the government will need to pay if it truly wants THY to become one of the world’s leading airlines — or more realistically attract equity investment from one of the major European airlines.

Although legally foreign companies can hold up to 40% of THY, they are highly unlikely to want to come near THY while the government is committed to its Golden Share. It may be an unduly harsh assessment, but although Turkey is situated between Europe and Asia, in terms of aviation geography Turkey is largely irrelevant, and Istanbul is simply not needed as a east–west hub. That’s not to say THY cannot build itself up a strong niche carrier in Europe, based on VFR, tourism and business traffic.

That alone may make THY attractive for an airline investor (and in particular Lufthansa) and thereby secure its long term future, but to secure significant external investment the government will have to give up control.