Hawaiian Airlines: escalated competition for niche operator

June 2006

Hawaiian Airlines, an old–established niche operator and the 17th largest US carrier, emerged from a two–year Chapter 11 reorganisation in June 2005 with a greatly strengthened balance sheet and an impressive financial turnaround under its belt.

However, instead of consolidating and building on those successes, Hawaiian is finding itself having to deal with significant competitive challenges in virtually all of its markets.

First of all, markets between the US mainland and Hawaii, which accounted for 63% of Hawaiian’s passenger revenues in 2005, have seen a 34% increase in total seats since 2000. All of the large network carriers — American, United, Northwest, Delta and Continental — have added capacity, while new entrants such as ATA, Southwest and US Airways have joined the fray. Just like international destinations, the long–haul domestic routes to Hawaii have proved an attractive place where to put the capacity removed from mainland domestic service.

Second, the inter–island markets, which accounted for 29% of Hawaiian’s passenger revenues in 2005, are in a state of flux following Mesa’s entry with its new low–fare subsidiary "go!" on June 9. The highly profitable, cash–rich US regional airline has introduced service with five 50–seat CRJ- 200s, with plans to add 90–seat RJs later, in four major inter–island markets, cutting prevailing fare levels in half and offering limited introductory fares of $19 one–way. The main established operators, Hawaiian and Aloha, have matched the fares. Overall, inter–island capacity is up by about 20% this month from the year–ago level.

The escalated competition has meant that Hawaiian’s yields and unit revenues are under pressure — just as revenue trends on the US mainland have turned positive, enabling mainland carriers to better cope with the high fuel prices.

All of this is a pity because Hawaiian deserves some mainstream Wall Street coverage following its successful Chapter 11 reorganisation. Currently the stock is only covered by some smaller brokerages or boutique investment banks. In mid–May, Caris & Company, a new Wall Street investment bank that aims to cater for the "longer term investor with a minimum of a 12–month time horizon", started Hawaiian Holdings with a "buy" recommendation.

But perhaps things will change because Hawaiian’s leadership is at least now getting invited to speak at investor conferences. Most recently, CEO Mark Dunkerly (ex–COO of Sabena and before that at BA) and CFO Peter Ingram (ex–AMR) gave a comprehensive presentation at Merrill Lynch’s annual transportation conference in mid–June. Dunkerley also spoke at Calyon Securities' airline conference in December 2005.

Hawaiian cannot be ignored for several reasons. First, it has been among the most profitable US airlines in the past three years, achieving operating margins similar to Southwest’s and AirTran’s. Second, it has one of the strongest balance sheets in the industry. Third, it has top operational performance, great customer service and a strong brand. Fourth, it is poised for long–haul growth with four additional 767s due to join the fleet later this year.

But there is a question mark over Hawaiian’s cost structure, which the Chapter 11 process did not adequately address. Is the airline a long–term survivor with a CASM of 10.50 cents?

Mesa has frequently cited Hawaiian’s high cost structure and Aloha’s weak cash position (though Aloha achieved low unit costs through its Chapter 11 restructuring, completed in February 2006), as reasons why it thought Hawaii presented a good opportunity. But to what extent is the Hawaiian market different? Could the encumbents win thanks to their stronger market position, customer service and expertise in a market described as insular or,as Hawaiian’s leadership put it, "unusual and quirky"?

Hawaiian is one of the oldest US airlines, having operated continuously since 1929, when it was founded as Inter–Island Airways.

The present name was adopted in 1941. The airline currently operates 135 daily departures with an all–leased fleet of 25 aircraft — 14 767–300ERs and 11 717–200s -that has an average age of six years.

Neither a network carrier nor an LCC, Hawaiian describes itself as a "destination carrier". The focus is exclusively on the Hawaii state, with little ambition to become more broadly based. The strategy is to "leverage Hawaii’s culture as a competitive advantage" and design the schedule and product specifically for Hawaii customers.

In addition to its Hawaii–US mainland and inter–island operations, Hawaiian has a modest South Pacific network (American Samoa, Tahiti and Australia), which accounts for 7% of revenues. The airline also operates public charter services to Anchorage (Alaska) and other ad hoc charters.

Like other leisure–oriented carriers, Hawaiian has always had strong load factors — last year’s was an industry–leading 87.5% — but limited pricing power. However, until recent years, maintaining fares at economic levels was always a struggle in the inter–island market, due to price sensitivity of the traffic and competition.

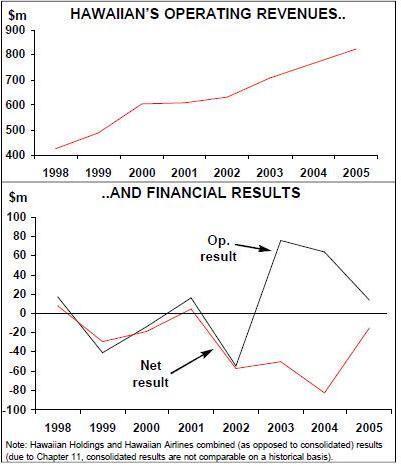

Because of those and cost issues, up to and including 2002 Hawaiian was a chronically unprofitable airline. It failed to turn in operating profits even in the industry’s boom years.

Chapter 11 accomplishments

Hawaiian Airlines filed for Chapter 11 in March 2003 to facilitate the renegotiation of its aircraft leases. In addition to securing concessions from its three aircraft lessors and other suppliers, the airline restructured key labour contracts, increased aircraft utilisation and dramatically improved operational performance. On the revenue side, the accomplishments included enhanced yield management, marketing and distribution.

In many ways, it was a much less brutal Chapter 11 restructuring than the ones implemented by the large network carriers.

On the labour front, Hawaiian focused on productivity improvements rather than take–home pay. This may have left it with a higher- than–desirable cost structure, but it helped preserve the good will of employees — something that the management considers a key aspect of Hawaiian’s competitive advantage.

It was a particularly smart move to focus on the operational metrics. Hawaiian has been ranked the nation’s top airline for on time performance for 30 consecutive months (since November 2003). For the past year or so, the airline has also been number one in terms of fewest cancellations and least mishandled baggage. These are key aspects of service that can inspire loyalty among passengers. Significantly, Hawaiian maintained value for creditors and shareholders. Creditors — even those with unsecured claims — were paid in full, while shares in the old company retained value. The latter was possible because the parent company, Hawaiian Holdings, did not file for Chapter 11 — only the airline did. However, while Holdings retained its equity interest in the airline, new shares were issued to creditors to help pay for the claims, which resulted in some dilution. The Chapter 11 exit in June 2005 was accounted for as a business combination, with Hawaiian merging into HHIC, a wholly owned unit of Holdings, and HHIC then changing its name to Hawaiian Airlines Inc.

The claims were settled through a combination of $126.4m in cash payments and the issuance of $87m of common stock. The exit financing transactions also included a $50m senior secured credit facility, a $25m junior secured term loan and a private placement of $60m of convertible notes.

In March and April this year Hawaiian completed a balance sheet restructuring that was really a culmination of the financing activities associated with the Chapter 11 exit. The two loan facilities were increased by $90m, which provided funds for the acquisition of four used 767s and the redemption of the $60m convertible notes, which needed to be refinanced before June 1 to avoid a significant dilution to shareholders. As a result of all that, Hawaiian’s balance sheet is in good shape, with unrestricted cash of $153.7m at the end of March — about 19% of 2005 revenues — and an acceptable level of debt. The company believes that it is well positioned to face the competitive challenges in the two areas and take advantage of opportunities that may arise.

Hawaiian’s ownership structure will become more conventional as RC Aviation, an investment vehicle controlled by Holdings' chairman Lawrence Hershfield, and other Chapter 11 backers, including ex- AMR chief Don Carty (also on Hawaiian’s board), reduce their holdings, thus increasing the free float. RC Aviation held 36% of Hawaiian’s common stock when the company emerged from bankruptcy. Hawaiian is listed on the American Stock Exchange (Amex).

In early June Hawaiian strengthened its board with the addition of five new members. The 12–member board includes seven independent directors, including three employee designees (ALPA, AFA and IAM).

Financial turnaround

The dramatically improved operational performance, enhancements to yield management and other revenue measures implemented in Chapter 11 paid quick dividends, enabling Hawaiian to start benefiting from unit revenue improvements a couple of years before the rest of the industry. The airline’s RASM surged by 10.2% in 2003 and 7.3% in 2004.

As a result, Hawaiian became profitable in 2003, achieving 8–9% operating margins in both 2003 and 2004 — years when only a few US airlines had positive margins. 2005 was a tougher year, with only 1.4% RASM growth, but Hawaiian still achieved a 1.7% operating margin. These results were impressive not just in light of the fuel price trend — Hawaiian’s average price per gallon doubled from 93 cents to $1.81 — but given the dramatic industry capacity increase in transpacific markets.

In absolute terms, 2005 saw a $14.1m operating profit and a $15.1m net loss on revenues of $825.5m. The net loss reflected an unusual $41m income tax provision, driven by the re–consolidation of Hawaiian and Holdings.

The first quarter of 2006, one of Hawaiian’s seasonally weakest periods, saw operating and net losses of $4.6m and 12.3m, respectively, on revenues of $210m. This was despite slightly stronger 5.1% RASM growth in the three–month period.

The recent financial statements are hard to read in that they reflect some very complex accounting, primarily relating to the emergence from Chapter 11. When Hawaiian was re–consolidated into Holdings, it was done on the basis of purchase accounting, which meant that all assets had to be revalued to market value. This led to the creation of intangible assets and a significant increase in amortisation expenses in 2005.

Importantly, virtually all of the increase in Hawaiian’s unit costs in 2005 and 1Q06was due to higher fuel prices and accounting adjustments. Hawaiian’s top executives said at the ML conference that various cost and revenue measures are under way aimed at restoring healthy profitability. Much of the effort focuses on IT — an area where the airline believes it already is a leader.

The executives also shed some light on the special challenges that Hawaiian faces on the CASM front, namely that the geography of the Hawaii islands limits the ability to get decent aircraft utilisation rates.

The inter–island services have impressive 25–minute turns, but because the average stage length is also only 25 minutes, in any 24–hour period the theoretical maximum daily utilisation that Hawaiian can get out of its 717s is only six hours. This problem is shared with competitors in those markets. On the Hawaii–West Coast routes, in turn, the distance allows just one rotation per day.

Within those constraints, however, Hawaiian has managed to increase fleet utilisation by reducing maintenance out–of–service times. The airline does not disclose the figures, but according to ESG’s Airline Monitor publication, in 2004 Hawaiian’s average daily aircraft utilisation was 7.05 hours. This compared with a range of 8.2 to 9.6 hours for most other US airlines, suggesting a fairly significant disadvantage.

In terms of unit costs, Hawaiian’s 9.82 cents in 2004 was similar to American’s, Continental’s and United’s CASM, and the yields were also almost identical. This was despite the fact that Hawaiian’s average stage length, at 619 miles, was only half of the network carriers'. In other words, although Hawaiian’s CASM did not at first glance look bad for an extreme short haul carrier, its yield is so low that it needs a lower cost structure.

Transpacific focus

Despite the increased seat capacity and competition, the US mainland–Hawaii routes have proved lucrative for most of the carriers. Hawaiian, which is the second largest operator after United with a market share "in the high teens", has grown its share since 2000, continues to achieve high load factors and last year saw little change in the yield.

The airline offers comprehensive coverage of the US West Coast, operating nonstop service to as many as nine cities (Seattle, Portland, Sacramento, San Francisco, San Jose, Las Vegas, Los Angeles, Phoenix and San Diego).

Reflecting its confidence about the potential of the transpacific business, Hawaiian recently purchased four ex–Delta 767–300s in order to boost frequencies on five existing routes to the West Coast from September — obviously very low–risk expansion. As a result, the airline’s ASMs will increase by around 15% in the fourth quarter, and 2007 will also see double–digit growth.

The four 767–300s were obtained for a bargain price of $31.8m, because there is less demand for the non–ER version. The aircraft are well suited for the Hawaii–West Coast markets and were a bargain even though Hawaiian has to spend an additional $34m on ETOPS modifications. The airline has said in recent months that it may be in the market for additional aircraft of that type for growth or to replace other more expensive aircraft.

That said, transpacific market shares and yields are under growing pressure due to near–term excess capacity. There has been a surge in low–cost carrier activity. US Airways entered the market in late 2005, while ATA and Southwest continue to add service. Aloha also now serves multiple mainland cities from Hawaii.

United, the market leader, added 21 weekly flights to Hawaii in its summer schedule, including new routes from Seattle and Portland to Honolulu that compete head–to–head with Hawaiian’s flights.

Hawaiian intends to continue to focus heavily on Honolulu, because it does not have the hinterland feed enjoyed by the mainland network carriers, which have added much service to the other islands.

For example, United generates so much flow traffic that it can schedule up to 11 nonstop daily flights from San Francisco to Oahu, Maui, Kauai and the Big Island, whereas Hawaiian, without feed (and despite its numerous alliances) could only offer one daily flight. But the Honolulu focus allows Hawaiian to serve some secondary markets on the mainland that competitors cannot, such as Sacramento.

Hawaiian also tries to differentiate itself by designing its schedule and product specifically for people who live in the cities it serves. For example, its flights are timed to suit the city’s residents, not connecting traffic.

The airline believes that its exclusive focus on Hawaii and superior market knowledge give it a competitive advantage and that the smaller size makes it more responsive. Under one recent initiative, it picks up bags at hotels for a small fee. Hawaiian enjoys strong brand awareness. One recent survey indicated that it is the most recognised airline brand to Hawaii among West Coast residents. Hawaiian has won numerous "best airline to Hawaii" type awards, which is impressive considering that it is a predominantly leisure carrier and its competitors cater much more for the business traveller.

The inter-island challenge

Inter–island traffic has declined by 21% in the past five years, from about 10m passengers in 2000 to 7.9m in 2005. Mesa argues that this is because the markets are overpriced, noting that the average one–way fare has more than doubled to over $100, and that the market could grow again with a lower fare structure. Mesa has reported strong initial bookings.

However, Hawaiian argues that the traffic decline is structural and permanent and that it has two causes. First, an increase in direct flights from the US mainland to Oahu’s neighbour islands by competitors has meant that fewer people today need to change aircraft in Honolulu. Second, infrastructure in the neighbour islands is also developing, reducing the need to travel to Honolulu. For example, there is now a Home Depot store in Maui.

Therefore, in Hawaiian’s view, the inter–island markets are not under–served and could not be stimulated in the mid–to–long term. The markets will continue to shrink. The incumbent carriers have also pointed out that fares were at unprofitable levels in the past.

Mesa believes that it can be profitable with $52–53 average fares because of its lower cost structure. However, the incumbents operate aircraft that are much more suitable than RJs for the large markets — Hawaiian has 717s and Aloha 737–200s. Almost 70% of the total inter–island flights are in just four markets, which are among the 20 largest O&D markets in the US; for example, Honolulu–Maui is larger than New York–Boston.

With its 10% inter–island market share, Mesa would not be challenging Hawaiian’s and Aloha’s dominance, each of which would have a 40% market share, with turboprop operator Island Air accounting for the remaining 10%. However, load factors and yields can be expected to be negatively affected.

Clearly, Aloha is in a much weaker position to withstand a prolonged period of price cutting. There has been much speculation that Mesa’s real motive is to drive Aloha out of business.

Hawaiian filed a lawsuit against Mesa in February, alleging that Mesa misused the bankruptcy process, in violation of confidentiality agreements it signed, to learn about Hawaiian’s inter–island business and then use that information to develop its own business plans for the market. The case is yet to be heard in court, but many lawyers predict that Hawaiian will win the lawsuit.

Otherwise, Hawaiian has said that it intends to continue competing vigorously in the inter–island market, which "remains an integral component of our overall business", and that it is well positioned to win the market share battles. However, new growth will focus on the transpacific — the expansion planned for later this year will reduce inter–island’s share of total revenues below the current 29%.