Air Deccan: IPO struggle reflects Indian overcapacity worries

June 2006

After a last minute price reduction and an extension of the offer period, Indian LCC Air Deccan just managed to complete its IPO in June — only to see the value of its shares fall by a third on its stock market debut. As with the Air Berlin (see Aviation Strategy, May 2006), is Air Deccan’s IPO a victim of poor timing, or does the poor reception from the market indicate trouble ahead for the Bangalore–based carrier?

Air Deccan was launched in August 2003 as a subsidiary of Deccan Aviation, a Bangalore helicopter charter company that was set up in the late 1990s by Indian army officers (including Capt G.R. Gopinath, the current managing director of Air Deccan). Today Air Deccan operates 90 routes to 55 domestic destinations and has a 14% market share, making it the third largest domestic airline in India.

Air Deccan follows elements of a typical LCC business model, with outsourced ground handling, few frills and both online and telephone booking (although — as is traditional in the Indian market — there is still a large proportion of travel agent bookings). However, it varies from the LCC model in that it operates both turboprops and A320s. Air Deccan initially focussed on "under–served" destinations in the south of India, with fares typically around 20%-35% lower than fares at full service competitors, but it has since expanded to the east, west and north of the country, both to cities that previously have not had any scheduled passenger services but also to an increasing number of domestic trunk routes.

The airline has bases at seven Indian cities — Delhi, Mumbai, Kolkata, Bangalore, Hyderabad and Chennai — with the latest addition being Trivandrum in the south of India, which was launched in April 2006 with a new A320 stationed there operating to Delhi via Chennai and to Mumbai via Cochin.

In April 2005 Air Deccan raised $55m in convertible debentures to fund fleet expansion from US–based Capital International and Indian investor ICICI Venture Funds, but continued rapid growth (it carried 4.1m passengers in the year to March 2006) led to this year’s IPO. This was launched in mid–May with a range of Rs150- Rs175 per share (€2.78-€3.25), a price that with 24.55m shares being issued (representing 25% of the airline’s equity) would raise between €68m- €80m for the airline.

Lead managers for the IPO were Enam Financial Consultants and ICICI Securities, although it was reported that they were appointed only after other companies — including JP Morgan and ABN Amro Rothschild — "declined to manage the issue", citing that they had other commitments in May. However, sources indicate that they pulled out because of differences over timing, with their preferred IPO date being much later in the year. Air Deccan, however, had already delayed the IPO from February this year due to ongoing negotiations with Airbus on a new A320 order, and the airline also had to meet a May deadline for an IPO or else it would have had to re–apply to the Securities and Exchange Board of India for listing permission. Ominously, the banks that withdrew were allegedly also unhappy about an initial suggested price by the airline of Rs 300–Rs 325 per share — a level that would have raised as much as €148m.

At the actual market range of Rs150–Rs175, the aim was to close the offer period on 23 May. However, the prospectus was poorly received by potential investors, and so the offer period was extended to 26 May and the price band extended downwards to Rs 146 (€2.71).

In the end the IPO went away at a price of Rs148 (€2.75) per share, which raised €67.4m, valuing the airline at €269m. However, this was almost €13m less than had been envisaged — and considering that as late as April this year Air Deccan was still hoping to price its shares at up to Rs 250 each (which would have raised more than €100m), the return of €67m from the IPO — prior to issue fees — must be regarded as disappointing. But worse was yet to come, because as soon as the shares began trading on the Bombay stock exchange — on 12 June — they fell immediately, closing at a price of Rs98, a worrying 33% below the IPO price. As Aviation Strategy went to press, the shares were trading in the mid–80s.

Approximately €25m of the targeted €80m (at a price of Rs 175) had been earmarked to pay off high–interest debt over the next four years, with the remainder to be used mainly for infrastructure investments (including a training centre, a hangar, and better facilities at airports) and to fund fleet expansion. How the €13m shortfall will affect Air Deccan’s expansion plans is unclear, but the airline is committed to substantial fleet expansion over the next seven years.

Fleet

Air Deccan currently operates a fleet of 31 aircraft. Initially the core of the airline’s fleet was the 48–seat ATR 42, but in February 2005 Air Deccan ordered 30 72–seat ATR 72–500s — half of which are to be purchased and half leased — and also agreed to lease three second–hand ATR 72–500s and three second–hand ATR 42–500s. The ATRs are arriving at the rate of eight per year and will boost Air Deccan’s regional network.

Air Deccan ordered its first jets — a couple of A320s — in February 2004 (they were delivered in late 2005), and followed this up with an order for 30 A320s in December of the same year, for delivery from 2007 onwards. Air Deccan then tried to bring forward the delivery dates, and the first aircraft will now arrive from late 2006 onwards. After bringing in other A320s on temporary leases, in December last year Air Deccan also placed an order for 30 more A320s, for delivery from 2008. At list prices this deal is worth around $1.5bn, but it is believed the airline received a substantial discount, probably of the order of 25–30%.

The A320s will lower the airline’s unit costs and are being used for more links between the bigger cities. In particular the aircraft will extend Air Deccan’s network to northern India, although this means the airline will start to face increasing competition. For example, a daily A320 service from Delhi to Patna in northwest India started in June, but on this route Air Deccan competes against Indian Airlines, Air Sahara and Jet Airways.

Altogether, Air Deccan plans to add up to another 100 aircraft by 2013, when it will have a fleet of 125. It currently has 89 aircraft on order, with 17 due to arrive by the end of the next financial year (March 2007), and the airline will receive a new aircraft virtually each month for the next eight years.

In the 2006/07 financial year alone 60 new routes will be added, bring the total network to 145 routes by April 2007. However, this raises one key problem — pilot recruitment. The airline currently has 385 pilots (out of a total workforce of 2,400) and is looking to employ another 100 pilots through 2006, in order to staff a fleet of more than 40 aircraft by 2007. However, Air Deccan (along with all other Indian airlines) has been affected what the Indian CAA describes as "an acute shortage of experienced commercial pilots".

Pilot shortage forced Air Deccan to postpone the launch of some routes in 2005, and as a stop gap the airline has had to borrow pilots from Singapore–based LCC Jetstar Asia.

Assuming that pilots can be found, there is one more fundamental question: can Air Deccan continue to find enough new routes and passengers to fill up its aircraft? The airline insist that it can, and points out that that of the 150 Indian airports that are suitable to commercial passenger traffic, more than 50 currently have no service.

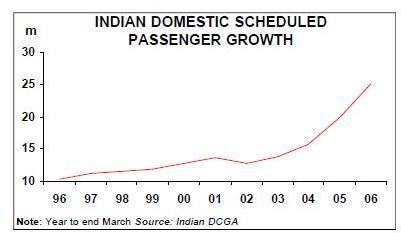

With an estimated 300m Indians (out of a total population of 1.1bn) classified as "middle class" — i.e. able to afford air transport — Air Deccan has made a strategic decision to expand as fast as it possibly can in the face of growing competition so that, as one analyst puts it, it wins the "land grab" race. And it’s hard to argue against the potential of a market where the average number of air trips per person is just 0.02 a year, compared with 2.02 in the US. Approximately 25m passengers were carried domestically in India in 2006, up from 14m three years ago, and this is expected to grow by 25% a year to the end of the decade.

By keeping to a strategy of connecting smaller cities in India combined with expansion on selected trunk routes, Air Deccan believes it will continue to attract business travellers and the middle class who, according to Capt. Gopinath, "don’t mind spending slightly more than what they spend on rail travel to save time and effort".

The problem is that many other airlines have made the same analysis of the market potential, and are expanding (or planning to expand) just as quickly as Air Deccan.

IPO blues

With only two other airlines listed in India — Jet Airways and Spice Jet — it had been thought that Air Deccan’s IPO would be well received.

The relative failure of the IPO is therefore being blamed on a substantial fall in the Bombay stock exchange in mid–May. Air Deccan was also not helped by a New Delhi consumer court decision in June that it had to pay compensation to a business passenger for a delayed flight and poor in–flight service. As part of the court proceedings, Air Deccan admitted that it had "many defective aircraft", with the court declaring that the airline needed to improve its fleet maintenance.

But while these issues affected the success of the IPO, the poor reception by the market also reflects concern about increasing competition in the Indian aviation market.

Air Deccan was India’s first LCC and the provided the impetus to encourage new demand and stimulate a dormant Indian aviation sector. But at the same time this has encouraged a host of new entrants and fierce competition for that lucrative middle class and business traveller market.

Currently, domestic competition comes from Jet Airways (serving 43 domestic destinations), Air Sahara (23), Indian Airlines (59) and a host of start–ups, including SpiceJet, GoAir, Paramount and Kingfisher, with many others planning to launch, including Easy Air, Magic, Indigo, Indus Air and AirOne.

The failure of the merger between Jet and Sahara to materialise is perhaps indicative of the fiercely independent nature of Indian airline entrepreneurs who all appear determined to compete for increasing shares of a rapidly growing market.

The growth of competition means that Air Deccan is increasingly running into a rival airline whenever it opens up a new route — and that competition can only erode Air Deccan’s margins.

That’s significant because as Devesh Desai — Air Deccan’s finance controller — points out, only one–third of its routes are profitable at present, as it normally takes at least a year for a new route to break even. Losses at the more than 30 routes Air Deccan started in the March–November 2005 period (which increased the airline’s overall capacity by more than 50%), contributed to the airline’s poor financial performance during that that period (the last period of results reported in the IPO prospectus).

In the financial year to end of March 2005 the airline recorded revenue of €56m, with an operating loss of €3m and a net loss of €6m. However, the prospectus stated that in the eight months to the end of November 2005 that although Air Deccan had a turnover of €96m, operating losses totalled €23m and net losses €22m. The airline attributes this to the costs of expansion, but the airline has also been hit badly by rising fuel prices, which are now responsible for more than a third of all costs (see chart, above).

Although rivals such as Jet Airways and Indian Airlines have imposed fuel surcharges, Air Deccan has not passed on extra costs to its passengers. Warwick Brady, who became COO of Air Deccan in September 2005 (and who previously headed up Ryanair’s operations at London Stansted) says that "we can manage without doing it".

Captain Gopinath says that the airline has made investments in new routes "in the hope that the middle class flies" and that "it will take another 12 months for us to record profits." The airline expects to carry 7.5m passengers in the 2007/08 year, but some analysts are cautious about the future. One Indian analyst say he does not believe the airline will break even until the first quarter of 2008, thanks to rising fuel costs and increasing competition.

The warning signs are there already. In the year to end of March 2005 Air Deccan’s load factor was 76.4%, but growing competition pared this back to 73% in the eight month period ending November 2005 — although Air Deccan argues this is due mainly to the frantic pace of routes launches.

At present Air Deccan has no international traffic rights because of the Indian government’s rule that no start–up airline can operate international flights within five years from launch. That precludes Air Deccan from launching international routes until August 2008.

In the meantime Air Deccan has signed an alliance with Thai LCC Nok Air — which will launch routes from Bangkok to Bangalore in October — with each airline selling the other’s flights on its respective website.

Deccan Aviation is also launching an LCC in Sri Lanka, based on Deccan Lanka, an existing charter helicopter operation. In order to obtain a scheduled passenger licence from the Sri Lankan government Deccan Aviation sold 52% of Deccan Lanka to local investors, and the "new" airline aims to operate between Sri Lanka and India later this year with a fleet of six ATRs and A320s. Yet this is likely to be no more than a temporary tactic, and Air Deccan is likely to be seeking its own international route rights in 2008.

| Fleet | Orders (Options) | |

| A320-200 | 14 | 62 (2) |

| ATR 42 | 13 | |

| ATR 72 | 4 | 27 |

| Total | 31 | 89 (2) |

| FY ending | FY ending | Apr-Nov | |

| Mar 31 2004 Mar 31 2005 | 2005 | ||

| Fuel | 14% | 27% | 34% |

| Aircraft/engine leases | 16% | 13% | 13% |

| Maintenance | 13% | 15% | 11% |

| Other operating costs | 25% | 22% | 20% |

| Employee costs | 11% | 9% | 10% |

| Admin costs | 11% | 6% | 7% |

| Dep. & Amort. | 3% | 3% | 2% |

| Finance/bank costs | 6% | 3% | 2% |

| Other costs | 0% | 2% | 1% |

| Total | 100% | 100% | 100% |